-

Resistance at $8.32 poses a challenge for APT’s upward price movement

Various market metrics pointed to a contrasting scenario where buyer confidence remains strong

As a seasoned crypto investor with a knack for spotting trends and navigating market ebbs and flows, I find myself intrigued by the performance of Aptos (APT) in these tumultuous times. Despite the broader market’s downturn, APT has shown an impressive resilience, surging 46.58% over the last month and an additional 5.14% recently.

Amidst a broader crypto market slump where several altcoins have dropped in value, Aptos stands out with impressive resilience. Over the past month, it has climbed by approximately 46.58%, and just recently, it saw an additional increase of 5.14%.

Indeed, as AMBCrypto suggests, this surge could just be the start, given the signs that suggest an intensifying bullish market and increased buying interest.

Resistance turns to support, fueling APT rally despite hurdle

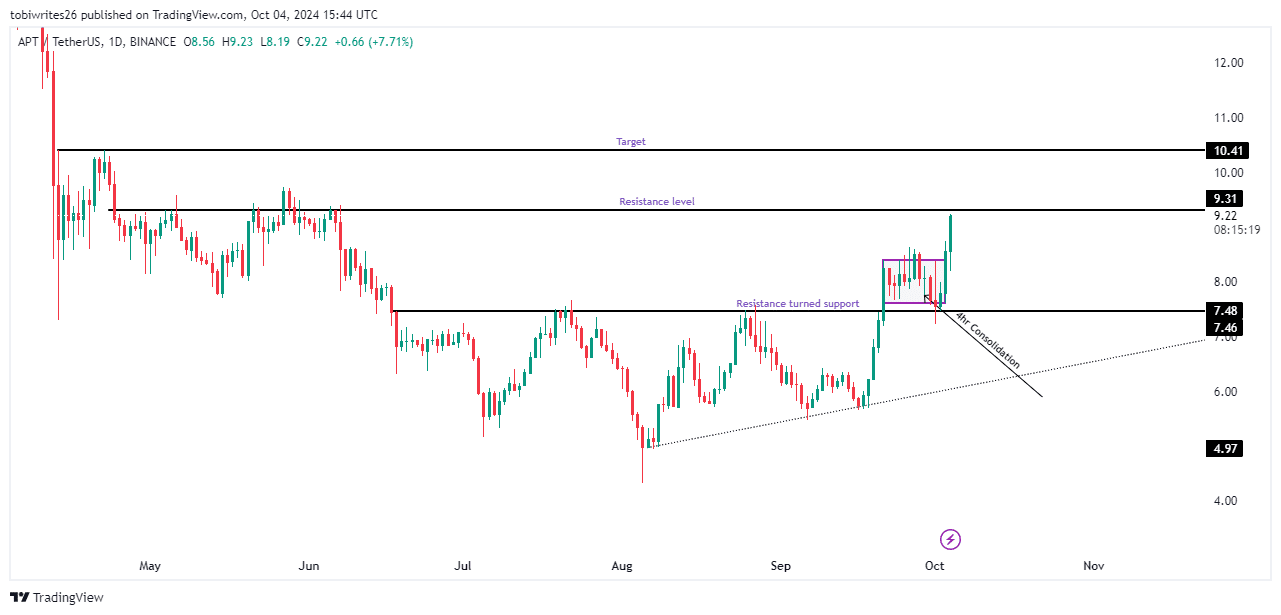

Following its escape from the rising triangle formation, APT experienced a temporary period of sideways movement on the 4-hour chart, reaching a low of $7.46 – a level that had earlier functioned as a resistance point. This shift has played a crucial role in fueling its recent upward trend.

Currently, APT faces a fresh hurdle – a resistance level slightly above its current price, which needs to be overcome for potential future growth.

If the price consistently stays above this line and keeps rising, it is expected that the next significant point of interest for potential buyers or sellers would be around $10.41. At this point, a possible reassessment of the value of APT may occur, influencing its future movement.

Technical indicators lean bullish for APT

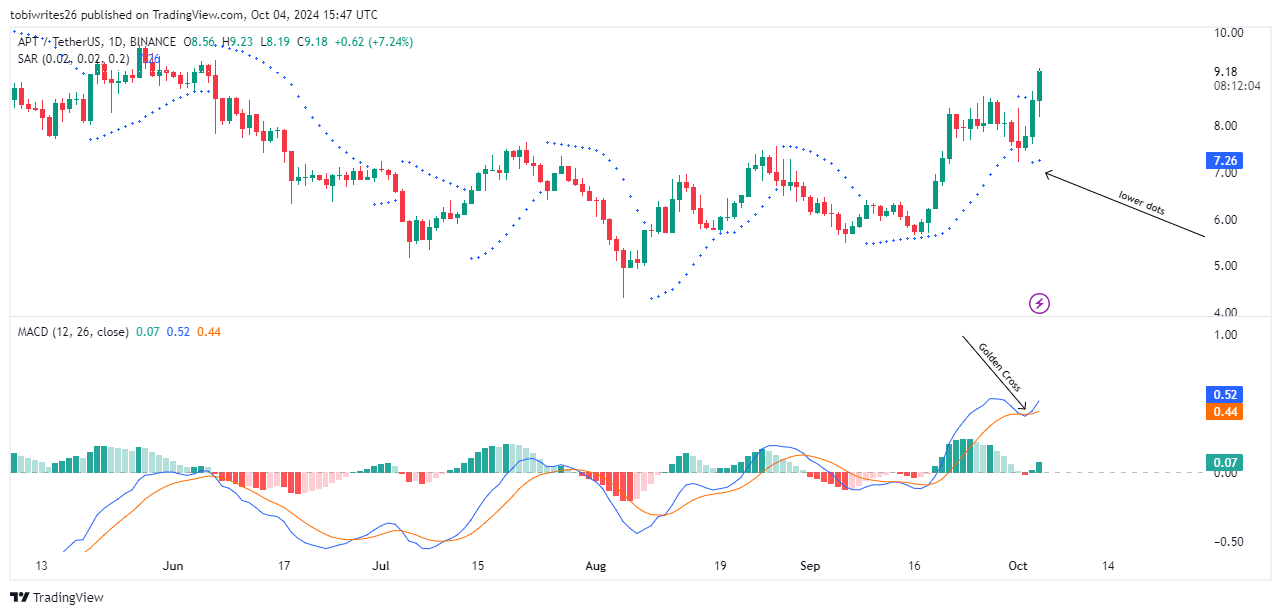

Currently, when I’m composing this, various technical signals such as the Parabolic Stop and Reverse (SAR) and Moving Average Convergence Divergence (MACD) are indicating that the current market movements are being strongly driven by traders who are actively joining the market.

The Parabolic Stop and Reverse (SAR) indicator, useful for spotting possible price changes, showed points beneath the current price level, suggesting a strengthening trend of buyers taking over. More of these points appearing would provide additional evidence that the market is planning to move in a bullish direction.

Simultaneously, the Moving Average Convergence Divergence (MACD) increased within the positive region and created a ‘golden cross’ – a situation where the MACD line (blue) surpasses the signal line (orange). Generally, this pattern indicates that market participants are becoming more active in buying, which often leads to an upward trend in prices.

Collectively, these signs seem to suggest an upcoming bullish phase could be on the horizon. However, further analysis by AMBCrypto revealed there’s more to it than just this.

On-chain metrics echo bullish sentiments for APT

Additionally, AMBCrypto noted that the on-chain activities of Advanced Persistent Threats (APT) have been reflecting their technical signals, suggesting a positive outlook for the market.

As per Coinglass, the trading volume and Open Interest have notably risen by 18.84% to $1.32 billion and 6.35% to $185.01 million respectively. These figures, indicative of market activity, suggest significant growth concurrent with price increases, hinting at a sustained bullish trend for APT.

Essentially, the general feeling among investors suggests that APT might break past its existing resistance level, potentially even climbing up to approximately $10.41 in the future.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-10-05 11:03