- Shiba Inu maintained its bullish structure despite the 28.6% drop from its local highs

- Imbalance on the daily chart was filled, but it is unclear if this will lead to a recovery

As a researcher with a keen eye for spotting market trends and patterns, I have to admit that Shiba Inu [SHIB] has been quite the rollercoaster ride these past few weeks. The coin managed to maintain its bullish structure despite the 28.6% drop from its local highs, which is quite impressive given the volatile nature of memecoins. However, it’s unclear if this will lead to a recovery just yet.

During the latter part of September, Shiba Inu [SHIB] was among the popular meme cryptocurrencies that fueled optimism among investors. Starting from September 18th, SHIB experienced a surge of 67.36% within nine days. However, it failed to surpass the bearish resistance level at approximately $0.000021.

After the subsequent retreat, SHIB dipped below the $0.0000175 resistance level, which could indicate an early signal of bears taking control. However, it remains uncertain whether traders should brace for additional losses or if this is merely a temporary setback before another upward surge.

Shiba Inu sentiment has done a 180

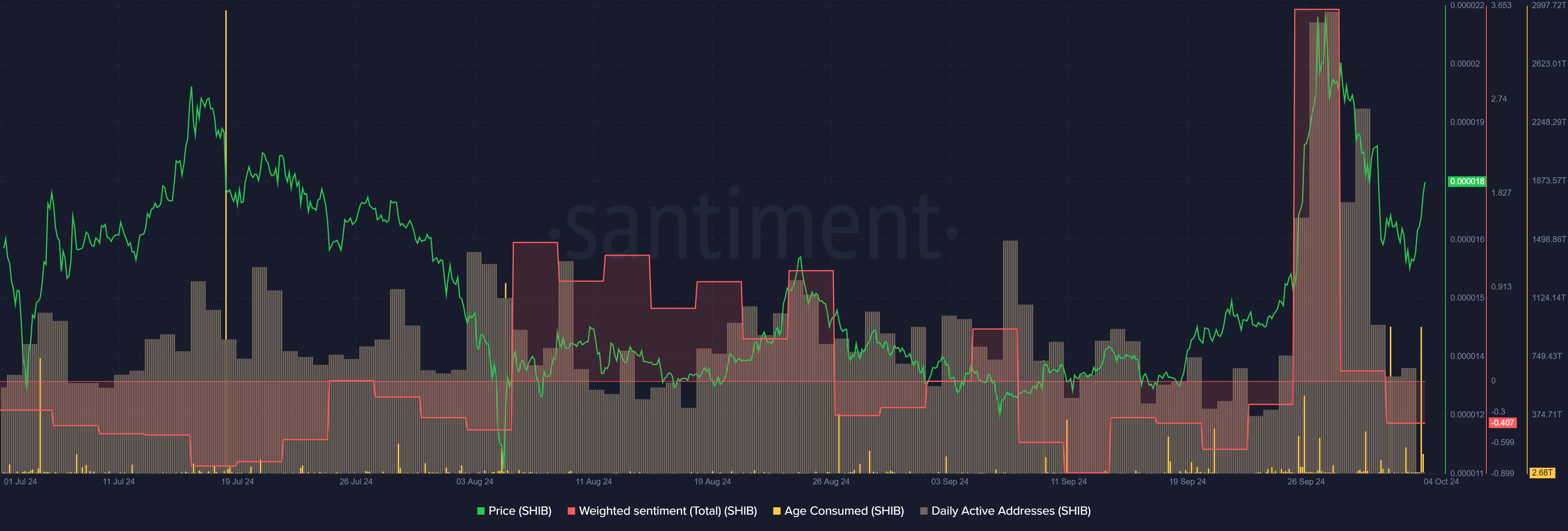

Towards the end of September, the overall market feeling was strongly optimistic, with sentiment scores higher than they’ve been in the last three months. These scores even exceeded the positive sentiments recorded during the mid-August rally.

Daily active Shiba Inu wallets reached an all-time high recently, last seen on September 29th since May. This suggests a strong optimistic outlook that has unfortunately declined significantly over the past four days.

Over the last two days, I’ve observed some significant surges in the activity metric related to age. This suggests a noteworthy transfer of tokens between different addresses, which often indicates increased selling pressure.

Insights from long and short-term holders

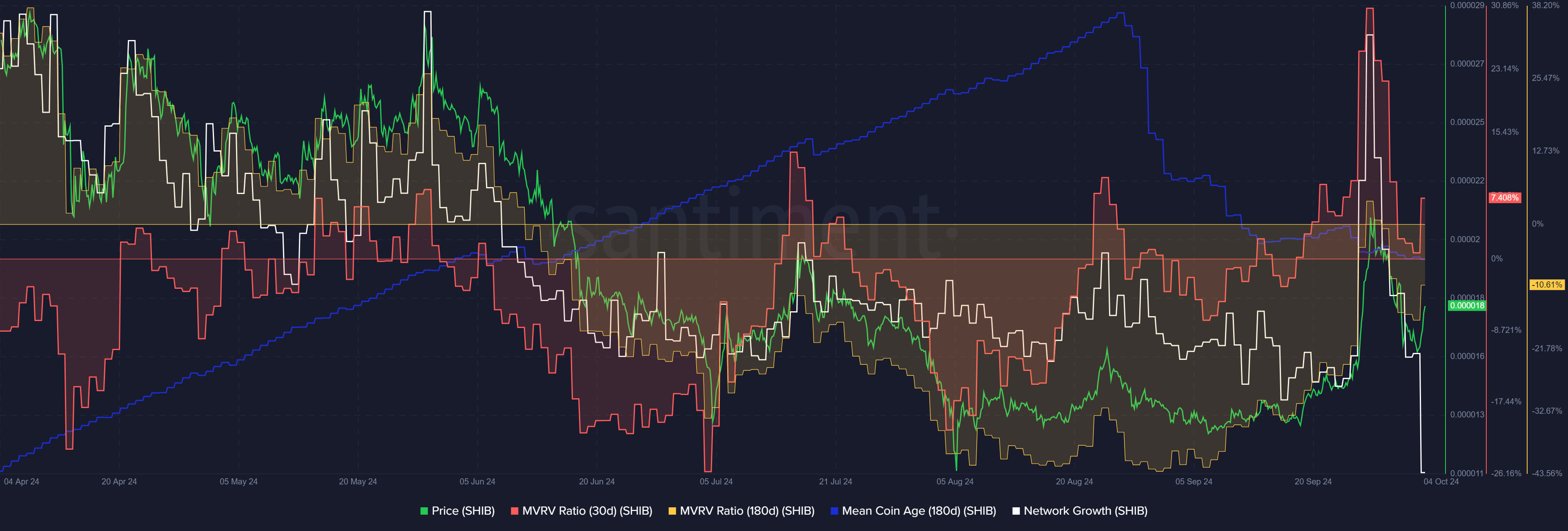

As an analyst, I’ve been observing the Market Value to Realized Value (MVRV) indicators for SHIB. At present, the 30-day MVRV remains positive, indicating that on average, short-term holders are still enjoying profits. Conversely, the 180-day MVRV has dipped below zero following a brief resurfacing during the recent rally. This suggests that long-term SHIB holders may be facing realized losses at this point.

The text emphasized that long-term investors were ready to sell off, having reached their initial investment level, given the persistent drop in the price of the meme coin since May.

As the price increased, so did the network’s expansion rate, indicating a greater number of people joining the market. Furthermore, the average age of coins has been decreasing since late August as well.

Read Shiba Inu’s [SHIB] Price Prediction 2024-25

Consequently, long-term investors chose to distribute their tokens at that point in time. The surge up to $0.0000217 acted as a temporary peak. It’s probable that Shiba Inu requires another period of accumulation before it can replicate the gains seen in September.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- Michelle Trachtenberg’s Desperate Secret

2024-10-05 13:11