-

LINK has implemented strategic tools to attract institutional investors

However, the underlying network may present challenges

As a seasoned crypto investor with a knack for deciphering market trends and a keen interest in Chainlink [LINK], I find myself standing at a crossroads. On one hand, LINK has been aggressively courting institutional investors through strategic partnerships, which undoubtedly adds to its appeal. The recent collaboration with Taurus, a top digital asset infrastructure provider, could potentially supercharge LINK’s transaction bandwidth and attract significant institutional interest. If successful, this could catapult LINK into the big leagues and pave the way for long-term value growth.

In the last two months, Chainlink’s price tagged $12 on two separate occasions, yet each attempt met with resistance. The initial encounter resulted in a notable decline, whereas this recent occurrence has seen an uptick in bullish signs appearing sooner.

Currently priced at $11.28, the immediate hurdle for the bullish trend seems to be surpassing the $12 mark. Analyst predictions suggest that this could happen prior to the conclusion of the fourth quarter.

Although the recent test of Bitcoin‘s $62k barrier is fueling a sense of optimism (due in part to the October excitement), it seems that there might be additional, hidden elements motivating investors to wager on LINK‘s potential worth.

LINK is deploying strategic partnership

As an analyst, I’m excited to share that in my quest to fortify Chainlink Labs’ institutional standing, we’ve entered into a partnership with Taurus – a leading digital asset infrastructure provider. This strategic alliance is geared towards amplifying the transaction capacity of LINK, a key aspect in ensuring our blockchain remains competitive in the rapidly evolving landscape.

As an enthusiastic crypto investor, I believe that the success of LINK could ignite intense institutional attention, dramatically elevating its profile and potentially setting the stage for substantial long-term value appreciation.

Even though those efforts were made, participants are leaving LINK‘s network, as indicated by the following graph.

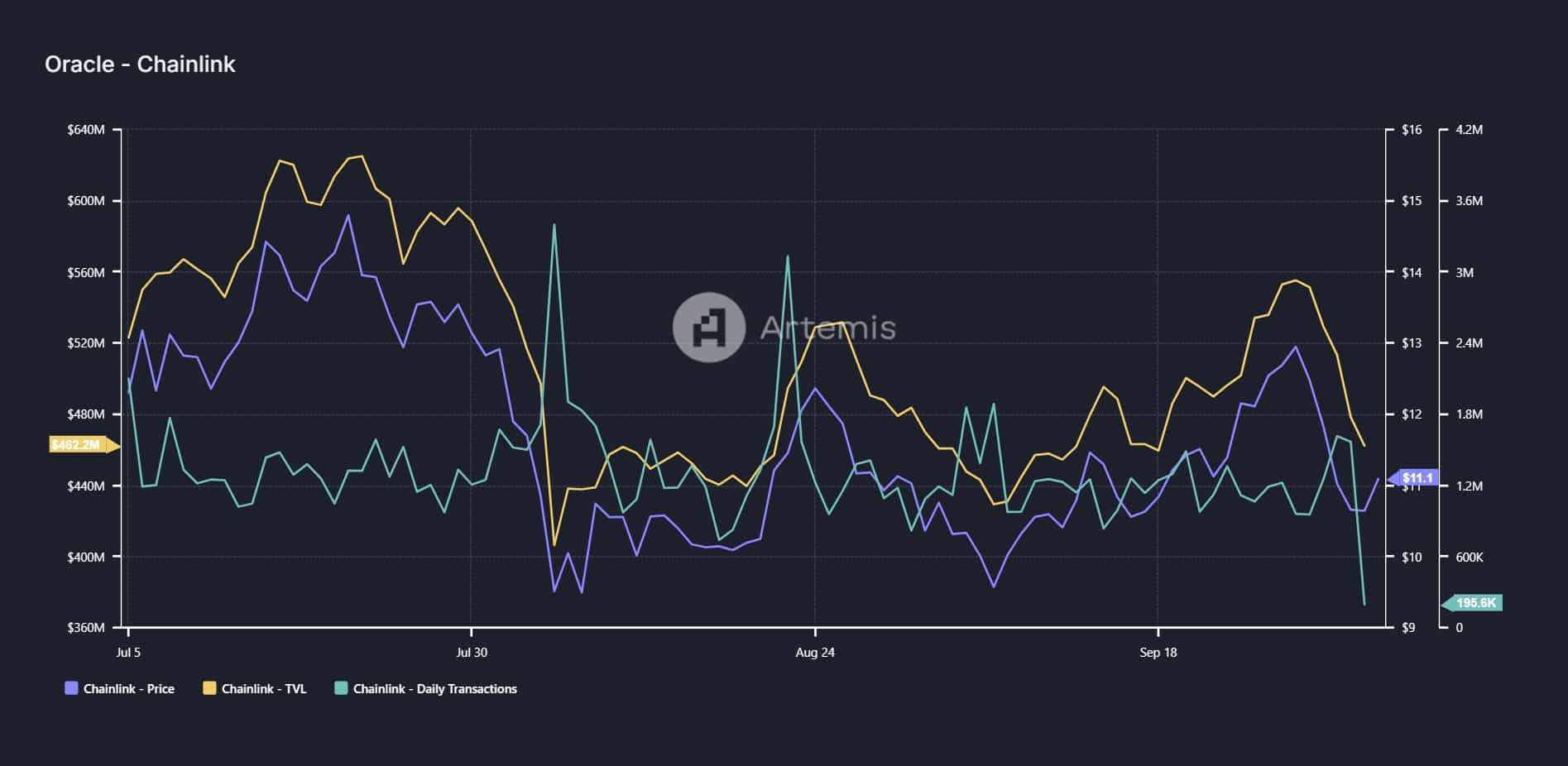

Source : Artemis Terminal

Due to September’s market turbulence, the decentralized finance (DeFi) platform associated with LINK experienced a substantial decrease in the amount of total value it was holding, falling from a high of $555 million just a week before to $462 million as of the current news reporting.

To further our worry, the number of daily transactions, peaking at one million around mid-July, has dropped down to a three-month minimum of 195 thousand.

In simpler terms, these joint ventures are springing up at a time when LINK is facing an internal turmoil. If this approach proves successful, there might be a short-term adjustment in LINK’s pricing.

Backed by big players

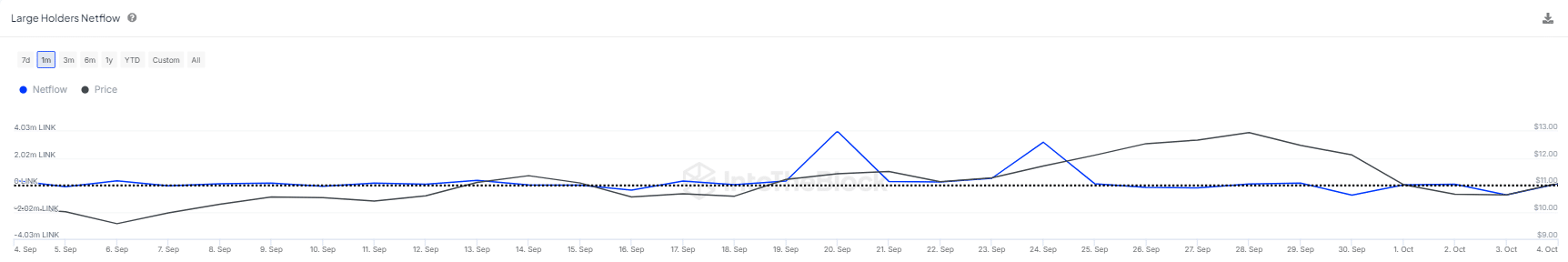

Approximately half of the significant investors (whale wallets) are currently in possession of about 489 million LINK tokens. These influential investors have played a key role in shaping LINK’s value during the month of September.

Previously this month, these whales had been selling off their assets. But in recent times, there’s been a significant change as big investors have started buying tokens again.

Source : IntoTheBlock

The resurgence in whale accumulation has helped LINK flip the key $10 resistance into support. With this critical flip achieved, breaking through the $12 barrier seems feasible.

Yet, despite external predictions suggesting a potential rise of LINK to $40 during the next market uptrend, internal issues within the network, such as decreasing user engagement, present a stark contrast.

In summary, things seem quite promising at the moment, but there’s a need for more partnerships to boost confidence among institutional investors. If this is achieved, a significant surge could occur shortly – a situation that the Chainlink network has yet to experience.

Read More

2024-10-05 21:11