- Bitcoin has declined by 5.41% over the past week.

- Market fundamentals suggest a potential upside if Bitcoin closes above 21-week EMA.

As a seasoned crypto investor with over half a decade of experience under my belt, I have witnessed my fair share of market highs and lows. The recent 5.41% decline in Bitcoin over the past week has certainly piqued my interest, especially given October’s historical tendency for positive price action. However, I remain optimistic about BTC‘s potential upside based on the current market fundamentals.

Following an unexpected surge in September, Bitcoin [BTC] has faced challenges at the beginning of October, which is typically a period of growth. Consequently, during the last seven days, there’s been a significant drop in its value.

Currently, at the moment I’m speaking, Bitcoin was being traded for approximately $61,980. This represented a decrease of 5.41% over the past week, and an additional drop of 0.34% within the previous day’s trading, continuing the downward trend.

Prior to this decline, BTC had been on an upward trajectory, hiking by 9.87% on monthly charts.

Under the present market circumstances, there’s uncertainty about whether Bitcoin will persist in its upward trajectory, given its recent downward trend.

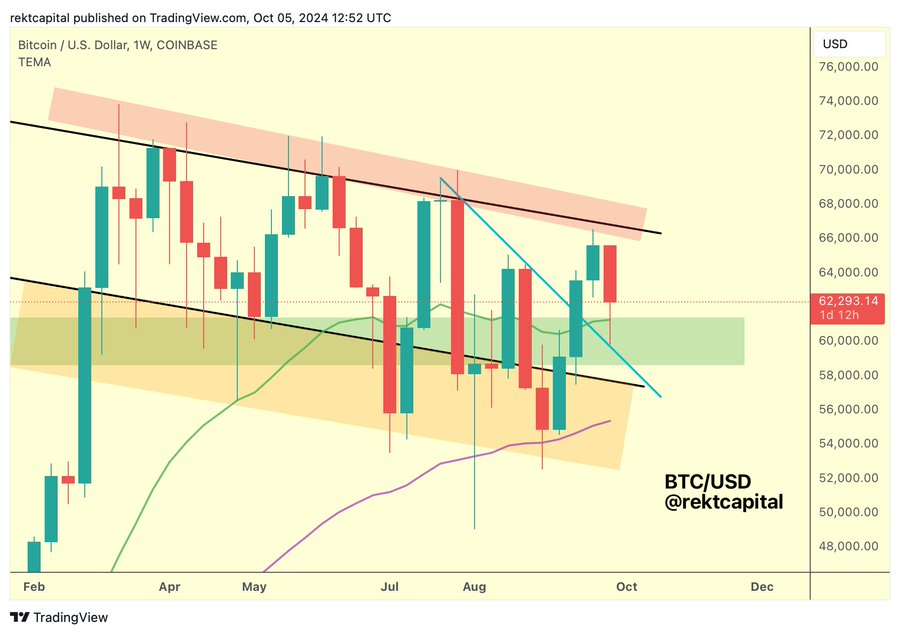

Based on the analysis by well-known cryptocurrency expert Rekt Capital, there could be an upcoming price surge. He supports this prediction by referring to the 21-week exponential moving average (EMA).

What market sentiment suggests

In his analysis, RektCapital posited that 21-week EMA has been successfully retested as support.

Maintaining its position above a certain level suggests that the Bitcoin market’s overall mood continues to be optimistic. This implies that more investors are joining the market, and the trend seems to lean towards an upward trajectory.

Based on this examination, Bitcoin (BTC) has surpassed an earlier resistance trendline which had been holding strong for several months. This breakout indicates a positive outlook, implying that the downtrend might be ending and a change in direction, possibly toward a bullish trend, could be on the horizon.

In simpler terms, if the price closes strongly above its 21-week moving average and breaks out from a long-term downward trend, it suggests that the market’s momentum will continue to rise, particularly when the weekly closing price surpasses $62k-$63k.

What Bitcoin’s charts suggest

Without a doubt, RektCapital’s analysis suggested a positive future for Bitcoin. To fully understand its potential trajectory, it’s crucial to examine what other market signals may imply as well.

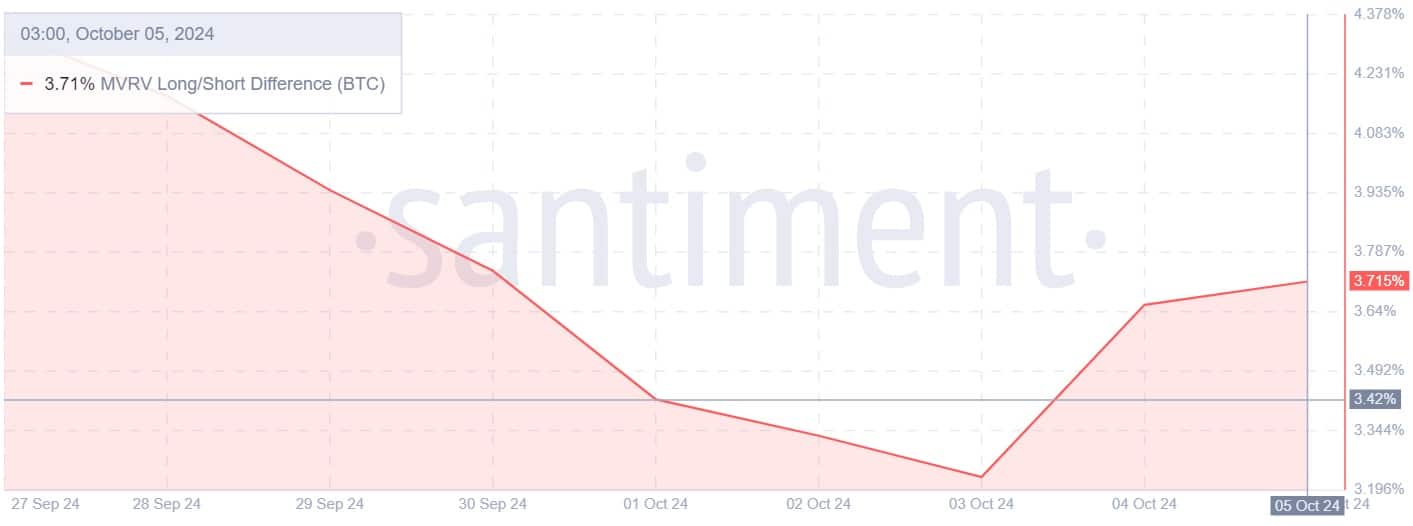

As a crypto investor, I always keep an eye on Bitcoin’s MVRV long/short difference. Recently, I’ve noticed it transitioning from a downtrend to an uptrend, which is a positive sign for potential price increases in the near future.

Since the 4th of September, there’s been an upward trend in the MVRV long/short difference, following a series of decreases in the days leading up to that point.

It implies that long-term investors feel more secure with their investments since they’re already earning a profit, and thus, they are less inclined to sell. As these differences grow, it indicates that long-term investors are increasingly optimistic about future gains.

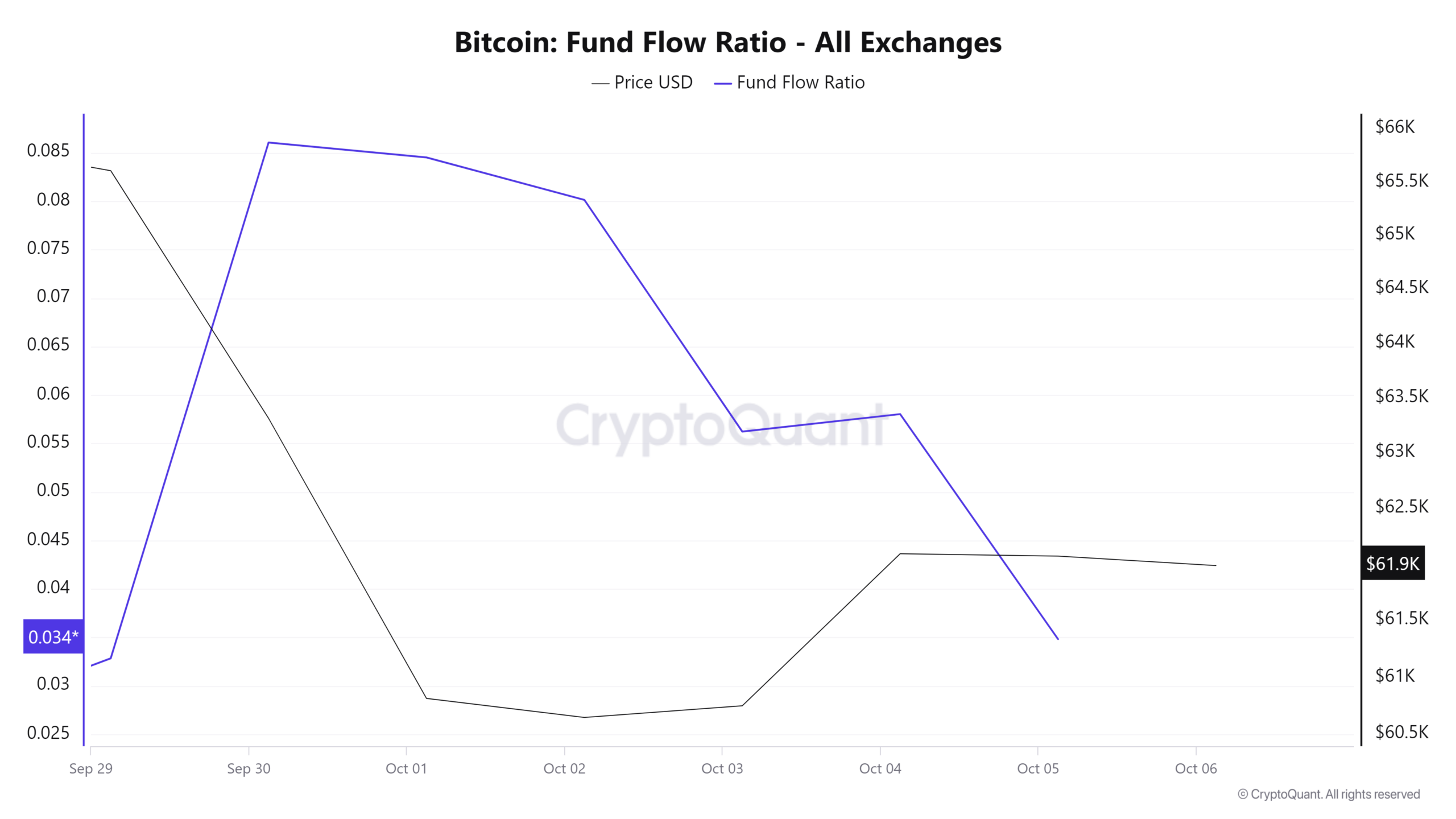

Over the last six days, the Fund flow ratio has dropped even as markets have fallen. This implies that investors are not sending as much Bitcoin to exchanges for selling, preferring instead to keep it in personal wallets.

Such market behavior indicates accumulation as investors anticipate further gains.

To sum up, the accumulated Bitcoin Funding Rate across exchanges has predominantly stayed in a positive zone during the past week. This trend indicates that investors are mostly adopting long-term bullish positions, expecting potential increases in the Bitcoin price.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

In simpler terms, the market has been moving horizontally for a few days now. While some investors are stockpiling, others are going long. This trend indicates that the market could potentially see more growth in the near future.

If the market sentiment holds, BTC will attempt $62785 resistance in the short term.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-10-06 20:08