-

Options market data indicated that ETH price could have stabilized.

However, market sentiment was still negative amid overhangs from Middle-East tensions.

As a seasoned crypto investor with over a decade of experience navigating the volatile digital asset market, I find myself cautiously optimistic about Ethereum’s [ETH] current situation. The recent stabilization in ETH prices following geopolitical tensions is a promising sign, as suggested by Jake Ostrovskis, a respected figure in the crypto trading community.

After the recent market turbulence caused by tensions in the Middle East, it seems that the value of Ethereum‘s currency (ETH) has found a more steady level. The unrest had a significant impact on the cryptocurrency markets, causing fear and uncertainty.

As per Jake Ostrovskis, a crypto trader at Wintermute, there might have been a local base forming among the largest altcoins, according to data from the options market. He pointed out this potential development.

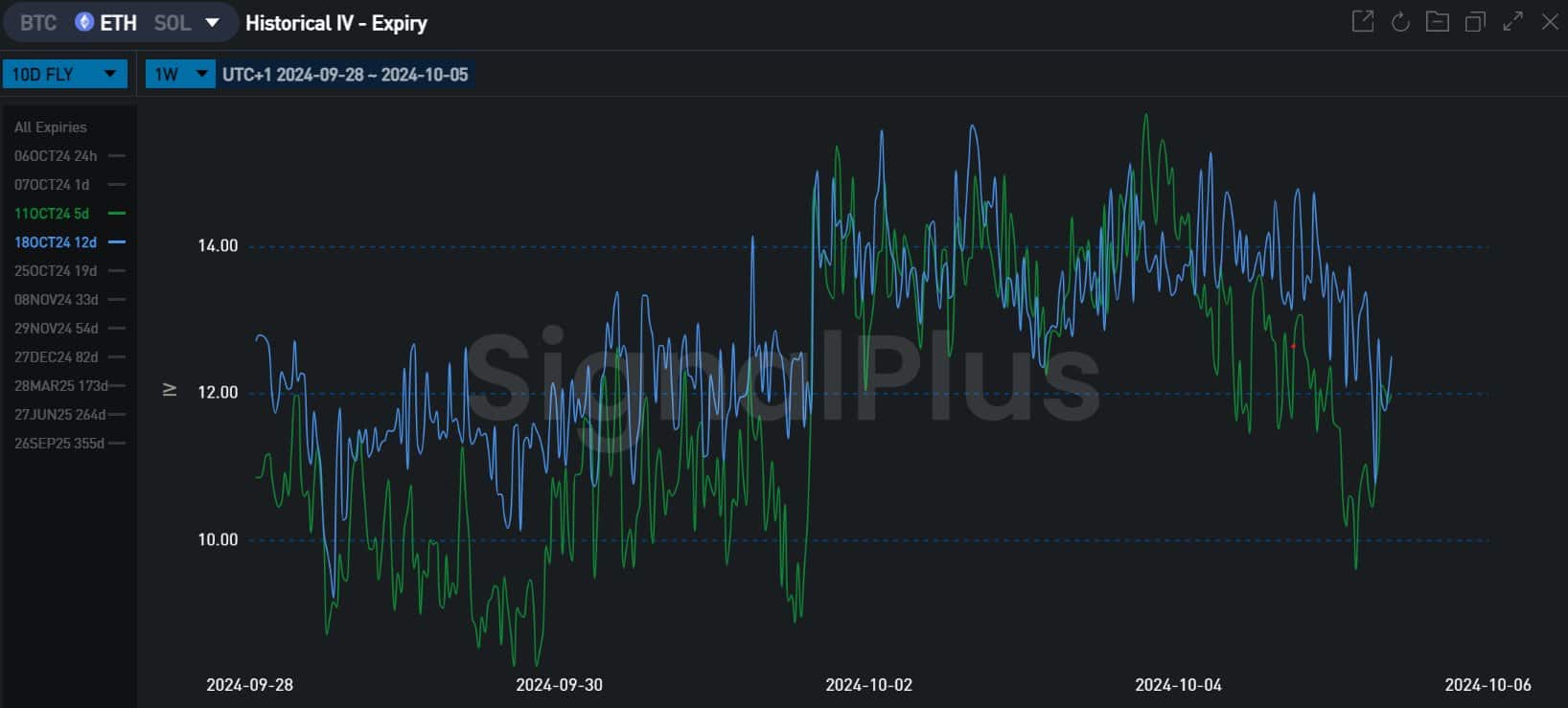

Starting from October 1st, there has been a significant trend in Ether (ETH) trading towards shorter-term derivative contracts. Currently, we’re seeing these positions being closed out as the market appears to be strengthening.

Is ETH’s local bottom in?

In recent times, an increase in the use of hedging strategies for Ethereum (ETH) short-term contracts reflects traders’ efforts to secure their investments by assuming hedging positions. This move was particularly noticeable during the heightened tension between Israel and Iran.

They used short-term options to achieve this.

Conversely, during the weekend approach, there was a significant reduction in hedging activities and decreasing expected volatility for short-term option positions.

This suggested that traders were becoming confident of ETH market stability and that hedging was unnecessary.

In simpler terms, it seems that the lowest point for ETH (Ethereum) might have been reached already, given that Israel has not responded to the recent Iranian attack.

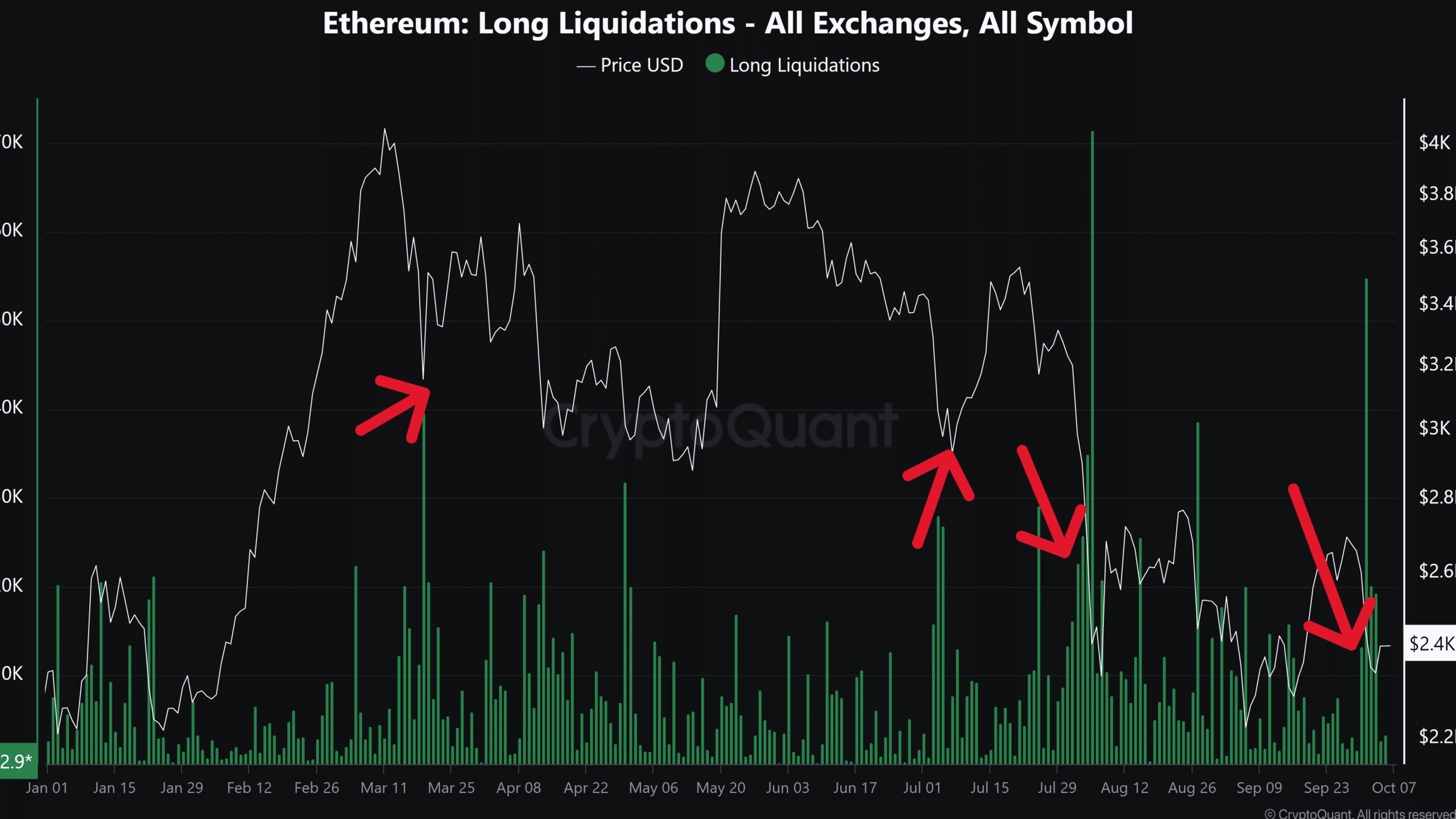

Another data set that suggested ETH might have hit bottom was the hike in long liquidations. The recent plunge liquidated over $50 million worth of ETH long positions.

Historically, an increase in Ethereum (ETH) long position liquidations has often occurred around market low points or local bottoms. Such occurrences were noticeable in March, July, and August.

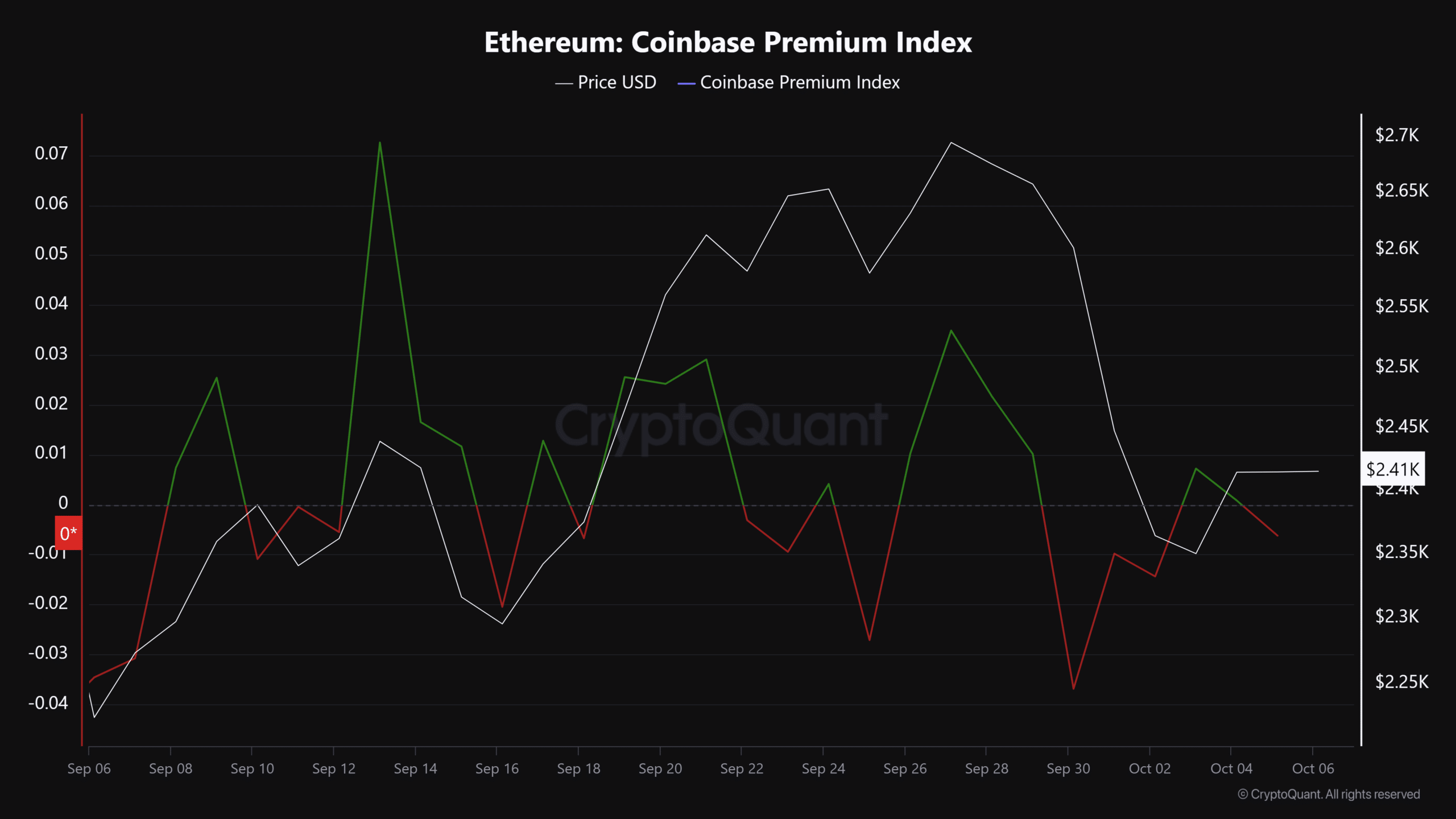

To put it simply, despite what we’ve seen, American investors did not show a substantial interest in Ethereum, as indicated by a low reading on the Coinbase Premium Index. Typically, an increase in the Coinbase Premium Index suggests a robust recovery for Ethereum.

Therefore, even though there might be some stability in the Ethereum market, keeping an eye on the demands from U.S. investors could indicate whether we’ve hit rock bottom and if a potential relief rally is about to take place.

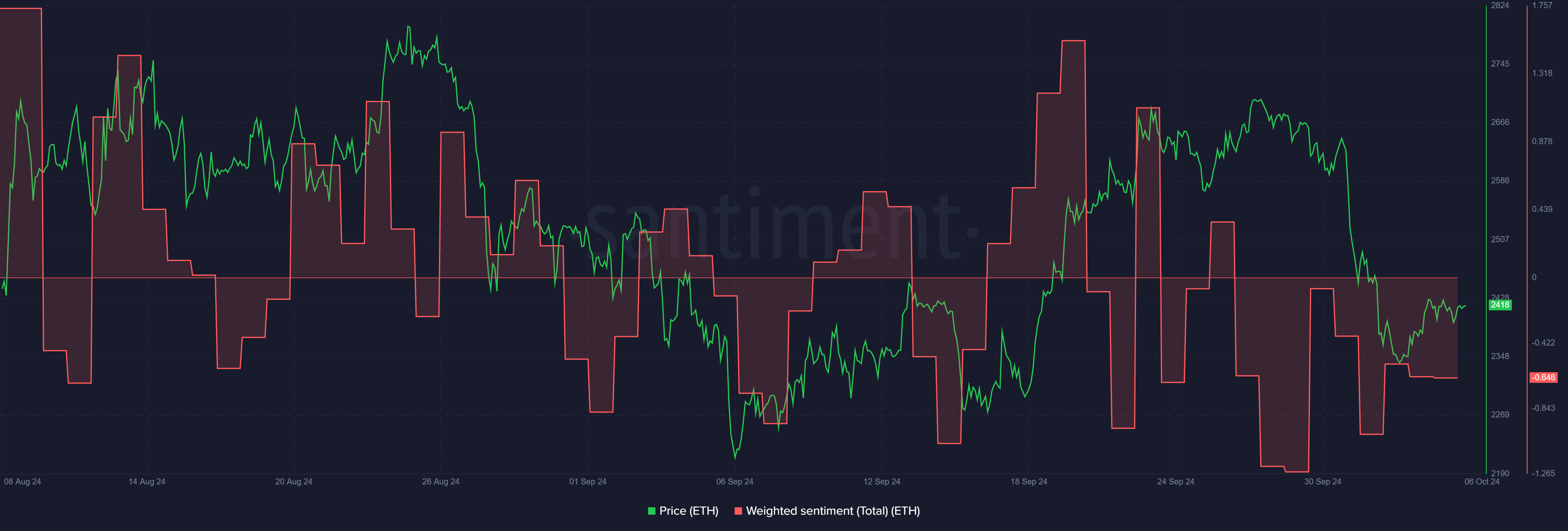

Furthermore, a sense of caution could be observed, given the unfavorable attitude towards ETH in the market.

This indicates that investors have stepped back, likely choosing to observe Israel’s response to the recent actions taken by Iran. Currently, Ethereum is trading at approximately $2,400, marking an 8.4% decrease over the last seven trading days.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-10-07 02:15