-

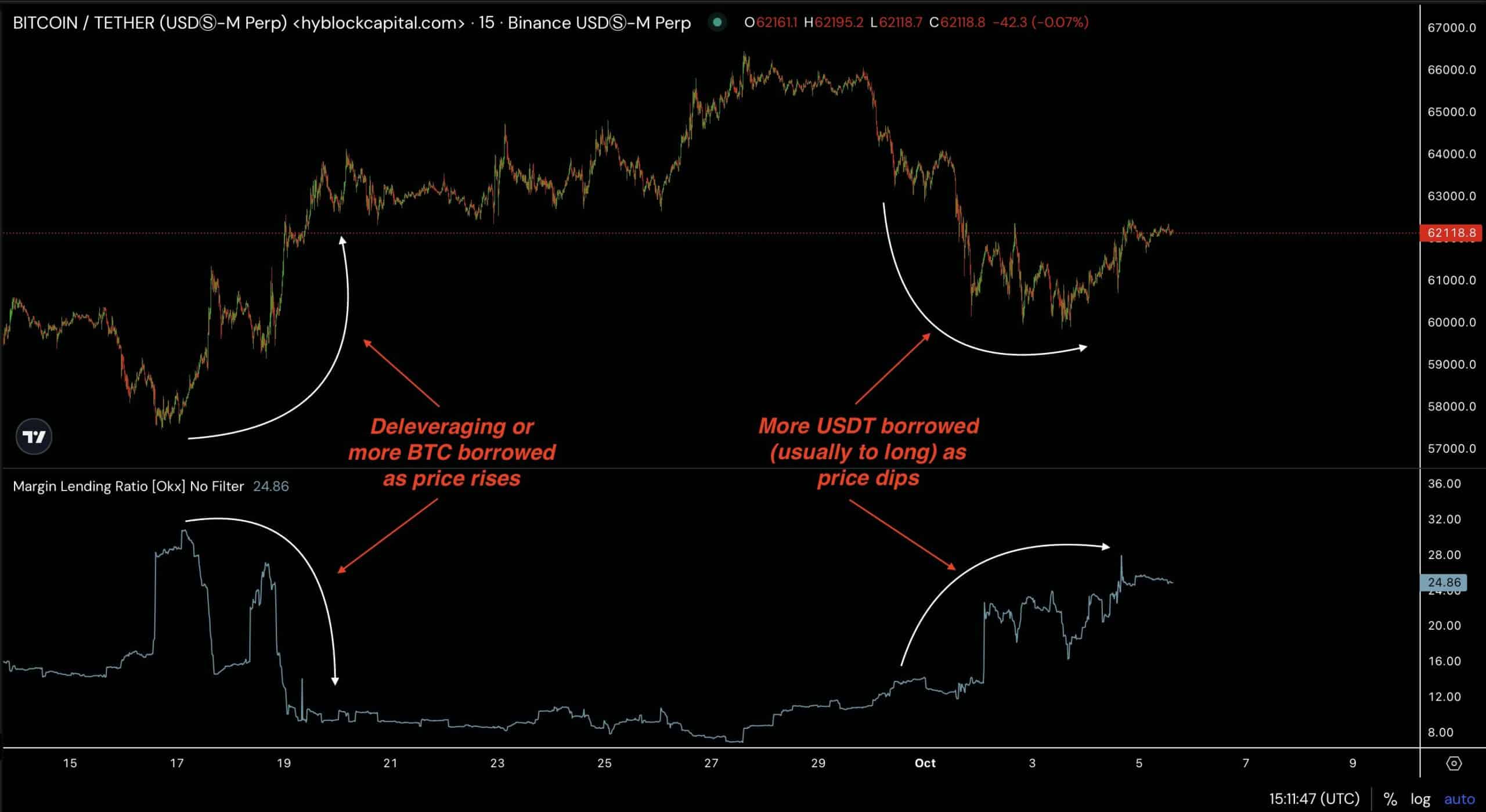

More USDT borrowing than Bitcoin during price dips.

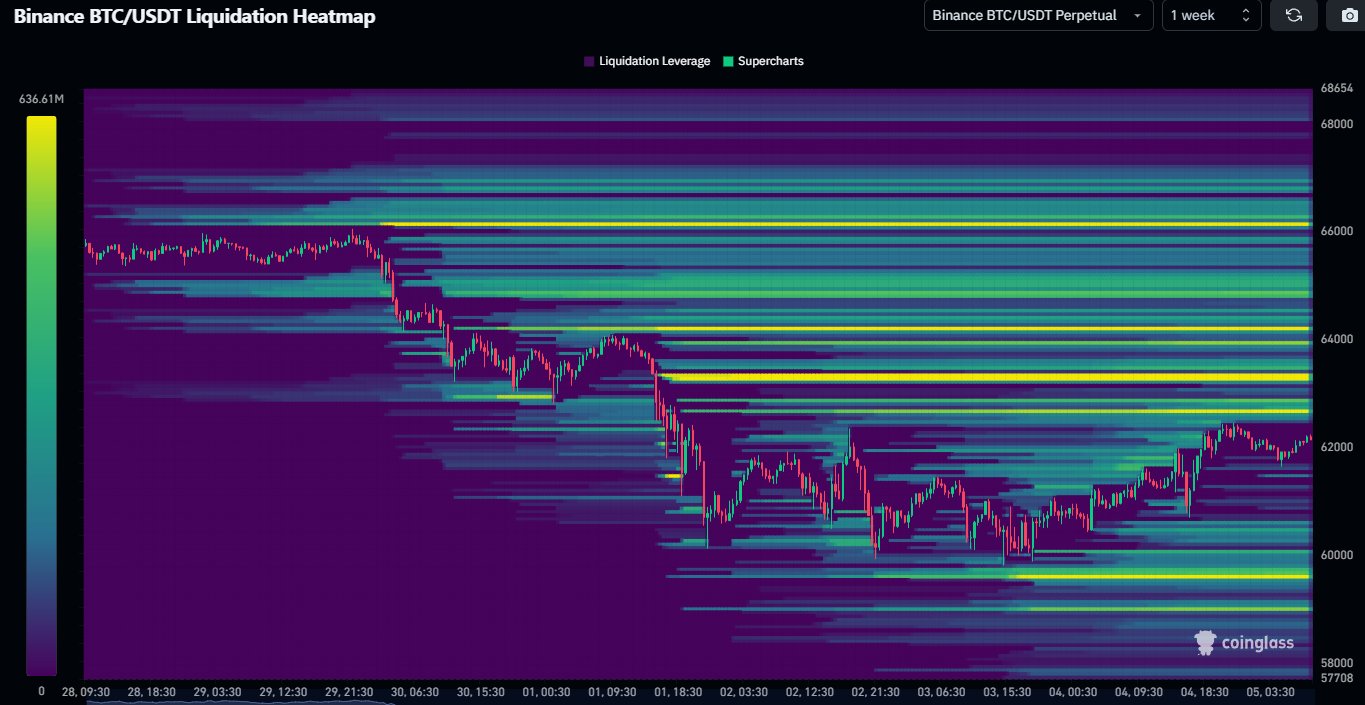

Liquidation heatmap showing the way for BTC is up.

As a seasoned analyst with over two decades of market analysis under my belt, I must say that the current state of Bitcoin (BTC) is reminiscent of watching a phoenix rise from the ashes. The shift from borrowing BTC to USDT during dips is a clear sign of confidence in the long-term potential of the cryptocurrency, and it’s a trend I’ve rarely seen before.

It appears that Bitcoin [BTC] may have reached a temporary low point, sitting roughly in the middle of the descending trendline it has been following over the last seven months.

Following a brief surge to around $66,000, Bitcoin started to adjust its value, causing some traders to ponder if the last quarter of the year might see an increase in bullish trends across the entire crypto market.

One interesting metric supporting this sentiment is the shift from borrowing BTC during price pumps to borrowing USDT during price dips.

More and more traders are taking out loans using Tether (USDT) to purchase Bitcoin at lower prices (buying the dip), signaling an optimistic outlook on Bitcoin’s performance in the coming months, suggesting a favorable trend for the next quarter.

Bitcoin breaking market structure

As an analyst, I find the recent movements in Bitcoin’s price reinforcing my bullish perspective. Following the break of the BTC/USD pair’s market structure, we saw a drop in price, which was essentially establishing a higher bottom after substantial long position liquidations.

In simpler terms, this current location serves as a starting point for a possible price increase. For Bitcoin to continue its upward momentum, it should exceed its Daily 200 Moving Average and reach beyond the peak prices from last week.

Should Bitcoin manage to break past its current resistance points, a significant milestone at around $70,000 could be within reach, suggesting an increasingly optimistic market trend as we move into the fourth quarter.

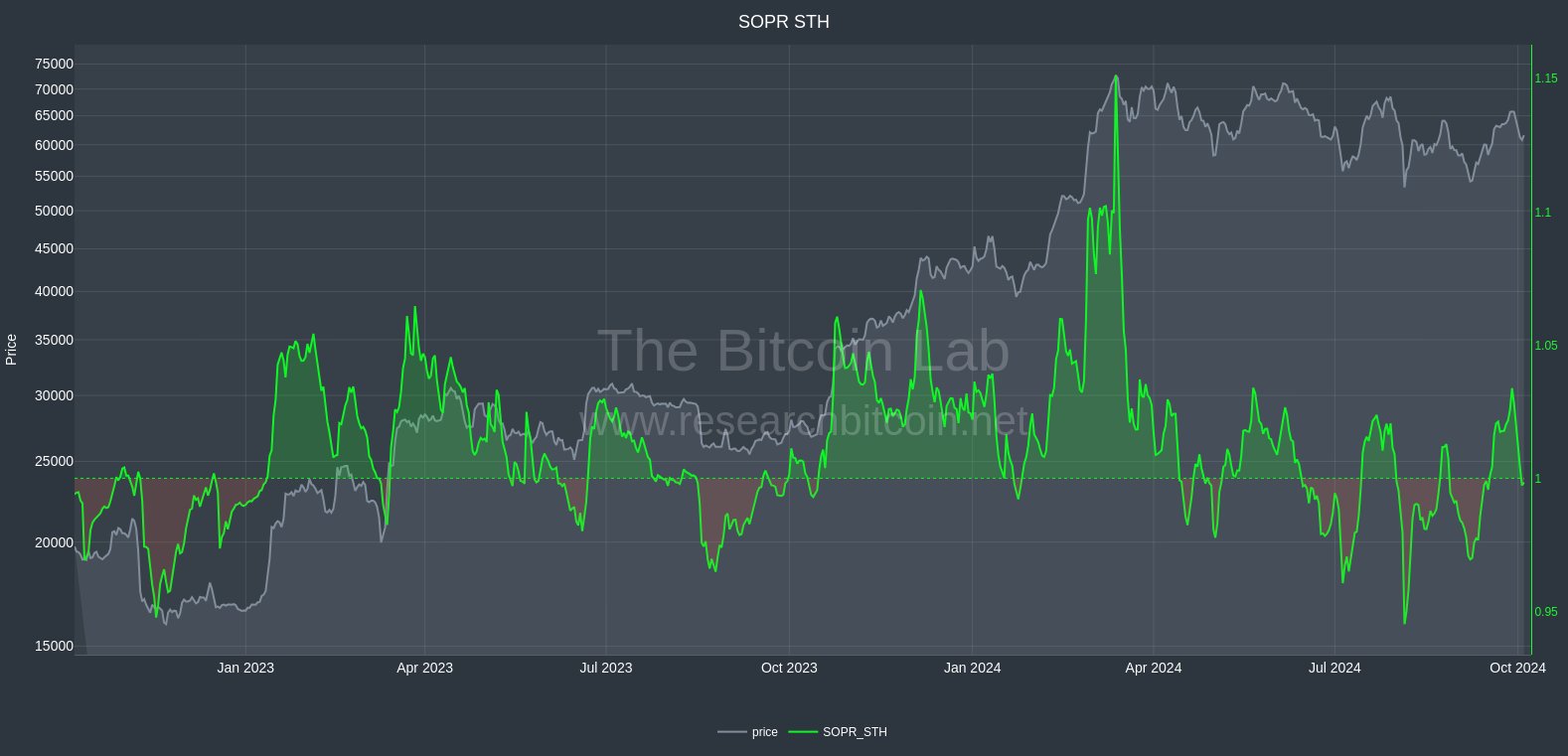

Short-Term Holder MVRV and SOPR retesting

Besides these metrics, the Bitcoin Short-Term Holder MVRV and SOPR are indicators that suggest favorable results as well.

The two indicators are each testing the “1” line again, suggesting that a rebound from this level would suggest a more optimistic viewpoint for Bitcoin’s future price trend.

At this point, brief investors stand to gain significantly, as a rise now could boost prices even more, benefiting not only quick traders but also those who have held onto their investments for the long haul.

Such a scenario would increase the likelihood of BTC reaching new highs before the end of the year.

Massive liquidity resting above

Additionally, the Bitcoin liquidation heatmap indicates that a substantial portion of the market’s liquidity lies above the current price point.

Because BTC tends to move towards more active trading zones due to higher liquidity, it seems that an increase in price could be imminent.

As an analyst, I’ve noticed that the significant liquidity range for Bitcoin currently resides between $63,000 and $66,000. If the positive price trend gathers pace over the next few days, there’s a possibility of a “short squeeze” occurring.

Even though there’s some availability of assets under $60K, it’s not heavily concentrated, suggesting a more likely direction is an upward trend.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As we move further into Q4, it seems that Bitcoin could see significant growth. Factors like an increase in USDT borrowing, the formation of a base for potential price recovery, and the liquidity chart indicating a positive trend, suggest a promising bullish scenario.

Approaching the $70,000 mark, Bitcoin could be preparing for a powerful end to the year, potentially providing high returns for traders who have strategically positioned their investments for further growth.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-10-07 08:08