-

INJ stakeholders lost significant gains made during the September rally.

Now, the hope for a breakout hinges on a key factor.

As a seasoned researcher with years of experience in the cryptospace, I’ve seen enough market ups and downs to know that every coin has its unique narrative. Injective [INJ], with its innovative burn auctions and impressive milestones, is no exception.

Last month, the downward trend for INJ was challenged, as it skyrocketed by approximately 40%, reaching $23. Yet, a price adjustment in October largely reversed these increases, causing INJ to drop back down to its previous values.

Lately, the Injective network has achieved significant milestones, leading to a substantial growth in its user base and a 6% surge in the value of INJ tokens.

Even though there was a temporary increase, the rally ended prematurely due to a bearish MACD crossing on the daily chart. Subsequently, AMBCrypto analyzed whether this pullback might trigger a breakout, as several experts believe it could.

INJ in short supply

With the introduction of the burn auction in 2023 as part of INJ 2.0, the token burning process has been made more straightforward and user-friendly.

In simpler terms, the INJ network simplifies the process of token burning, allowing each user to easily participate in contributing to the Auction Fund directly.

Just now, it was disclosed that an extra 200,000 INJ tokens will be destroyed. This step is believed to boost INJ’s market trends in the long run.

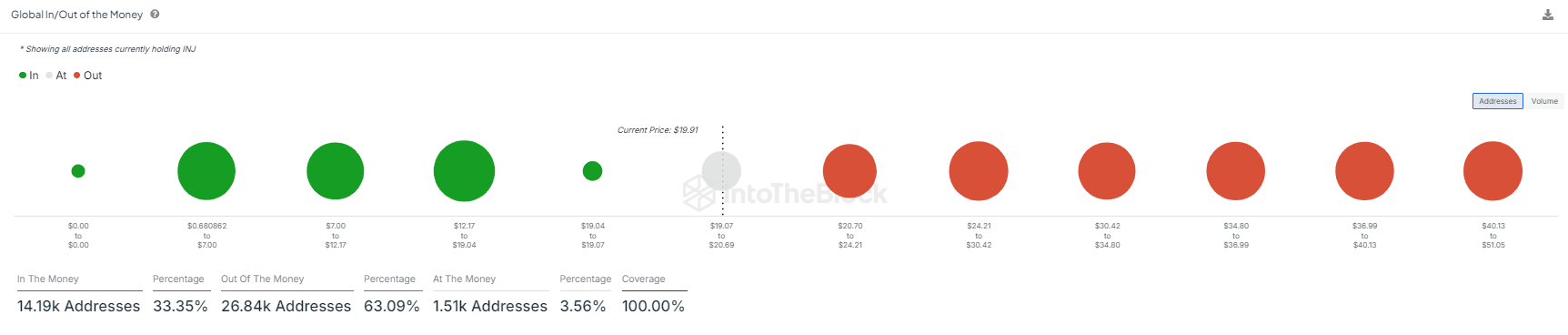

Consequently, as AMBCrypto noted, the latest drop in prices has left over 1.66 million INJ holders facing a loss, having bought their coins at an average price below the current market value, specifically around $22 per coin.

Source : IntoTheBlock

If other investors believe the current price represents a market floor and choose to purchase at a discount, they might find it advantageous to delay selling until they’ve broken even, along with the network advancements we’ve discussed earlier.

If the current pattern persists, Injective’s upcoming challenge would be converting the previous barrier at approximately $23 from a resistance to a support level. Should they manage this feat, the potential new resistance could reach approximately $30.

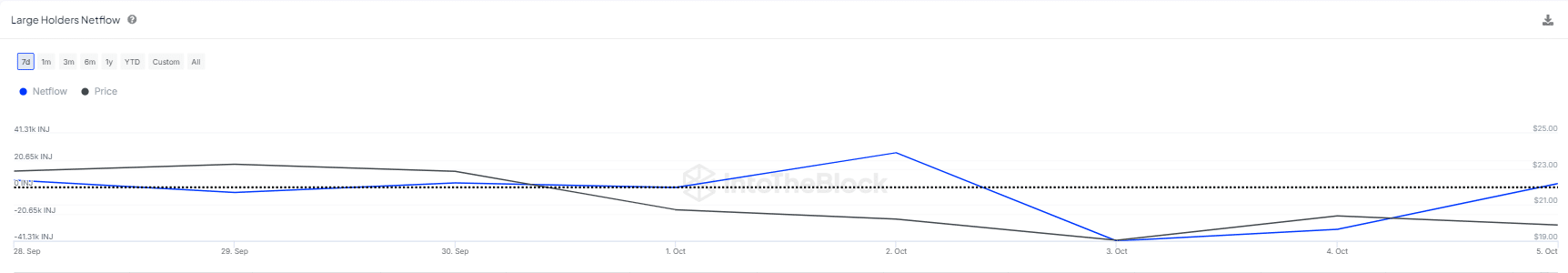

Whales are supporting this idea

This week, significant groups of whales stepped in to halt a potential decline of INJ, averting a dip that might have brought the price down to $18. As a result, there was a substantial 7% increase, propelling INJ back towards $20.

The chart below shows that approximately 45K INJ tokens flowed from exchanges into whale wallets, accumulating during the dip and successfully flipping the $18 level into support.

Source : IntoTheBlock

Although this indicates a positive trend, a decrease in large investors’ holdings might present difficulties for buyers in sustaining the $23 price point.

To put it simply, this buildup indicates a possible low point in the market, urging those with losses to hang on and attracting those seeking profits due to fear of missing out (FOMO), which is vital for reinforcing the $23 level as a strong support.

Read Injective’s [INJ] Price Prediction 2024–2025

Conversely, if whales decide to withdraw, key stakeholders might become skeptical about the ongoing recovery, potentially causing the value of INJ to drop back down to $18.

Consequently, monitoring whale behavior becomes crucial for a significant price surge. Persistent involvement of whales might bolster the bulls’ resolve, enabling them to sustain the $23 price floor. This could pave the way for the next potential resistance level at $30.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-10-07 09:11