As someone who has navigated the complex world of personal finance for many years, I can confidently say that understanding the differences between APR and APY is crucial to making informed decisions about your money.

Have you ever found yourself in a situation where you signed up for a credit card, enticed by a low-interest rate, but later discovered that you were paying more than anticipated? Or perhaps you opened a savings account, expecting a substantial return on your investment, only to find that the interest wasn’t accumulating as quickly as you thought it would?

Oh, isn’t it common for us to get confused about financial jargon? For instance, distinguishing Annual Percentage Rate (APR) from Annual Percentage Yield (APY).

This piece will clearly outline the differences between APR and APY, empowering you to make informed decisions in the future. Be it lending or saving, grasping this concept can help avoid unnecessary troubles – and financial strain – down the line.

Top 5 APR vs. APY Key Takeaways

- APR represents the basic interest rate on loans or credit, showing the annual cost of borrowing without considering how often interest is compounded.

- APY reflects the actual rate of return on savings or investments, factoring in compounding interest over a year.

- The key difference between APR and APY is that APY includes the effect of compound interest, while APR does not, making APY more accurate for calculating yearly returns or costs.

- Regarding other differences, APR is commonly used for loans, mortgages, and credit card purchases, while APY is used for savings accounts and investment products that benefit from compounding interest.

- When borrowing, aim for the lowest APR to minimize costs. When saving or investing, seek the highest APY to maximize your returns.

What Is APR?

The Annual Percentage Rate (APR) represents the yearly interest rate you either pay on a loan as a borrower or earn on an investment, expressed as a percentage. It shows the true yearly cost of borrowing money or the income you make from an investment.

As a researcher, I’ve found that Annual Percentage Rate (APR) encompasses any additional costs associated with a transaction. However, it fails to consider the frequency at which interest is accumulated and added to the account balance, a process often referred to as compounding.

The APR (Annual Percentage Rate) is beneficial as it provides a single figure for comparison among various loans, credit cards, or investment opportunities. This makes it easier for you to make informed decisions when choosing the best option.

Regardless if you’re thinking about a mortgage, a personal loan, or a credit card, the Annual Percentage Rate (APR) provides a straightforward understanding of the overall expense involved in borrowing money over a year, or the expected yield during the same period.

As a crypto investor, always bear in mind that Annual Percentage Rate (APR) offers a quick look at costs, but it fails to reveal the frequency at which interest is compounded onto your account. This compounding interval significantly impacts the total amount you might eventually pay or earn over the long term.

Calculating APR

The formula for calculating APR is simple:

APR = Periodic Rate x Number of Periods in a Year.

For example, if the interest rate is 1% per month, the APR would be:

APR = 1% x 12 (since there are 12 months in a year) = 12%.

What Is APY?

In simpler terms, the Annual Percentage Yield (APY) represents the total yearly earnings you get from an investment, factoring in any interest that’s compounded over time.

Interest accumulation occurs when the interest is consistently added to your account’s total, resulting in a growth of both your balance and the interest earned with each passing period. Essentially, the larger your account grows, the more interest it generates progressively.

APY gives a more accurate picture of your earnings because it considers the effect of compound interest and any fees tied to the investment, showing you the true return over time.

Calculating APY

To calculate APY, you use the formula:

APY = (1 + Periodic Rate)^Number of Periods – 1.

If you put $10,000 into a savings account offering a yearly return of 2% that compounds monthly, here’s how the math works out:

APY = (1 + 0.02/12)^12 – 1 = 0.0202, or 2.02%.

This means that after a year, you’d earn $202 in interest on your $10,000 investment.

APR vs. APY: Types of Accounts

Financial products and accounts use either APR or APY, which have different meanings. It’s important to know which one applies to the account you’re considering, so here are the most common examples:

APR Accounts

- Loans: Credit cards, mortgages, auto loans, and personal loans.

- Lines of Credit: Home equity lines of credit (HELOCs), business lines of credit.

APY Accounts

- Savings Accounts: Traditional savings accounts, high-yield savings accounts.

- Certificates of Deposit (CDs): Short-term CDs, long-term CDs.

- Retirement Accounts: 401(k)s, IRAs.

- Money Market Accounts

- 529 Accounts

- Bonds

APR vs. APY: What Are The Differences Between Them?

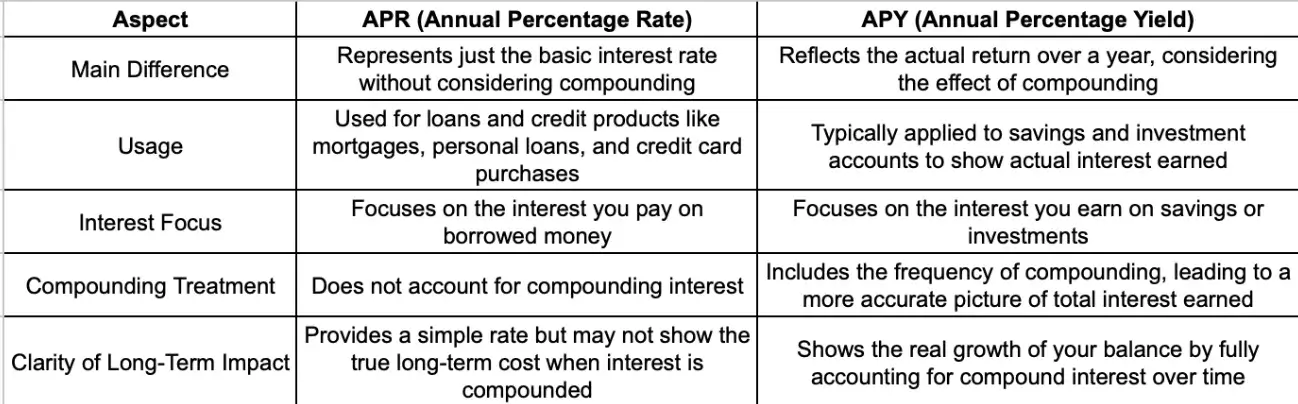

Main Differences Between APR and APY

In simpler terms, APY (Annual Percentage Yield) takes into account the growth of interest due to compounding, giving you a more accurate representation of your annual earnings. On the other hand, APR (Annual Percentage Rate) only provides the initial rate without considering any potential increases from compounding.

Here’s a simple example:

- APR – If a loan has a 5% APR, you’ll pay 5% interest on the original amount (the principal) each year, with no extra fees or compounding. So, if you borrow $1,000, you’ll pay $50 in interest for the year.

- APY – If a savings account offers 5% APR but compounds monthly, the APY will be a little higher because the interest gets added to your balance every month. So, by the end of the year, you’ll earn more than just 5% because each month’s interest adds to your balance, which then earns more interest the following month. So, APY permanently takes into account compound interest.

Other Differences Between APR vs. APY

Besides how they handle compounding interest, there are also other minor differences between them.

Among their uses, one distinction lies: APR (Annual Percentage Rate) is generally associated with loans and credit products such as mortgages, credit card transactions, or personal loans. It serves to illustrate the yearly expense of borrowing money in a simple percentage form, solely reflecting the interest rate you’ll be charged. Conversely, APY (Annual Percentage Yield) is predominantly employed for savings and investment accounts, where it demonstrates the true interest earned on deposits, taking into account compound interest.

A notable distinction lies in the emphasis on interest accrued versus interest owed. The Annual Percentage Rate (APR) concentrates on the interest you pay when borrowing money. It gives a consistent yearly rate, but it doesn’t factor in how frequently interest might be added to your debt. On the other hand, the Annual Percentage Yield (APY), which is relevant for savings and investments, illustrates what you earn. It takes compounding into account, thereby offering a truer representation of the growth of your money over time.

In simpler terms, the APR (Annual Percentage Rate) only considers basic interest accumulation, while APY (Annual Percentage Yield) takes into account how often that interest is compounded, be it daily, monthly, or annually.

Over the long term, the differences between APR and APY become more pronounced. While APR gives a clear idea of the annual percentage charged on your loan, it doesn’t show the total cost over time if interest compounds frequently. In contrast, APY shows how much your savings or investments will grow because it fully considers the compounding effect.

APR vs. APY: Which Is Better?

Well, it depends—especially on whether you’re the borrower or the lender.

When you’re taking out a loan, it’s crucial to aim for the lowest interest rate possible. However, it’s important to understand the distinction between Annual Percentage Rate (APR) and Annual Percentage Yield (APY). APR represents only the basic interest rate multiplied by the number of times the loan is compounded per year, without considering any compounding effects. On the other hand, APY takes into account how frequently the interest is compounded, providing a more accurate representation of what you’ll actually pay over a year.

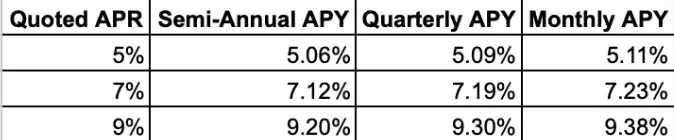

For instance, if a lender provides you with a 5% Annual Percentage Rate (APR) for a loan, it might seem appealing. But if the interest accumulates monthly, the true annual cost (Annual Percentage Yield, or APY) becomes 5.11%. While this difference may appear minor, it can accumulate significantly, particularly for long-term loans.

Here’s a quick breakdown:

As you can see, the more often interest is compounded, the higher your actual cost will be. So, when looking at loan offers, be sure to ask about both the APR and the APY (and how often the interest compounds) to ensure you’re getting the best deal.

As a researcher seeking ways to maximize returns on savings, I’d suggest focusing on securing the highest Annual Percentage Yield (APY) from banks. APY takes into account compound interest, making it seem more attractive than just the annual percentage rate (APR). However, it’s crucial to also consider how frequently the interest is compounded, as this can significantly impact your earnings in the long run.

FAQs

Are APY and APR The Same?

While both APY (Annual Percentage Yield) and APR (Annual Percentage Rate) are used to determine interest, they have distinct roles. APY is the amount of money you’d earn from an interest-bearing account over a year, such as a savings account, money market, or IRA. On the other hand, APR represents the amount of interest you’ll pay when borrowing money through a loan or using a credit card.

Is It Better to Have a Higher APY or a Lower APR?

Typically, a higher Annual Percentage Yield (APY) is advantageous since it means greater returns on your savings or investments. Conversely, a lower Annual Percentage Rate (APR) is beneficial when taking out loans, as this translates to lower interest payments in the long run.

Why Is APR Higher Than APY?

Typically, Annual Percentage Rates (APR) are more than Annual Percentage Yield (APY) rates because lenders calculate APR according to the creditworthiness of the borrower, and those perceived as higher-risk individuals usually receive a higher APR.

What Do APR and APY Mean in Crypto?

In the realm of cryptocurrency, both APR (Annual Percentage Rate) and APY (Annual Percentage Yield) serve roles akin to their traditional finance counterparts. APY signifies the return or interest you receive from your crypto savings accounts, while APR represents the interest fee that borrowers are required to pay on crypto loans.

Conclusion

From now on, remember the fundamental variations between Annual Percentage Rate (APR) and Annual Percentage Yield (APY). In the future, when assessing loans or savings accounts, always consider these differences to steer clear of unexpected situations and make decisions that favor your financial growth!

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-10-07 16:52