-

Pepe coin has maintained its upward trajectory, but now faces key resistance ahead.

Technical indicators point to PEPE overcoming the selling pressure at this critical level, suggesting further gains ahead.

As an experienced crypto investor with a keen eye for market trends, I’ve been closely watching the trajectory of Pepe [PEPE]. Having navigated through numerous bull and bear markets, I can confidently say that this meme coin’s recent surge is nothing short of impressive.

😱 Trump's Tariff Bombshell Could Crush EUR/USD!

Markets on edge — read the urgent new forecasts before it’s too late!

View Urgent ForecastOver the past month, Pepe [PEPE] has climbed more than 57%, and it appears this momentum isn’t stopping. In fact, within the last 24 hours, its value has increased by another 14%.

As predicted by AMBCrypto, there could be more growth ahead; however, PEPE needs to surmount its immediate obstacles or hurdles first to ensure potential further advancements.

What traders’ activities indicate

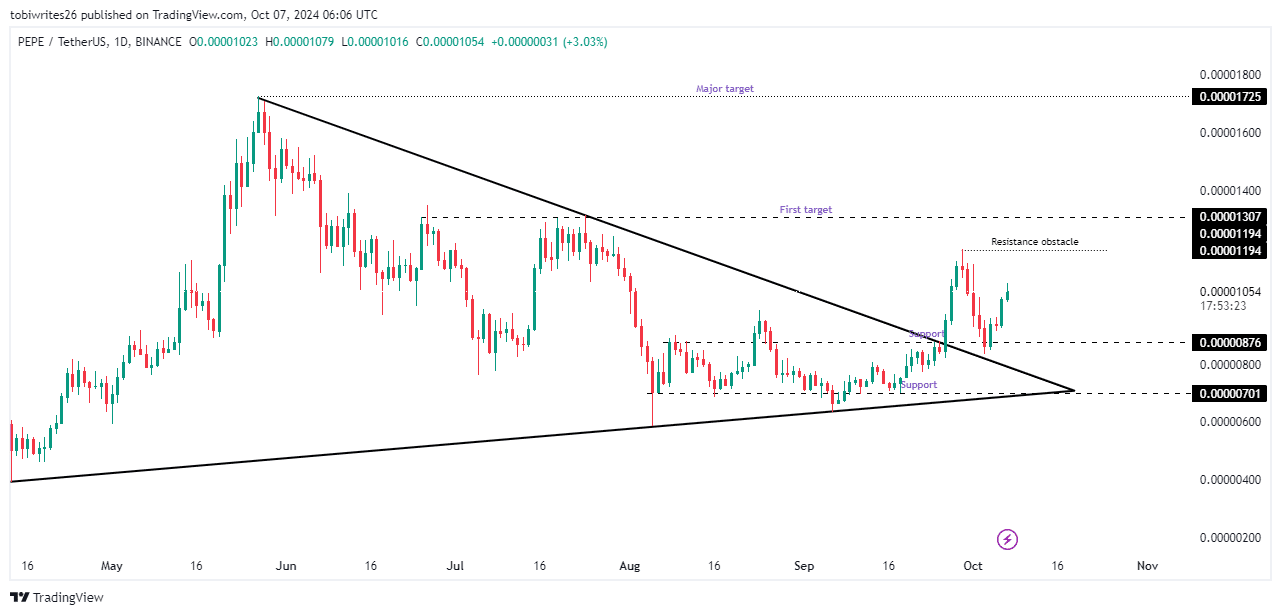

PEPE traded within a symmetrical triangle for months before breaking out on the 26th of September.

In general, this bullish trend usually indicates substantial growth, yet following the surge, the token saw a drop of approximately 30.44% in a turbulent market.

Currently, PEPE is experiencing a new surge, pushing upward following a rebound from a supportive area where it found a floor.

If it doesn’t manage to break through the resistance at $0.00001194, there might be a possible reversal or decline.

As an analyst, I foresee that clearing the current resistance could pave the way for PEPE to revisit the $0.00001307 mark, a level we consider as a near-term goal.

Sustained buying pressure and momentum could then push the price higher toward $0.00001725.

According to AMBCrypto’s analysis, they have supported these predictions using technical signals, which suggest a potentially optimistic trend for the market.

PEPE coin’s continued rally

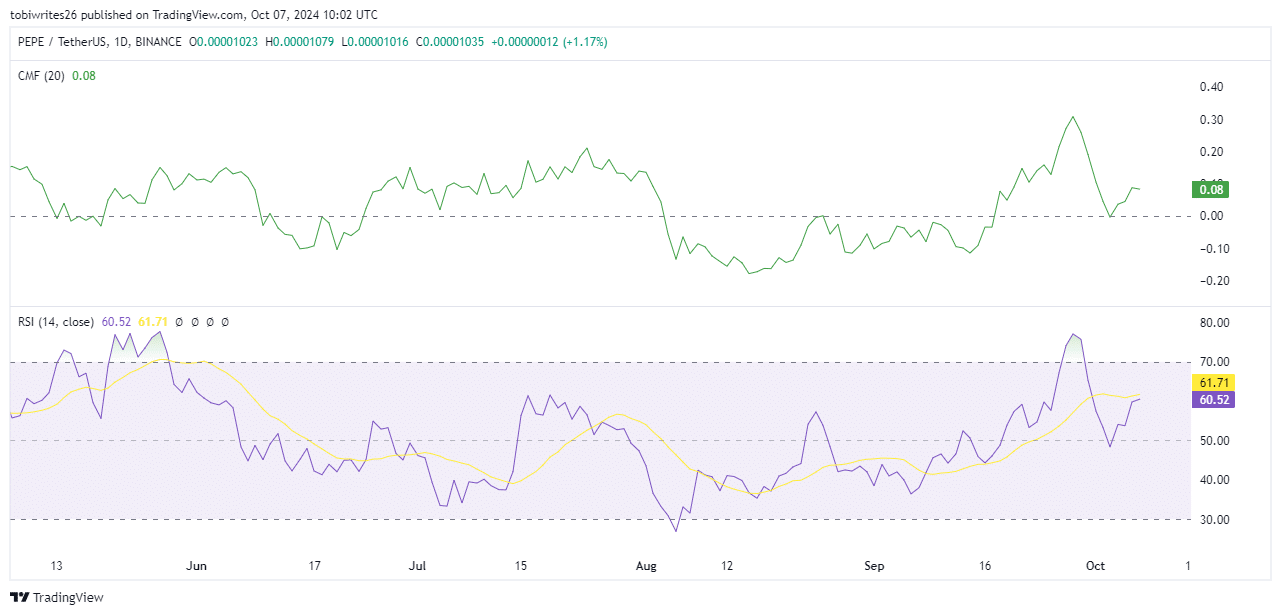

Based on AMBCrypto’s technical analysis, it appears that the token PEPE may experience additional growth. This prediction is supported by the Chaikin Money Flow (CMF) and Relative Strength Index (RSI), which suggest a surge in bullish energy.

The Chaikin Money Flow indicates the movement of funds into or out of an asset, reflecting its liquidity. A positive and increasing value suggests a strong influx of capital, signaling robust liquidity flows.

The Relative Strength Index (RSI) measures the market’s mood, whether it’s positive (bullish) or negative (bearish), by tracking fluctuations in the rate and intensity of price variations.

If Relative Strength Index (RSI) exceeds 50 and is on an uptrend, it usually suggests that the asset’s price may move in a similar ascending pattern.

Currently, as I’m typing this, both the CMF (Cyclical Market Indicator) and RSI (Relative Strength Index) have bounced back from their respective benchmarks – a value of 0.00 for the CMF and 50 for the RSI.

Given that both indicators are showing a positive trajectory and consistently moving upwards, it’s quite probable that the PEPE price increase will continue.

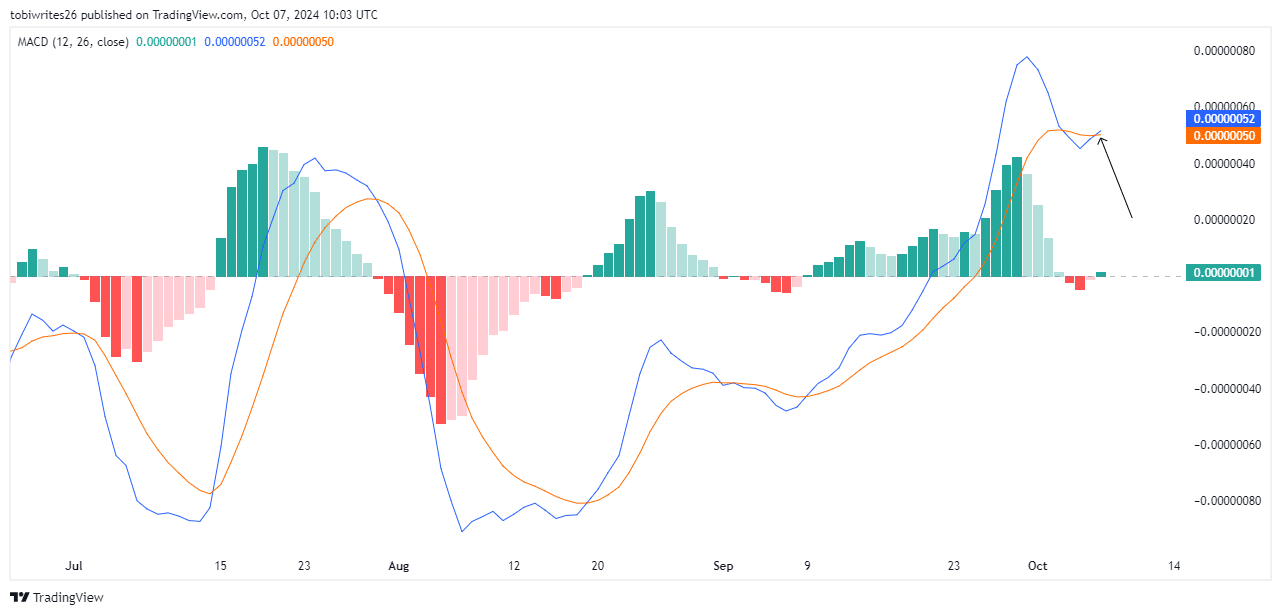

As a crypto enthusiast, I’ve noticed an exciting development with PEPE – it’s showing a golden cross pattern. This technical formation, where the blue MACD line surges over the orange signal line, is often a bullish sign, suggesting robust uptrend potential.

After this merge, PEPE is presently benefiting from this surge, evident by the solitary upward trend indicator visible on the graph.

Adding to the belief, it seems likely that the PEPE coin might break through the barrier at $0.00001194, potentially paving the way for further increases in value.

Traders’ interest remains strong

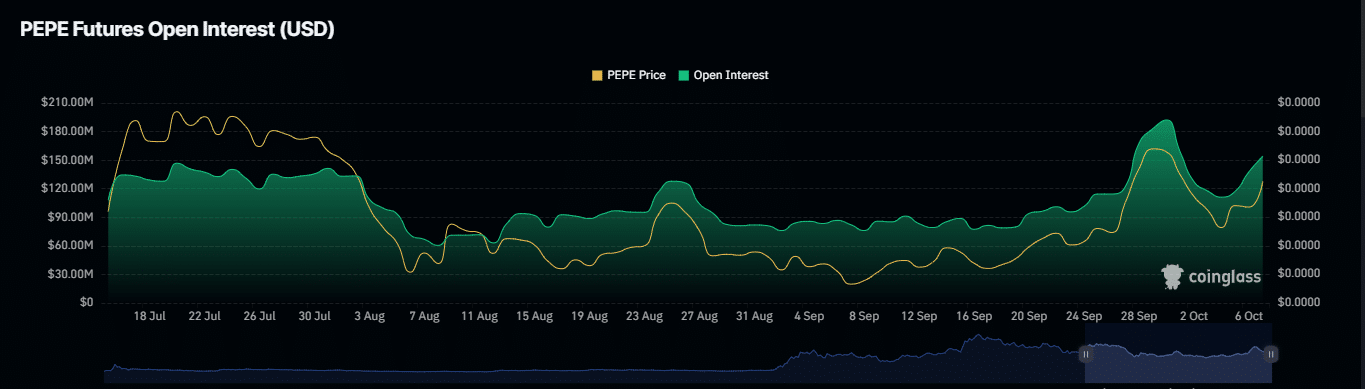

The quantity of derivative agreements yet to be settled for a certain asset, known as Open Interest, has experienced a growth, boosting it to a level of approximately $162 million, representing a significant rise of 15.10%.

Read Pepe’s [PEPE] Price Prediction 2024–2025

The increase in Open Interest indicates that a higher number of investors are entering the market as long positions, possibly initiating fresh contracts or increasing their current holdings, due to expectations of further price increases.

Should this pattern continue along with other favorable technical signals, it’s likely that PEPE will meet its anticipated price goals.

Read More

- Masters Toronto 2025: Everything You Need to Know

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- The Lowdown on Labubu: What to Know About the Viral Toy

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

2024-10-07 19:04