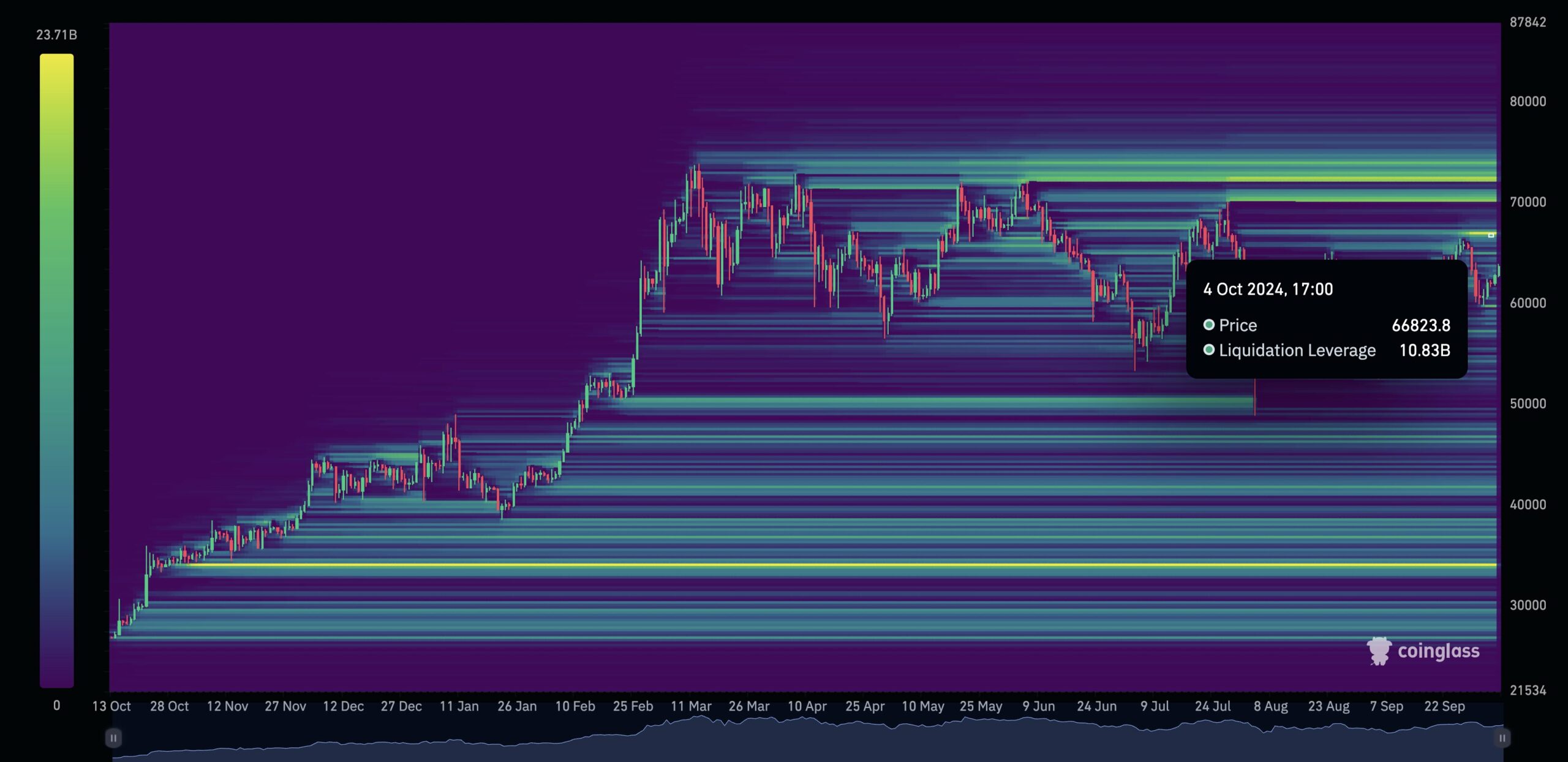

- Bitcoin’s $66,200 liquidation level could trigger a $10 billion short squeeze.

- Further liquidations at $70,300 and $72,578 could accelerate Bitcoin’s upward trajectory.

As a seasoned analyst with years of market observation under my belt, I can confidently say that we are standing at the precipice of a significant event for Bitcoin [BTC]. The approaching liquidation levels, particularly $66k, $70.3k, and $72.578, have the potential to ignite a short squeeze of unprecedented proportions.

As Bitcoin (BTC) nears significant selling points, there’s a strong possibility it might cause a rapid buying frenzy due to a short squeeze, potentially pushing the price rapidly higher.

Based on a tweet from a well-known expert, approximately $10 billion in short positions could be threatened if the price reaches $66k. Hitting this price point could initiate a series of events.

As a crypto investor, I’m buoyed by the potential liquidation levels at approximately $70,300 and $72,578. These thresholds could potentially intensify the bullish momentum, lending credence to a promising outlook for Bitcoin in the coming days.

A short squeeze could be triggered at $66,200

When the price reaches $66,200, approximately $10 billion worth of short positions will need to be closed, resulting in these sellers having to buy the asset at the current market price instead (effectively becoming spot purchases).

This change might initiate a “short-squeeze,” causing market players to buy back their Bitcoin holdings (covering their positions). This action would boost demand for Bitcoin, leading to increased pressure to buy.

Generally speaking, such an occurrence tends to drive up the price, so this point becomes a significant benchmark for Bitcoin’s immediate future trajectory.

Bitcoin next price surge could happen at $70,300

Should Bitcoin surpass the $66,200 barrier, a noteworthy resistance point lies approximately at $70,300. This level could potentially trigger a $16 billion worth of short position liquidations.

Another round of liquidations could push prices even higher, potentially reaching new heights.

As a researcher, I’ve observed that these liquidations often spark a chain reaction, intensifying price fluctuations, and causing bearish positions to be compulsorily bought back due to the market pressure.

Bitcoin final surge

As an analyst, I’ve identified a crucial point of potential liquidation for the market at approximately $72,578. Currently, there are short positions amounting to around $18 billion that could be liquidated if this price level is reached.

Should Bitcoin reach that value, it’s likely to spark another surge of buying activity, potentially causing the price to climb even higher.

The market will be very volatile, and this zone might be the starting point for a big rally.

BTC paints a bullish picture

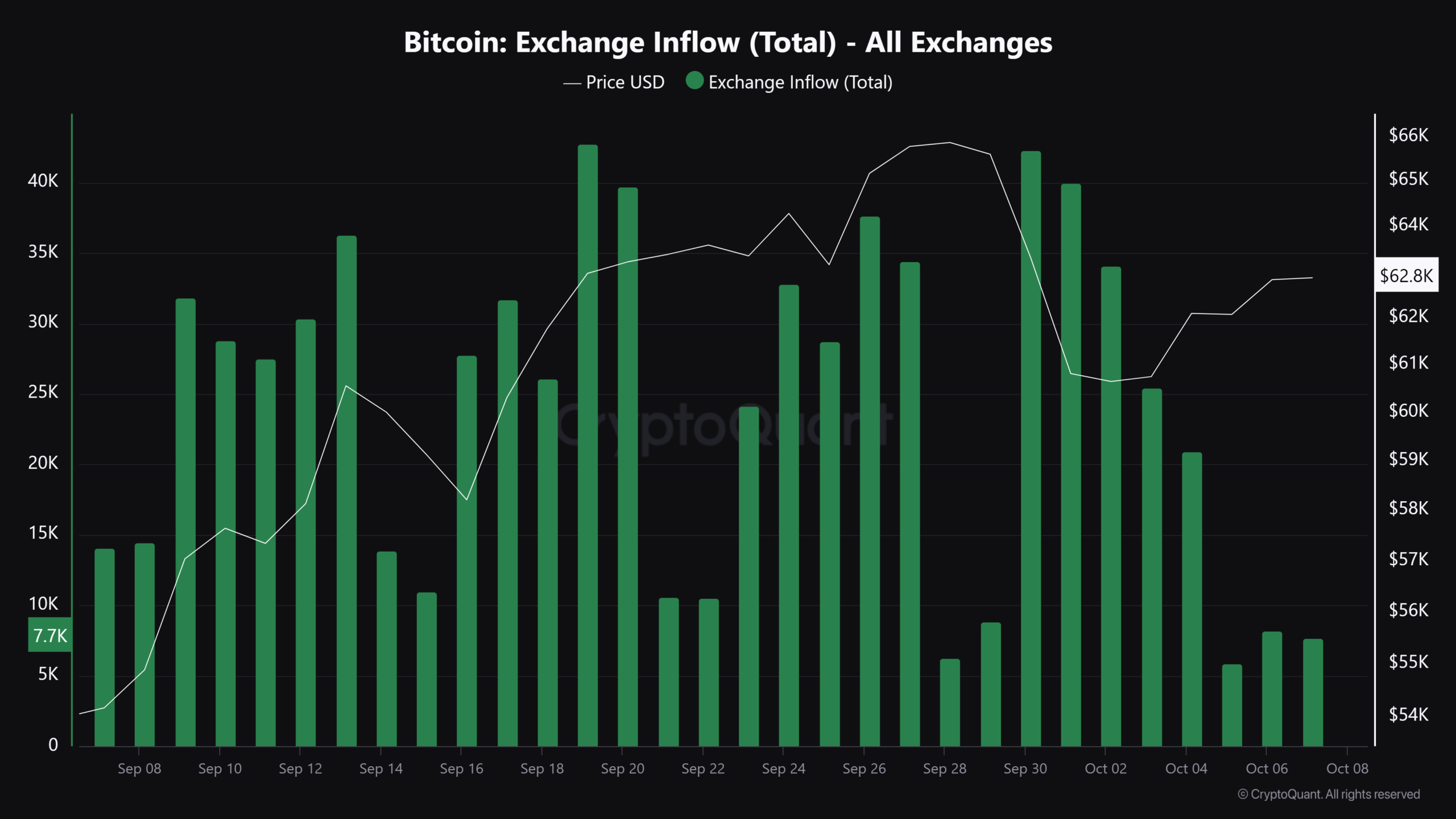

Starting from September 7th, there’s been an upward trend in Bitcoin’s Open Interest. This indicates that more traders are engaging in leveraged positions, suggesting increased participation.

Over the past month, we’ve seen Bitcoin’s inflow into exchanges occasionally surge upwards, and right now, it appears to be picking up speed following a recent decline.

This shows a rise in Bitcoin trading due to heightened investor engagement, as they prepare for possible price fluctuations.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

The market is now on high alert with the way Bitcoin approaches these key liquidation zones.

In simple terms, this brief compression could lead to significant price surges, especially when the anticipated chain reactions of sell-offs actually occur.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Masters Toronto 2025: Everything You Need to Know

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-10-08 07:04