-

XRP nears resistance with bullish support from RSI and Bollinger Bands.

Open interest and on-chain activity boost momentum, but NVT raises caution.

As a seasoned analyst with years of experience navigating the cryptocurrency markets, I find myself intrigued by Ripple’s current position. While XRP is indeed showing signs of bullish momentum – with its price contained within Bollinger Bands and a neutral RSI, suggesting a potential breakout – it’s important to remember that the market remains complex and unpredictable.

Right now, Ripple (XRP) is garnering positive interest from both individual and large-scale investors. Presently, XRP is being traded at $0.5421, showing a 1.93% increase in the past 24 hours. At this moment, the public sentiment stands at 0.07, while smart money is at 0.74, suggesting that optimism is growing about XRP potentially overcoming crucial resistance levels and continuing its price surge.

However, market conditions remain complex, and several factors could impact this trajectory.

XRP chart shows potential

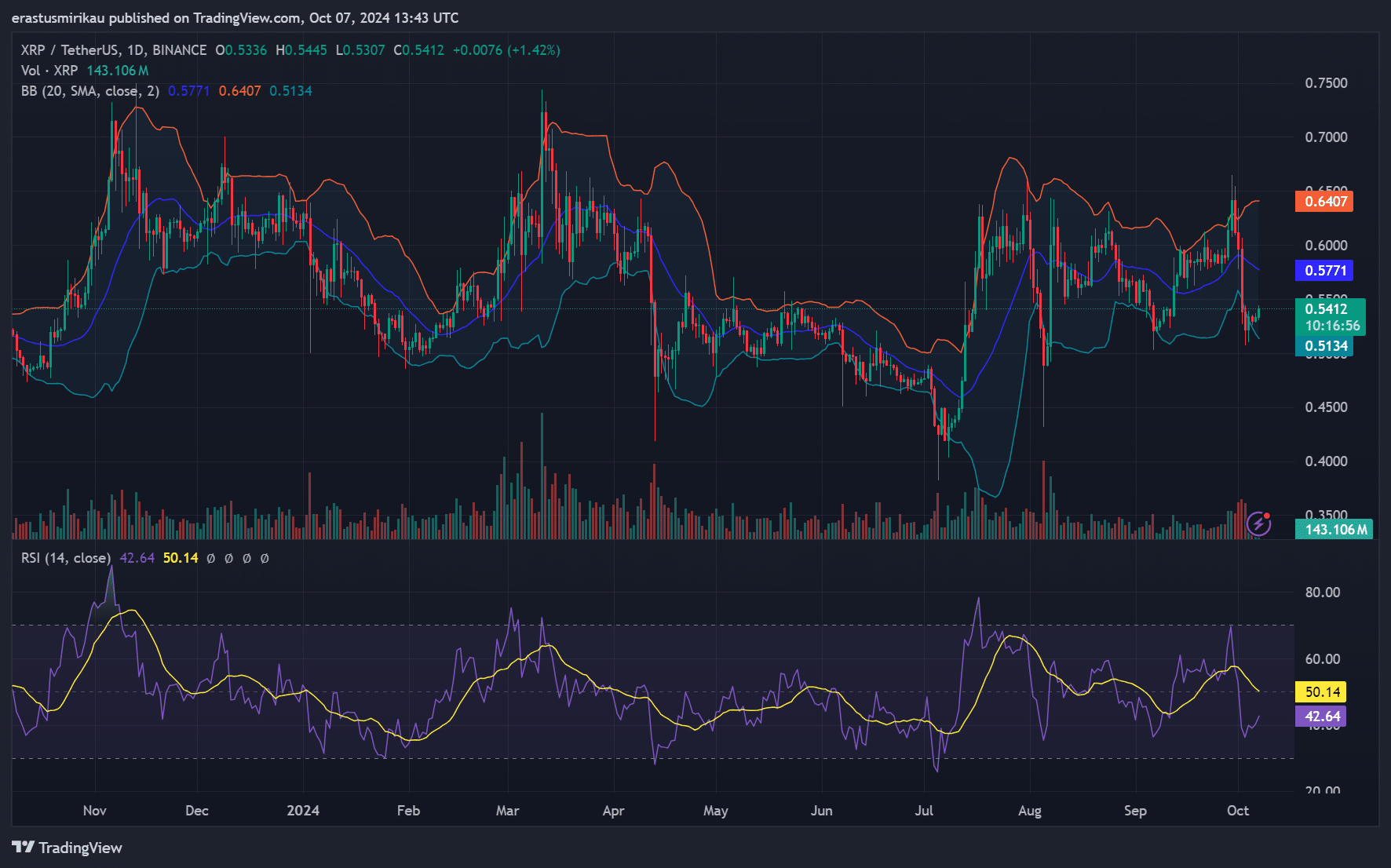

The price of XRP is currently fluctuating within its Bollinger Bands, which means it’s moving between approximately $0.5336 and $0.5445. This indicates a moderate trend in the market, as the Relative Strength Index (RSI) stands at 50.14, suggesting neither an overbought nor oversold position.

Thus, the market seems balanced, neither showing signs of being overbought nor oversold. This equilibrium might be an indication of an impending breakout for traders. Should the bullish trend persist, a surge beyond $0.5445 could potentially drive XRP‘s price even higher.

However, failure to breach this level could see the price consolidate or even retrace.

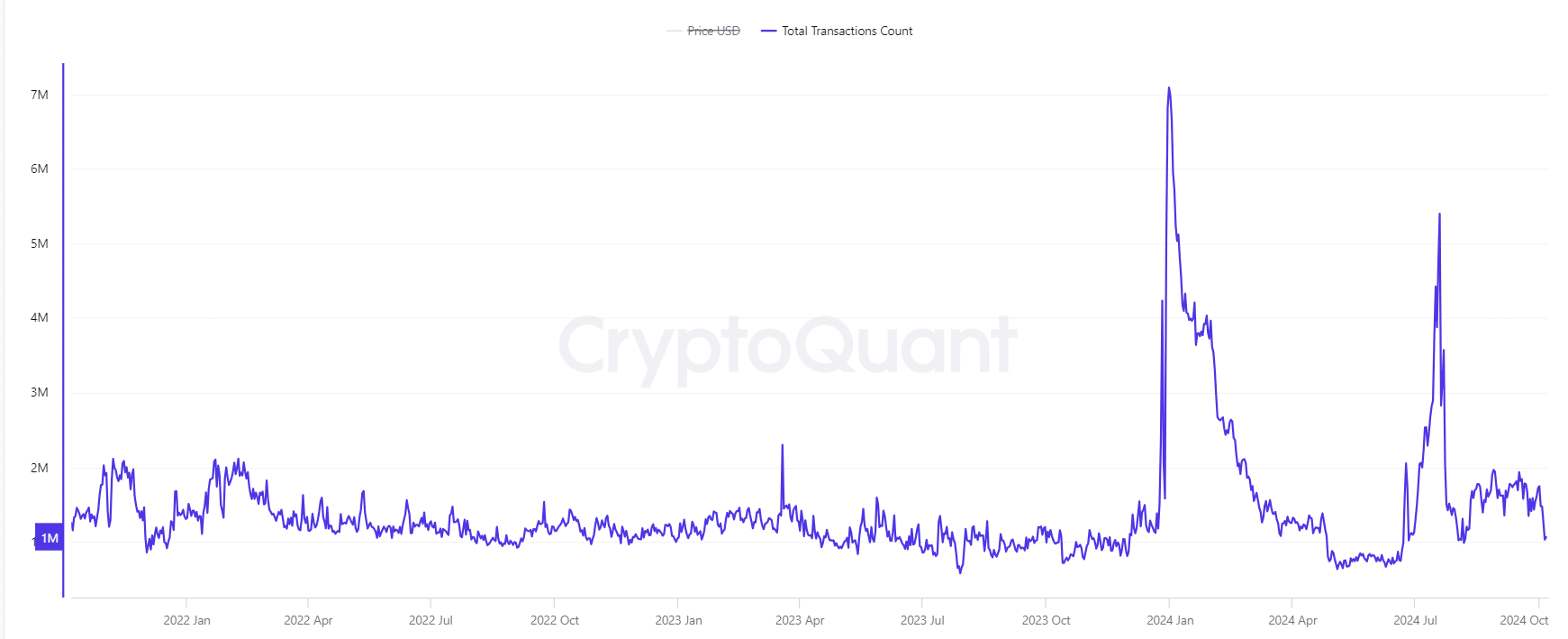

Although XRP‘s price and overall sentiment seem optimistic for a bullish trend, the Network Value to Transactions (NVT) ratio indicates a more restrained perspective. At the moment, the NVT ratio is reported as 388.20, marking a decrease of 4.89% over the last 24 hours, as per CryptoQuant’s latest data.

A Network Value to Transactions (NVT) ratio that’s high tends to signal a network priced higher than its transaction volume, implying that the current price may not be substantially backed by actual network activity. Consequently, even though there might be optimistic feelings among traders, they should remain cautious about possible overvaluation.

Rising on-chain activity: A positive signal

Instead of that, on-chain statistics paint a more optimistic picture. Over the past day, XRP‘s transaction count increased by 1.17% to 1,180,400, and active addresses grew by 1.11%, amounting to 9,329. These rises in transactional and user activity lend support to a positive outlook on XRP.

Furthermore, an increase in network engagement tends to coincide with more robust price movements, which is a promising indicator for short-term outlook.

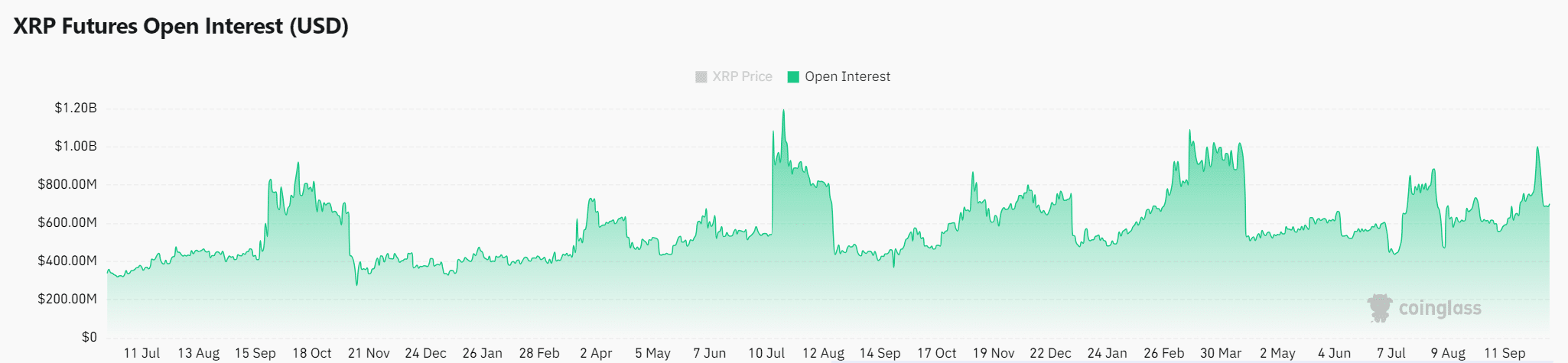

Open interest gaining momentum

Furthermore, the open interest for XRP has grown by 1.95% within the last day, amounting to $714.94 million as of now. An increase in open interest typically indicates higher levels of trader engagement and growing market trust.

As a result, the increasing number of traders adopting positions might suggest that XRP is gaining traction, hinting at a potential price surge ahead.

Read XRP’s Price Prediction 2024–2025

Conclusively, XRP’s bullish sentiment, rising open interest, and increasing on-chain activity all suggest that the momentum could push prices higher. However, the elevated NVT ratio serves as a cautionary note.

Should XRP surpass its current resistance level, it might lead to a prolonged price increase. Consequently, it’s advisable for investors to keep an eye on any breakout that exceeds the $0.5445 mark.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2024-10-08 11:03