- The technical indicators and futures market data outlined Cardano’s conviction levels.

- The lack of significant capital inflows weakened any bullish bias for the coming days.

As a seasoned crypto investor with a knack for spotting trends and interpreting technical indicators, I find myself in a rather ambiguous position regarding Cardano [ADA]. The recent price action has been reminiscent of a game of ping-pong within its two-month range.

After an unsuccessful attempt to break out earlier in the month, Cardano [ADA] has returned to its two-month average range. This change was triggered by a halt in Bitcoin‘s [BTC] progress around the $66,500 mark, causing its momentum to slow down.

After that point, Bitcoin has dipped down and held steady around the $60,000 area. On the other hand, Cardano’s bullish pattern persists on the daily chart, nearly shifting to a bearish trend. Here’s what traders and investors might encounter with this altcoin.

Undecided market sentiment could move prices either way

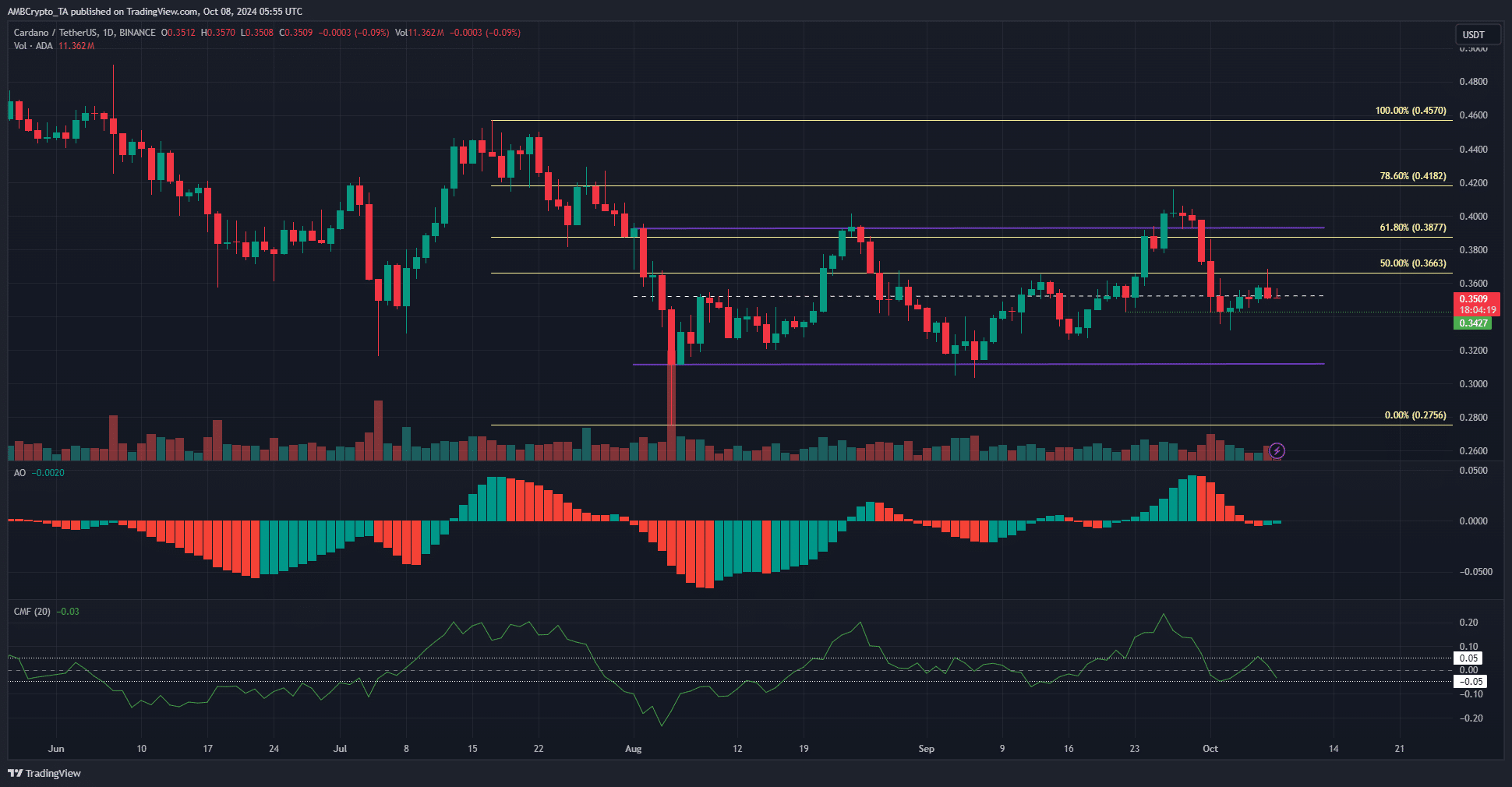

After being turned away at around $0.415, Cardano settled back near the middle price point of $0.325. AMBCrypto analyzed the broader trend and determined that ADA‘s direction was bearish. The prolonged consolidation below $0.4 in recent months might signal the conclusion of this downtrend.

Reflecting on the recent events, it appears that my earlier prediction of a significant surge past $0.41 didn’t materialize, indicating that the market may not be primed for a major rally at this moment. Consequently, the current dip down to the mid-range level presents an enticing buying opportunity for investors who have a long-term perspective.

As an analyst, I’d advise a cautious approach when it comes to swing trading ADA right now. The Awesome Oscillator indicates that the momentum is neutral, and the Chaikin Money Flow (CMF) suggests there are no substantial inflows or outflows of capital in the ADA market at this time.

In other words, it’s uncertain which direction the upcoming trend will take, but considering the daily pattern and the significance of $0.342, there seems to be a slight preference for an uptrend in the near future.

Speculators opt to stay away from trading Cardano

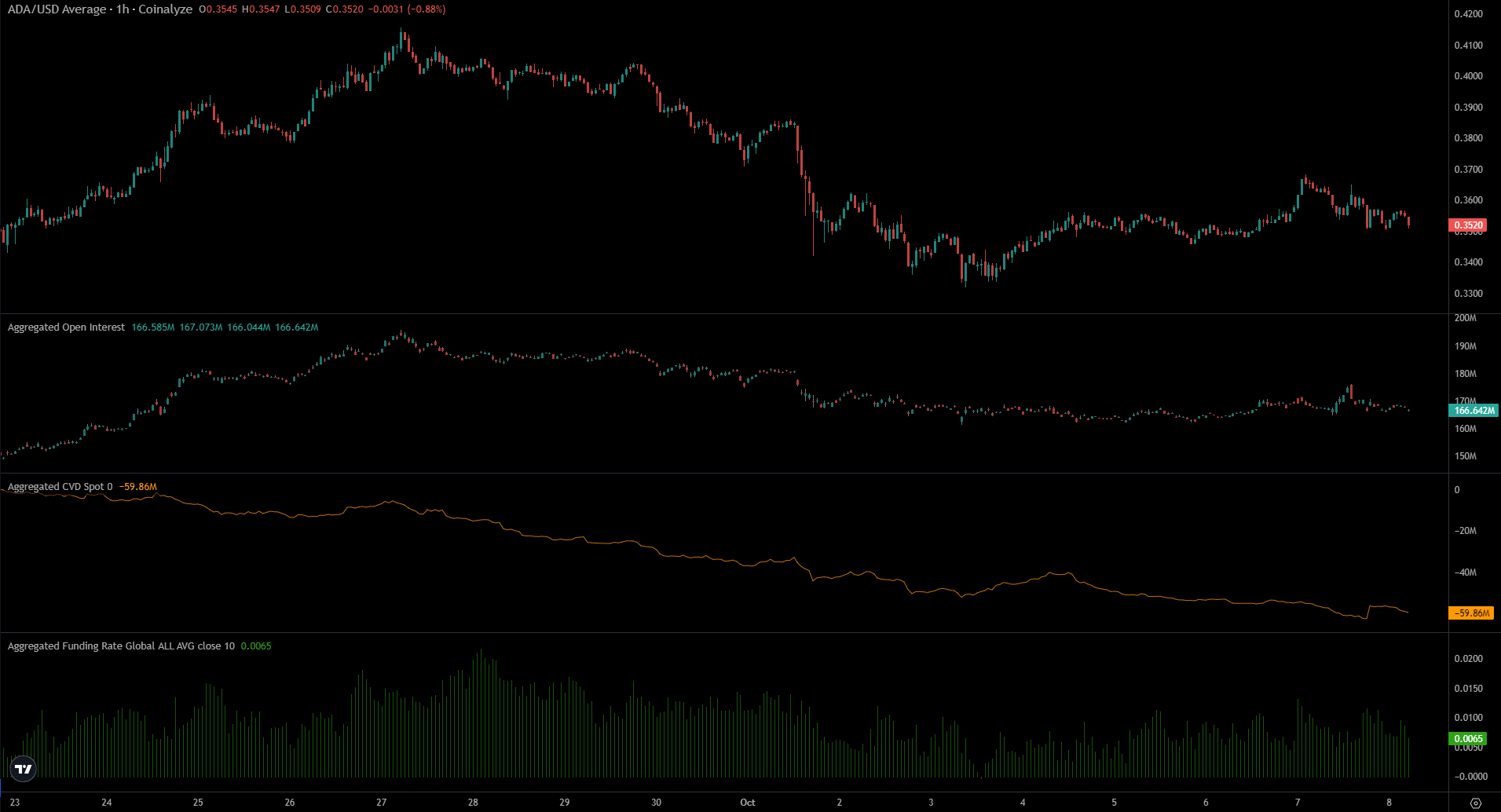

Over the last ten days, the price fluctuations of Cardano have been quite erratic. Since September 27th, there’s been a predominantly bearish trend developing for the short term.

Read Cardano’s [ADA] Price Prediction 2024-25

The spot CVD reflected this trend and has been in a steady downtrend, showing selling pressure.

In October, the Open Interest has consistently hovered around the $170 million level. Speculators seem cautious about ADA due to its uncertain behavior following the price rejection at approximately $0.416.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-10-08 19:03