-

TRX has been stuck in a range-bound market for nearly two weeks amid a lack of market participation.

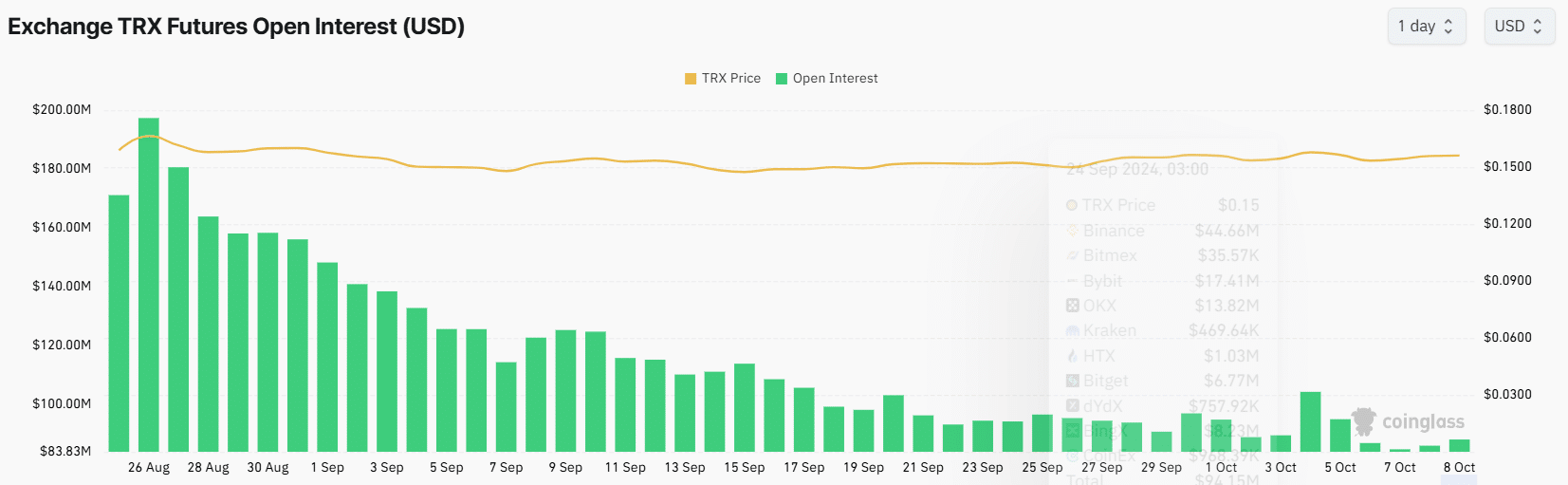

Tron’s Open Interest has dropped to significantly low levels, showing fading market interest.

As a seasoned researcher with years of experience in the volatile world of cryptocurrencies, I must say that analyzing TRX‘s current market position is akin to navigating a labyrinth filled with enigmatic signals. The slight 1% gain amidst a general market downturn is intriguing, but the real question lies in whether it’s a fleeting bullish spark or the beginning of a larger trend.

Among the leading cryptocurrencies, Tron (TRX) stood out as the only one not experiencing losses at the current moment, having slightly increased by 1%. This growth has pushed its value to approximately $0.156 per token.

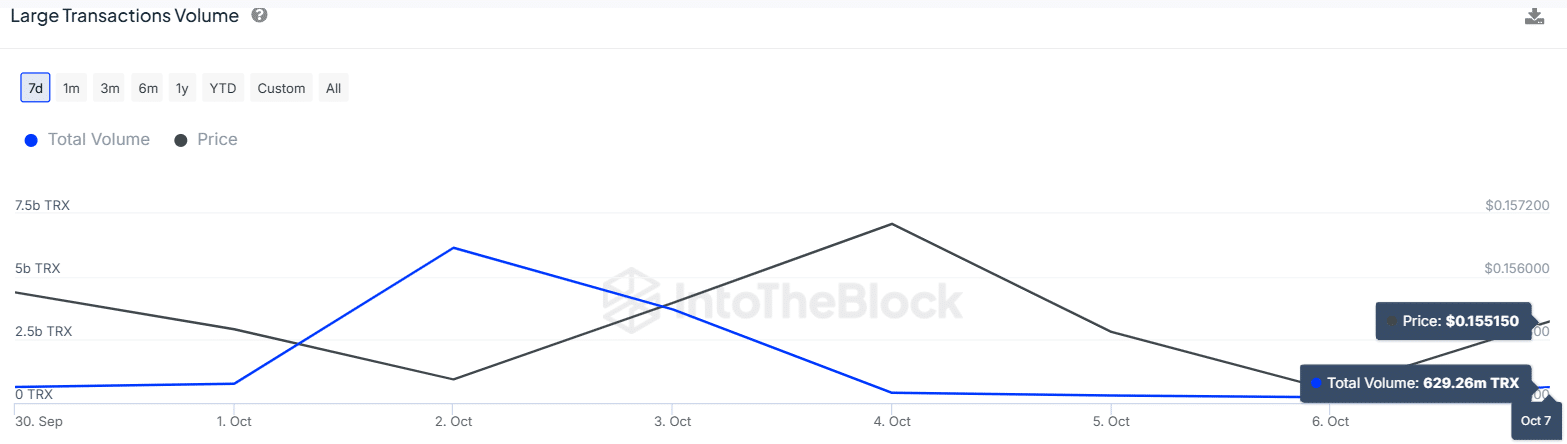

One possible reason for the minor increase could be an upsurge in high-value transactions.

According to data from IntoTheBlock, large transactions related to TRX significantly surged on October 7th, jumping from approximately 224 million to an impressive 629 million. This substantial rise signified a 180% increase in transaction volume.

As a crypto investor, I’ve noticed an uptick in significant transactions exceeding $100,000 with TRX. This suggests that ‘whales’ are showing increased interest in this coin. Yet, the question remains: Will these volumes be substantial enough to propel TRX beyond its current consolidation phase?

Tron price outlook

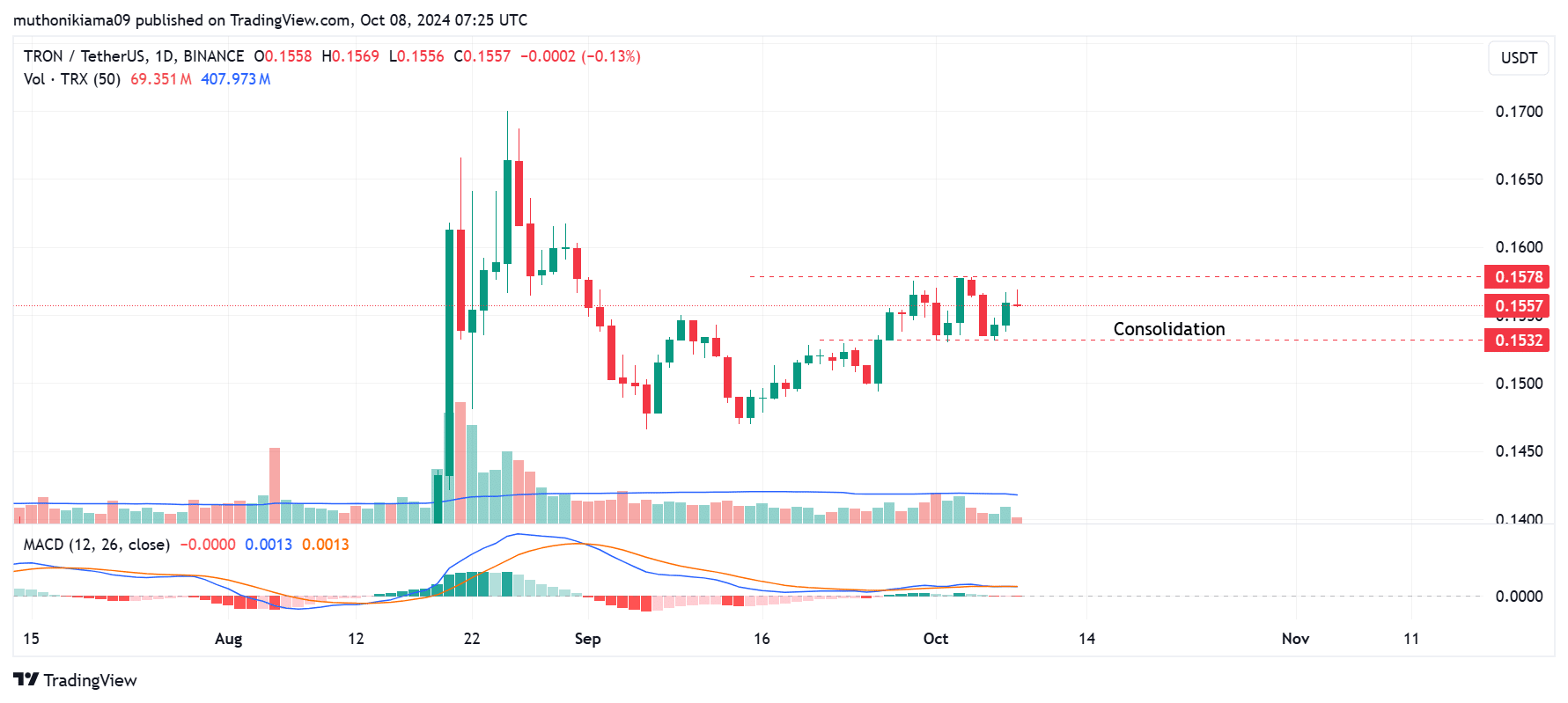

TRX’s trading activity since late September has been characterized by a period of sideways movement, with its value fluctuating between a minimum of $0.153 and a maximum of $0.157.

From the appearance of the bar graph, it seems like the price hasn’t managed to break free from its current holding pattern because both buyers and sellers appear to be less active or engaged in transactions.

Since early September, the histogram bars have consistently stayed beneath the 50-day moving average, indicating a continued period of market dormancy.

When the MACD line is less steep compared to the signal line, it indicates a weakening momentum.

Investors could be anticipating a cue that prompts them to initiate fresh trade transactions, either as buyers or sellers.

If there is no significant change in trading volumes, TRX might continue trading within a range-bound market, with an uptrend facing resistance at $0.157.

Open Interest and Funding Rates show THIS

According to information from Coinglass, Tron’s Open Interest has plummeted to remarkably low figures. Currently, the Open Interest for TRX is approximately $86 million, representing a close-to-half decrease since late August.

A decrease in the number of traders initiating and maintaining positions on TRX suggests a waning overall market enthusiasm or apathy, indicating that both optimistic bulls and pessimistic bears may be uncertain and possibly fatigued following the August trend surge.

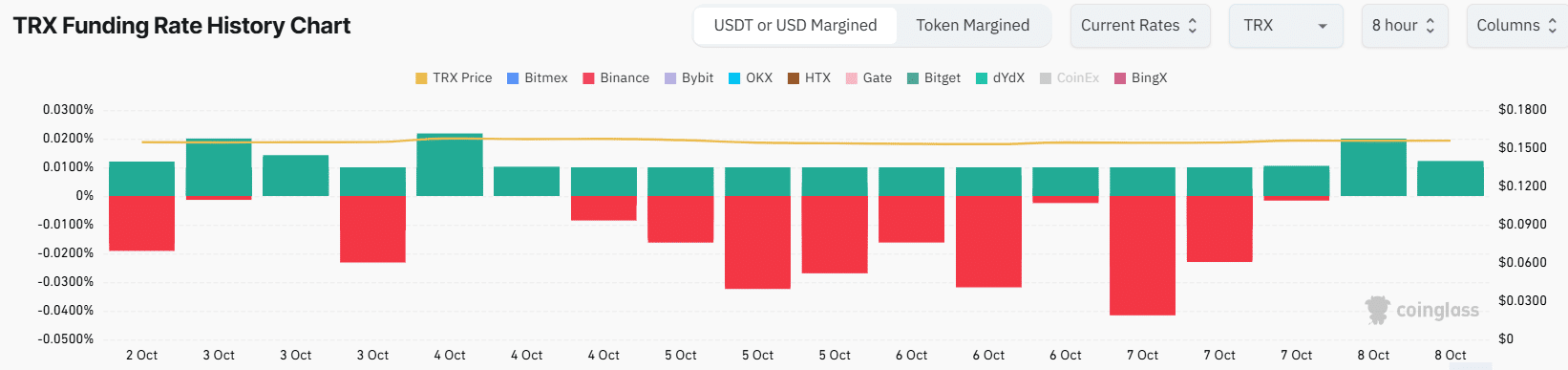

Looking at Funding Rates, it seems that if Tron (TRX) doesn’t manage to break out bullishly from its current consolidation period, there is a possibility that the bearish trend may resume in its price movement.

In the last seven days, there has been an increase in short positions on TRX.

This data shows that traders are betting on a bearish breakout from the range-bound market.

One of the factors that could have triggered the negative funding rates is a slight dip in the TRX wallets that are in profits.

Read Tron’s [TRX] Price Prediction 2024–2025

As reported by IntoTheBlock, the proportion of In-The-Money wallets has dropped slightly from 97% to 95% over the past week.

As a crypto investor, I’m observing a slight dip in prices right now. If an increasing number of wallets find themselves in the red due to this trend, there’s a potential for the market to plunge even more, as some investors might opt to sell off their holdings to cut their losses short.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-10-08 20:08