-

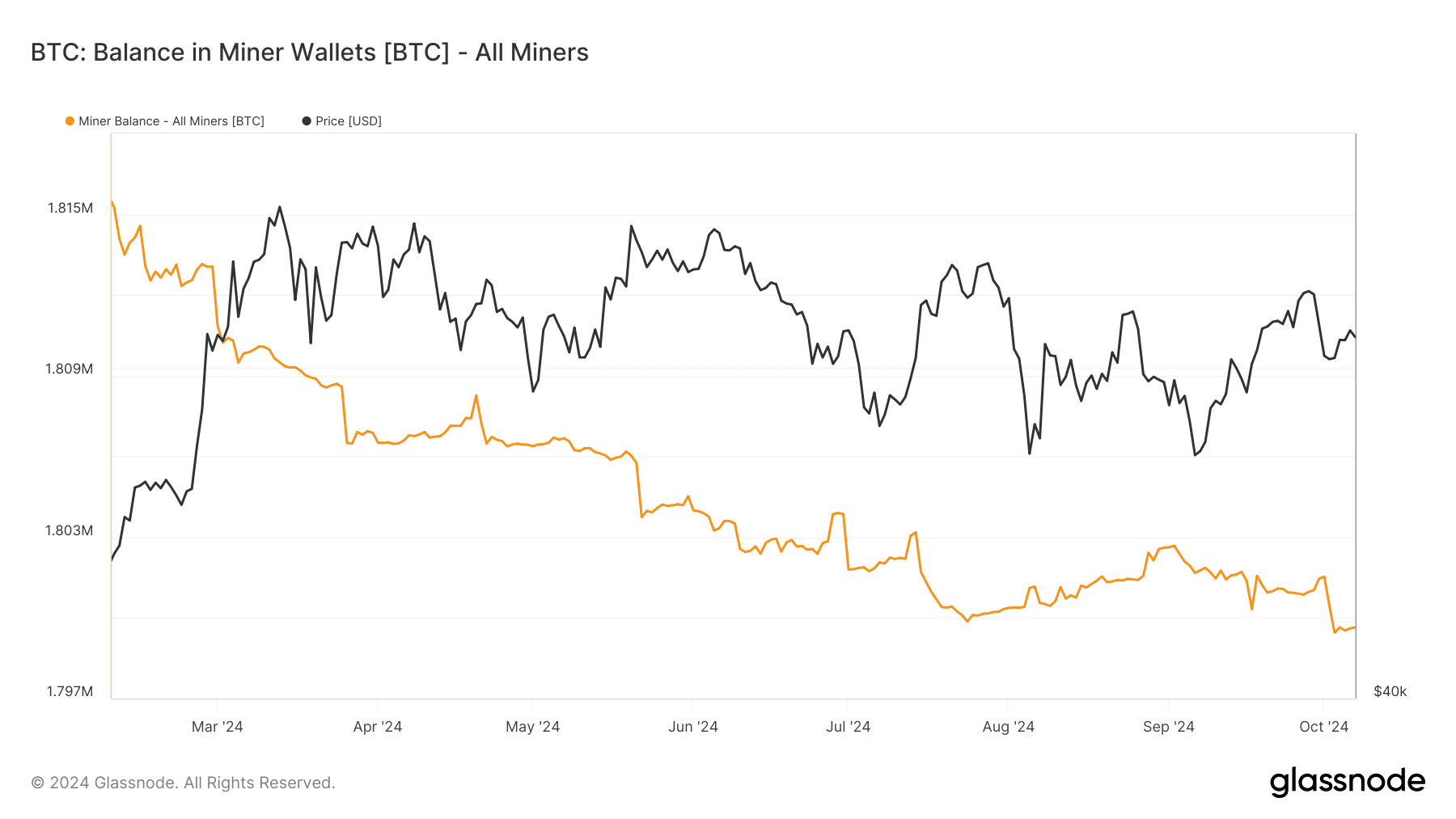

Bitcoin miners saw a decline in their balances, dropping to around 1.799 million BTC in September.

Despite volatility, Bitcoin miners’ revenue remained stable, with a slight increase to around 2.5%.

As a seasoned analyst with years of experience navigating the tumultuous waters of the cryptocurrency market, I can say that Bitcoin miners are no strangers to volatility. September was no exception, as miners witnessed a decline in their balances while managing to hold onto their revenue fairly steadily.

In September, Bitcoin [BTC] miners faced varying outcomes due to the currency’s unstable price fluctuations. Even though they kept their Bitcoin, these miners observed a drop in earnings relative to August.

Bitcoin miners’ balances decline

Throughout September, the collective Bitcoin mining reserves progressively diminished. Initially, they were approximately 1,802 thousand Bitcoins at the beginning of the month, yet by its conclusion, they stood at roughly 1,801 thousand Bitcoins.

This slight increase from a mid-month low of 1.800 million BTC reflected a brief upward trend.

Currently, according to Glassnode’s latest data, the miners’ Bitcoin balance has dropped even more, now roughly at 1.799 million BTC. This figure resembles its state back in July, a period when miners faced a significant decrease.

Fewer holdings moved to exchanges

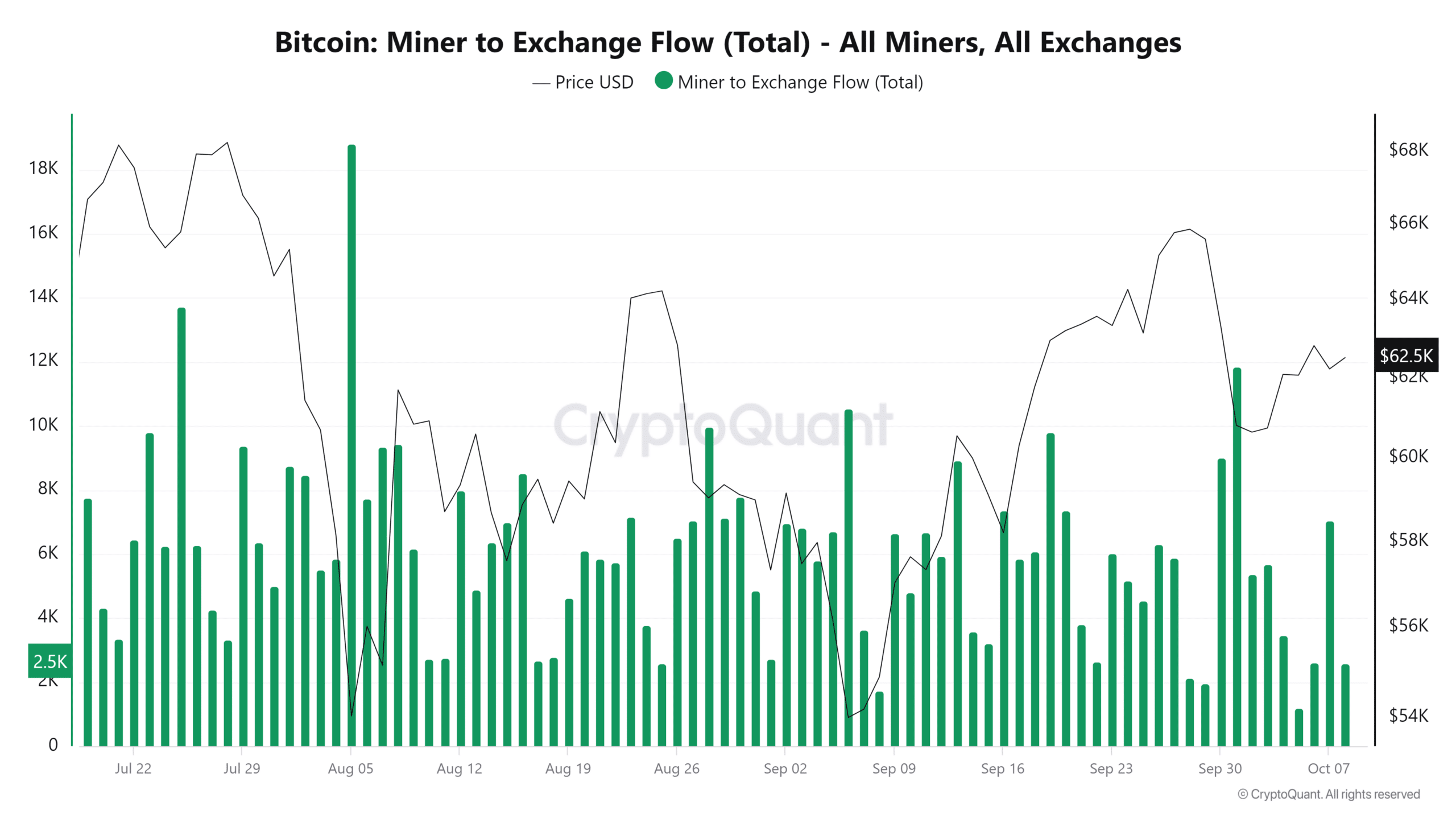

Contrary to the fluctuating prices of Bitcoin in September, there was a decrease in the amount of Bitcoins moved from miners to exchanges compared to the transfers made in August. Although there were some transfers, they were significantly less than what occurred during the preceding month.

In September, the biggest Bitcoin transfer amounted to 11,842 BTC, which is less than the approximately 18,000 BTC transferred in August.

From my analysis, I’ve observed that the revenue metrics for Bitcoin miners over the past month have remained relatively stable, with no notable increases or decreases.

While experiencing slight daily variations, certain days saw a rise in revenue by approximately 2.5%, a significantly more modest increase compared to the substantial 18% jumps observed in August.

As an analyst, I’ve noticed that the lowest earnings for miners occurred approximately at 1.2% during the month of September. However, at present, it appears that the revenue has found a degree of stability, hovering around the 2.5% mark.

Bitcoin remains volatile

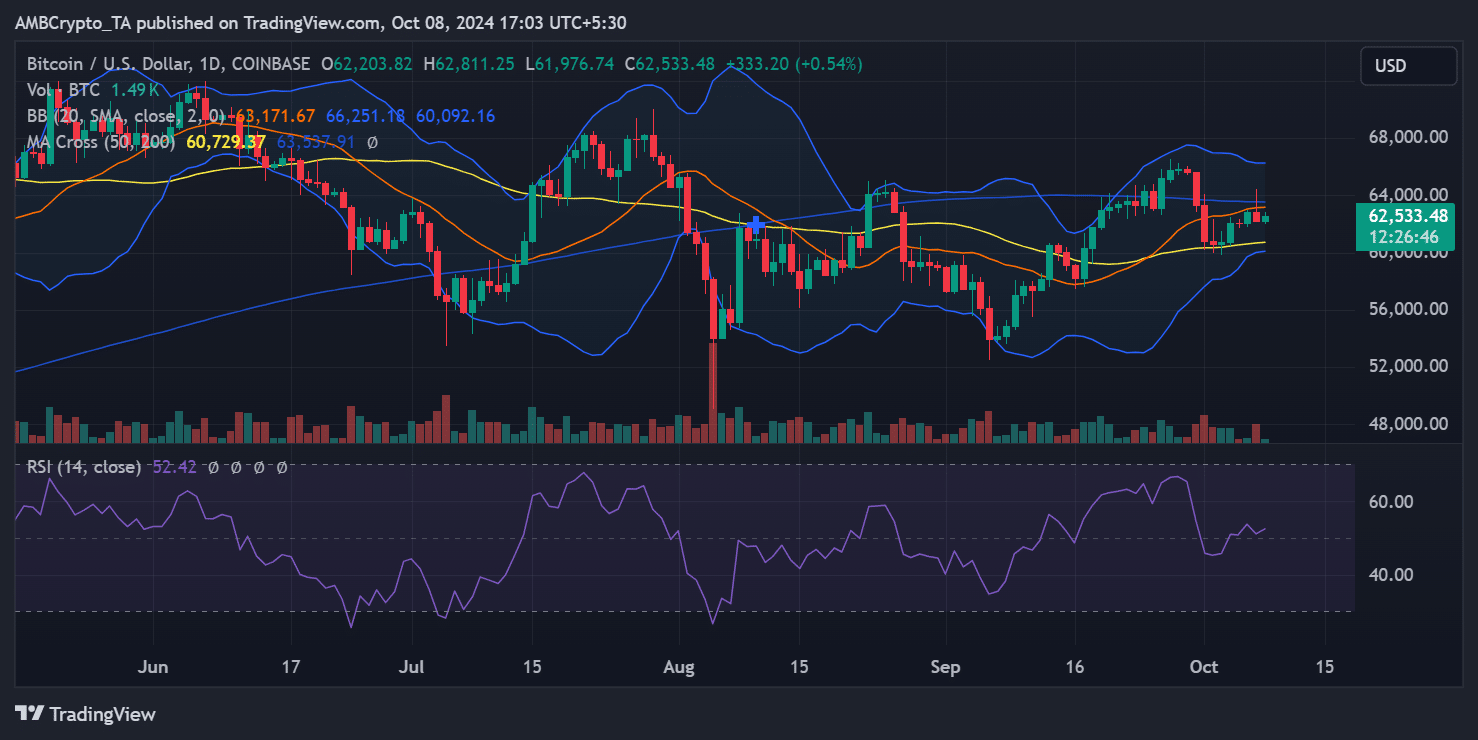

In October, Bitcoin’s price fluctuations persisted rather than stabilizing, contrary to the expected “Uptober” pattern. The daily price graph indicates that Bitcoin has been finding it difficult to bounce back from its initial monthly losses.

An examination of Bollinger Bands suggests that the price fluctuations remain considerable, implying that market volatility is likely to persist.

In the upcoming weeks, this persistent instability might result in Bitcoin miners encountering a variety of performance indicators.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Presently, Bitcoin is being traded approximately at $62,480, with a minimal rise of almost 1% compared to earlier values. Its 50-day moving average is acting as a robust foundation, while its 200-day moving average stands at $63,700, serving as a potential barrier for further increases.

Miners are dealing with decreasing funds and consistent income while prices are erratic. Given Bitcoin’s ongoing uncertainty, miners might experience varying results over the short-term.

Read More

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Oblivion Remastered – Ring of Namira Quest Guide

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Solo Leveling Arise Amamiya Mirei Guide

- Ryan Reynolds Calls Justin Baldoni a ‘Predator’ in Explosive Legal Feud!

- Avowed Update 1.3 Brings Huge Changes and Community Features!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

2024-10-09 07:03