-

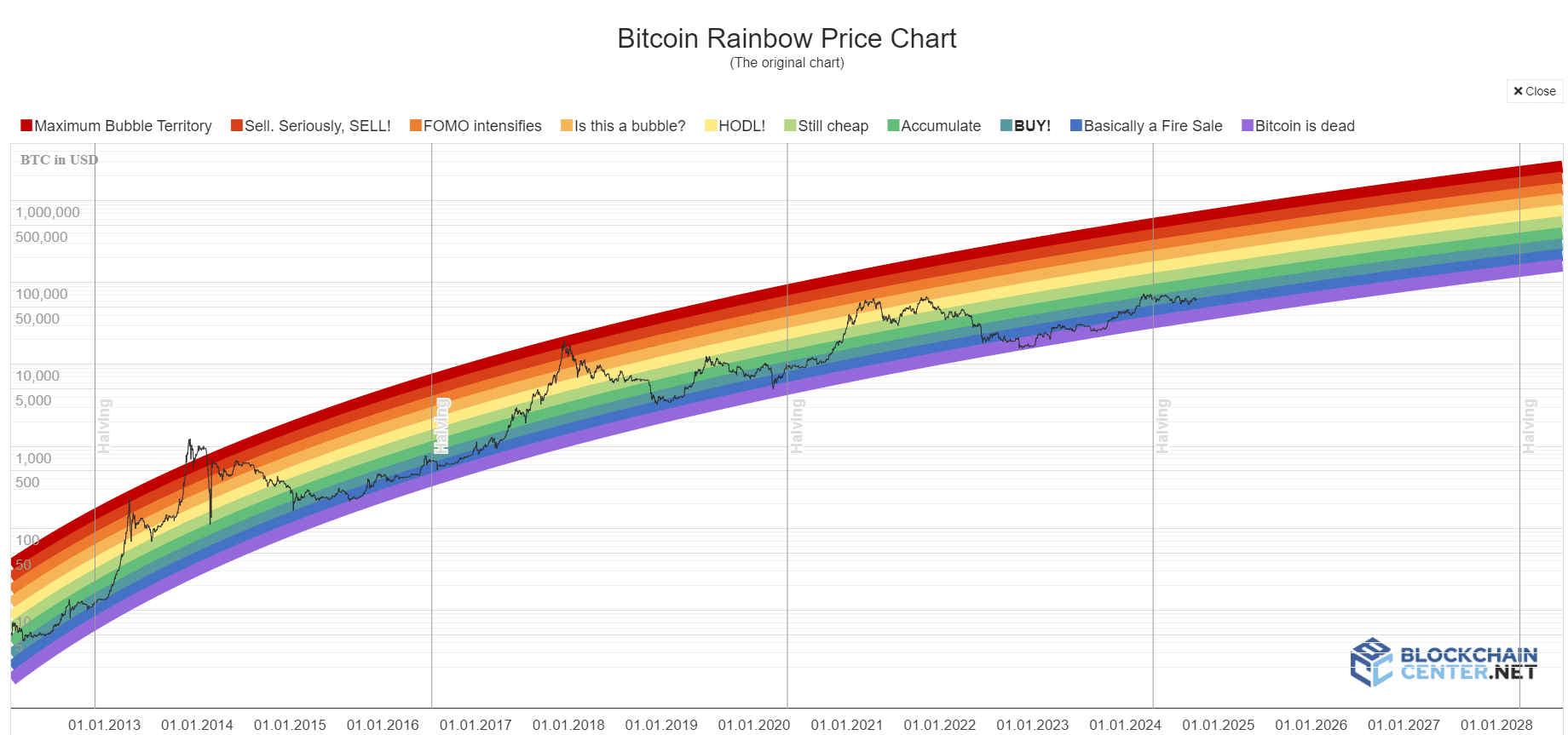

The Rainbow Chart showed the bottom is closer than the top for BTC

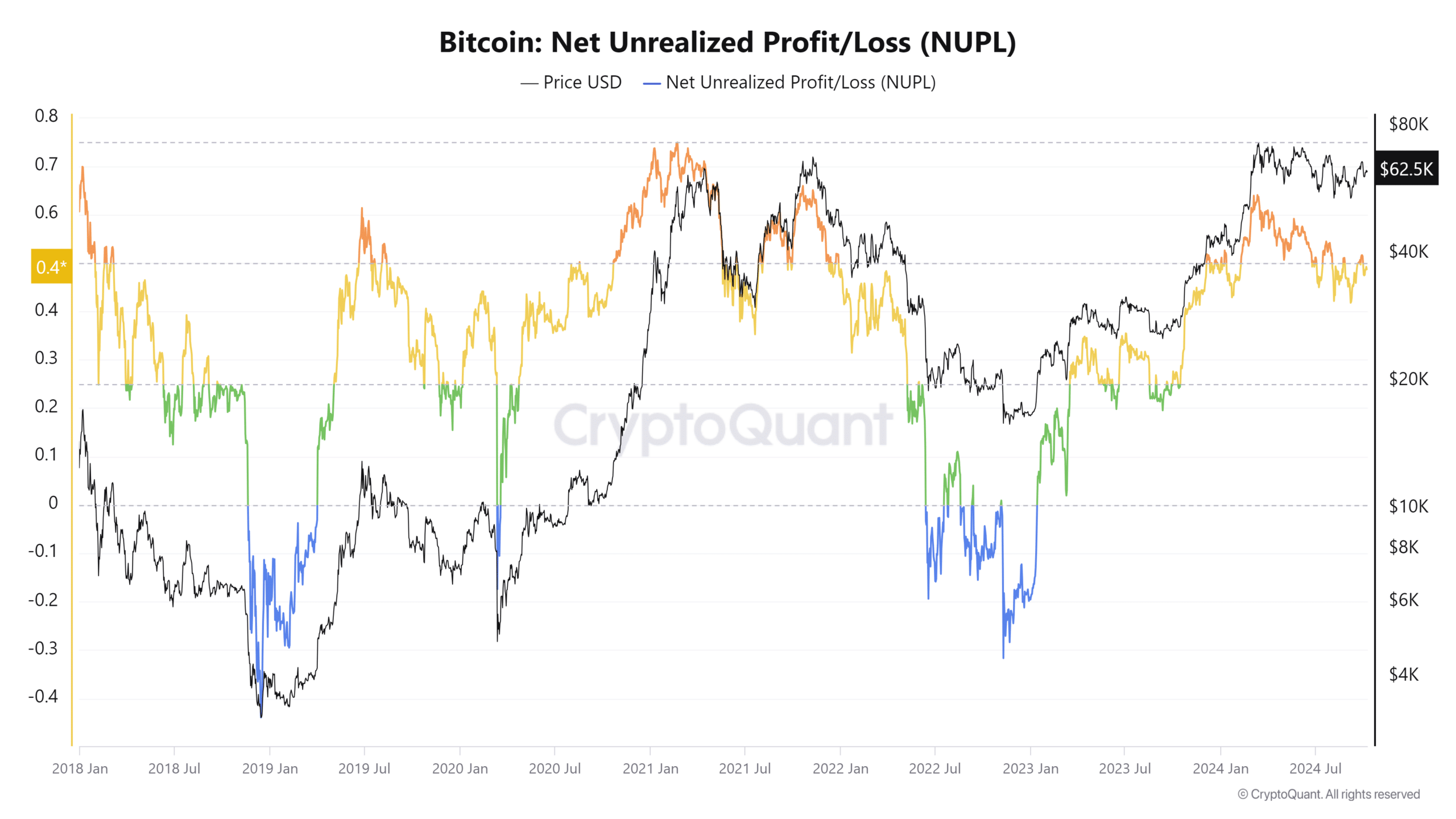

Falling NUPL noted reduced selling pressure from profit-takers

As a seasoned researcher who has closely observed the crypto market for more than a decade now, I find myself intrigued by the current state of Bitcoin (BTC). The Rainbow Chart, while not always accurate, has been quite insightful in its predictions, especially when it comes to bottoms. And with BTC still lingering in the ‘fire sale’ zone, I can’t help but feel a bit like a vulture circling overhead, waiting for the right moment to swoop down.

Approximately thirteen months back, Bitcoin [BTC] was being exchanged at around $25.7k. The market was gloomy last September, with the halving event still over six months away. However, the mood changed in October due to whispers of a possible approval for a spot ETF by the SEC. Additionally, it seemed like inflation had reached its maximum point.

As an analyst, I’ve observed several factors that have made Bitcoin particularly appealing to potential investors over time, leading to its price trending upward and reaching an unprecedented peak of $73,700 in March 2024. Now, I find myself pondering whether the current circumstances in October could potentially ignite a rally strong enough to surpass this year’s highs.

Bitcoin Rainbow Chart encourages investors

The Rainbow Chart for Bitcoin offers an engaging perspective on Bitcoin’s historical price fluctuations over the long term. This chart employs a logarithmic scale to depict Bitcoin’s price data, using different colors to indicate to investors whether it’s advisable to buy, sell, or hold onto their Bitcoins at any given point in time.

This instrument isn’t always spot-on, but it performs remarkably well when it comes to forecasting trends and timing market peaks and troughs, particularly the latter. Lately, it seems to be leaning towards the pessimistic view of “Bitcoin is obsolete,” but it hasn’t quite dipped into the ideal buying range just yet.

Although Bitcoin currently remains in an attractive buying range, the Bitcoin Rainbow Chart characterizes it as a significant discount, or “fire sale” situation. By looking at the pattern compared to the previous cycle, the latter half of October might mark the beginning of a robust Bitcoin surge.

This rally could be the bull run that follows a halving event.

Downtrend since April has impacted holder profitability

As an analyst, I’d rephrase it as follows: At the moment, the Net Unrealized Profit/Loss stands at 0.47, indicating that the market capitalization surpasses the realized one. This suggests that a significant number of investors might still be in profit, despite the downward trend in price over the last six months.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As the NUPL dropped in tandem with the price, it suggests that the urge to sell among profitable holders may be decreasing. Consequently, this could indicate potential price growth in the upcoming months. Typically, a NUPL value exceeding 0.7 indicates market peak.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-10-09 09:43