- Crypto investors have reportedly shifted focus to the recent Chinese stock rally

- As the equity uptrend falters, will investors revert to crypto trading?

As a seasoned researcher with a keen eye for market trends and a penchant for deciphering the intricacies of global financial systems, I have witnessed firsthand how geopolitical events can significantly impact the trading landscape.

Chinese stocks’ rally has tapered after a disappointing stimulus package, raising hopes of a potential shift to Bitcoin [BTC] and crypto trading.

Starting from late September, Asian stocks have been surging due to robust Chinese government stimulus measures and anticipation that these policies might persist into 2024.

As per Alex Kruger, an economist and market analyst, it was anticipated that the Chinese government would reveal a supplementary fiscal package worth $1.4 trillion. Instead, they unveiled a plan for just $14 billion.

This decrease in market confidence led to a reversal for many Chinese stocks that had previously shown growth. Now, let’s consider how this might impact Bitcoin and cryptocurrency trading.

China’s influence on crypto trading

Based on a recent Bloomberg analysis, the surge in Chinese stocks could be causing some cryptocurrency investors to shift their funds towards these thriving equities. The report points out the widening gap between Tether’s USDT value and the U.S dollar (USD) since late September as a significant signal.

One expert noted that this coincided with China’s quantitative easing program and might signal “panic buying” of Chinese stocks.

If traders are quickly swapping their Chinese stocks for traditional currencies, it might suggest they’re engaging in a mass purchase of Chinese stocks out of fear or anxiety.

Given my recent investments in USDT, I may have decided to cash out and explore opportunities in the Chinese stock market. With the temporary lull in the Chinese equity market rally, I’m left wondering if I should now consider shifting my attention back to Bitcoin (BTC) and cryptocurrency trading once more.

As per QCP Capital, a cryptocurrency trading company based in Singapore, the decline in the Chinese stock market rally might stimulate Bitcoin (BTC). In simpler terms, the firm is suggesting that the weakening of the Chinese stock market rally could potentially increase the demand for Bitcoin.

With the decline in China’s market, I foresee a shift in investments towards cryptocurrencies. This move underscores the evolving maturity of the crypto sector as an appealing alternative for high-risk, high-reward assets.

However, it added that the upcoming earning season and September US CPI data scheduled for 10 October could be downside risks. They could complicate the crypto market’s outlook.

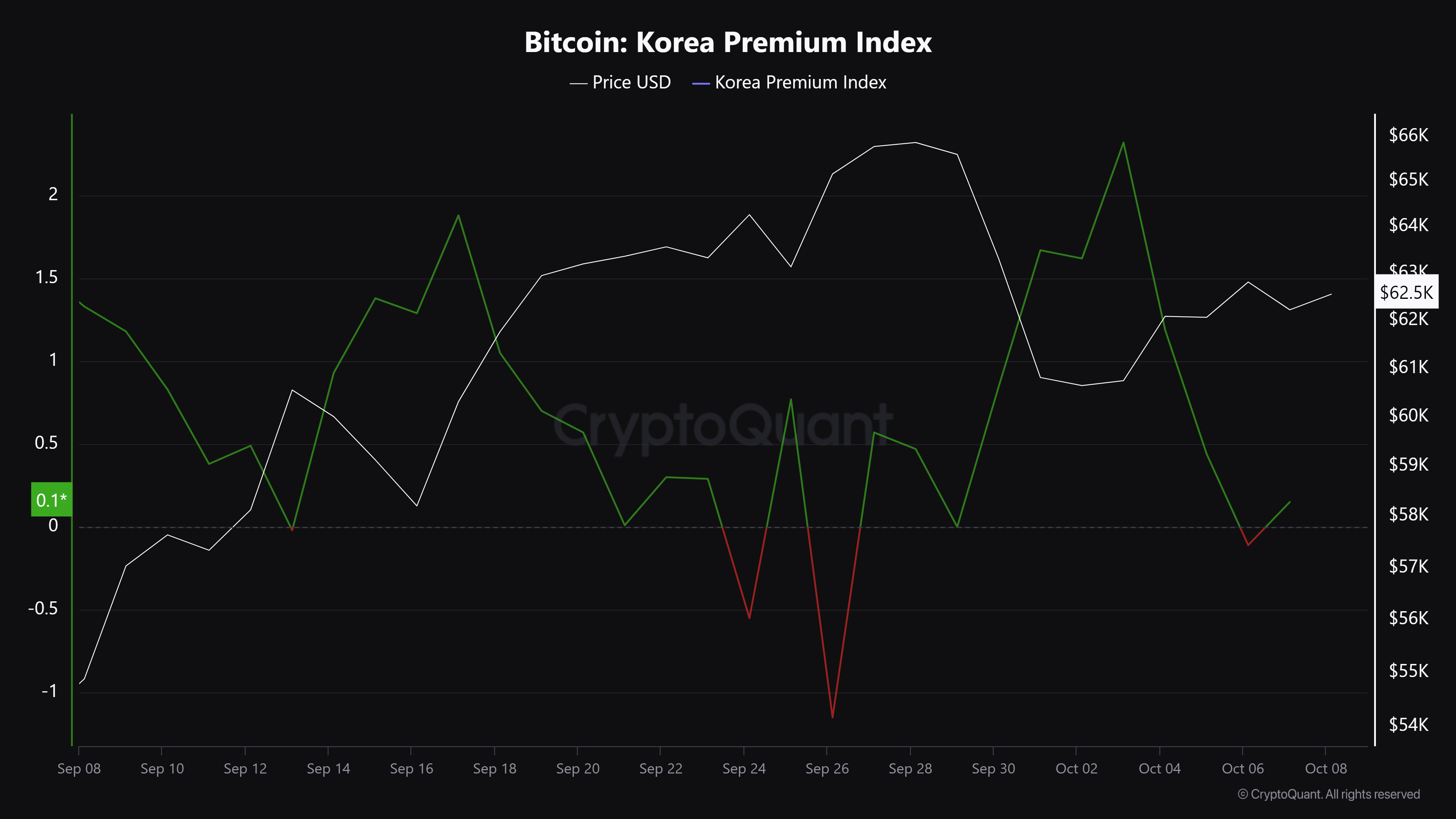

Currently, the Bitcoin Korean Premium Index is shaping up as a V-shaped reversal pattern. At this moment, it’s sitting above the neutral point following its decline during the first week of October.

The metric, also known as Kimchi Premium, tracks BTC price differences between South Korean and foreign exchanges. A higher premium would suggest a stronger demand for BTC in Korea than overseas.

The aforementioned positive reading suggested little Korean demand for the asset. At the time of writing, BTC was valued at $62.5k, down about 1% on the weekly charts.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-10-09 11:03