-

Bittensor surged 300% as subnets boosted growth; traders eyed key support at $300 for stability.

TAO showed bullish momentum with net outflows and key resistance at $600, signaling potential further gains.

As a seasoned crypto investor with a knack for spotting promising opportunities, I find myself intrigued by the recent surge of Bittensor [TAO]. Having witnessed the rise and fall of numerous altcoins, I can confidently say that TAO’s 300% price increase has caught my attention.

Bittensor’s TAO token has experienced significant growth, surging by an impressive 300%, drawing interest from both traders and financial backers alike.

As of press time, Bittensor’s price was $601.10, with a 24-hour trading volume of $216.9 million.

Although the price has dropped by 4.07% in the last 24 hours, it has risen by 9.34% over the past week, reflecting sustained market interest.

At the moment of reporting, the market value of all circulating TAO tokens issued by Bittensor was approximately 4.43 billion dollars, with a total supply of around 7.4 million tokens in circulation.

One major reason behind TAO’s recent surge is the rapid expansion of subnets on the network.

Recently implemented, subnets have proven integral to the growth of Bittensor, currently boasting over fifty active subnets on the main network, with additional launches imminent.

These smaller networks within our larger system (subnets) have significantly increased our total capacity, drawing both developers and users, ultimately improving TAO‘s market standing as a whole.

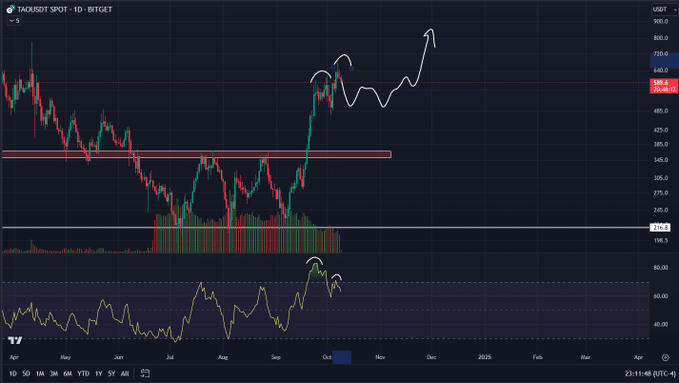

Price breakout and key support levels

Lately, TAO managed to escape from a downward pattern, known as a descending channel, which significantly contributed to the upward momentum it’s currently experiencing.

According to Roman’s analysis as a cryptocurrency expert, there appears to be a discrepancy between the price of TAO and its Relative Strength Index (RSI), which suggests a possible price adjustment may occur in the future.

Despite this, Roman also mentioned,

“Don’t be afraid of some correction, $TAO is up 300%.”

Support areas can be pinpointed near the $300 mark, where this figure has shown strength by acting as both a barrier to increase and a foundation for growth in the past. If a pullback happens, this level might function as a solid base, contributing to the stability of TAO‘s price.

On the positive side, the resistance level ranges from around $580 to $600. If this resistance is consistently broken, it may lead to further growth for TAO, particularly if overall market circumstances continue to be advantageous.

TAO — Bitcoin correlation

The behavior of TAO‘s price seems to have similar patterns with Bitcoin [BTC]. This connection might influence the future trends we see in TAO.

If Bitcoin sees a correction, Bittensor could experience more volatility, as noted by Roman, who also expects Bitcoin to face short-term downward pressure.

Conversely, a significant surge in Bitcoin’s value, particularly if it breaks through the $65,000 barrier, might stimulate optimistic sentiments throughout the crypto market, thereby boosting coins such as TAO.

It’s recommended that investors closely monitor Bitcoin’s activity, as it can serve as a significant clue about wider market movements.

Technical indicators show mixed signals

As long as Bittensor maintains its upward trend, there are signs that a period of stabilization may be on the horizon. Although the Awesome Oscillator (AO) continues to display positivity, the diminishing size of the green bars hints at a decrease in bullish energy.

As I pen this down, the Relative Strength Index (RSI) stands at 64.65, positioning TAO within a bullish domain yet approaching the boundaries of being overbought.

In simpler terms, the Aroon Up indicator shows a strong upward trend as it’s currently at 85.71%, meaning there’s a significant positive momentum. On the other hand, the Aroon Down indicator is at 57.14%, indicating that some bearish pressure might be developing, suggesting a potential reversal or correction could occur.

The conflicting signs suggest that although TAO‘s long-term progress remains favorable, it might experience a temporary downturn before continuing its uptrend.

Traders may need to monitor these indicators closely for signs of any potential trend reversal.

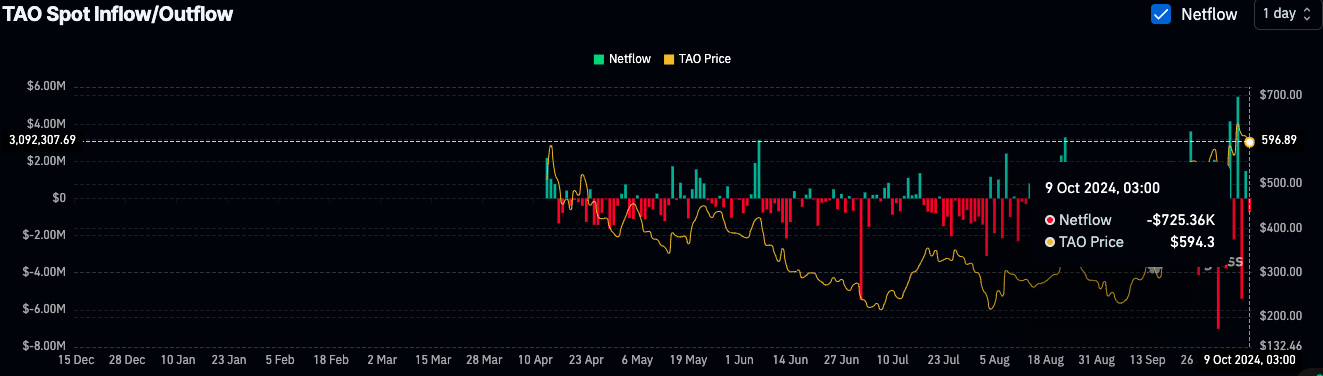

Net outflows indicate positive sentiment

Data recorded on the blockchain indicates that on October 9th, there was an overall withdrawal of approximately $725,360 worth of TAO tokens from exchanges, suggesting a higher rate of tokens being taken out compared to those going in.

Read Bittensor’s [TAO] Price Prediction 2024–2025

This outflow indicates that owners might be transferring their TAO tokens into private wallets, possibly suggesting a decrease in the urge to sell.

Even with a continuous flow, TAO‘s price maintains its strength, signifying ongoing faith in the token’s potential success in the market.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

2024-10-09 17:44