- Bitcoin rallied to $64,000, but the U.S. market’s absence raises concerns about the rally’s sustainability.

- Metrics show a decline in Bitcoin’s Open Interest and retail activity, signaling potential caution for investors.

As a seasoned analyst who has weathered numerous crypto market cycles, I have learned to read between the lines when assessing market trends. The recent Bitcoin rally to $64,000 is indeed impressive, but it’s the underlying factors that raise concerns about its sustainability.

Over the last several days, the worldwide cryptocurrency market has seen a substantial surge, adding more than $60 billion to its total value.

The rise occurs due to Bitcoin’s price jumping back up towards $64,000, rekindling enthusiasm among those who invest in it.

Although it’s drawn a lot of interest, some experts have their doubts about the long-term viability of this surge, pointing out some peculiar patterns hidden beneath the surface.

Market driven by Asian capital, not U.S. buyers?

A CryptoQuant expert going by the name BQYoutube has brought attention to an important finding on the CryptoQuant QuickTake system.

In a post titled “We are going up. But Coinbase Ain’t Buying,” the analyst pointed out that the U.S. market, represented by Coinbase, has not been participating in the recent rally.

It’s worth noting that as Bitcoin’s price increased, the Coinbase Premium – an indicator measuring the gap between Bitcoin’s price on Coinbase compared to other platforms – has dipped into a negative range.

The decrease in Coinbase Premium suggests that the U.S. market may not be as excited about the rally, which could lessen the overall positive outlook.

One possible explanation for Bitcoin’s recent surge in value might stem from the increase of investment capital flowing from Asia, as proposed by BQYoutube analysts. They speculate that the recent interest rate reduction in China and the influx of capital from Asia could be fueling the rise in Bitcoin prices.

However, this rally lacks full support without significant U.S. participation.

Historically, the U.S. market has been significant in fueling prolonged increases in Bitcoin’s value. If its participation lessens now, it could indicate weaknesses that may affect the ongoing price trend.

Warning: The rally might prove risky if the U.S. market continues to be detached, since a consistent price surge typically depends on extensive involvement from the global market.

Retail interest in Bitcoin rebounds slightly

Beyond these findings, it’s crucial to examine Bitcoin’s primary on-chain indicators for a more comprehensive view of the situation.

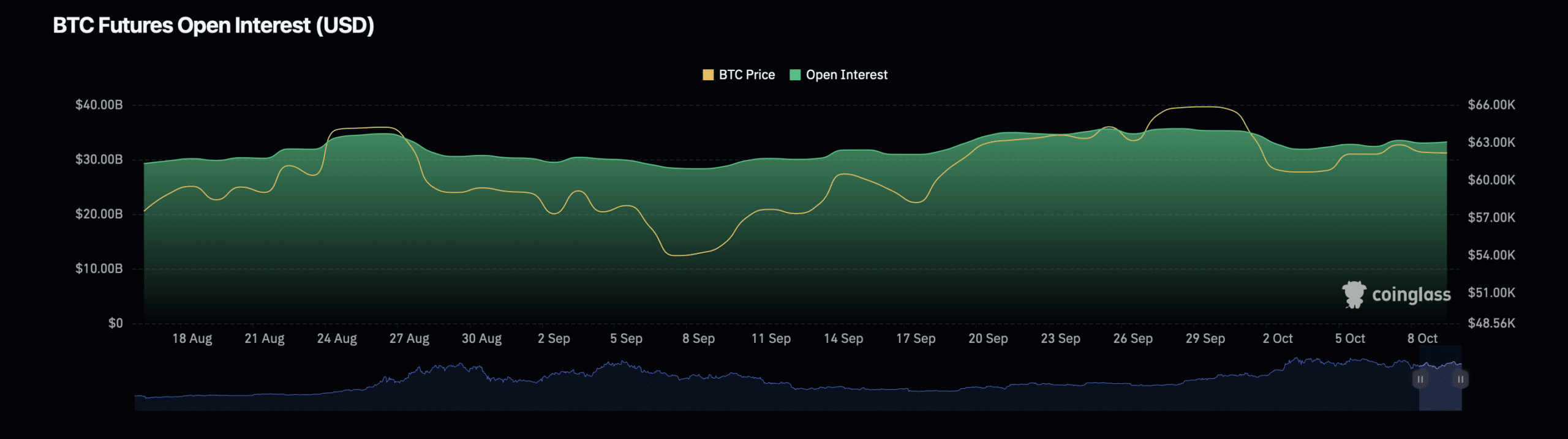

Data from Coinglass shows a decline in Bitcoin’s Open Interest, which refers to the total number of outstanding derivative contracts.

This metric has dropped by 0.83%, bringing its value to $33.25 billion.

In much the same way, the volume of open interest in Bitcoin, representing the overall amount of trades, has dropped significantly by 31.04%. Currently, it’s at approximately $45.49 billion as we speak.

These drops might signal that traders had become less hopeful regarding the immediate trajectory of the asset’s growth.

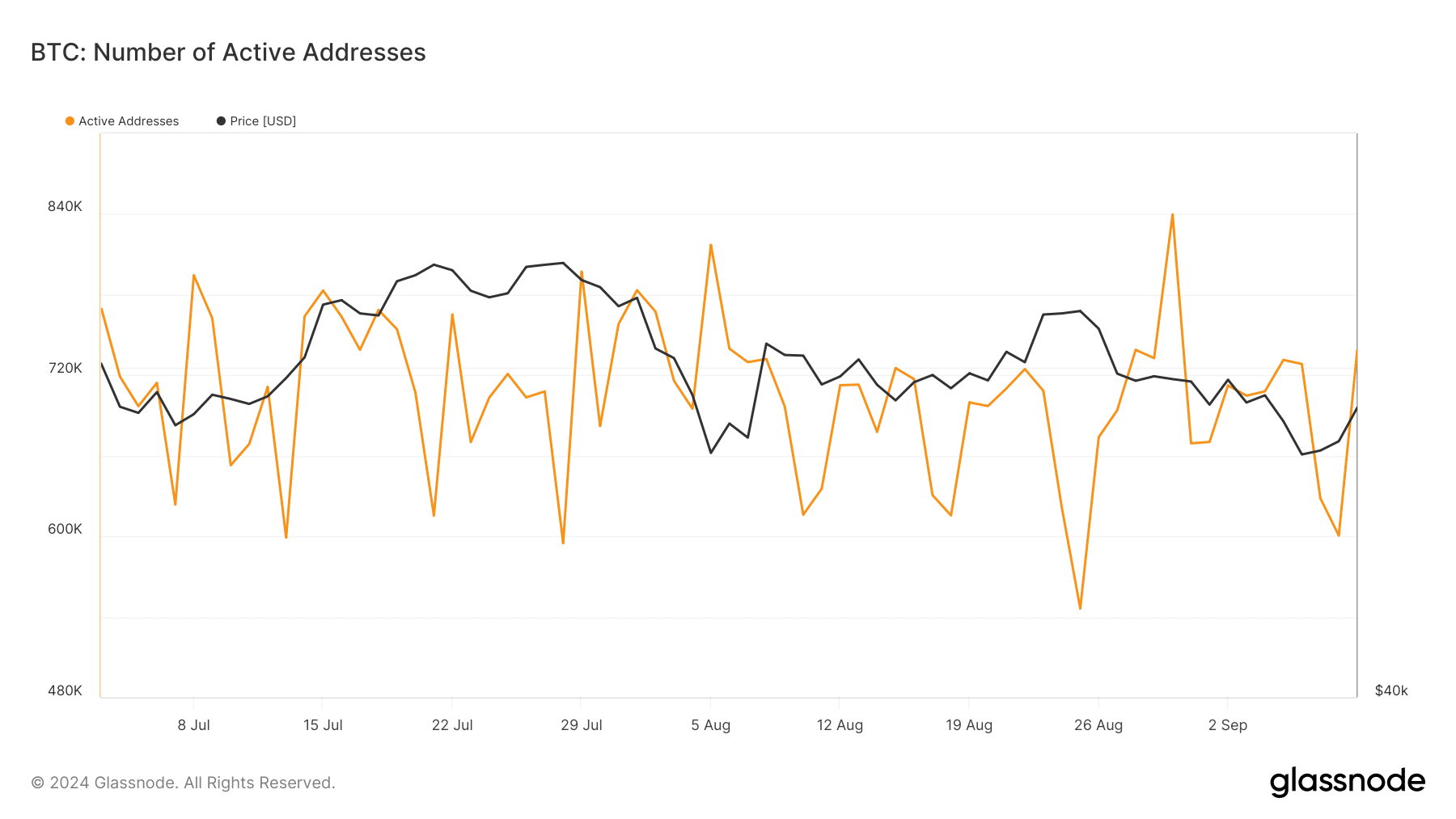

A crucial statistic to keep an eye on is the number of active Bitcoin addresses, as they offer valuable insights into the level of consumer engagement.

According to data from Glassnode, there has been a significant decrease in the number of actively used Bitcoin accounts over the last few months, with the peak of 839,000 accounts being reached on the 30th of August.

By the end of September, the number of actively used addresses dropped approximately to 600,000, indicating a decrease in retail enthusiasm for this particular activity.

Lately, the data indicates a slight improvement as the number of active addresses has risen again, surpassing 700,000 in the past few days.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

To put it simply, although the recent surge in Bitcoin’s price is generating enthusiasm, the absence of significant U.S. involvement and decreasing trading activity could potentially pose difficulties for Bitcoin’s immediate future.

However, the rebound in retail interest could signal renewed confidence in the market.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-10-10 03:04