-

The Bitcoin Protocol reached nearly 24,000 BTC locked, totaling around $1.5 billion in value.

Bitcoin ranks third in NFT sales volume, with nearly $15 million in sales over seven days.

As an analyst with over two decades of experience in the digital asset market, I must admit that the recent growth of the Bitcoin Protocol, Babylon, has been nothing short of astounding. The surge in Total Value Locked (TVL) to nearly $1.5 billion is a clear testament to the increasing trust and interest in the network.

Recently, there’s been a substantial rise in the overall value tied up (Total Value Locked or TVL) within the Bitcoin protocol, often referred to as Babylon. This spike can be attributed to the lifting of some staking limitations.

Also, this change allowed more BTC to be staked, setting a new milestone for the network.

Additionally, the enlarged staking capability represents another advancement in its development, placing it among networks boasting some of the most significant NFT trading volumes.

Bitcoin Protocol locks more BTC

Based on the latest figures, it’s been estimated that around 24,000 Bitcoins are currently secured within the Bitcoin Protocol system known as Babylon, which translates to approximately $1.5 billion in value using today’s Bitcoin market prices.

Additionally, this significant achievement occurred following the removal of the deposit limit from the protocol on the 8th of August, enabling users to increase their BTC stakes.

Thousands of BTC were staked within just over an hour, spanning around 10 Bitcoin blocks.

The only restriction was a 500 BTC limit per transaction, a change from the initial 1,000 BTC cap when the protocol launched earlier in August.

Furthermore, eliminating the limit on staking triggered swift expansion in Total Value Locked (TVL), demonstrating a surge in users’ desire to employ the Bitcoin Protocol for staking activities.

Comparing the Bitcoin Protocol’s staked assets to Ethereum

Currently, about 0.122% of all Bitcoin in circulation, which amounts to approximately 24,000 Bitcoins, is being staked within the Bitcoin network. With a market capitalization surpassing $1.2 trillion and a total circulating supply over 19.7 million BTC, Bitcoin holds significant value.

Although the percentage is impressive given the novelty of the staking feature in this protocol, it’s quite modest when contrasted with Ethereum [ETH].

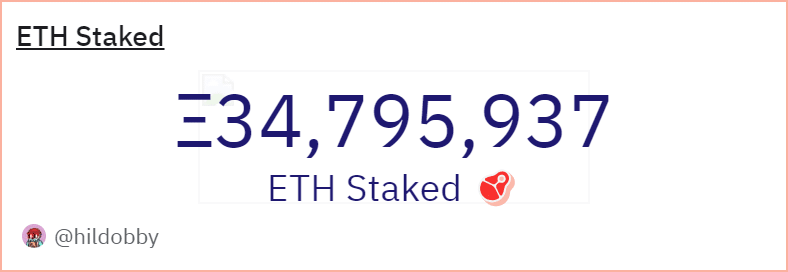

According to Dune Analytics data, approximately 35 million Ethereum (ETH) is now locked up in staking, which represents over a quarter of the entire ETH circulating supply.

The data reveals that the total value of Ethereum in the market is around $294 billion, with approximately 120.4 million Ethereum coins in circulation. Notably, Ethereum’s staking involvement significantly outpaces Bitcoin’s.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Growth in NFT sales volume

Beyond just staking, the Bitcoin network has also shown progress in the field of Non-Fungible Tokens (NFTs). This network is currently ranked among the top five networks based on NFT sales volume.

In addition, data from Crypto Slam indicates that Bitcoin saw approximately $15 million worth of NFT transactions within the last week. This places it as the third most active network for NFT sales, falling behind only Ethereum and Mythos.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- BLUR PREDICTION. BLUR cryptocurrency

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

2024-10-10 07:35