- Render price remains in a stable range near $5.50 after a period of consolidation and rising whale activity.

- The long-short ratio decline and OI-weighted funding rate indicate potential shifts in market sentiment.

As a seasoned researcher with years of market analysis under my belt, I find myself intrigued by the current state of Render (RENDER). The price consolidation within a symmetrical triangle pattern has been a common sight in my watchlist for the past few months, and it’s always interesting to see how markets behave during such periods.

Over the last three months, the price of RENDER has been moving sideways inside a symmetrical triangle structure, indicating that traders are unsure about its future direction.

During this duration, I’ve observed that a significant upward trendline has consistently held its ground as a robust support, having been frequently challenged yet unbroken.

As reported by IntoTheBlock, the increased whale activity has soared by a staggering 4843%. This has sparked interest among market players as they monitor if this upward trend might propel the price past the existing resistance points.

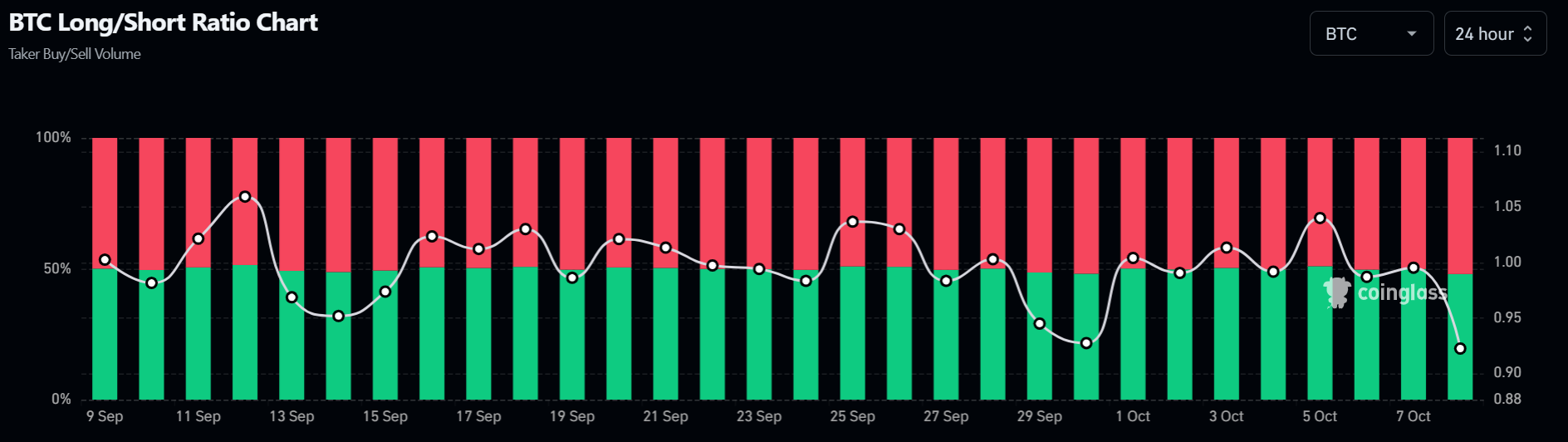

Render long/short ratio shows market caution

For the past three consecutive days, the trend of long positions versus short ones (long-short ratio) has been gradually decreasing, suggesting a rise in short sellers in the market. At present, this ratio is at approximately 0.9223, which typically indicates pessimistic or bearish sentiments among traders.

This change might indicate that market players are cautious, potentially causing prices to remain lower than significant resistance points.

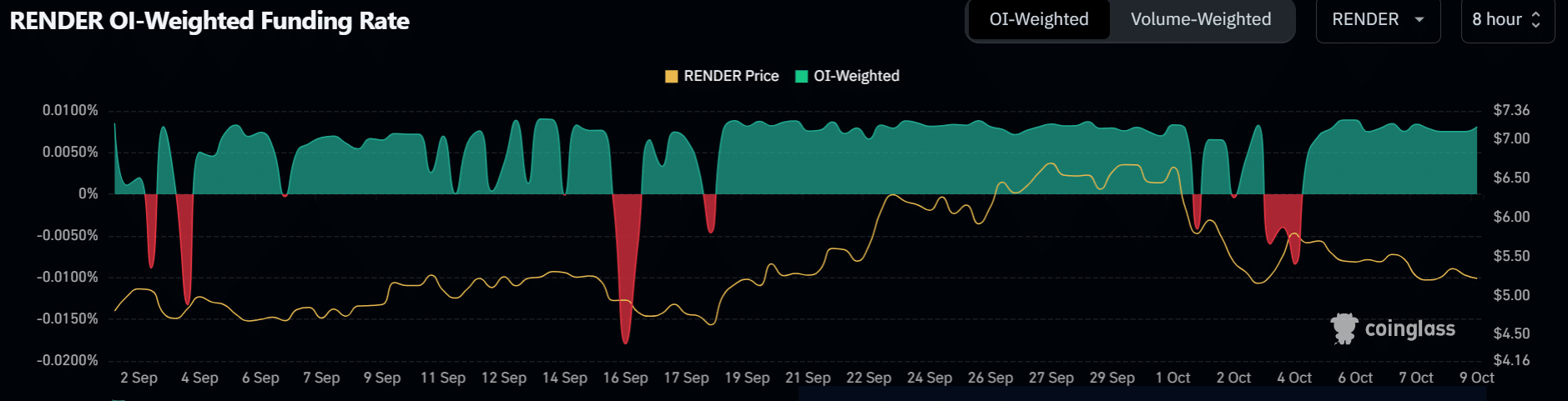

Funding rates indicate equilibrium

Based on data from Coinglass, there are intriguing changes observed in the OI-Weighted Funding Rate chart for RENDER between September 2 and October 9.

Following a drop down to $5.00 in mid-September, the price then bounced back and settled at approximately $5.50. The funding rate, meanwhile, has been fairly steady, suggesting a market that’s more balanced, with fewer ups and downs in investor positions.

This balance indicates that both optimists (bulls) and pessimists (bears) are holding back, awaiting a more powerful trigger to move beyond the current price limits.

Can Render whale activity trigger a breakout?

On Render, the combination of rising whale activity and a strong upward trendline provides an intriguing pattern.

Is your portfolio green? Check the Render Profit Calculator

Instead, when a long-short ratio is persistently declining and the funding rate remains stable, it could be an indication of an imminent market surge.

Keeping a close eye on these significant factors – the trading volume, investment rates, and the balance between long and short positions – will help us gauge if the activity of ‘whales’ could potentially halt any more drops in the value of Render.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- ANKR PREDICTION. ANKR cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- Isabella Strahan Shares Health Journey Update After Finishing Chemo

- DOOM: The Dark Ages Debuts on Top of Weekly Retail UK Charts

- Badminton’s Huang Yaqiong Wins Olympic Gold Moments Before Engagement

- 2 Astronauts Stuck in Space After 8-Day Mission Goes Awry

2024-10-10 09:11