-

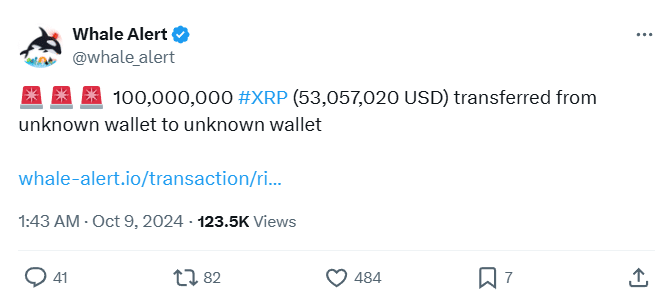

Whale transfer of 100M XRP raised questions as traders monitor key support levels near $0.50.

XRP derivatives showed declining activity, while liquidations suggested bearish traders were caught off guard.

As a seasoned crypto investor with battle-scarred eyes from navigating the volatile cryptocurrency market for years, I find myself intrigued by the latest 100 million XRP transfer between two unknown wallets. The history of these wallets and their connection to Ripple raises eyebrows, as we all wait to see if this could be a precursor to more significant transactions that may impact XRP’s price trajectory.

A large transaction worth approximately 100 million units of Ripple (XRP) between two unidentified digital wallets, believed to be connected to Ripple, has sparked discussion and curiosity within the cryptocurrency world. This transfer, which held a value of around 53 million dollars at the time, has ignited questions about possible market manipulation or activity.

The transaction was made from the wallet “rP4X2hTa7A” to the wallet “rhWt2bhRq3”. Both these accounts have a history of handling substantial transactions.

1) The continuous examination of these wallets stems from their past pattern of significant transactions, frequently associated with Ripple. This latest activity has sparked speculation about possible future big transfers, which might influence the course of XRP‘s price movement.

The blockchain records indicate that the wallets participating in the latest transaction have a history of being active. Notably, the wallet that initiated the transaction, labeled “rP4X2hTa7A,” has been frequently associated with Ripple, as it has previously received substantial amounts of XRP.

On September 23rd, this wallet was sent 200 million XRP directly from Ripple. Since then, it appears to have distributed funds to multiple, unidentified wallets.

XRP price trends and technical analysis

Currently, one unit of XRP is being traded for approximately $0.5281. Over the last day, this digital currency has seen a modest rise of 0.17%. With a total supply of 57 billion XRP currently in circulation, its market capitalization now stands at around $29.9 billion.

According to technical analysis, the price of XRP is generally at around $0.53, which falls beneath the midpoint of the Bollinger Band. This suggests that the market may be leaning towards a downward trend.

As the cost neared a significant floor value at roughly $0.50, a rebound from here might hint at an impending change in direction.

On the downside, a break below $0.50 could lead to the price testing the $0.48 mark.

Currently, the Awesome Oscillator (AO) indicates a decline in momentum, yet the reduction in bar size implies that selling force might be lessening. Keep an eye out for a potential bullish cross-over in the near future, as it may signal a change in sentiment towards a bullish trend.

Aroon indicator and resistance levels

In simpler terms, the Aroon Indicator suggests a lean towards pessimism rather than optimism. The Aroon Down, currently at 57.14%, indicates a moderate level of downward push, while the Aroon Up is at 28.57%, suggesting only a faint upward thrust.

It implies that the cost might continue to be affected in the immediate future unless there’s a change in market conditions.

For XRP, the price point of resistance hovered near $0.55. If we manage to breach this threshold, it might trigger an uptrend towards approximately $0.60. However, if we can’t exceed it, there could be more consolidation or even a possible drop.

XRP derivatives data and market activity

According to Coinglass data, XRP derivatives data reveals a notable drop in trading activity.

The volume dropped by 26.72%, amounting to $738.79 million, and the Open Interest (OI) decreased by 0.53%, reaching $685.37 million.

The slowdown in trading activities might be indicative of a more careful strategy among traders. Yet, the rise of 2.73% in Options Open Interest indicates that certain traders are still preparing for future market shifts.

Read Ripple (XRP) Price Prediction 2024-25

24-hour data shows that losses were highest among those holding short positions, amounting to approximately $399,160, while long position holders experienced losses of about $299,590. In simpler terms, more money was lost by traders betting against the market than those who bet on it during this timeframe.

This indicated that recent price movements caught bearish traders off guard.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Quick Guide: Finding Garlic in Oblivion Remastered

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- How to Get to Frostcrag Spire in Oblivion Remastered

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

2024-10-10 13:12