-

WIF has declined by 8.08% in 24 hours.

Fundamentals suggested a shift in market sentiment, signaling a further dip.

As a seasoned crypto investor with battle scars from the 2017 bull run and the subsequent bear market, I’ve learned to read between the lines when it comes to market trends. The recent dip in WIF‘s price has left me feeling a bit like a seesaw – up one minute, down the next.

For approximately a month now, memecoins have experienced substantial growth. Among them, Doge-what (WIF) has been the frontrunner. Consequently, WIF has seen tremendous growth during this timeframe.

Currently, dogwifhat is priced at $2.37, representing a 8.08% decrease from its value yesterday.

Before this downturn, the WIF was showing a steady increase, climbing by 36.53% each month and extending its growth trend by another 13.73% every week.

Thus, we wonder if dogwhati’s upward trend can continue, or if a drop on the daily chart might indicate an upcoming reversal.

What WIF charts suggest

Based on AMBCrypto’s assessment, Dogecoin experienced a significant drop after peaking at $0.28 three days back. Over this timeframe, it declined by approximately 17.86%.

This decrease in value has raised questions about the future direction of the meme coin. Therefore, it’s crucial to examine other factors that might indicate its potential path.

Initially, the Relative Strength Index (RSI) of WIF, which measures the strength of a stock’s price action, has dropped from 66 to 54 over the past three days. This indicates that there has been increased selling activity in the market, suggesting stronger seller pressure.

The current trend was weakening, suggesting a possible reversal on WIF price charts.

The downward trajectory is reinforced as the reading on the DMI, which shows negative values, consistently remains higher than its positive counterpart. Currently, the negative index stands at 27, contrasting with a positive index of 25.

A declining +DMI suggested that the current trend was losing momentum.

Over the last three days, Open Interest per exchange has decreased from approximately $257.3 million to $207.2 million. This suggests that traders may have been closing their positions.

Such behavior signals a lack of confidence as investors anticipated a further decline.

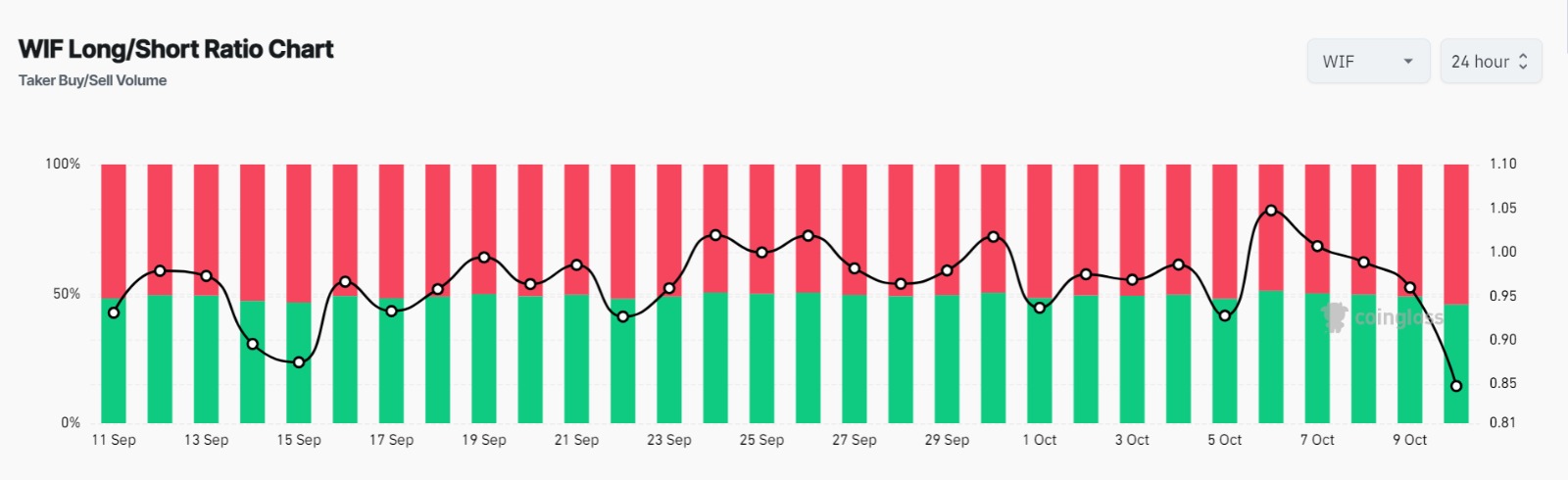

To summarize, the Long/Short Ratio has dropped from a peak of 1.0072 to 0.8477 in the last three days. This indicates that there have been more short positions taken, meaning that the majority of traders are bearish and expect prices to fall.

Read dogwifhat’s [WIF] Price Prediction 2024–2025

Essentially, while WIF is generally trending upward, recent developments point towards a possible downturn. If this bearish trend continues, it’s likely that WIF may soon reach a temporary floor around $2.03 in the near future.

Should the bulls regain control following this pullback, they’ll strive to test the persistent resistance barrier at $2.8. If the prices manage to exceed this level, WIF could reach a 4-month peak approximately at $3.5.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Solo Leveling Arise Tawata Kanae Guide

2024-10-10 19:35