- Peter Schiff humorously advised Michael Saylor to borrow $4.3 billion to buy seized Bitcoin.

- Bitcoin price fell by 1.81%, trading at around $61,010 amid sale preparations.

As a seasoned researcher with extensive experience in the digital asset sector, I find myself intrigued by the ongoing banter between Peter Schiff and MicroStrategy CEO Michael Saylor. It’s like watching a modern-day economic chess match unfold before our eyes.

Amid ongoing discussions about the various uses for the Bitcoin [BTC] seized from the Silk Road marketplace, prominent economist and noted BTC critic Peter Schiff voiced his opinion on X (formerly Twitter).

On October 9th, he participated in the conversations regarding the U.S. government’s planned auction of 69,370 Bitcoins, worth around $4.3 billion.

Schiff takes a jab at Michael Saylor

Renowned for his firm belief in gold rather than cryptocurrencies, Schiff playfully proposed that MicroStrategy’s CEO, Michael Saylor, might want to take out a loan of approximately $4.3 billion to invest in Bitcoin instead.

He said,

It seems that the U.S. government might soon auction off approximately 69,370 Bitcoins, valued at around $4.3 billion based on current market values. On rare occasions, the government does something shrewd. I believe that @saylor should consider taking out another $4.3 billion loan to purchase it. What do you all think?

But why Saylor?

Schiff’s decision to focus on Saylor is likely due to his aggressive approach towards Bitcoin at MicroStrategy, under his leadership, they have acquired billions worth of Bitcoin since 2020.

As expected, Schiff has often denounced this approach as a precarious gamble.

In case you haven’t heard, MicroStrategy has just secured over a billion dollars in funding, some of which they are using to purchase an extra 7,420 Bitcoin.

With this recent acquisition, our Bitcoin reserves have swelled to a total of 252,220 coins, currently estimating around a worth of 16 billion dollars.

Community reaction

That being said, the post generated significant engagement within the crypto community.

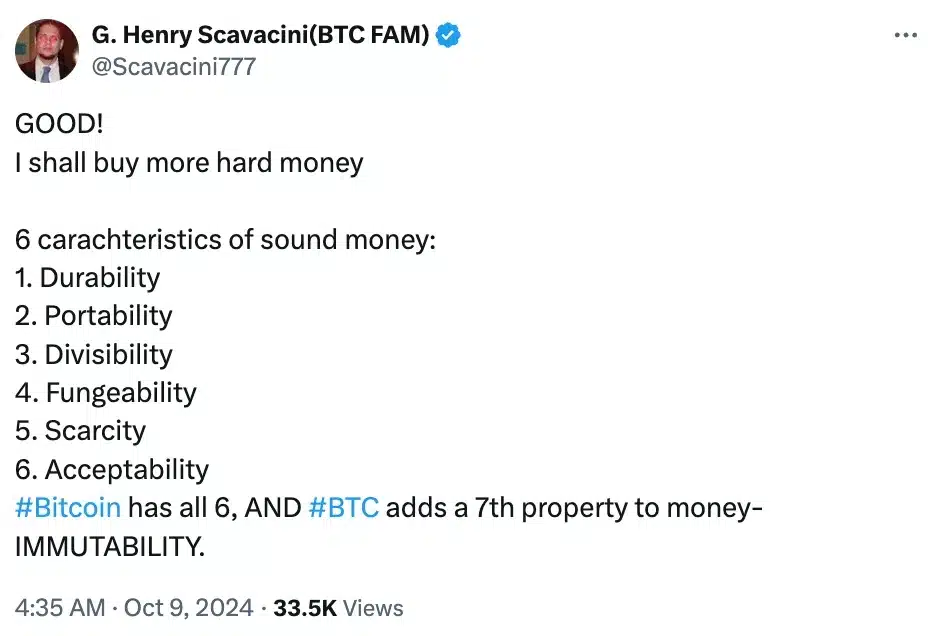

To begin, let’s discuss Henry Scavacini’s key points about the fundamental characteristics of Bitcoin:

Additionally, Scavacini emphasized the uniqueness of an eighth trait – immutability – as a feature that sets blockchain-held assets apart.

Discussions about this topic sparked more conversation within the community, with numerous members stepping up to safeguard Bitcoin’s standing as a type of “solid currency.

In response to this, Schiff replied,

“It’s missing the most important. Actual real value.”

Schiff: The Bitcoin critic

For people who may not know, Schiff has consistently spoken against Bitcoin. He argues that its worth is less substantial compared to gold when considering its tangible value.

He recently suggested that the hype surrounding Bitcoin has caused investors to overlook gold’s remarkable performance, which has reached new heights.

Other possible suggestions

Instead of Schiff’s idea, Democratic Representative Ro Khanna proposed that the government should keep the confiscated Bitcoins as a strategic reserve, rather than selling or returning them.

Additionally, if elected as President, Republican nominee Donald Trump has expressed an inclination towards setting up a Bitcoin reserve.

He said,

Should I get elected, my government’s stance on Bitcoin will be clear: We will retain 100% of any Bitcoin that the U.S. government currently owns and will acquire in the future.

As I delve into the latest developments, I find myself observing that, with the impending sale of Bitcoin seized by the U.S. government, there’s been a subsequent dip in its value by approximately 1.81%.

BTC was trading at approximately $61,010 according to CoinMarketCap.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2024-10-10 21:12