-

Analysts downplayed the positive impact of Fed rate cuts on Bitcoin.

Andrew Kang stated that BTC could remain range-bound until a key crypto catalyst emerges.

As a seasoned researcher who has witnessed the cryptocurrency market’s rollercoaster ride for over a decade, I find Andrew Kang’s contrarian view on the impact of Fed rate cuts and China’s stimulus package on Bitcoin intriguing. His argument that the crypto market might have overstated these factors’ influence is plausible given the market’s history of defying conventional wisdom.

2024’s fourth quarter might see a significant surge in Bitcoin [BTC], as there’s widespread anticipation due to the continued interest rate reductions by the U.S. Federal Reserve and the implementation of a stimulus plan in China, which could potentially boost its value.

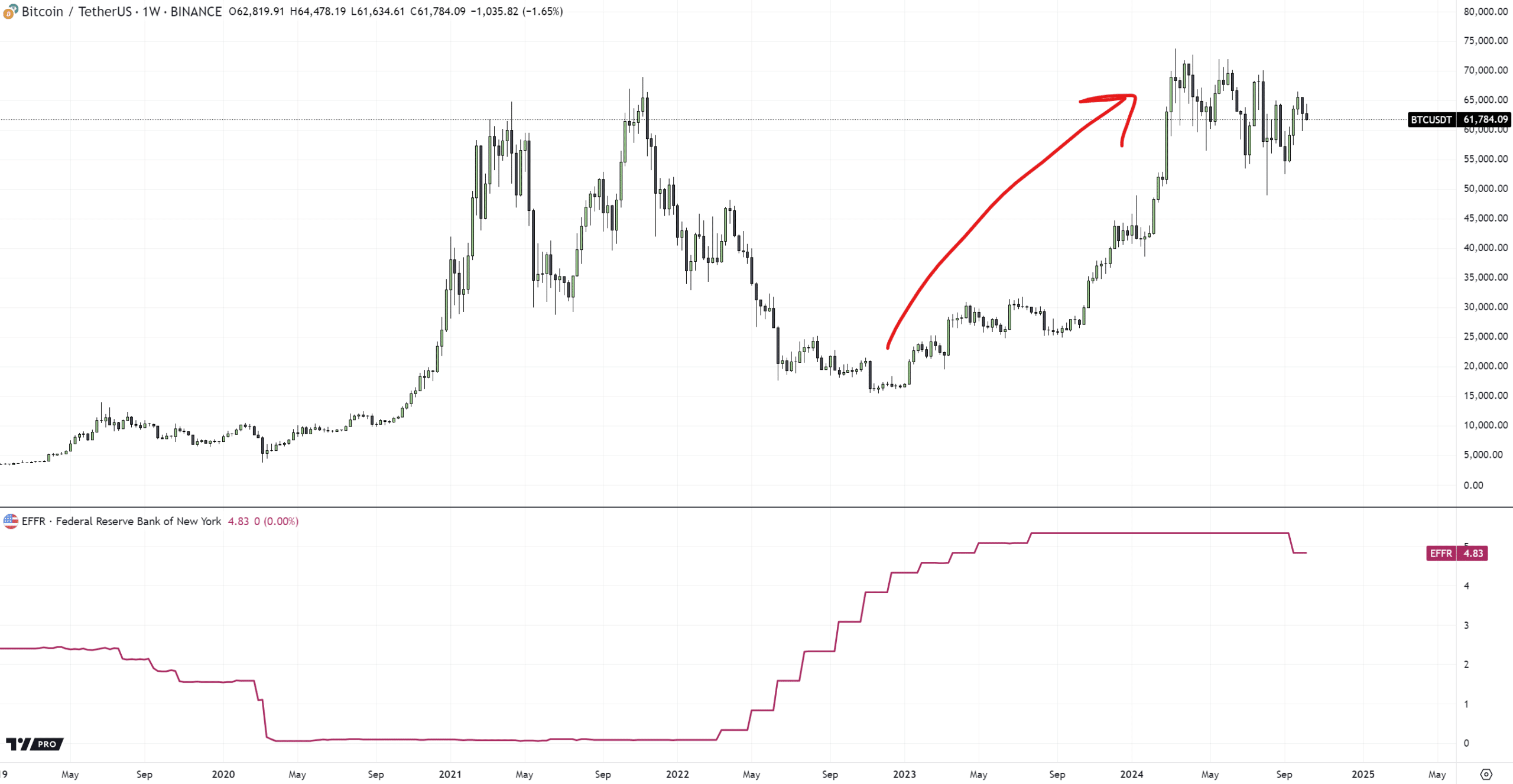

1) It’s been seen that these elements have a generally beneficial impact on worldwide liquidity and risk-based investments such as Bitcoin (BTC). The significant 50 basis point reduction by the Fed in September is believed to be the trigger for BTC’s price surge to $66,000.

Contrarian view Fed rate cuts

However, Andrew Kang, one of the co-founders at crypto investment company Mechanism Capital, adopts a prudent and unconventional viewpoint.

As per Kang’s perspective, the effects of the Federal Reserve rate reductions and China’s policies might have been exaggerated. In simpler terms, he suggests that these actions may not have had as significant an impact as people believe.

It seems to me that overall, the effects of Federal Reserve rate reductions and China’s economic stimulus on the cryptocurrency market might have been exaggerated by its participants.

Kang argued that Fed rates are just one of the many factors influencing global liquidity. He added that even global liquidity is just one of the many factors influencing crypto prices.

To support his point, Kang referred to Bitcoin’s dramatic surge that occurred from 2023 onwards, during a time when the Federal Reserve increased interest rates to unprecedented levels.

It might appear illogical for Bitcoin (BTC) to surge 4.5 times during a time when interest rates were at or near multi-decade highs, suggesting little connection between rates and BTC price movements. However, it would be unrealistic to expect a significant inverse correlation between the two to emerge immediately as interest rates begin to decrease.

Although he acknowledged Fed rates’ importance, he felt the market overemphasized it.

SwissOne Capital, a crypto-focused asset manager, supported the projection.

In a related statement, it was pointed out that alternative cryptocurrencies (altcoins) are expected to see greater gains compared to Bitcoin during times when the Federal Reserve reduces interest rates, since Bitcoin’s dominance tends to wane during such cycles.

In the period around mid-2019 when interest rates were reduced, Bitcoin’s dominance dropped down to 38%.

China stimulus

Additionally, Kang pointed out that China’s economic stimulus might have a greater positive impact on stocks compared to cryptocurrencies. This assertion is based on recent price discrepancies observed in US Dollar Tether (USDT) and the Chinese Yuan (CNY) during trading.

Observations show a shift from cryptocurrencies to A shares in China. This trend is supported by data, as USDT has been trading below the Chinese Yuan (CNY) since the announcement of Chinese stimulus. As of late, this difference remains at around 3%.

Even though the Chinese stock market momentarily halted its growth, experts predict that another economic stimulus plan from the Chinese government might rekindle the upward trend.

If so, crypto investors might reallocate capital to stocks, as Kang noted.

Therefore, it’s anticipated that Bitcoin (BTC) will stay within a price range of approximately $50,000 to $72,000 until a significant event or development in the crypto world serves as a catalyst for market movement.

I’m not suggesting a negative outlook, but it seems some investors may have jumped the gun a bit. Regardless, I maintain that we’re currently within the $50,000 to $72,000 range for cryptocurrency until there’s a significant event or development that moves the market.

For now, Bitcoin remained beneath its 200-day moving average, implying that it hadn’t shown a compelling market pattern change towards becoming bullish.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-10-10 23:04