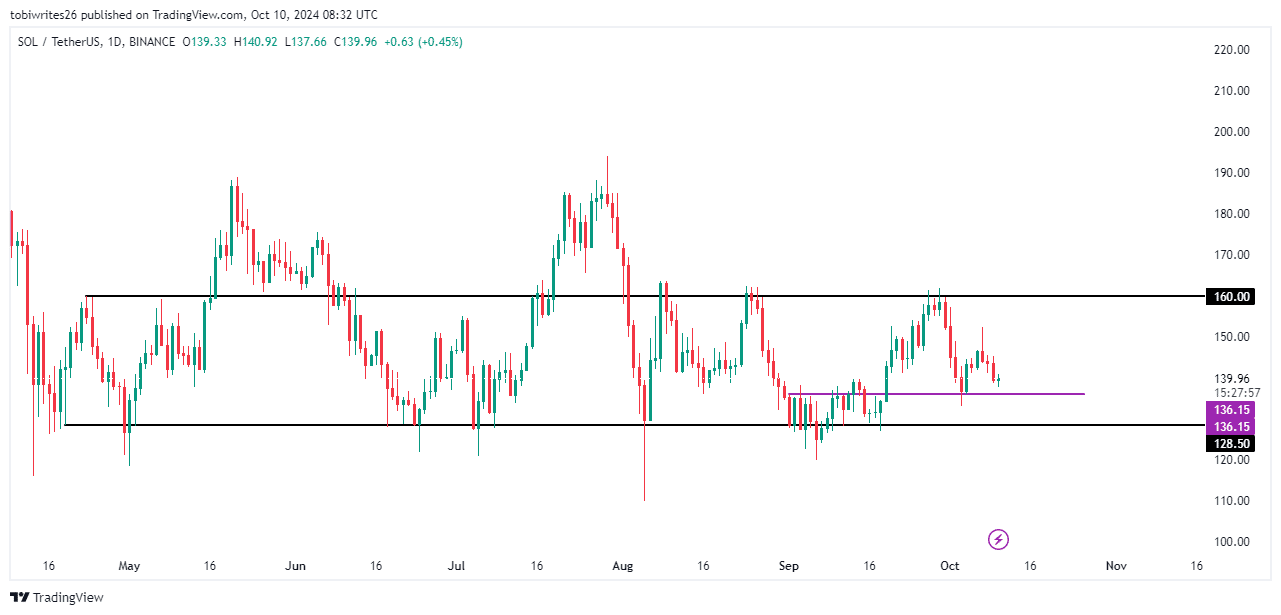

- While price continues to drop, a significant support level at $136.15 could halt and possibly reverse the trend.

- Indicators present conflicting signals; some point to a reversal whereas others indicate decline.

As a seasoned analyst with years of market experience under my belt, I see Solana [SOL] at a critical juncture right now. The price action over the past month has been fairly uneventful, but the recent decline has certainly piqued my interest.

For much of this month, Solana [SOL] has advanced only slightly, experiencing a small increase of about 3.43%. This sluggish growth may be attributed to trading within a holding pattern or consolidation channel. However, in recent trading periods, its progress seems more laborious, yielding a modest weekly gain of approximately 0.45% but also recording a daily drop of 2.43%.

Although the market typically expects SOL to drop further, reaching the bottom of the consolidation channel between $128.50, additional factors should be considered.

SOL chart presents a decline set-up

As I analyze the Solana chart, I’ve noticed a recent reaction from the cryptocurrency at its resistance level within the consolidation channel. This channel, marked by the fluctuation of prices between robust support and resistance levels, appears to be containing Solana’s price movements as expected.

Following its rejection at the resistance point, the price has generally moved in a descending pattern, often predicted to touch the support point of 128.50, a trend that has been noticeable on multiple instances.

If a small reinforcement line forms at $136.15 within the price range, it could signal a surge in Solana prices if there’s enough buying power behind it.

From my perspective as an analyst, I’ve noticed that Solana (SOL) trading activities have shown a mix of responses, casting some uncertainty over its potential path. Whether the current support at $136.15 can hold firm remains to be seen.

Indicators signal downturn for Solana, yet the depth is unclear

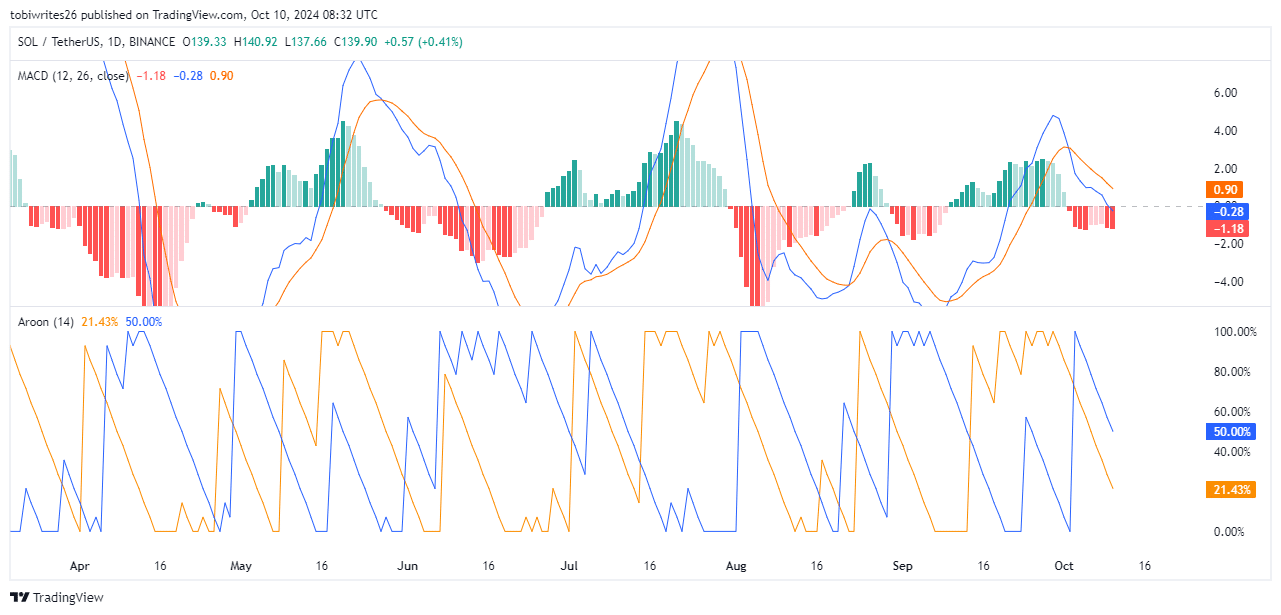

As a crypto investor, I’m seeing some concerning signs regarding Solana (SOL). The technical indicators suggest that SOL might continue its downward trend, largely influenced by a strong bearish sentiment. Specifically, the Moving Average Convergence Divergence (MACD) and the Aroon line are flashing red flags, hinting at a potential drop in price. I’m keeping a close eye on these signals to make informed decisions about my investment strategy.

The Aroon indicator, characterized by an orange ‘Aroon Up’ line and a blue ‘Aroon Down’ line, monitors the duration between price peaks and troughs to determine the robustness and trajectory of a market trend.

In simpler terms, if the Aroon Down line is above the Aroon Up line for SOL, it suggests that the market is trending downward or bearish at this moment.

The MACD lends credence to this perspective, since it’s moving lower and showing progressively more negative momentum indicators, along with the MACD line (in blue) dipping beneath the signal line.

Based on current patterns, it appears that SOL might experience a decrease as trading continues. The specific magnitude of this decline is still unclear; if market conditions improve and a support level at 136.15 is reached, the price could stabilize there. However, if unfavorable market dynamics persist, SOL could potentially drop to 128.50 or lower.

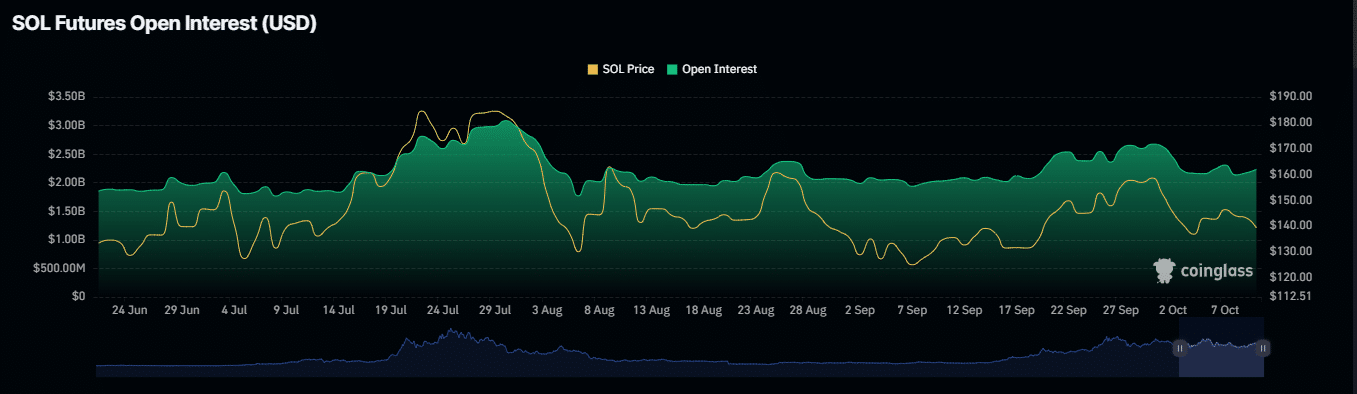

Currently, AMBCrypto has observed that on-chain indicators suggest a rise in optimistic trading attitudes, as there’s been a surge in new long positions and continued support for existing ones.

Selling pressure on SOL eases

As a researcher, I’ve been observing the on-chain data from Coinglass, and it appears that the downward trend for Solana (SOL) may be easing off. The selling pressure seems to be subsiding, suggesting that the bulls are starting to regain control of the market dynamics.

The open interest, which tracks unsettled derivative contracts—futures contracts in this instance—has increased by 5.21% to $2.25 billion. This suggests a rise in long positions, potentially driving the price forward.

Read Solana’s [SOL] Price Prediction 2024–2025

At the same time, the funding rate is now showing a positive value of 0.0021%, which means that long-term traders are compensating short-term traders because they expect the prices to rise.

As a crypto investor, if the bullish trends persist, Solana (SOL) seems poised for an upward surge. The current support at around 136.15 should ideally hold firm. On the flip side, a bearish shift might lead SOL to dip towards the lower support level of approximately 128.50.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- WCT PREDICTION. WCT cryptocurrency

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

2024-10-11 01:44