- The strong recent gains could herald a vertical move.

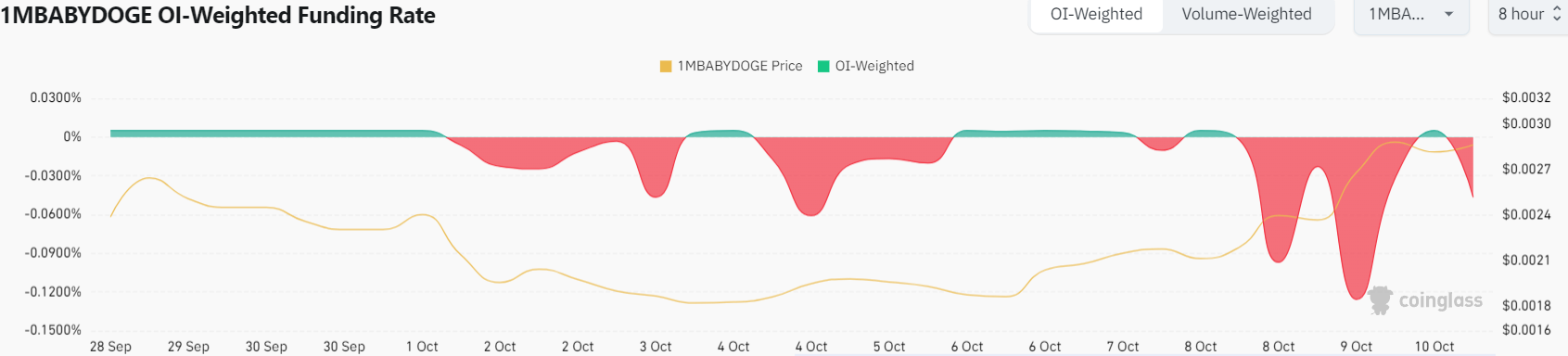

- The Funding Rate suggested that sentiment was not as bullish as it seemed.

As a seasoned researcher with over two decades of market analysis under my belt, I must admit that the recent surge in Baby Doge (BABYDOGE) has caught my attention. The 237% rally since its August lows is undeniably impressive, and the breaking of September highs is a testament to the coin’s resilience.

Over the past month, the cryptocurrency Baby Doge (BabyDoge) has experienced a significant surge, increasing nearly 200%. Notably, at the time of writing, it has climbed as much as 237% compared to its lowest point this year, which occurred in the early part of August.

The September rally commenced as the meme coin became available for trading on Binance. Getting listed on leading exchanges often sparks enthusiasm and redirects focus towards the token, and in this case, supporters of BABYDOGE rode the rising tide.

Baby Doge coin breaks September highs

Starting from its lowest point on September 6th, BabyDoge experienced a substantial increase of 217% over a three-week period. However, it later underwent a significant drop to test the level of $0.0018 (for ease of reading, this value has been reduced by a factor of one million).

This 33% retracement was quickly overcome in the first week of October.

Despite Bitcoin [BTC] finding it difficult to surpass the $63k barrier, Baby Doge Coin experienced a remarkable surge of 64%. This rapid, significant increase in value sparked curiosity and drew in additional investors seeking further growth opportunities.

1) The trend indicated by the moving averages suggested a bullish movement, while the surge beyond previous local peaks signified a determined bullish stance. Additionally, the A/D indicator increased noticeably in October, indicating robust demand.

Assessing the speculative sentiment

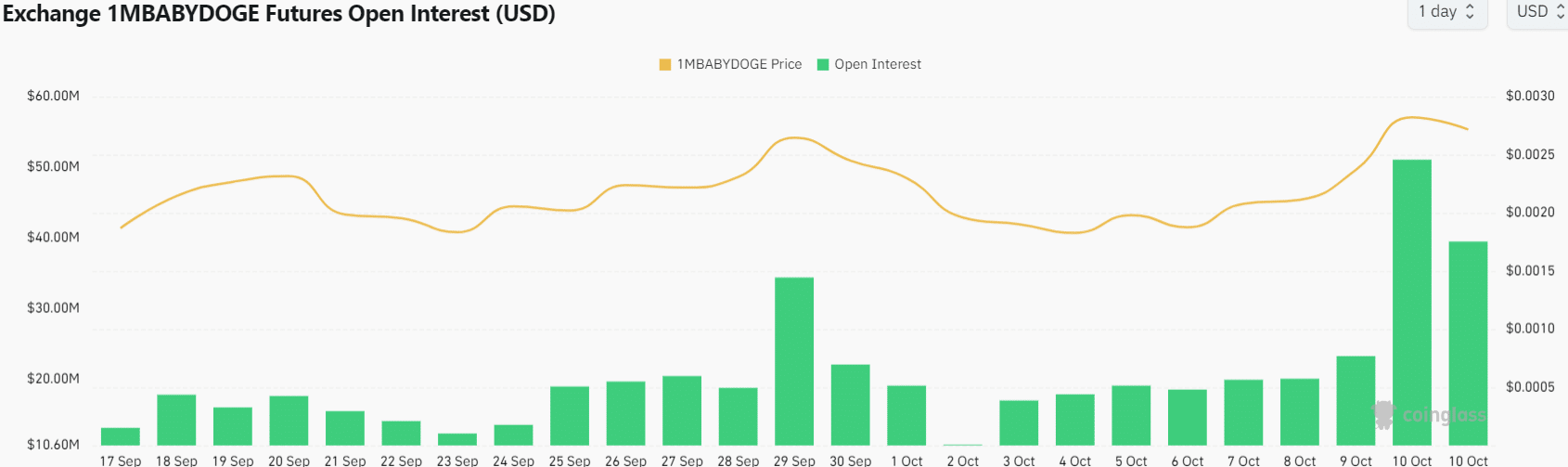

Over the last three days, the Open Interest significantly increased from $18.5 million to $39.5 million. This rapid growth, combined with a robust price surge, indicates a positive market sentiment, suggesting investors are optimistic (bullish).

The nearly 10% dip of the past 24 hours was accompanied by an OI drop.

Over the last week, although there was a positive mood among traders in the short term, the majority of transactions (Funding Rate) have been unfavorable for them. Essentially, this means that short sellers had to compensate long position holders for their trades.

Realistic or not, here’s BABYDOGE’s market cap in BTC’s terms

It also pointed toward bearish sentiment, going against the findings on the Open Interest chart.

In the Futures market, these conflicting indicators might complicate traders’ choices, yet the case for a bullish outlook appears stronger given the latest price trends.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-11 02:15