-

BTC needs to break $66,000 for a bullish run.

$5.64 billion in realized profits signal strong market activity.

As a seasoned researcher with years of experience navigating the cryptocurrency market, I find myself cautiously bearish on Bitcoin (BTC) at this juncture. The rejection at $66,000, coupled with the significant realized profits and heightened social sentiment, paints a complex picture.

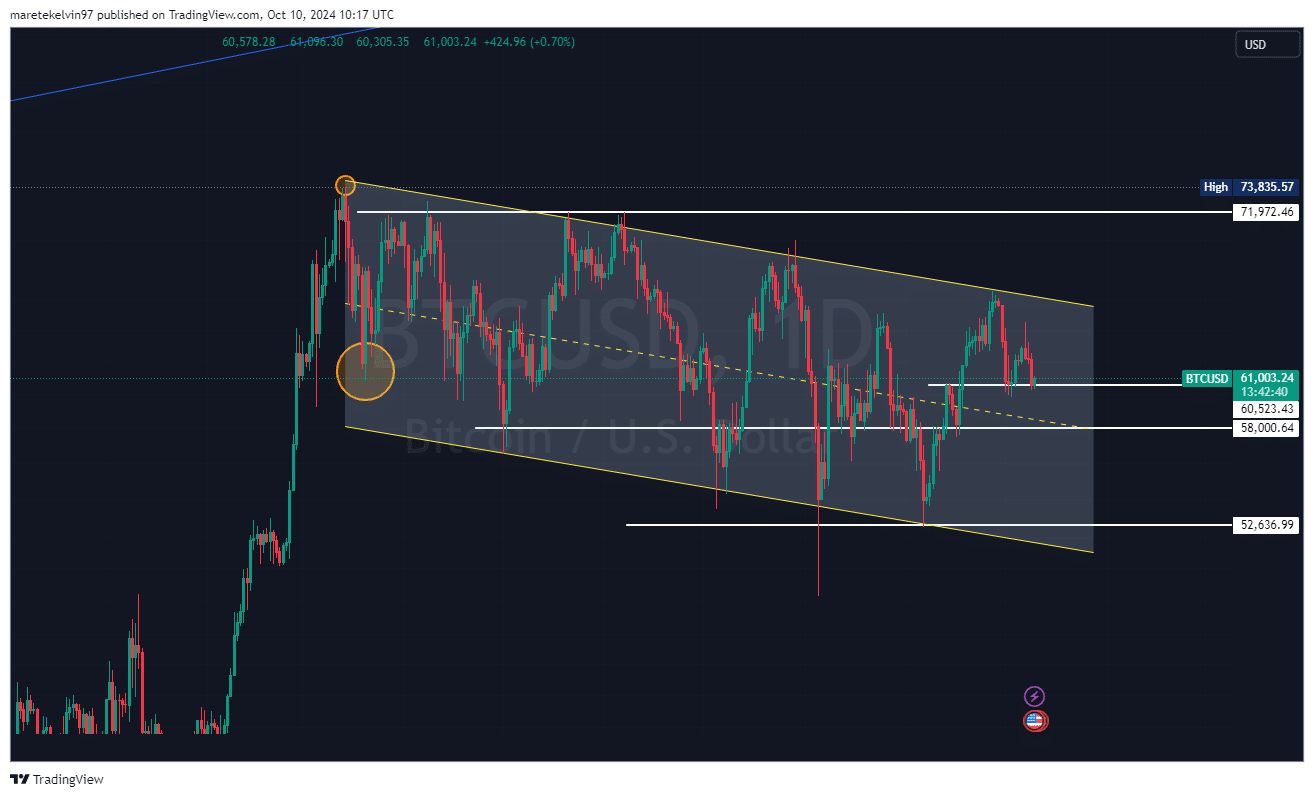

Bitcoin (BTC) remains challenged by a downward sloping parallel channel. The enthusiasm of a few days back appears to have waned, as a potential breakout doesn’t seem imminent at the moment.

Following a rejection at significant highs, Bitcoin might potentially drop to lower prices if it fails to break through a crucial cost barrier.

THIS signals more bearish run

The cost of Bitcoin recently encountered a barrier and was pushed back from the top limit of the falling parallel channel, which is set at around 66,000 dollars.

Looking at the price action, if we encounter a rejection at the top level (around $XXX), it will then expose the middle support level ($58,000) and possibly even the lower support level ($52,000) in case of a more bearish scenario.

Investors hoping for Bitcoin (BTC) to surge (bullish trend) should watch for it closing above $66,000, a price point previously showing strong resistance.

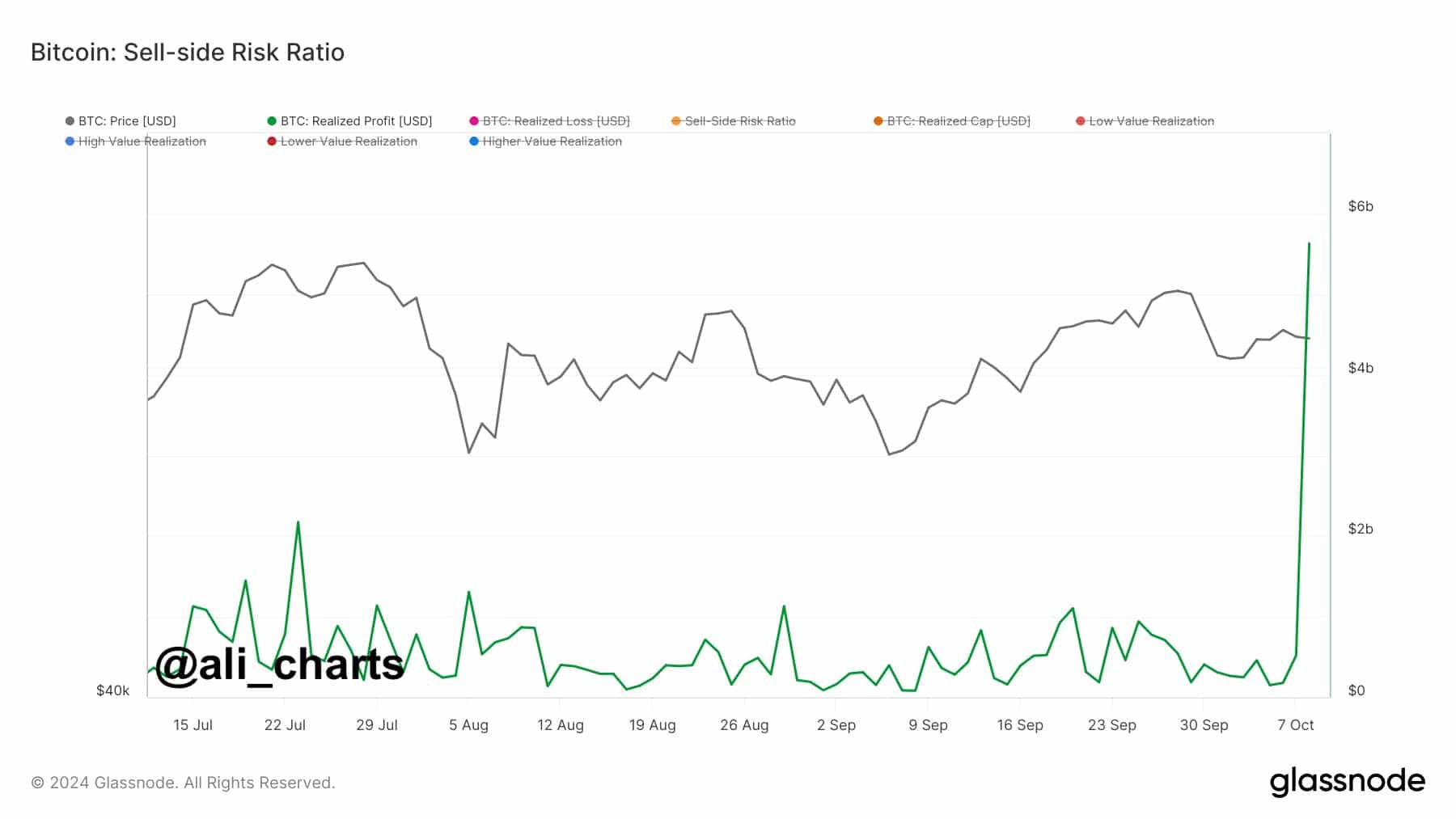

Realized profits boost market activity

In the past 24 hours, the Bitcoin market has shown remarkable activity, as evidenced by the staggering $5.64 billion in realized profits, which underscores widespread profit-making on a grand scale.

The increase (uptick) suggests that investors may be selling their holdings, which could potentially lead to a decrease (downward pressure) in the coming days.

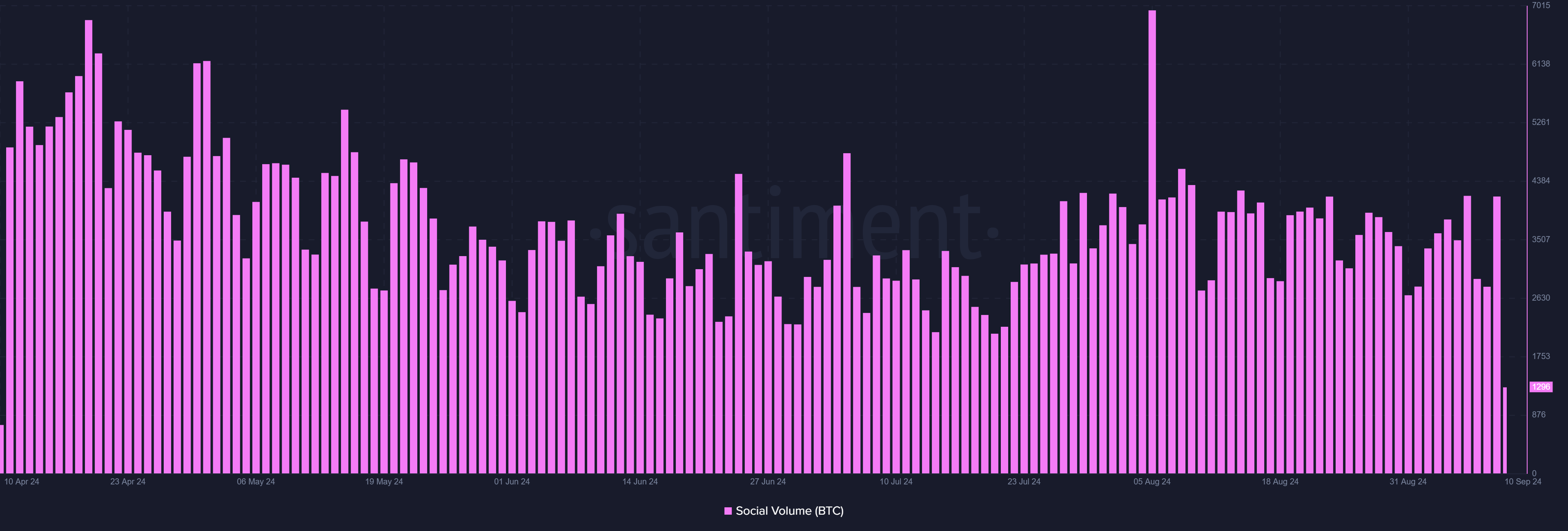

Bitcoin social sentiment spikes

Additionally, there’s been a significant surge in public opinion about Bitcoin, as per data from Santiment, in recent periods.

A significant portion of the excitement might stem from recent conjectures regarding Satoshi Nakamoto, the enigmatic inventor of Bitcoin.

If Bitcoin’s social buzz significantly rises, it might lead to temporary market fluctuations. However, maintaining a sustained price rise without initially breaching the $66,000 mark is unlikely.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Despite signs of a lively market based on actual earnings and public opinion, Bitcoin’s technical forecast remains uncertain. Keep an eye on the $66,000 threshold as it could signal a potential breakout.

Until then, market participants should prepare for potential dips to $58,000 or even $52,000.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-10-11 03:35