-

SUI has witnessed an increase in outflows this week after its uptrend faced resistance.

Lack of buyer support could see SUI drop to test support before making another upswing.

As a seasoned researcher who has navigated through countless cryptocurrency trends and cycles, I find myself observing SUI with a mix of intrigue and caution. The token’s remarkable rise over the past months has been nothing short of impressive, but recent developments suggest that we might be witnessing a correction.

Over the past few months, SUI has stood out as one of the leading performers within the cryptocurrency sector. Just in the last 30 days, SUI’s market cap has skyrocketed to over $5 billion thanks to a price increase of nearly 100%.

SUI’s gains have seen it stand out from the choppy trends witnessed with other altcoins.

After about a month of continuous growth, there are indications that the momentum might be slowing down, possibly leading to a reversal for a while, before the upward trend continues again.

SUI price analysis

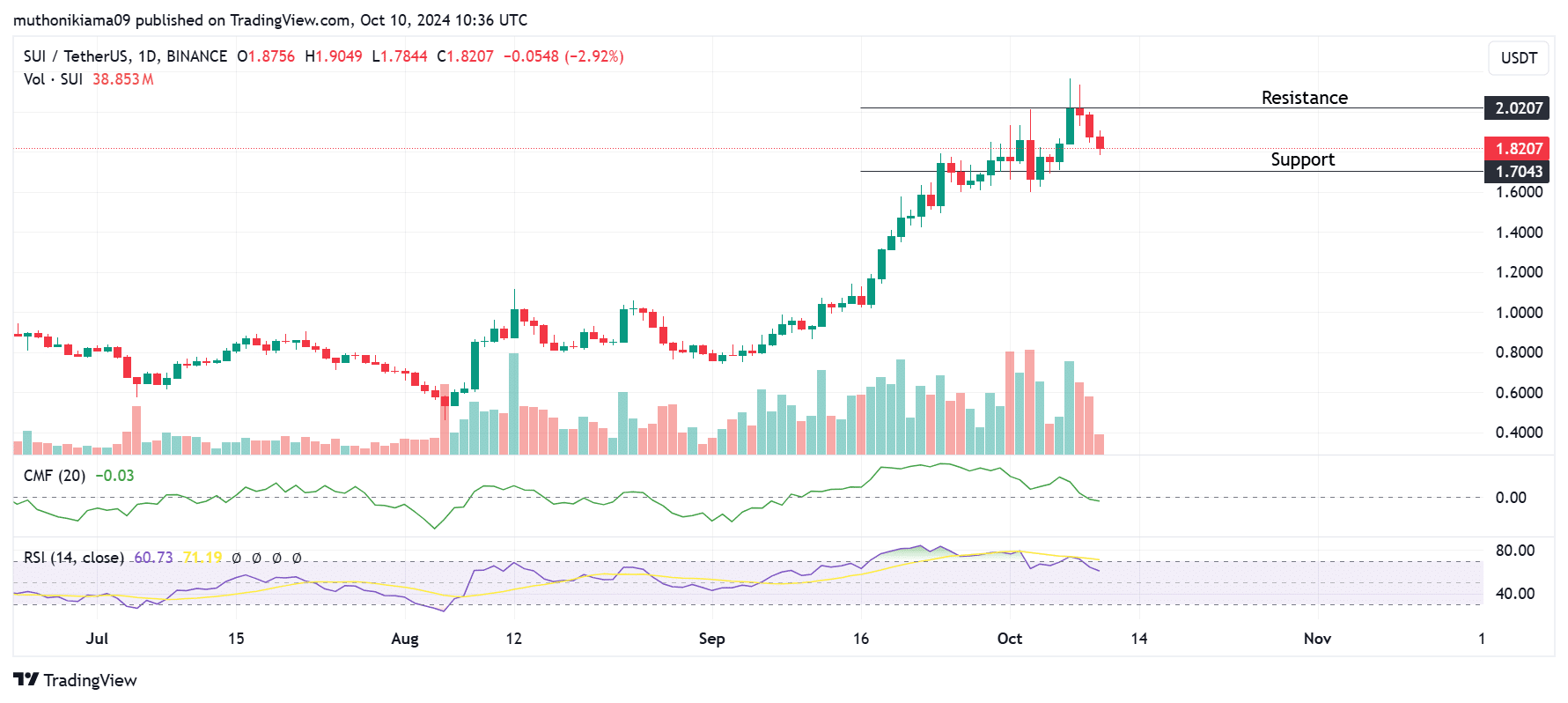

At the moment of reporting, SUI was valued at $1.82 following a 4.4% decrease over the past 24 hours. Notably, trading activity for this token dropped by 6%, as reported by CoinMarketCap, indicating a possible decline in investor enthusiasm.

Additionally, for the past three days straight, the volume histogram bars have been red, indicating a strong trend of selling activity.

As a researcher observing the market dynamics surrounding SUI, I’ve noticed a decline in buying activity. This trend is further supported by the downward trajectory of the Chaikin Money Flow (CMF), suggesting that funds are being withdrawn from the token this week.

On the daily chart, the Common Moving Framework (CMF) switched to a bearish stance due to increased selling activity overpowering buying activity. This shift may have occurred as traders cashed out their gains following indications that the upward trend was starting to falter.

After the Relative Strength Index (RSI) dropped beneath its signal line, triggering a sell signal, trading activity shifted towards selling. However, if this indicator moves back into a bullish zone, it’s possible that buyers may return to the market.

If purchases keep being infrequent and sellers stay active, the price could fall to check if $1.70 acts as a support level. Potential buyers may see this decrease as an opportunity for a fresh investment.

However, for a sustained uptrend, SUI needs to break resistance above $2.

Analyzing derivatives data

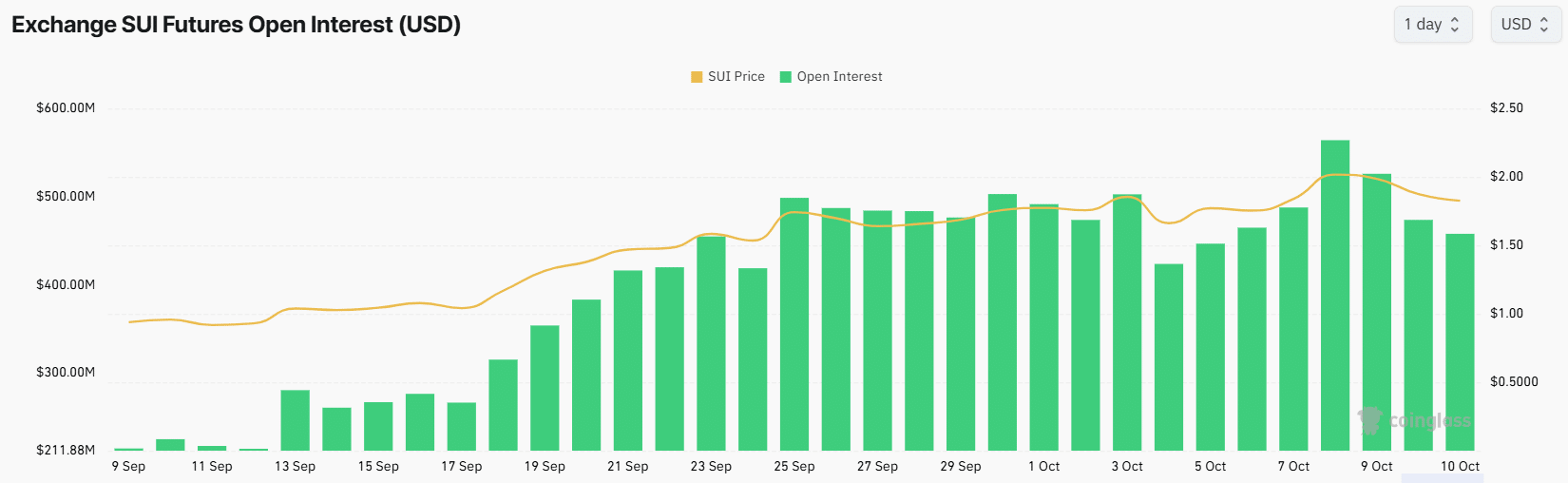

The derivatives market indicates a cooling trend for SUI, as it appears to have been excessively heated. Over the past 24 hours, open interest has decreased by 11%, bringing it down to approximately $457 million currently, according to Coinglass.

Earlier in the week, the total value of open positions for SUI hit a record high over $563 million. However, since then, these positions have decreased by more than $100 million, indicating that traders are wrapping up their deals on the token due to declining interest.

Read Sui’s [SUI] Price Prediction 2024–2025

Moreover, in the previous 24 hours, SUI recorded liquidations amounting to approximately $6 million, making it rank fourth among all cryptocurrencies. The majority of these liquidations were from traders holding long positions, which suggests a pessimistic outlook for the market.

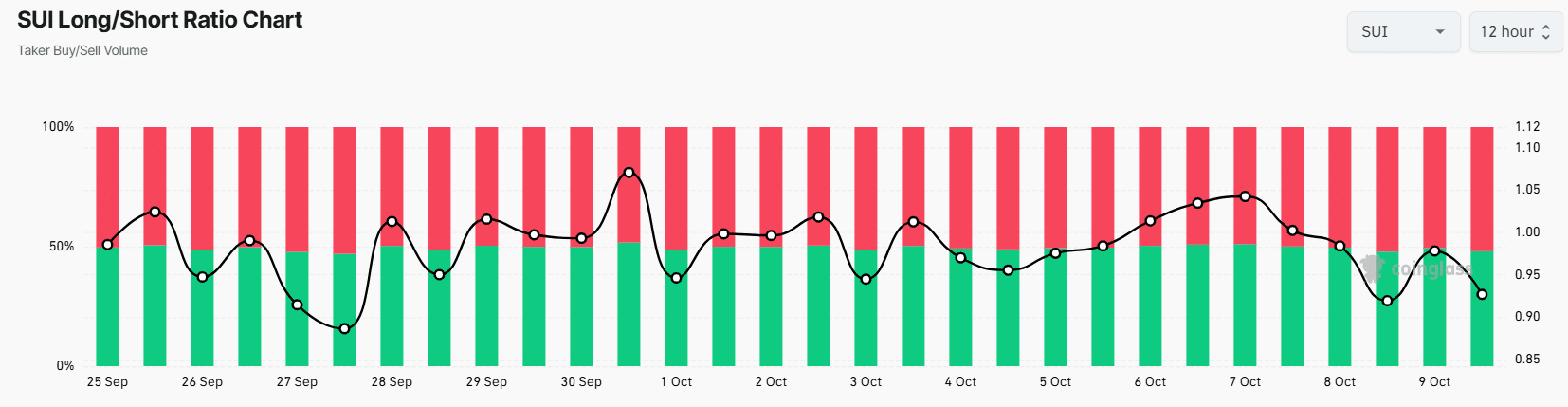

Prolonged sell-offs (liquidations) have influenced the Long/Short Ratio, causing it to decrease to 0.92. Although this figure is close to the neutral point, it implies that a slight majority of traders are currently in short positions as opposed to long ones.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

2024-10-11 05:43