-

PEPE retested a short term ascending support after the latest pullback.

Assessing whether demand is building up at this critical level.

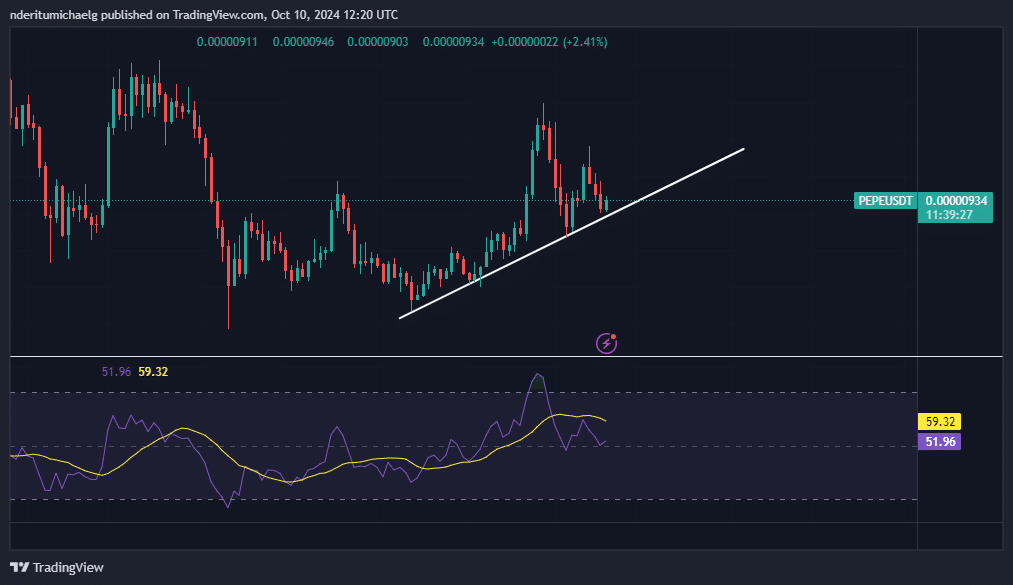

As a seasoned crypto investor with a knack for spotting trends and analyzing market behavior, I find myself at a crossroads with PEPE (PEPE). After a brief pullback, the memecoin is currently testing its short-term ascending support line, which was established during its September surge. The 24-hour uptick of 2.63% suggests that bullish sentiment may still be alive, but it’s too early to call it a definitive comeback just yet.

Currently, the memecoin PEPE finds itself in a crucial phase that could significantly impact its near-term trajectory. Over the past fortnight, it’s been evident that PEPE has faced challenges in preserving the bullish trend it had garnered in September.

But what if the bulls could make a comeback that marks a continuation of that momentum?

Despite PEPE losing its September advancements, its temporary upward trend could still persist. The meme coin has recently revisited the short-term rising support level that corresponds to its September behavior.

At the moment of reporting, PEPE was being traded at $0.00000935, having experienced a 2.63% increase over the past 24 hours. This surge indicates that the temporary upward trend may still be ongoing, leading to a positive response from the market upon retest.

The recent dip caused PEPE to reach its 50% Relative Strength Index (RSI) threshold. However, so far, the RSI indicator has hinted at a possible shift in trend and has stayed slightly above this area.

Once again, this was confirmation that the bullish momentum was still at play.

The point being made emphasizes the significance of the current standing of the memecoin. Further growth is probable if it manages to garner sufficient interest.

Alternatively, if the bears mounted a strong attack, there could have been an increased likelihood of further price drops due to weak demand.

Assessing the state of PEPE’s demand

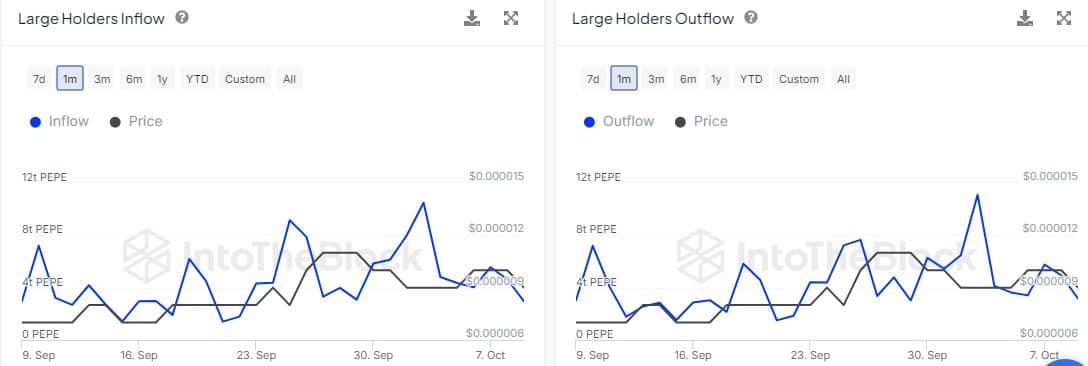

Initially, we examined the behavior of whales (large investors) as they significantly influence market trends. Analysis of large holder data showed a decrease in whale activity starting from early October.

On the 9th of October, it was found that large wallets holding PEPE tokens received approximately 2.96 trillion units, whereas a total of 3.17 trillion PEPE tokens were transferred out.

The substantial data container indicated a slight increase in outflows. Yet, this could have shifted within the past day as prices experienced a minor surge.

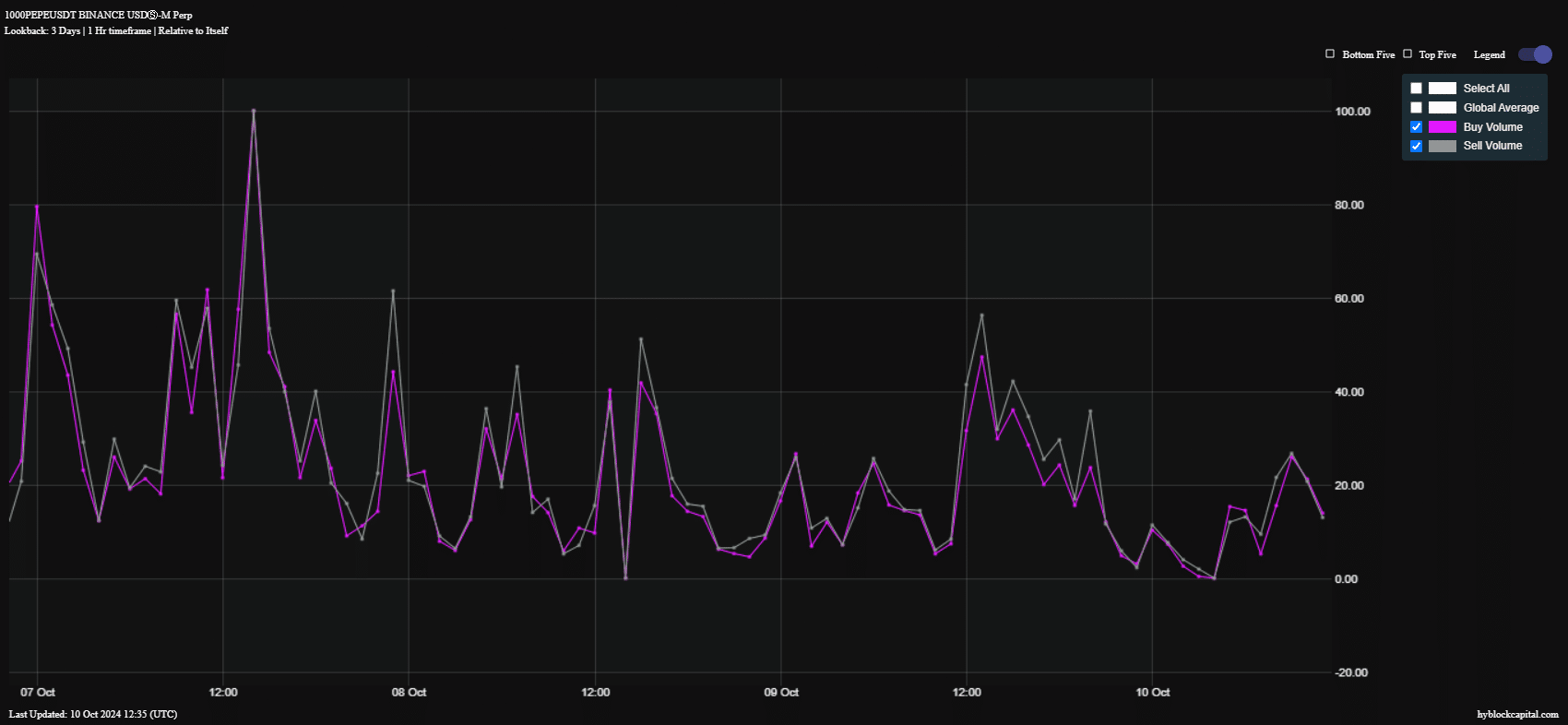

Over the past three days, on-chain transaction activity has slowed down noticeably. During this timeframe, sell volumes have significantly outweighed buy volumes, a trend that mirrors the increased selling pressure noted earlier.

However, the latest data revealed that PEPE buy volume was slightly higher than sell volume.

Read Pepe’s [PEPE] Price Prediction 2024–2025

Although the previous analysis didn’t reveal a definitive pattern, it remains uncertain which way the price might trend.

As the weekend nears, a change in volume could provide clearer directional signs. Therefore, it’s suggested to closely monitor whale behavior.

Read More

2024-10-11 06:15