-

Cardano made history by hosting the first loan smart contract enforceable at an Argentine court.

Despite the milestone, ADA’s price remained muted near its key support

As a seasoned researcher who has witnessed the evolution of blockchain technology and its legal implications over the years, I find the Cardano [ADA] smart contract milestone in Argentina to be a significant step forward. The ability to legally enforce smart contracts at the nation-state level is a game-changer for the crypto industry. It paves the way for a future where complex financial agreements can be executed and enforced with greater efficiency and transparency.

In simple terms, Cardano (ADA) became the platform for the first legally binding smart contract according to Argentine law. This agreement was a loan arrangement between two representatives of Cardano, and if violated, it could be enforced in a court of law.

The contract was a loan obligation worth 3000 ADA tokens between Mauro Andreoli and Luccas Macchia. Giving context to the impact of the development, Andreoli stated,

This implies that if there’s a violation (of the ADA), the legal system allows us to take action in a court of law to ensure compliance with the obligation stated in the Americans with Disabilities Act.

Great for Cardano?

Additionally, it could serve as a base for establishing a legal structure at the national level, as well as shaping the course of smart legal contracts in the future.

Furthermore, this development plays a crucial role in paving the way for advanced legal smart contracts in the future. It establishes a strong foundation and strengthens the system’s infrastructure. As we progress, it is imperative that we prioritize education for judges regarding these new developments.

Although the aforementioned milestone involved a loan contract, the same could be applied to other contracts, such as rental home and purchase agreements.

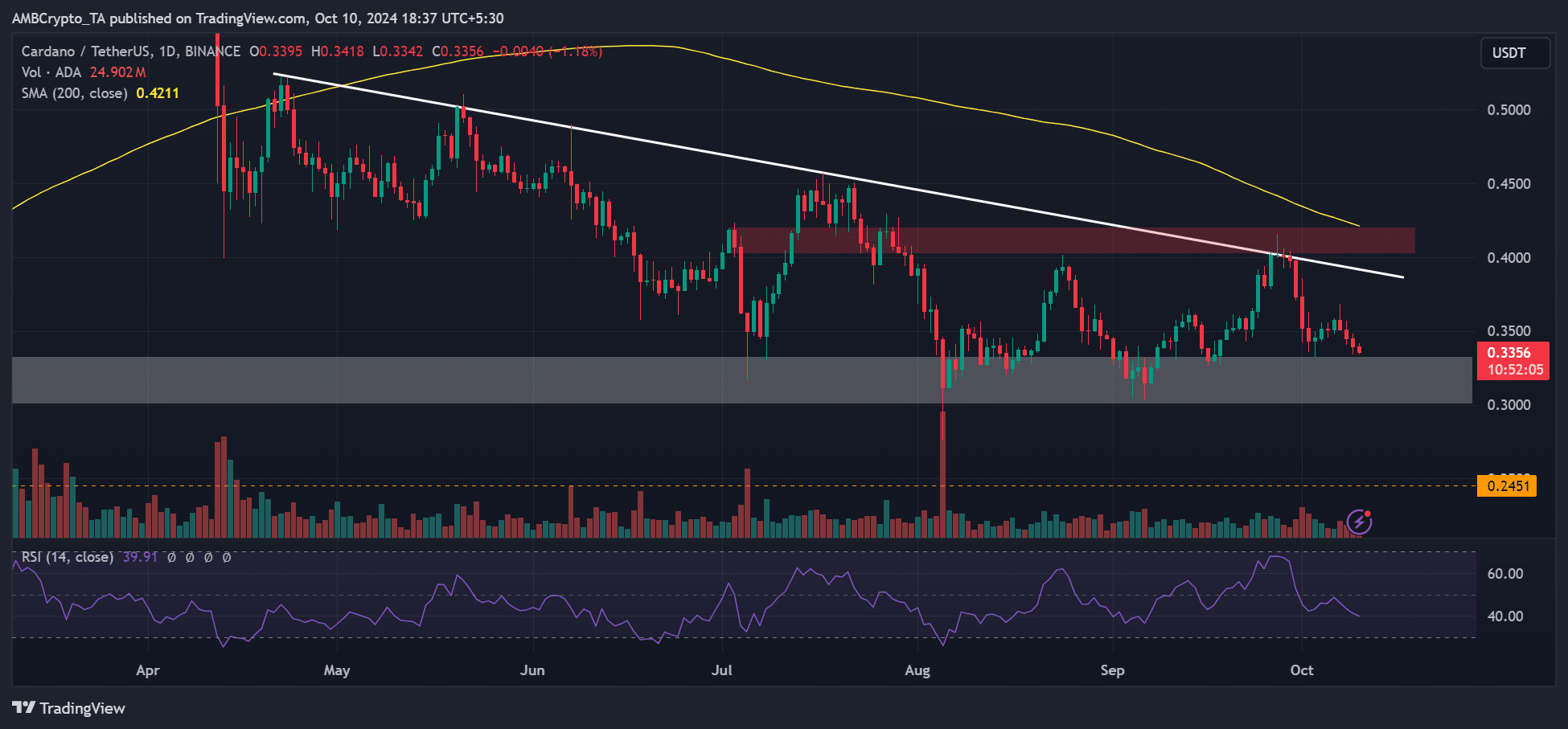

Despite the recent news, ADA‘s price didn’t show much movement on the charts. Instead, it remained above its support level of $0.30, mirroring a wider market drop.

In light of the FOMC minutes on October 9th, cryptocurrency markets experienced a downturn. Despite this, the broader market remained within a set range at the point of publication, due to unexpectedly high U.S. Consumer Price Index (CPI) figures for September.

In the near future, significant levels of interest may form around $0.3 for ADA, and a potential obstacle could arise from the trendline resistance (represented by the white line) or at $0.4. These areas should be closely monitored in the short term.

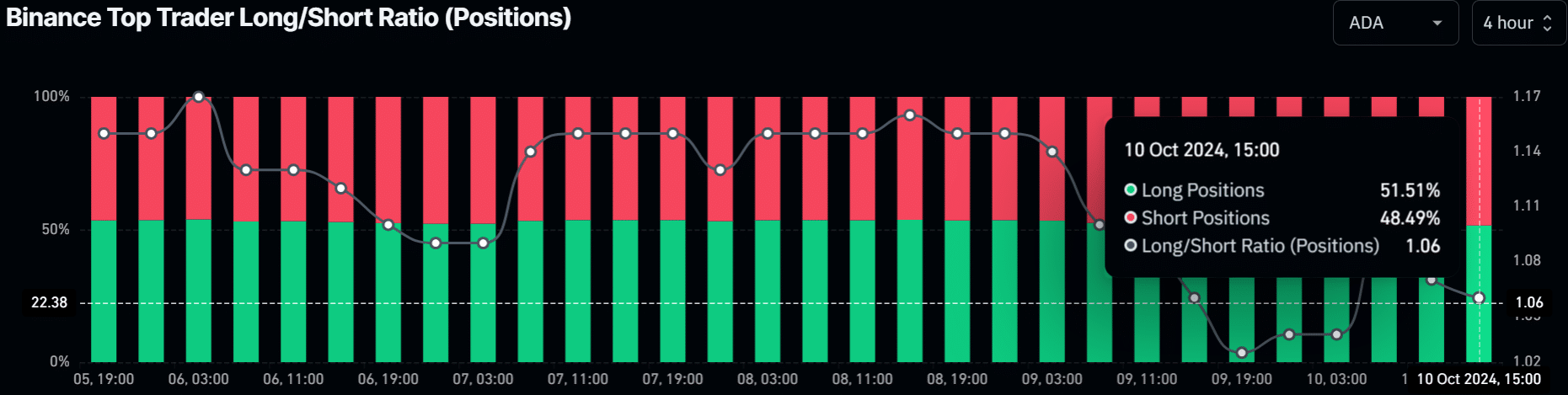

Based on the data from Binance‘s Top Traders Long/Short ratio, there was a slightly bullish bias, suggesting that many of the platform’s top traders held a net long position in the altcoin. Approximately 51% of these top positions were betting on ADA experiencing a short-term price reversal.

However, a strong rebound for ADA could only happen if Bitcoin’s [BTC] reverses its recent losses.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-10-11 10:26