- MANTRA token has a strongly bullish outlook for the coming weeks

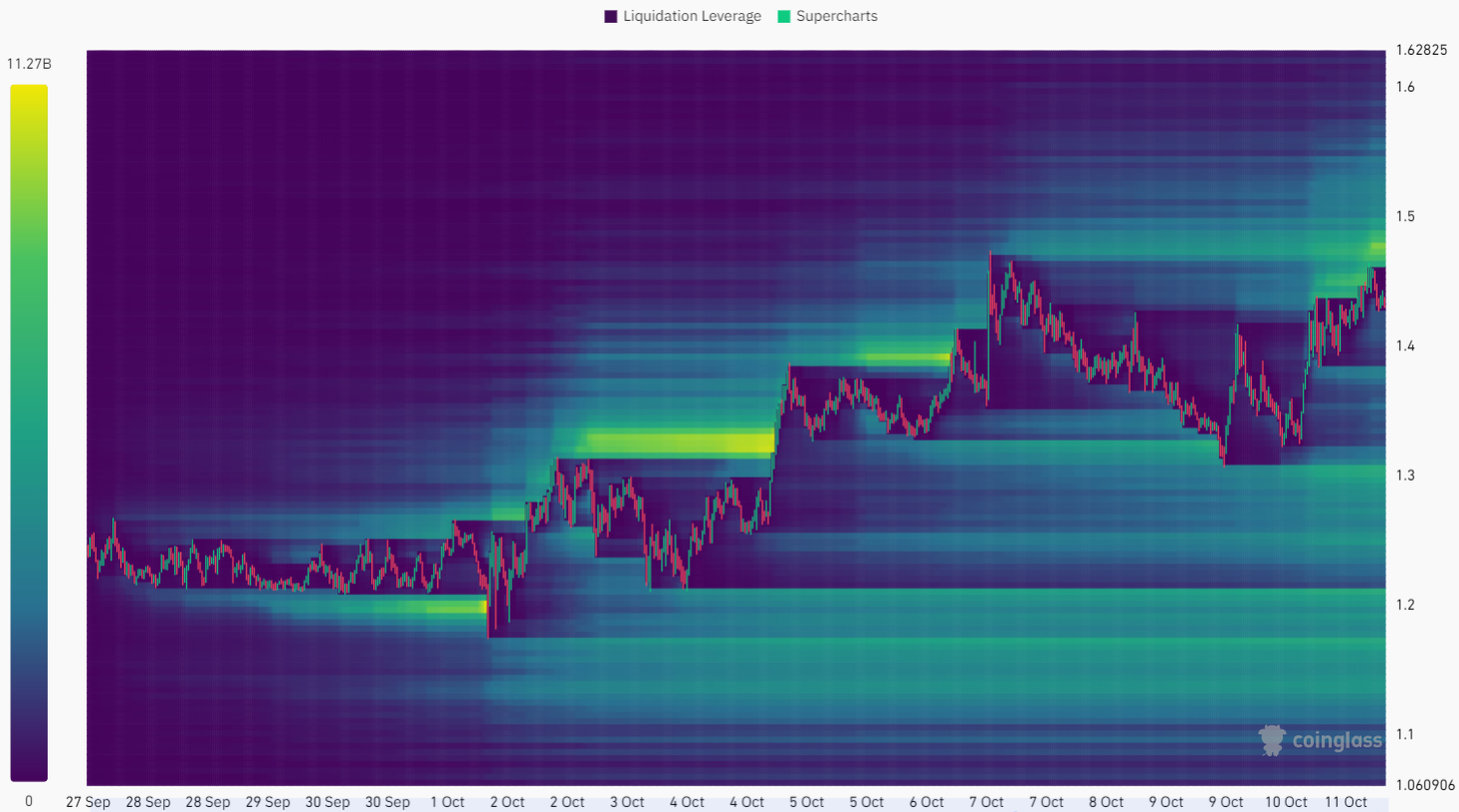

- Liquidation heatmap noted a magnetic zone at $1.5 that could stall the trend

As a seasoned analyst with over two decades of experience in the crypto market, I have seen my fair share of bullish and bearish trends. The current outlook for MANTRA [OM] is undeniably bullish, and I’m not one to bet against the market. However, I always remind myself that even the mightiest of bulls need a rest now and then.

At the current moment, MANTRA (OM) surpassed its previous July peaks, following a remarkable 69% surge since 8 September. Despite Bitcoin‘s [BTC] price drop from $66.5k to $59k in October due to selling pressure, this did not diminish OM’s optimistic outlook.

With it surpassing its latest peaks and sustained purchasing activity, there’s potential for even more growth, which might unfold gradually if the cost gravitates towards the significant $1.3 liquidity zone.

Chances of sustained price gains for OM

Looking at the current situation, the data seems to indicate a persistent increase in prices. The overall market setup on the daily chart has been positive since the beginning of September. Furthermore, the Chaikin Money Flow (CMF) has remained above 0.05 for most of the last fortnight.

Behind OM, there was strong evidence of purchasing interest, as suggested by the bullish crossover of the moving averages and the clear upward trend visible in the daily chart.

If there’s a price drop, or retracement, the amounts around $1.25 and $1.1 might act as a safety net for buyers. It seems plausible that the $1.41 level may transition to a support level in the near future. Additionally, potential target levels for the price rise could be the Fibonacci extension levels at approximately $1.6 and $1.9.

Liquidation levels showed a minor price dip could be looming

During the past two weeks, it appears there’s a significant concentration of liquidation points around the $1.48 area. It’s plausible that the price may be drawn towards this zone, only to then be pushed downward.

Is your portfolio green? Check the MANTRA Profit Calculator

And yet, it is also possible that the strong bullishness forces the price well beyond the cluster of liquidity overhead, as it did on 4 October. Overall, though OM might see a minor dip towards $1.3-$1.35, it is expected to trend higher in the coming days.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

2024-10-11 22:16