-

ETH made moderate gains on the monthly charts, hiking by just 2.89%

Analyst believes ETH must stay above $2300 to avoid mass sell-offs

As a seasoned analyst with over a decade of experience in the financial markets, I’ve seen my fair share of bull runs and bear markets. Looking at Ethereum’s current performance, it seems like a classic case of “two steps forward, one step back.” While ETH has made moderate gains, it remains significantly below its recent high, which is concerning for many analysts, including myself.

Over the last week, while Bitcoin [BTC] showed a downward trend, Ethereum [ETH] charted a unique course, resulting in modest increases on its monthly price graphs.

As I’m typing this, Ethereum was being traded at approximately $2,404. This represented a 1.06% increase compared to its weekly performance, and it also saw an upward trend on the daily charts as well.

Despite these gains, however, ETH remains significantly below its recent high of $2,700 and 50.7% from its ATH of $4878. As expected, these market conditions have left analysts talking. One of them is popular crypto analyst Ali Martinez, according to whom, $2,300 remains ETH’s key support level.

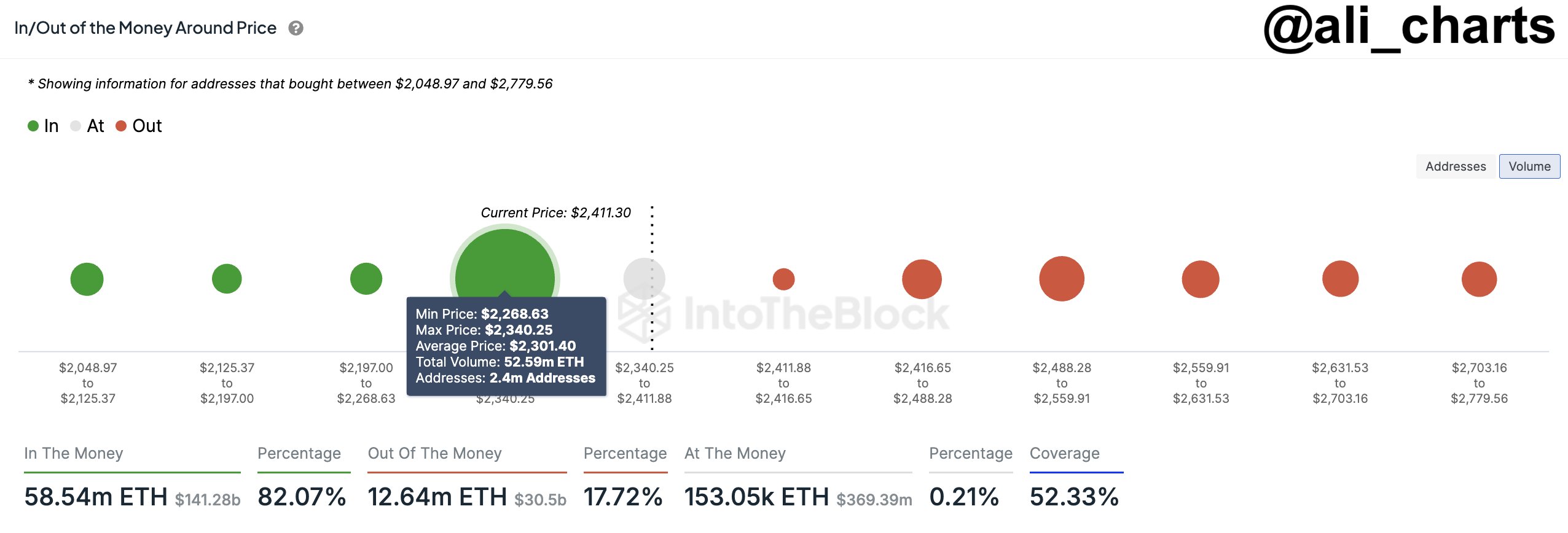

Why 2.4 million addresses are key

In Martinez’s assessment, he pointed out approximately 2.4 million Ethereum addresses that acquired around 52.6 million Ether tokens at a price of $2,300. He believes that the price of ETH should maintain above this point because it represents a crucial support level for the altcoin.

In other words, should the altcoin not sustain this critical support area, there could be a significant sell-off for ETH. If it falls below this point, it might trigger widespread panic among investors who would rush to sell in an effort to limit their potential losses.

Given this situation, it’s likely that Ethereum could experience increased selling, which might push its price even lower on the price graphs.

What does ETH’s chart say?

Now, while Martinez’s observation hints at an upcoming market sell-off, it’s crucial to verify this prediction by examining other market signals as well.

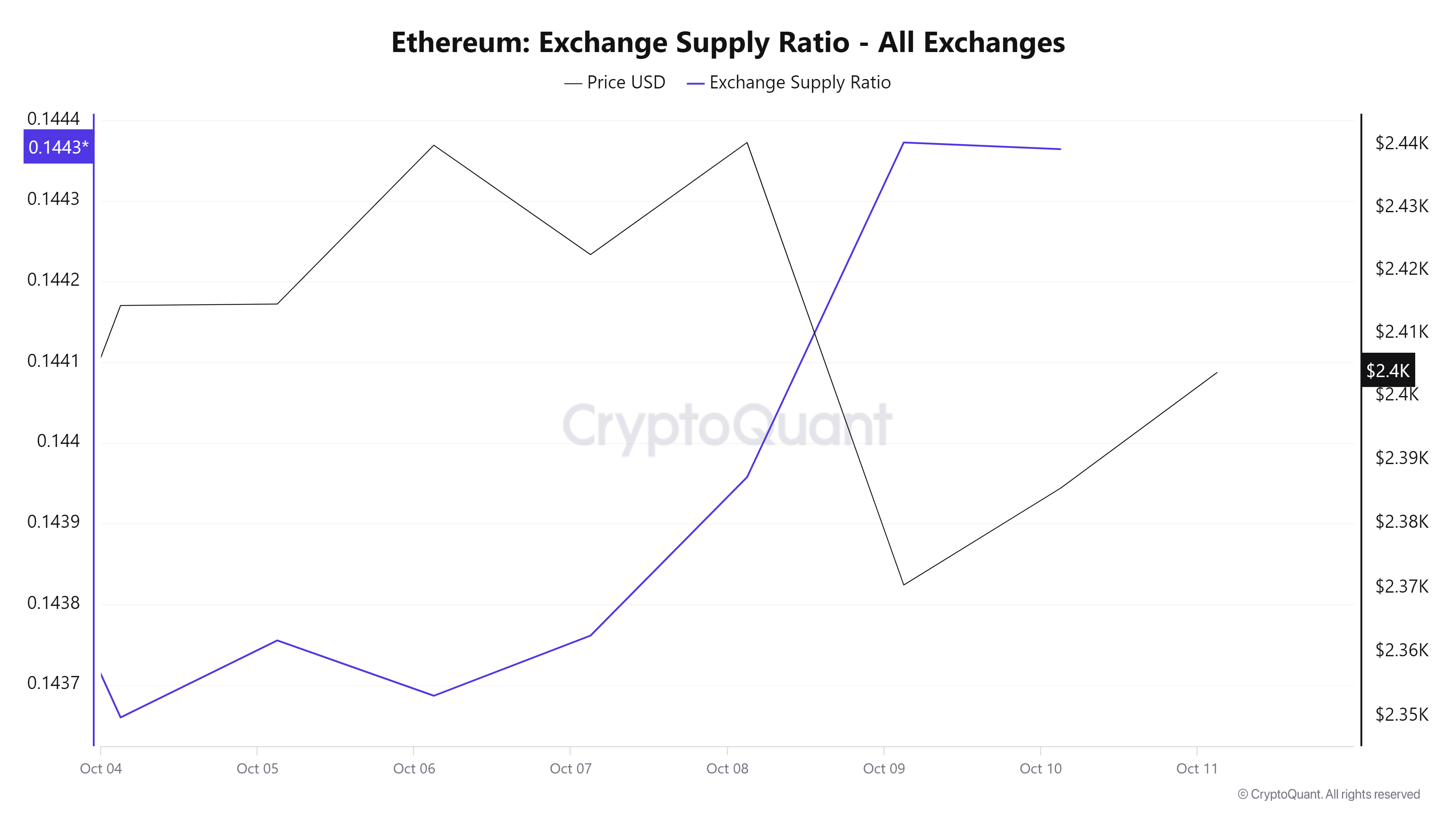

Over the last seven days, the Ratio of Ethereum held on exchanges increased from 0.143 to 0.1443. This rise in the exchange-held ratio implies that some holders might be considering selling or cashing out their Ethereum.

This is usually a bearish signal as investors move their ETH from private wallets to exchanges.

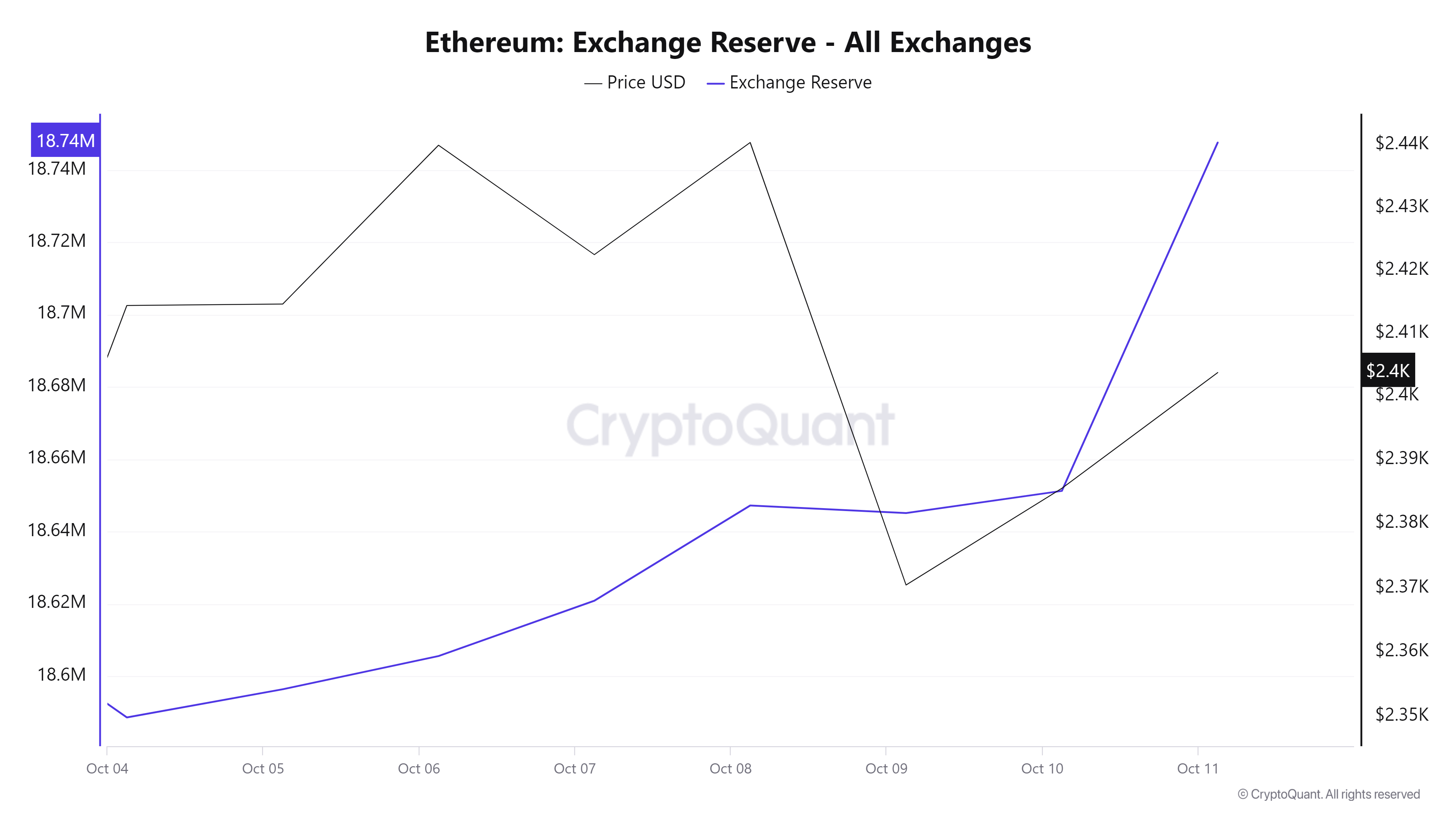

Moreover, the Exchange Reserve of Ethereum has been on an upward trend over the past week, reaching approximately $18.7 million as we speak. This increase in exchange reserve corresponds with our earlier findings of a surge in the exchange supply ratio, suggesting that investors are moving their ETH to exchanges, which aligns with our previous observations.

This type of market behavior would potentially lead to selling pressure, thus pushing prices down.

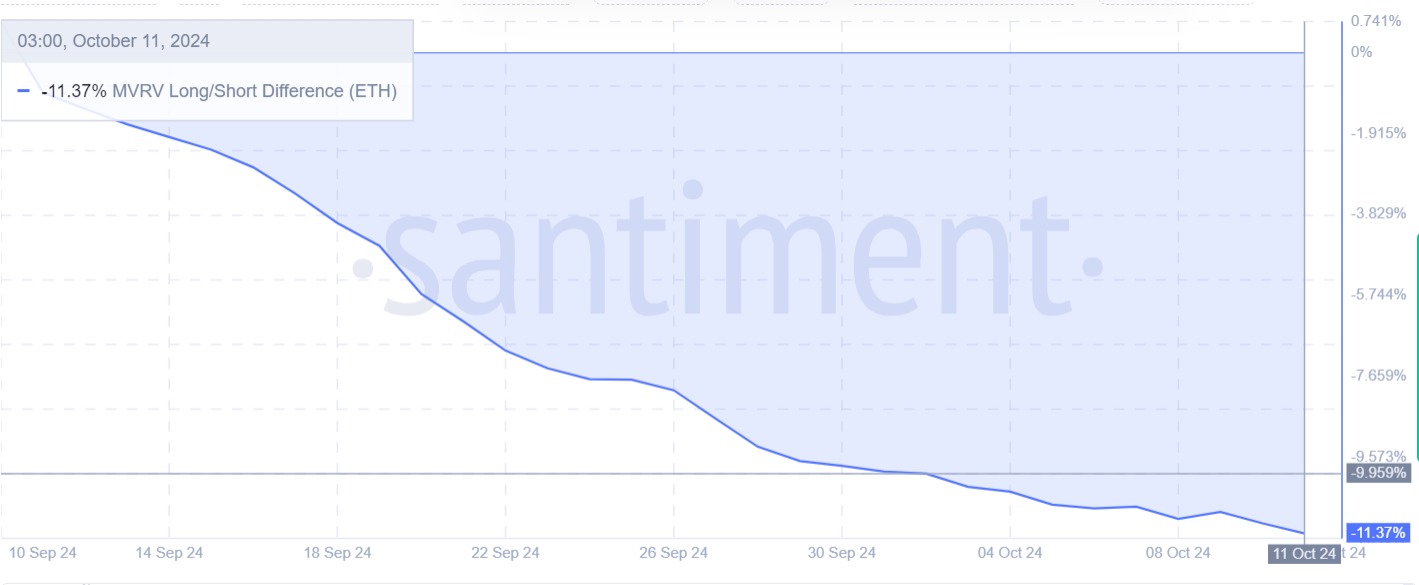

In summary, Ethereum’s MVRV long/short gap has persisted in the negative for the past month, indicating that long-term holders have been experiencing losses while short-term holders are making profits. Typically, this situation leads to long-term holder liquidation as they try to cut their losses, thereby increasing selling pressure in the market.

In other words, when long-term investors give up (or sell), it can create a short-term minimum price level because they are exiting their investments. However, this action could potentially push prices down further in the immediate future.

In simpler terms, based on AMBCrypto’s assessment, Ethereum (ETH) has been moving within a downward trending channel for several months. This is happening alongside a generally negative market atmosphere, suggesting that Ethereum might drop further before breaking out of this pattern. If there is a reversal, the strong support level for ETH would be around $2,325.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-10-12 01:45