-

ETH registered a moderate uptick, hiking by 3.39% on the monthly chart

Ethereum’s MVRV score declined over the past month

After years of closely observing and analyzing the cryptocurrency market, I have learned to read between the lines of seemingly conflicting indicators like the recent performance of Ethereum (ETH). While it’s true that ETH saw a moderate uptick on its monthly chart, the decline in its MVRV score over the past four months has been a cause for concern.

For the last month, Ethereum has experienced a shift in its luck. Earlier, it appeared as though the altcoin was struggling to sustain any growth whatsoever.

Currently, I’m observing that Ethereum is being traded at around $2441. This represents a 3.39% increase over the past month. Notably, Ethereum has also been experiencing growth on both the weekly and daily trading charts as well.

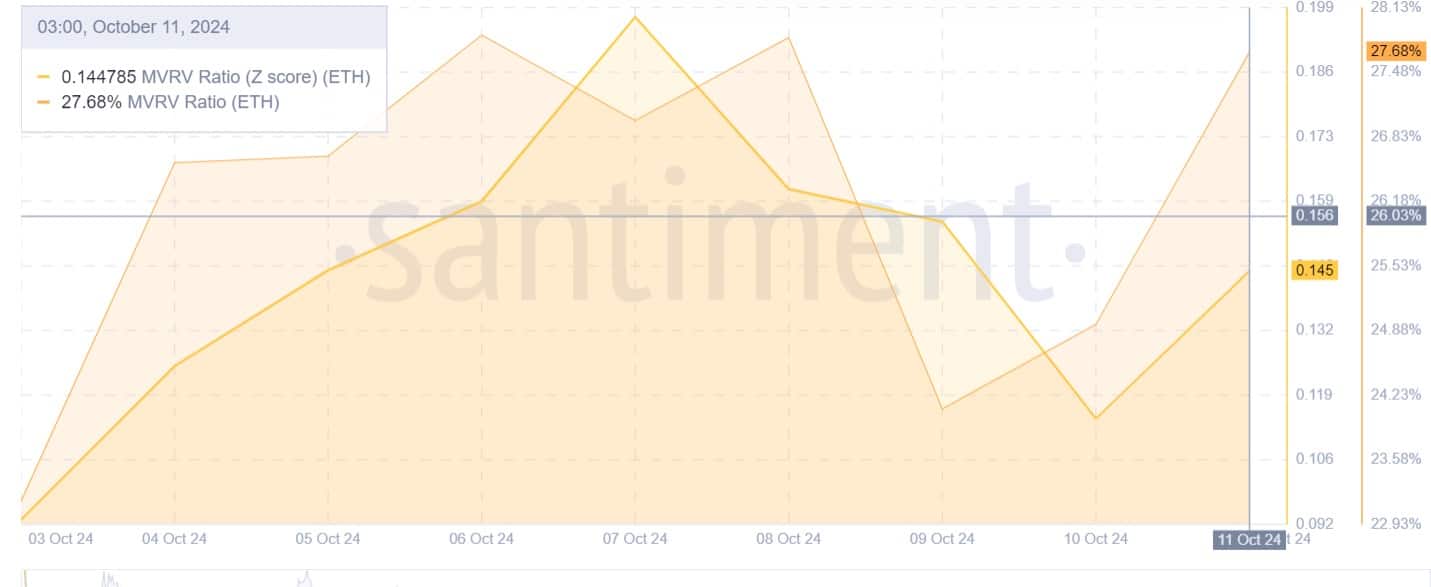

Given the current state of the market, numerous members within the Ethereum community are pondering the future direction of the altcoin. One such individual is Cryptoquant’s analyst Burak Kesmeci, who believes that the current Market Value to Realized Value (MVRV) levels for ETH might offer a good buying opportunity.

Ethereum MVRV score declines for 4 months

Kesmeci suggests in his study that Ethereum’s MVRV score has consistently dropped during the last four months. He explains that Ethereum’s MVRV ratio hasn’t been able to exceed its March value of 2.25, and at present, it stands at 1.22 points instead.

As an analyst, I find myself observing a significant trend with Ethereum’s MVRV score: it has consistently decreased over the past 120 days, reaching a low point of 1.93 recently. This implies that for ETH to potentially surge again, it needs to regain its March levels, which stood at 2.25.

In simpler terms, if Ethereum (ETH) is to show growth in its price again, its MVRV (Maker’s Value Realized to Market Value Ratio) should increase. Consequently, since ETH hasn’t seen any growth as of now, it seems unlikely that a bull run will occur at the moment.

What does ETH’s chart say?

To ensure a potential rally for ETH, as suggested by Kesmeci’s analysis, it’s crucial to examine additional market factors and evaluate the current state of play.

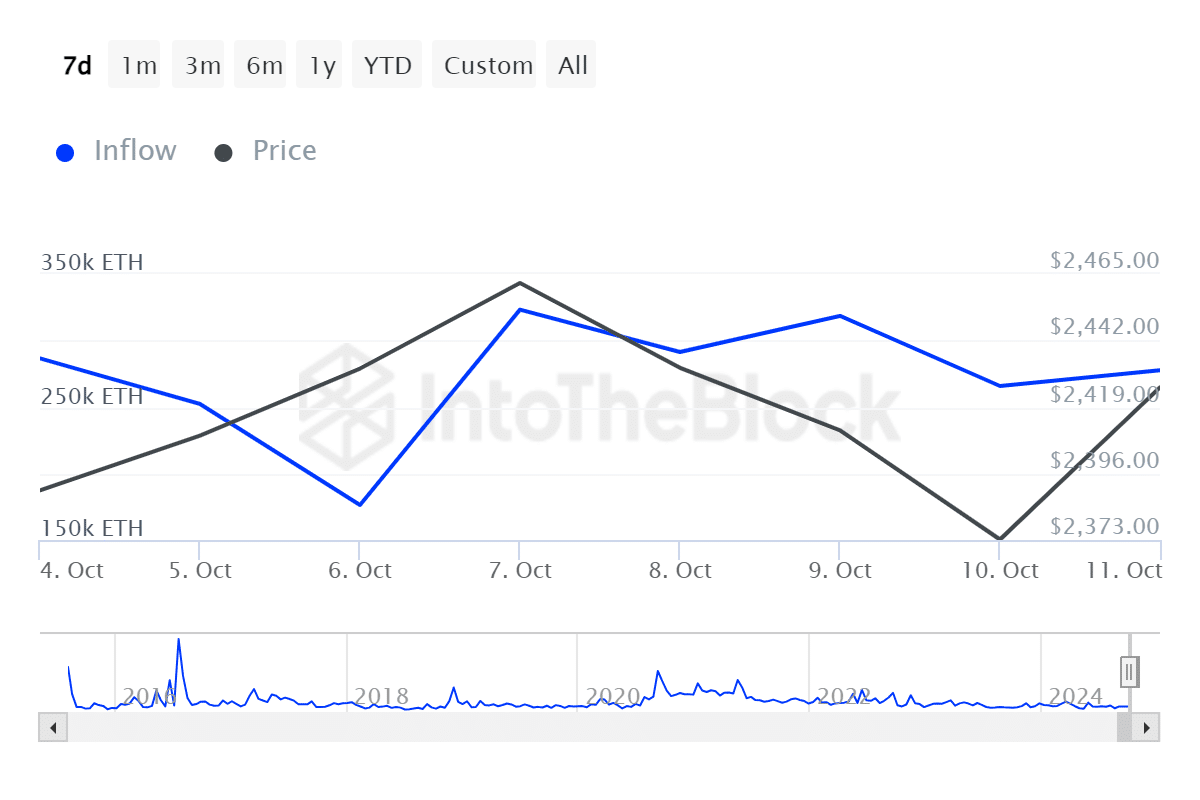

Initially, we’ve observed a significant rise in the number of large Ethereum holdings flowing in. This increase was approximately 57.46%, growing from about 176,290 to 277,580 over the last seven days.

Generally speaking, an increase in substantial investors’ incoming funds often indicates robust buying behavior and might signal a period of favorable trends.

Furthermore, the Open Interest on each Ethereum exchange increased by approximately 8.89%, climbing from $2.25 billion to $2.4 billion.

This implies that investors have been consistently establishing new investments, all the while maintaining their current positions.

Moreover, the MVRV Z-Score for Ethereum stands at 0.145, suggesting that the ETH market is currently thriving in a balanced and prosperous state.

At present, prices appear to be holding steady following a period of adjustment within the market. This suggests that the current market situation does not indicate a speculative bubble or an undervaluation.

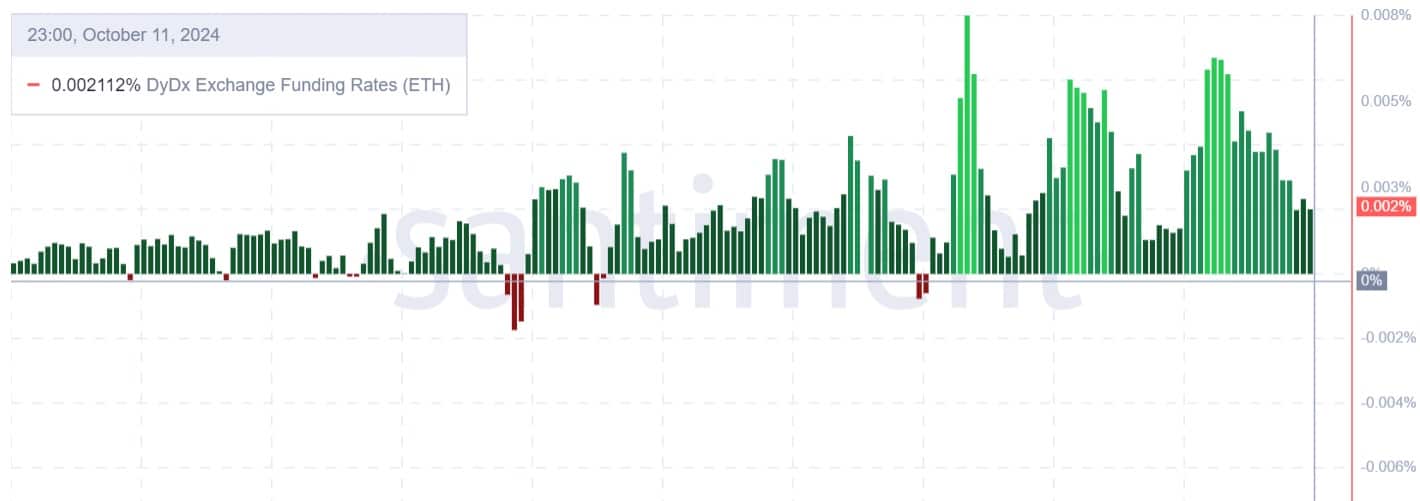

In summary, the funding rate on Dydx Exchange for Ethereum has stayed positive over the last week, indicating a strong interest in long positions. This suggests that investors are prepared to pay extra for their investments even during the recent market decline, demonstrating their optimism about the market’s future direction.

In simpler terms, although Ethereum (ETH) hasn’t seen a significant rise as of now, and it’s premature to declare a rally, the present circumstances seem promising for an impending increase. If the current market trends persist, Ethereum could potentially break through its resistance level at $2557 in the near future.

Read More

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Solana – Long or short? Here’s the position SOL traders are taking

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Lilo & Stitch & Mission: Impossible 8 Set to Break Major Box Office Record

2024-10-12 21:13