- Bitcoin’s realized share of Short-Term Holders has dropped from 55% to 40% – A sign of a market shift

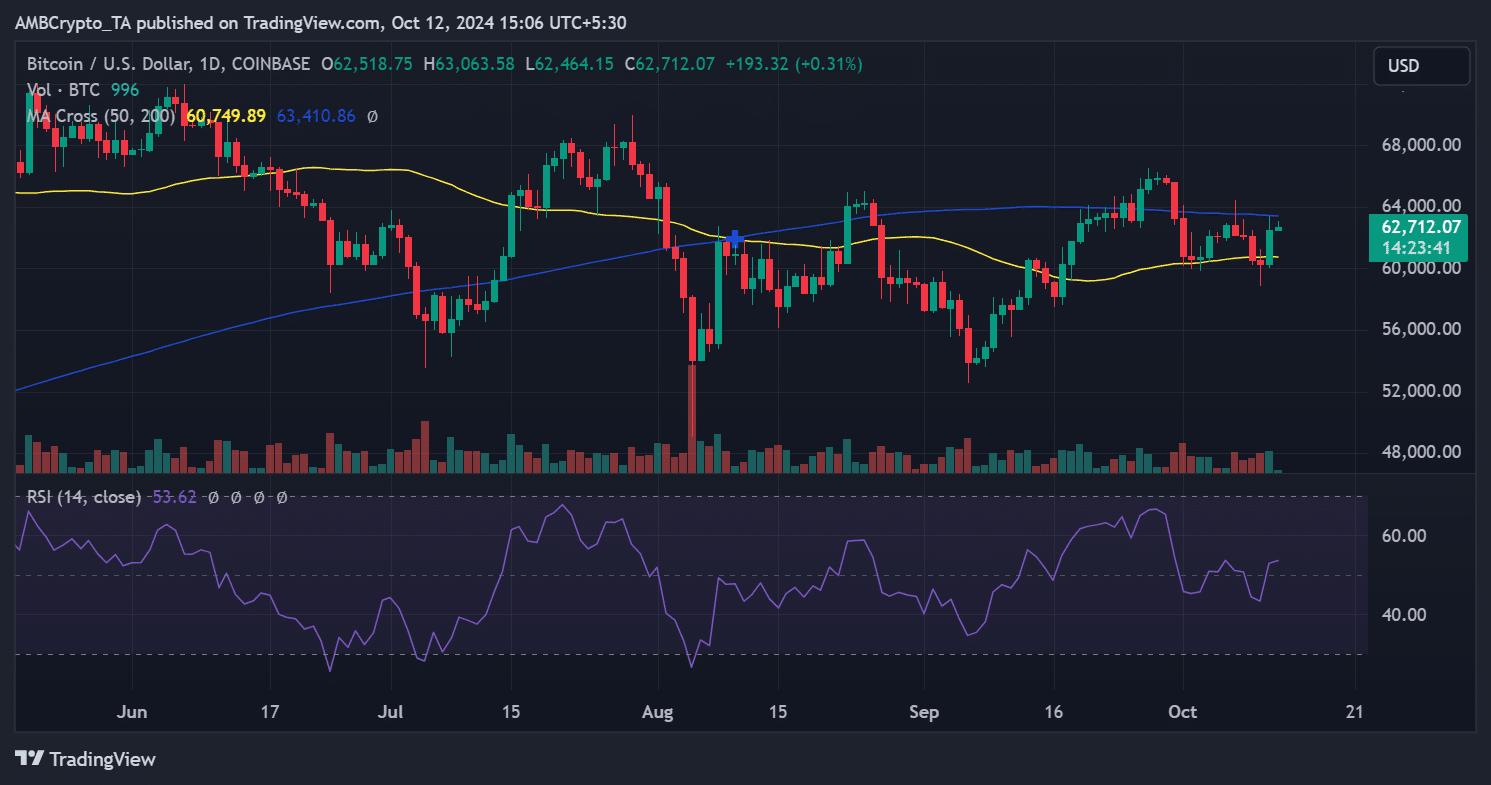

- Bitcoin broke above its 50-day moving average to climb to $62,700

As a seasoned crypto investor with a decade-long journey in this digital frontier, I find myself intrigued by Bitcoin’s recent market dynamics. The decline in Short-Term Holders and the subsequent rise above the 50-day moving average have piqued my interest.

Over the past day, Bitcoin’s decline seems to have slowed down slightly and started to climb instead. This period of sideways movement has resulted in a decrease in the proportion of Short-Term Holders (STH), indicating that the market could potentially be preparing for a substantial response or change.

Short-term holders exit the market

As per CryptoQuant’s latest findings, the proportion of Bitcoins owned by Short-Term Holders (STH) has decreased from approximately 55% three months back to roughly 40% currently. The study indicates that the significant price point for STH remains at around $62,700, a level consistent with recent times.

In simpler terms, the prices Bitcoin has reached in various age groups – $62,742 within a week, $62,462 over a month, and $64,029 over three months – could potentially serve as temporary barriers to further price increases.

The decrease in the number of short-term Unspent Transaction Output age groups implies that a significant number of recent market participants may have sold their holdings.

Contrary to that, long-term investors (LTI) in older demographics maintained their holdings. The market has been stabilizing near $62,000, and surpassing this significant threshold might indicate a more optimistic change in market dynamics.

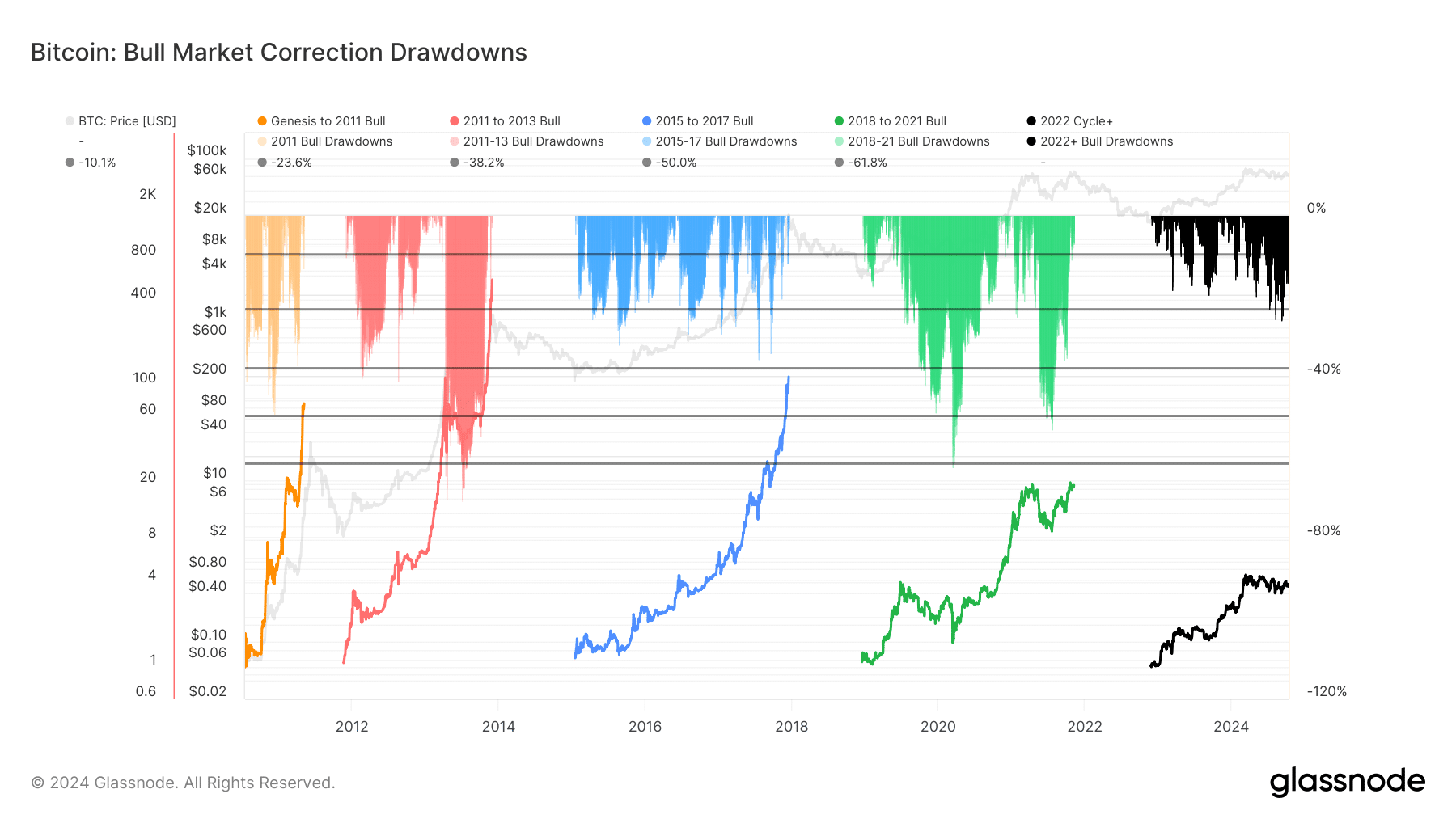

Bitcoin bull market drawdown and long-term holder gains

Examining Bitcoin’s past bear market recoveries has shown recurring trends, which can help us understand if the present market movement falls within larger market cycles or phases.

In every bull market, there are notable pullbacks or corrections that occur before reaching record-breaking highs. Historically, these downturns have been more drastic, with some drops reaching as much as 94%, but in recent times, the declines have been relatively milder.

In simpler terms, the recent decline in Bitcoin’s value, visible as a black drop on the 2022 and beyond chart, indicates that Bitcoin might still be undergoing a correction following its previous all-time high (highest value ever recorded). Yet, this decline appears to be less severe compared to past corrections, suggesting there may be more adjustments to come before Bitcoin starts rising again.

Although there might still be some risks leading to further declines, the relatively gentle dip suggests that Bitcoin could be nearing a possible recovery point.

Over time, investors who are able to endure market corrections often reap substantial rewards during the latter phases of a bull market’s growth period.

What do the charts say?

In simpler terms, the graph showing Bitcoin’s value suggests that people who bought recently are selling it off, but so far, this current market adjustment is less severe than what we’ve seen during past bull runs.

This means that Bitcoin could either see further downside or be near a market bottom.

In the recent trading day, Bitcoin surpassed its 50-day moving average (represented by the yellow line), leading to an increase of more than 3% in its value. The price escalated from approximately $60,279 to $62,518.

It’s possible this indicates the cryptocurrency is preparing to capitalize on its positive trends, potentially leading to an increase in its price over time.

– Read Bitcoin (BTC) Price Prediction 2024-25

The trend in the Bitcoin market is changing as short-term investors are selling off, but long-term investors remain steadfast. As the price settles near crucial points, there’s an increasing likelihood of a price recovery.

Should Bitcoin manage to surpass its crucial barrier points, it might indicate the commencement of a new bullish trend.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

- Quick Guide: Finding Garlic in Oblivion Remastered

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

2024-10-12 23:04