-

For WLD’s rally to be fully confirmed, it needs to breach a significant resistance level at $2.182

Technical indicators and on-chain metrics indicated that this level might be breached soon

As a seasoned crypto investor with battle scars from numerous market cycles, I have learned that every rally comes with its own set of challenges. The recent surge in Worldcoin [WLD] has been no exception, as it seems to be encountering a potential roadblock at the resistance level of $2.182.

Over the past day, the value of Worldcoin [WLD] has surged by 10.81%, reaching $2.041 at this moment. Yet, the upward trend of WLD might face a challenge due to a slight resistance level that lies just above its current price. This could limit additional growth on the charts.

WLD rally encounters a potential setback

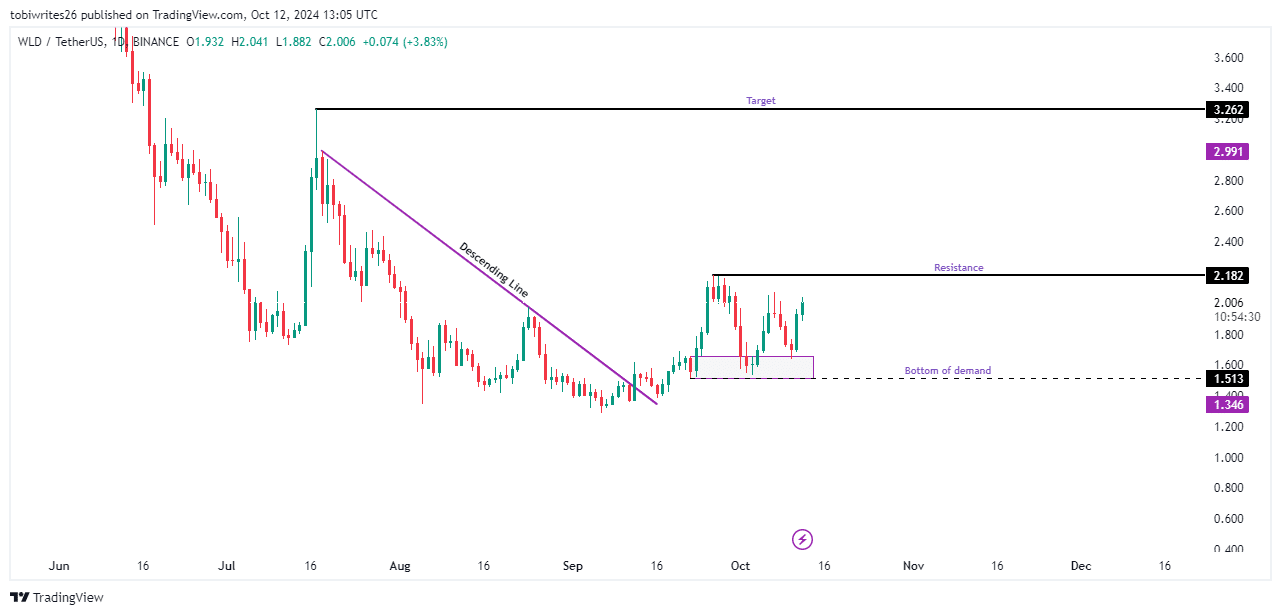

It appeared that WLD was heading towards $3.2 following its breakout from a downward trend, and at the same time, it was creating a peak that was higher than previous ones. Yet, it has faced difficulties in setting another such high to reinforce its uptrend as depicted on the charts.

Currently, WLD is found within a significant demand area and seems to be shaping up towards a new peak. But before this can happen, it needs to surpass the resistance level exactly at $2.182 – which was its earlier breakout high.

As a researcher examining market trends, I’ve noticed that if the Weighted Least Distance (WLD) model manages to break through this resistance level, it could potentially empower long-term traders. This might lead to them controlling the market’s momentum, causing prices to rise towards the pinnacle of the descending trend line. However, a possible reassessment of price levels may follow after this peak.

If WLD should drop and break below its support level at $1.513 within the demand zone, there’s a strong possibility that the asset’s value might experience a notable decrease.

In spite of these obstacles, it was discovered by AMBCrypto that the overall market feeling continues to be optimistic – Indicating a possibility for growth in the future.

Strong liquidity inflows and bullish momentum can propel WLD

Currently, the feeling towards WLD in the market is overwhelmingly optimistic – Backed by substantial cash inflows and favorable momentum signals.

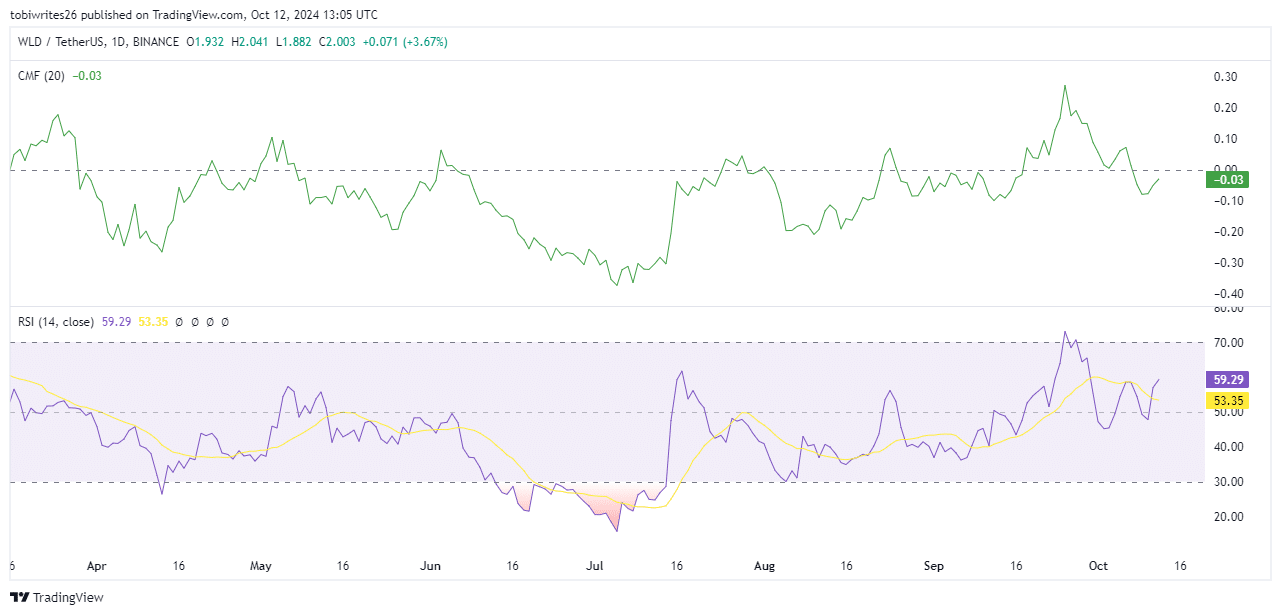

Consider this – The Chaikin Money Flow (CMF), which tracks the volume of money flowing in and out of an asset to assess trader activity, underlined a pronounced buying interest in WLD.

The increasing pattern in this purchasing behavior was confirmed by the Continuous Market Function (CMF) reaching an upward slope, moving closer to the significant 0.0 level. If it surpasses this point, it would indicate heightened buying intensity.

As an analyst, I observed a projected upward trend in the Relative Strength Index (RSI), a tool that quantifies the velocity and direction of price fluctuations.

This could indicate substantial buyer interest, contributing to the belief that WLD‘s price might increase significantly. Notably, this surge might coincide with an uptick in demand.

Selling activity subsides as short traders face market losses

In the past day, there’s been a substantial increase in sell-offs in the market, particularly among traders who anticipated a drop in WLD. Unfortunately for them, the market has gone in the opposite direction, resulting in considerable losses for these traders.

As I write this, there were liquidations totaling approximately $1.99 million of WLD, with $1.62 million coming from short positions. This suggests a robust bullish feeling among traders in the market.

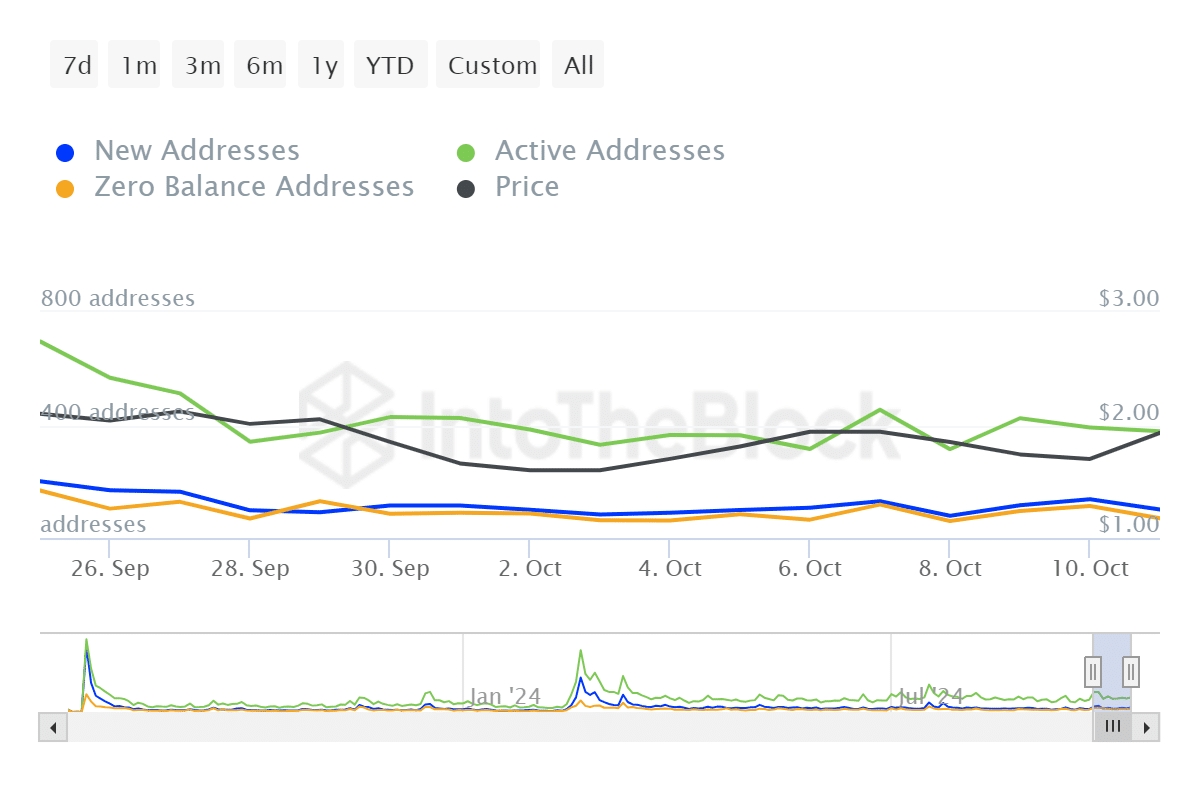

After analyzing data from IntoTheBlock, I noticed a drop in the number of active Waldercoin (WLD) addresses, which could be linked to the recent wave of short liquidations that forced many traders who had bet against the market to exit.

Should these trends continue, there’s a growing probability that WLD will conquer its current resistance levels and reach higher pricing heights.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

2024-10-13 02:15