-

SAND’s Open Interest jumped by 5.6% in the past 24 hours following a bullish breakout.

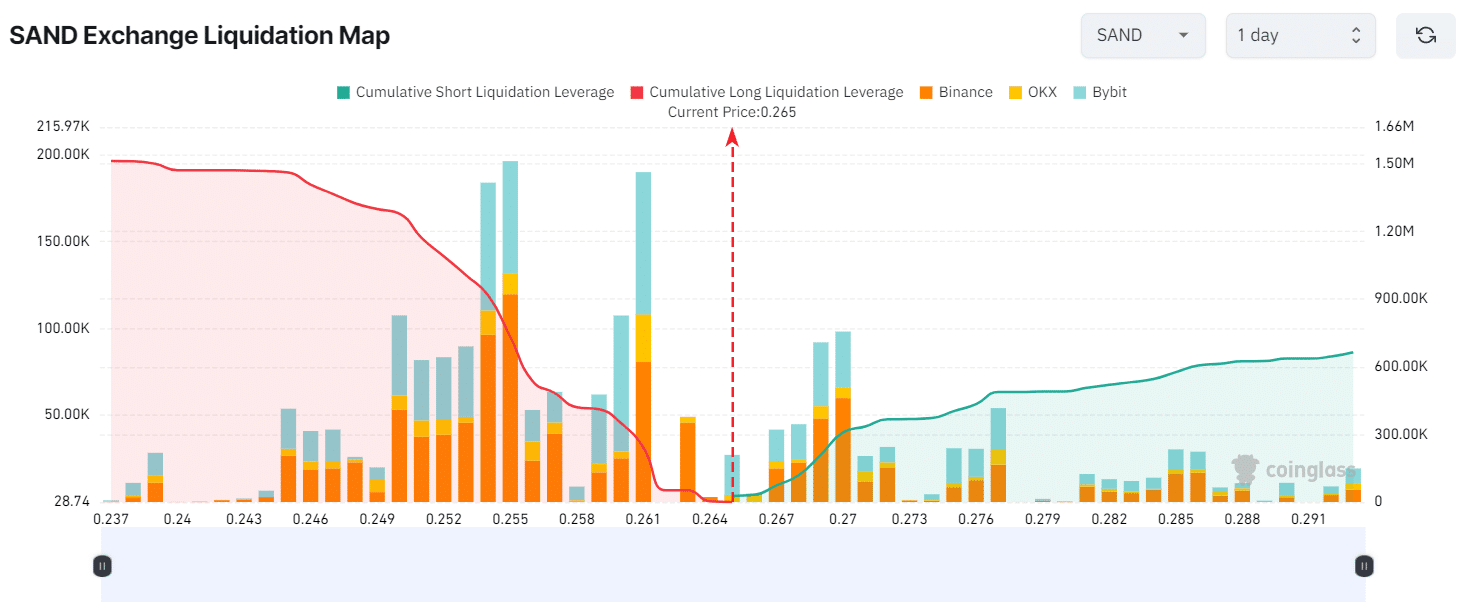

The major liquidation levels were at $0.255 and $0.27, with traders over-leveraged at these levels.

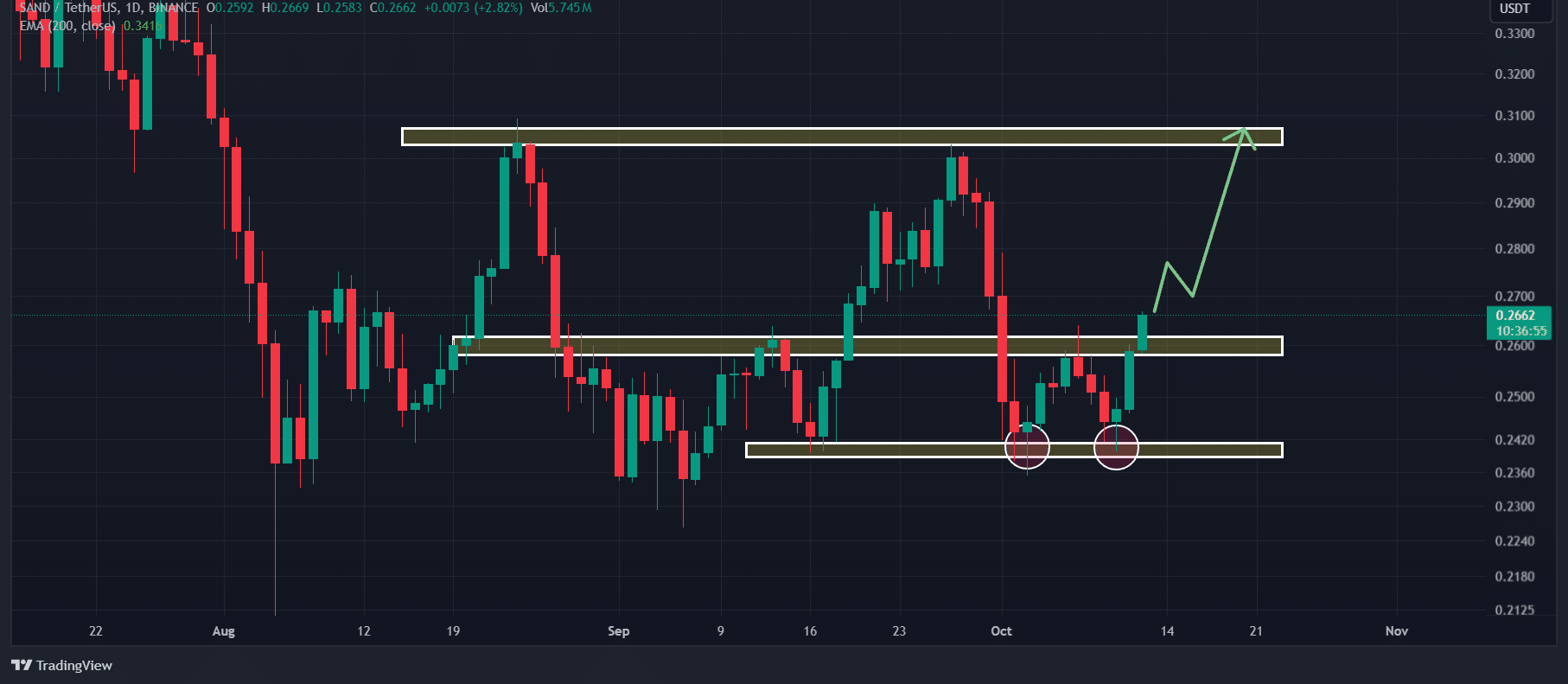

As a seasoned crypto investor with a knack for spotting opportunities in the ever-evolving digital asset market, I can’t help but be intrigued by the recent breakout of SAND, the virtual gaming platform token. The double bottom price action pattern and the subsequent bullish candle closing above the neckline are strong indicators of an uptrend.

The overall cryptocurrency market is experiencing a notable recovery.

In light of recent events, the virtual gaming platform The Sandbox [SAND], has surged out of a robust bullish trend and flipped its momentum from a decline to an increase in value.

SAND technical analysis and key levels

Based on AMBCrypto’s technical assessment, at the current moment, SAND showed signs of being bullish due to its escape from a double-bottom price trend. This breakout was substantiated when the daily candle closed over the neckline.

If Sandbox (SAND) manages to finish its daily trading at a price higher than $0.264, there’s a good chance that it might surge by approximately 15%, potentially reaching around $0.305 within the next few days.

As a crypto investor, I’m keeping an eye on SAND‘s current RSI of 52.30, which suggests that the coin might be primed for an upward trend in the near future.

Despite SAND’s bullish outlooks, the 200 Exponential Moving Average (EMA) indicated a downtrend. When an asset trades below the 200 EMA, traders and investors generally consider it to be in a downtrend, and vice versa.

SAND’s bullish on-chain metrics

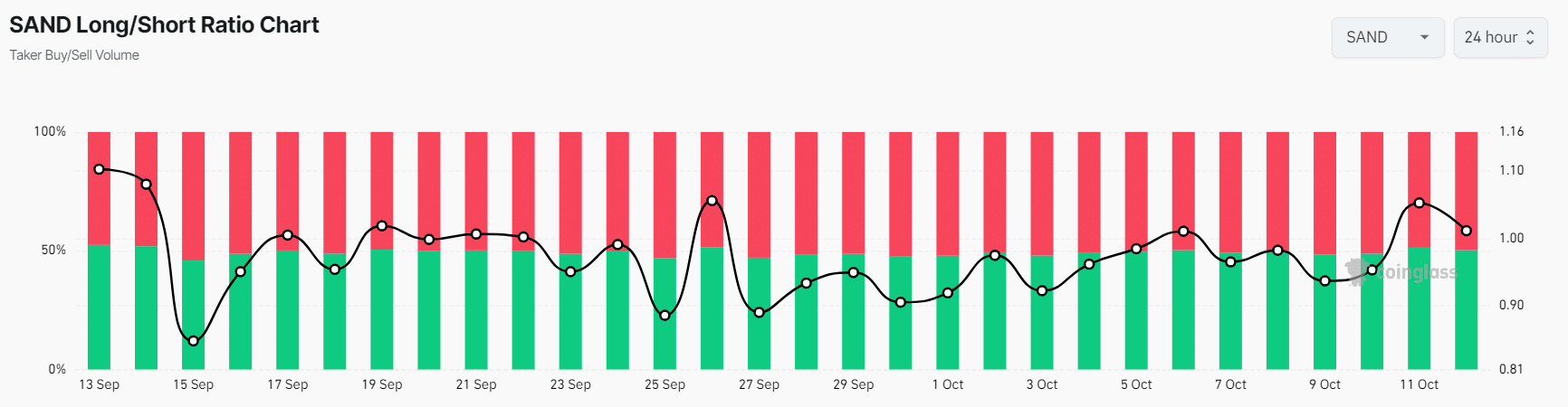

As a crypto investor, I’m buoyed by the optimistic perspective for SAND, reinforced by on-chain data. Specifically, according to Coinglass, the Long/Short Ratio for SAND stands at 1.03 as we speak, suggesting a bullish market mood, with more investors betting on its rise than on its fall.

Moreover, there was a 5.6% increase in its Futures Open Interest within the last 24 hours, and a 3.91% rise occurred over the previous four hours.

The increased enthusiasm among traders for the SAND token appears to be a result of the emergence of a double-bottom price action pattern, which is often a sign of potential growth.

Major liquidation levels

At present, significant liquidation points stand at approximately $0.255 (lower) and $0.27 (higher), as per Coinglass. Traders appear to be highly leveraged in these regions.

Should the market’s general feeling stay consistent and the price hits approximately $0.27, it is estimated that around $308,620 worth of short trades will be closed out.

If the market sentiment takes a turn for the worse and the price drops to $0.255, it’s estimated that around $732,960 of my long positions could get liquidated.

The data on this liquidation indicates that the number of long positions held by bulls is over twice as much as the number of short positions taken by bears.

By considering all these blockchain statistics together with conventional chart analysis, it seems that the bulls are presently in control of this asset and may be capable of bolstering SAND during the upcoming price surge.

Read The Sandbox’s [SAND] Price Prediction 2024–2025

Current price momentum

Currently, SAND is being traded around $0.266 and it has seen a significant increase of more than 5.2% in its value within the last day.

In that timeframe, its trading activity decreased by 6%, suggesting fewer traders and investors were involved.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-13 11:04