-

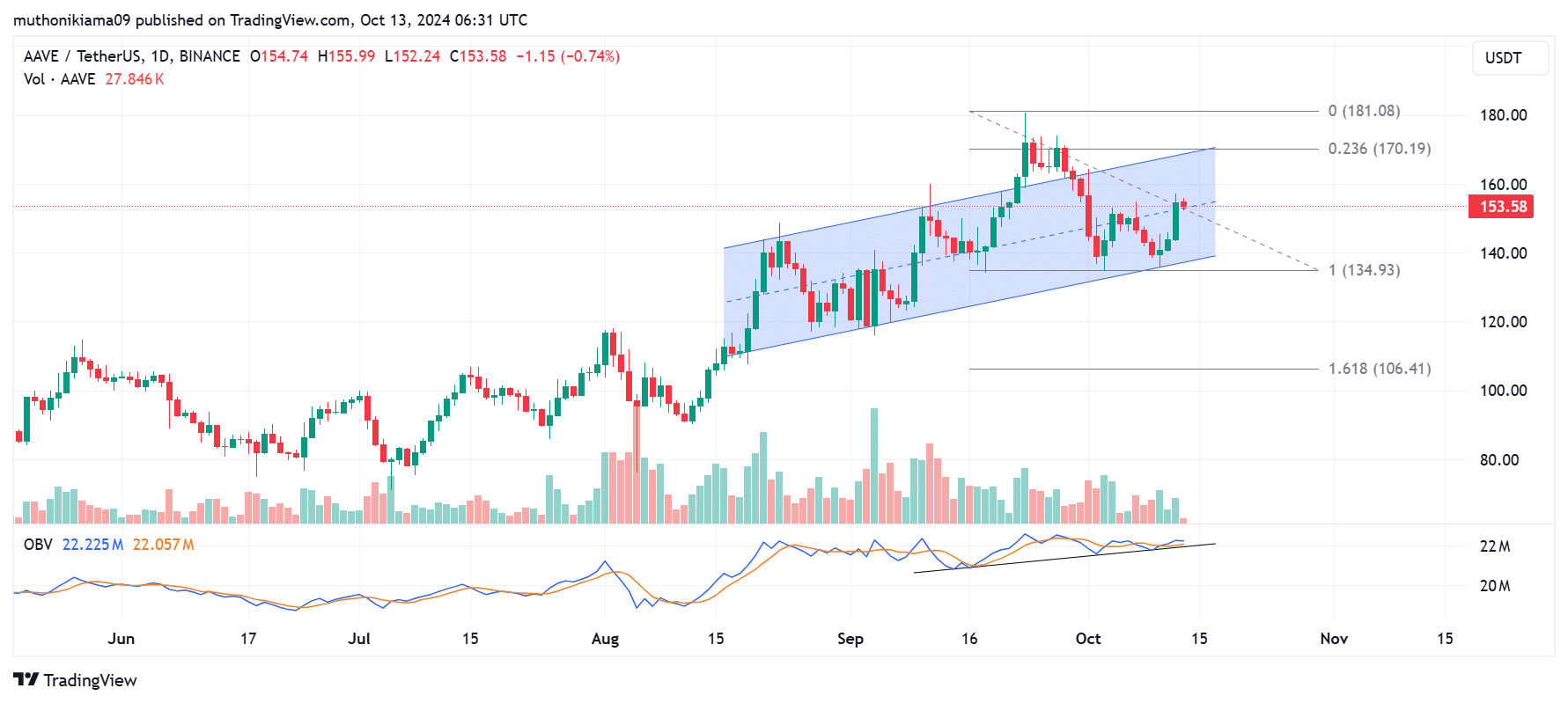

AAVE has broken above the midline of an ascending channel after a nearly 7% gain.

Despite a spike in exchange outflows, technical indicators show the trend is yet to flip bullish.

As a seasoned researcher with years of experience in the cryptocurrency market, I’ve seen more than a few bull runs and bear markets. The current trend of AAVE [AAVE] is intriguing, to say the least.

AAVE [AAVE] rebounded over the weekend after China’s new economic stimulus spurred gains across the cryptocurrency market. In the last 24 hours, AAVE gained nearly 7% to trade at $154 at press time.

These gains saw the token recover from a suppressed performance earlier in the week.

After following this upward trend, AAVE has surpassed the middle line of its rising channel on the daily chart, implying that the buyers are growing stronger.

For AAVE to break the upper boundary of this channel, it needs buyer support.

The sequence of three vertical bars, each a shade of green on the histogram, signifies that buyers have been dominating the market’s trend. This dominance facilitated AAVE‘s surge over the central line.

As a researcher, I’ve noticed an upward trend in the On-Balance Volume (OBV) indicator, suggesting a growing enthusiasm among investors, as it has surpassed the smoothening line. This signifies a shift towards optimism in the market.

As a dedicated crypto investor, I believe that for AAVE to surge beyond its ascending trendline and validate the bullish hypothesis, it’s crucial that it overcomes the resistance at the 0.236 Fibonacci retracement level, which corresponds to roughly $170 in this case.

Conversely, this pattern will be invalidated if the price drops below support at $134.

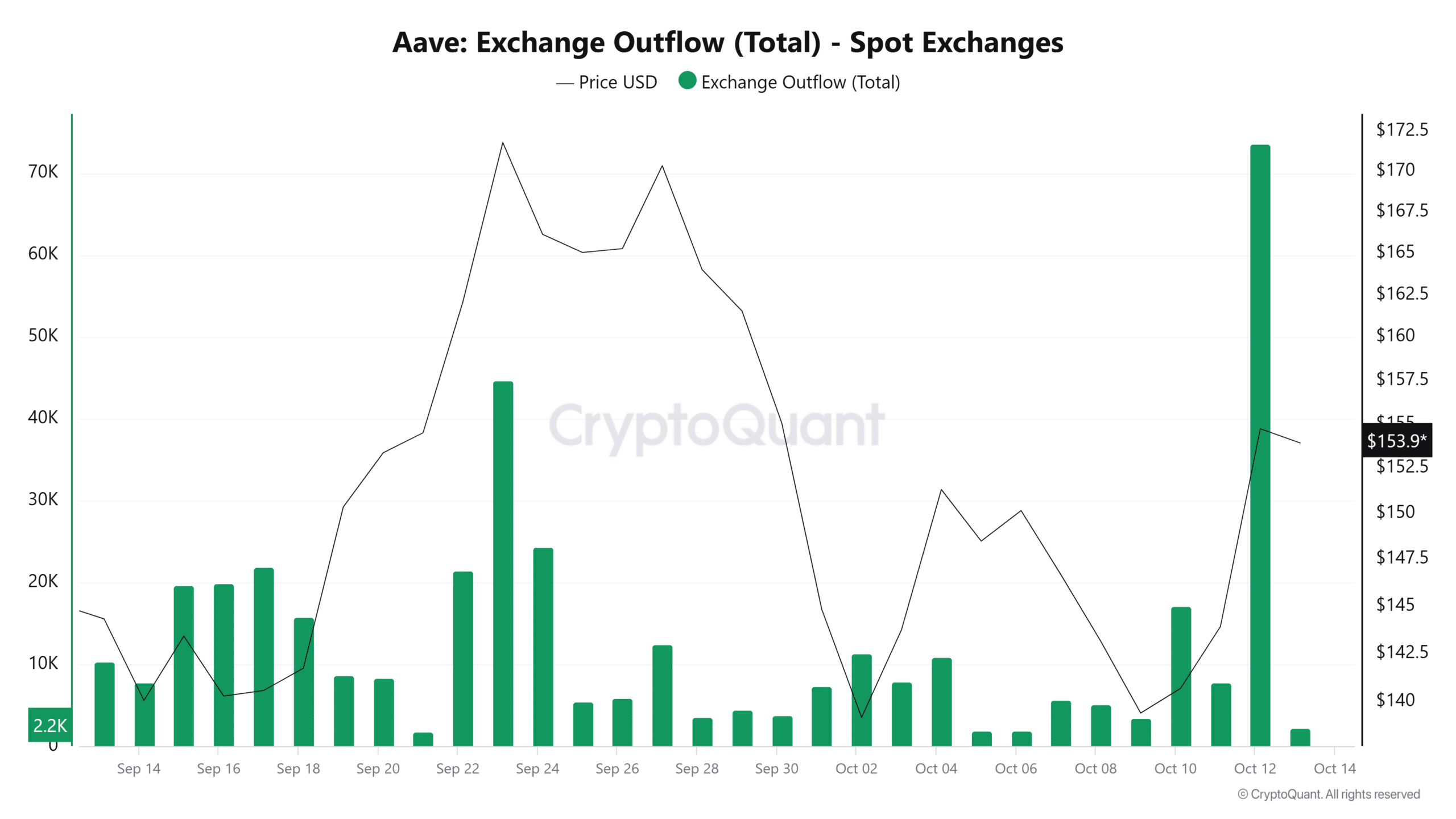

AAVE exchange outflow data is bullish

Traders appear to be rapidly removing their AAVE from exchanges, which may indicate that demand for this asset among buyers could persistently outpace supply from sellers.

12th October marked a peak in outgoing exchanges, hitting a one-month maximum, suggesting a reluctance to offload holdings.

As a crypto investor, when I see more fellow traders taking their tokens off the exchanges, I take it as a positive sign. This action reduces the immediate selling pressure, creating a smoother path towards an uptrend, which could potentially lead to a robust bull market.

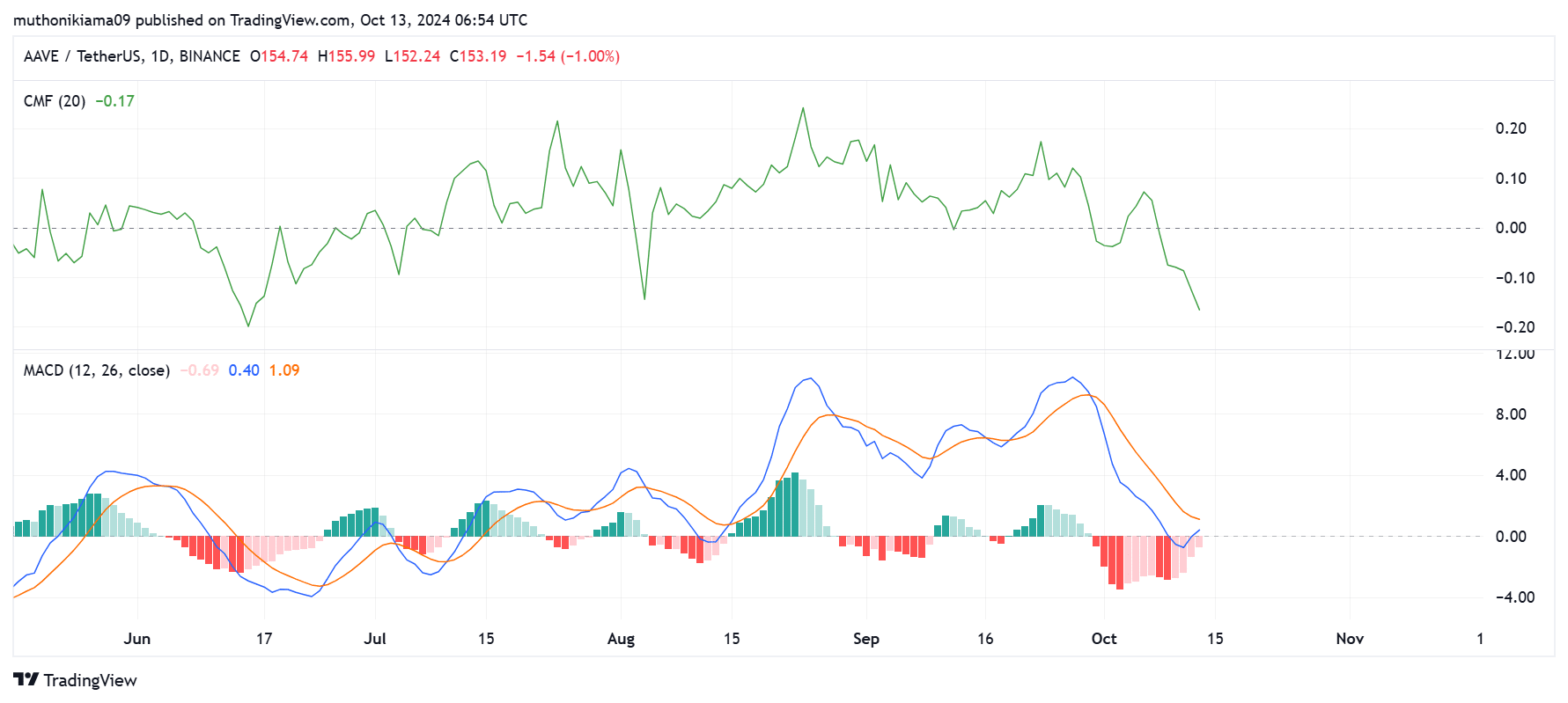

These technical indicators are bearish

A look at the Chaikin Money Flow (CMF) shows that capital is still flowing out of AAVE. At press time, the CMF had a score of -0.17.

As an analyst, I’ve noticed that this particular indicator has been consistently creating lower highs amidst the price increase, suggesting a weakening trend.

In simpler terms, the Moving Average Convergence Divergence (MACD), which often indicates market trends, currently lies beneath another line called the signal line. This arrangement, in turn, suggests that the market may be headed for a downturn or bears might have an advantage.

But if you observe, the MACD line is pointing upwards, and when it surpasses the signal line, it will signify that the altcoin is moving into an upward trend.

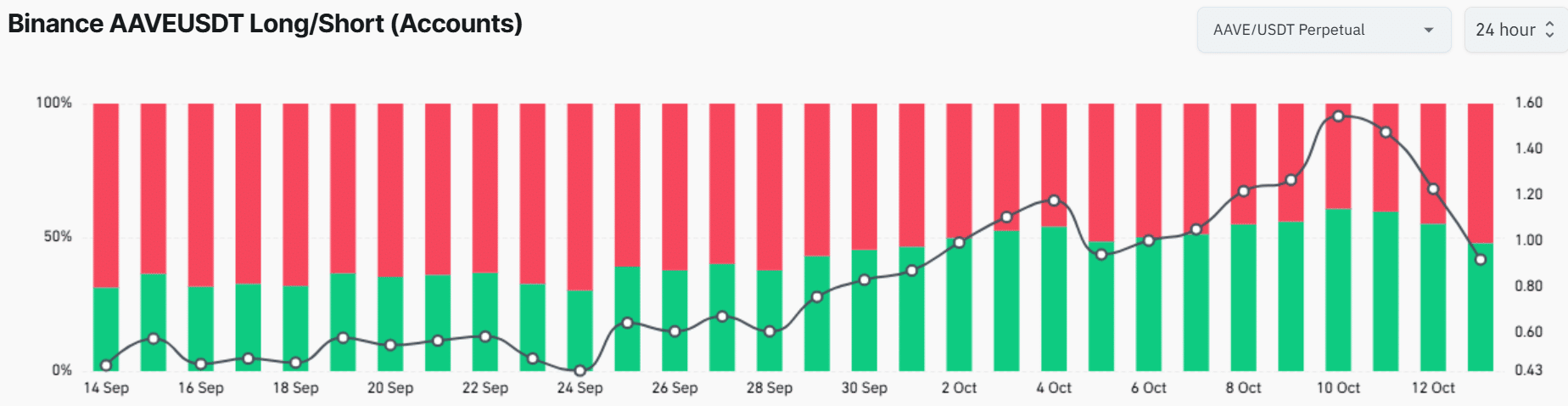

A look at the Long/Short Ratio

The long/short ratio on Coinglass shows that derivative traders are bearish.

Over the past day, this ratio has decreased from a balanced state of 1 to 0.87, hinting that investors may be uncertain about a continuous upward trend in the market.

Read Aave’s [AAVE] Price Prediction 2024–2025

On Binance, there’s been a significant decrease in the number of accounts holding long positions, falling from 60% to 47%. Simultaneously, the number of short positions on AAVE has risen substantially, climbing from 39% to 52%.

The shift in this ratio indicates that as AAVE began to rise, traders took on more short positions, suggesting they were confident that the upward trend might not continue.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-10-13 19:04