-

ETH attracted low investor interest compared to BTC, SOL.

Per crypto hedge fund, ETH could see renewed interest in 2025.

As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous market cycles and observed the ebb and flow of investor sentiment. The current situation with Ethereum (ETH) is not an exception, but rather a reminder of how markets can behave unexpectedly.

During this cycle, Ethereum‘s [ETH] performance has been lackluster due to an unprecedented amount of fear, uncertainty, and doubt (FUD), causing investors to focus their attention elsewhere.

As a crypto investor, I’ve noticed that Ethereum (ETH) seems to be playing catch-up with other cryptocurrencies, much like a middle child might feel overshadowed. This perspective is shared by Zaheer Ebtikar of the crypto hedge fund Split Capital, who refers to this phenomenon as ‘middle child syndrome.’

Ethereum appears to grapple with a ‘middle child’ complex. It doesn’t seem to attract much attention from institutional investors, and it has fallen out of favor among crypto private capital groups. Furthermore, the retail market seems to be absent when it comes to significant bids.

Investors abandon ETH

Compared to significant returns for Bitcoin and Solana, Ethereum provided investors with just an 8% increase in value over the entire year so far.

Ebtikar linked the underperformance to investors’ focus on BTC and other ETH competitors like SOL and Sui [SUI].

The executive noted that there are three capital sources in the crypto space: institutional (through ETFs/futures), private capital (liquid funds, VCs), and finally, retail. But only the first two mattered at the moment.

He added that institutional capital was heavily focused on BTC (through ETFs). ETH ETFs have seen net negative flows of $546 million since they debuted in July, underscoring the low interest.

Contrarily, Ebtikar noted that private investors considered ETH to be overpriced and instead channeled their funds towards other Ethereum alternatives deemed underpriced, including Solana (SOL), Celestia, and Sui.

As a crypto investor, I’ve noticed that the size of ETH ($ETH) seems overwhelming for its native capital to sustain, especially when considering the need to also support other index assets such as Solana ($SOL) and other large cap tokens like Theta ($TIA), Telcoin ($TAO), and Sui ($SUI). It’s a delicate balance that requires careful attention.

Coinbase analysts also echoed the above sentiment in their September report.

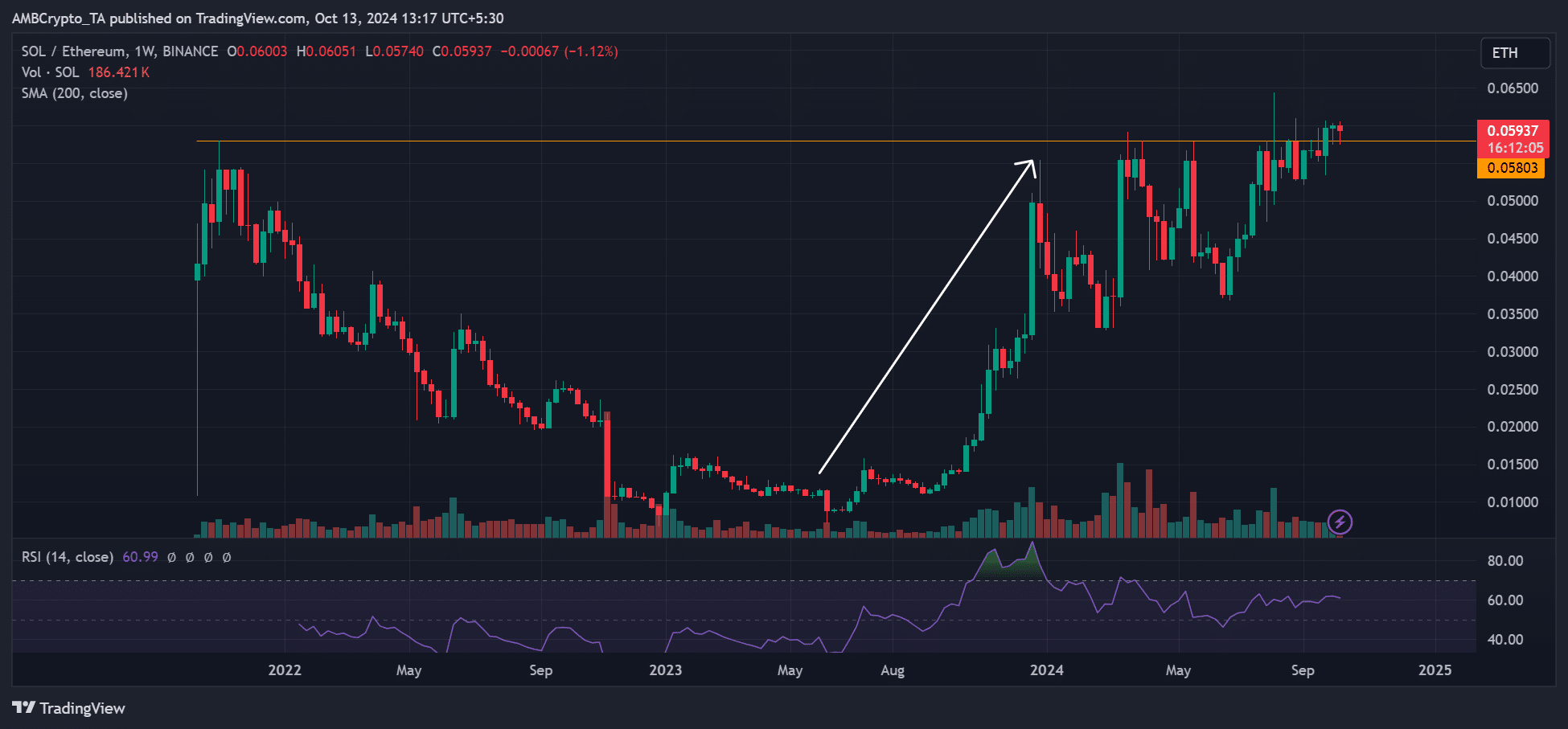

The SOLETH ratio, which tracks SOL’s value relative to ETH, has exploded since last year, cementing Ebtikar’s thesis that investors might have rotated to SOL from ETH.

That being said, Ebitaker also acknowledged that ETH was the only altcoin with an approved ETF in the US.

In summary, he anticipates that this asset might attract increased attention, particularly from institutional investors, starting around 2025.

He cited likely increased demand from ETF buyers, changes within the Ethereum Foundation and Trump’s win.

Currently, Ethereum (ETH) is worth approximately $2,400, and it’s holding steady within a range from around $2,300 to $2,500, which it has maintained since early October.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

- Quick Guide: Finding Garlic in Oblivion Remastered

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

2024-10-13 21:11