-

Ripple whales have accumulated close to 50 million XRP, worth approximately $26.5 million.

XRP is struggling to break key resistance levels, with its 50-day and 200-day moving averages at $0.56 and $0.54, respectively.

As a seasoned analyst with years of experience in the cryptocurrency market, I’ve seen my fair share of bull and bear markets. The recent developments in Ripple (XRP) have caught my attention, and not just because of the whale accumulation or the resistance levels it’s facing.

Over the last several days, XRP‘s trading pattern has been relatively flat, as the token hasn’t managed to surpass crucial resistance points, even though there have been encouraging price movements.

Nevertheless, there’s been a resurgence in whale investor involvement, as they’ve been accumulating more assets. Yet, this hasn’t halted the continuous flow of XRP onto exchanges.

Ripple whales continue accumulating

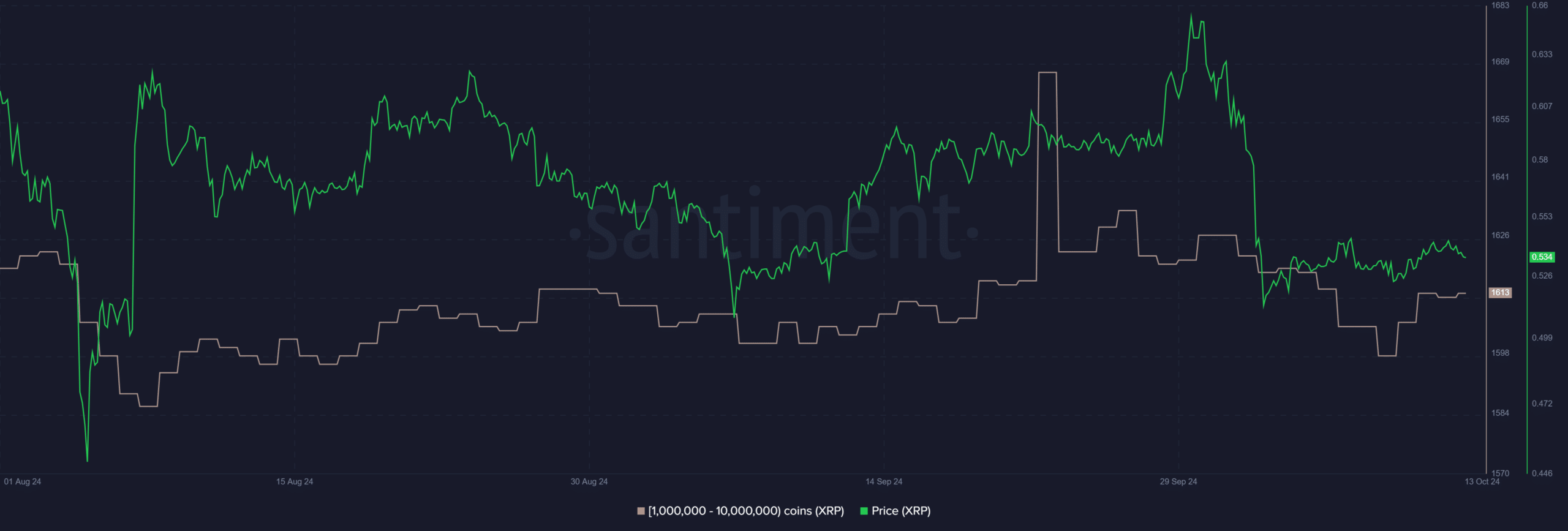

Over the last three days, as per data from Santiment, I’ve noticed an uptick in the number of Ripple whale addresses containing between 1 million and 10 million XRP. Specifically, the total count has grown from 1,606 to 1,614 addresses.

Over the course of this timeframe, a significant number of whales accumulated nearly 50 million units of XRP, equating to around $26.5 million in value.

It’s quite remarkable that this amassment has occurred, considering that XRP has been treading water with minimal price fluctuations. Yet, even amidst the price standstill, large investors seem optimistic about a possible breakout or prolonged expansion.

XRP fails to break key resistance levels

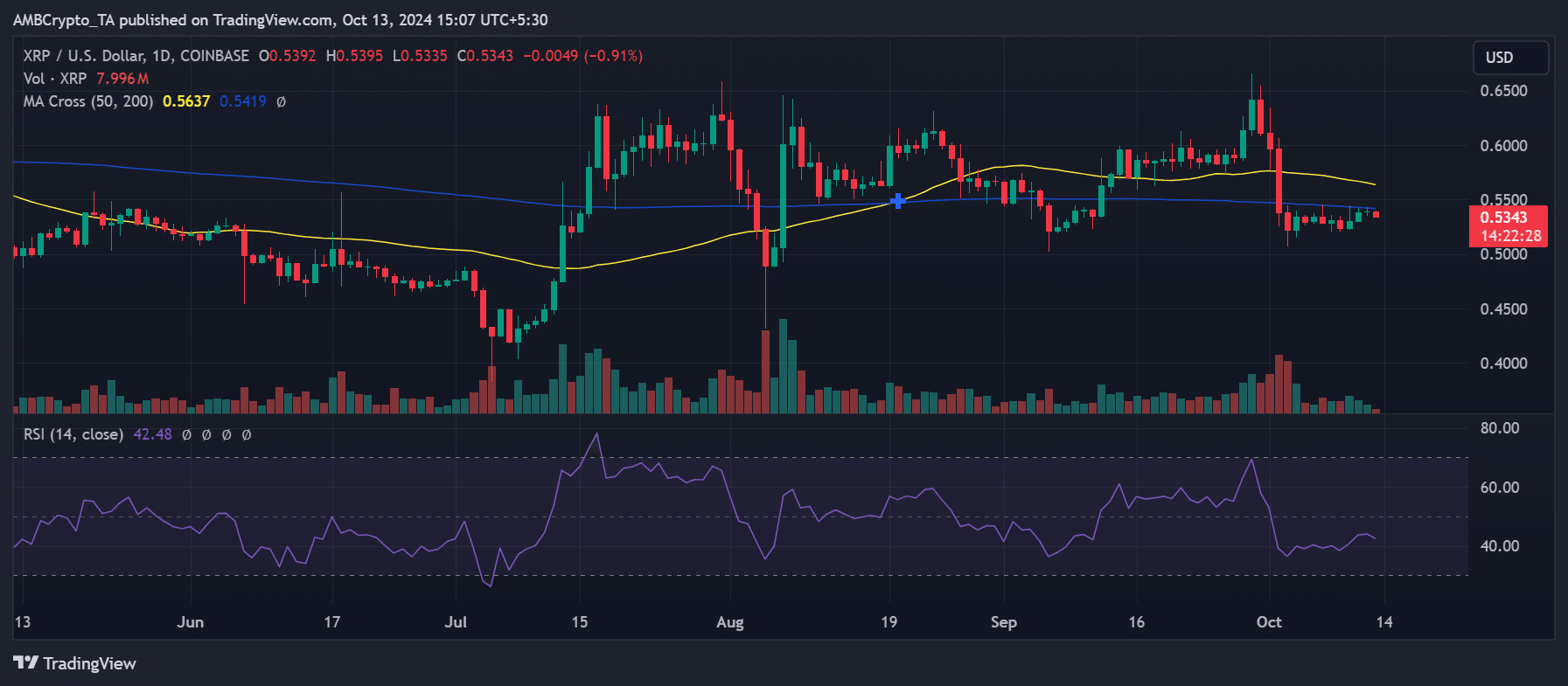

A look at the day-to-day fluctuations in Ripple’s price reveals that it’s having a tough time surpassing both its 50-day and 200-day moving averages.

Currently, the 50-day moving average serves as a potential barrier for future price increases, roughly around $0.56. Meanwhile, the 200-day moving average is positioned slightly lower, at approximately $0.54.

Over the past week, XRP displayed a few short-lived spikes in value, yet these surges fell short of breaking through the 200-day moving average. In its latest trading period, XRP edged up slightly to reach approximately $0.53.

Yet, despite maintaining an initial surge, the price has yet to break away from its current position, remaining stable at this point in time.

Moreover, Ripple’s Relative Strength Index (RSI) stood at 42, suggesting a declining trend approaching the oversold zone.

Thus, if the price continues to decline, it could fall further into bearish territory.

More XRP flowing into exchanges

As a researcher, I’ve observed that the increasing number of whales (large investors) holding a particular asset implies a favorable long-term outlook. However, delving deeper into the broader market dynamics, it seems the overall trend is painting a different picture.

New information from CryptoQuant indicates a rise in the transfer of Ripple to exchanges, suggesting that more investors might be choosing to offload their assets.

Over the last several days, we’ve observed that incoming exchanges are almost twice as much as the outgoing ones, according to our chart comparison.

Despite it generally signaling a bearish trend, the continuous buying by large-scale investors (whales) offers a balancing perspective, implying that some traders continue to have faith in XRP‘s future growth prospects.

At the moment, Ripple (XRP) is finding it difficult to surpass significant resistance points, instead moving laterally within its current pattern.

Realistic or not, here’s XRP’s market cap in BTC’s terms

Simultaneously, whales are amassing substantial quantities of XRP, while smaller traders are offloading it, causing an increase in supply on exchanges due to this selling pressure.

Keeping an eye on whether significant investors (whales) are buying up more XRP when its Relative Strength Index (RSI) nears the oversold zone could be key to determining if they might influence the market’s outlook and spark a price surge.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2024-10-14 02:16