- Saylor plans to make MicroStrategy a Bitcoin bank.

- MSTR rallied and hit an ATH after the revelation.

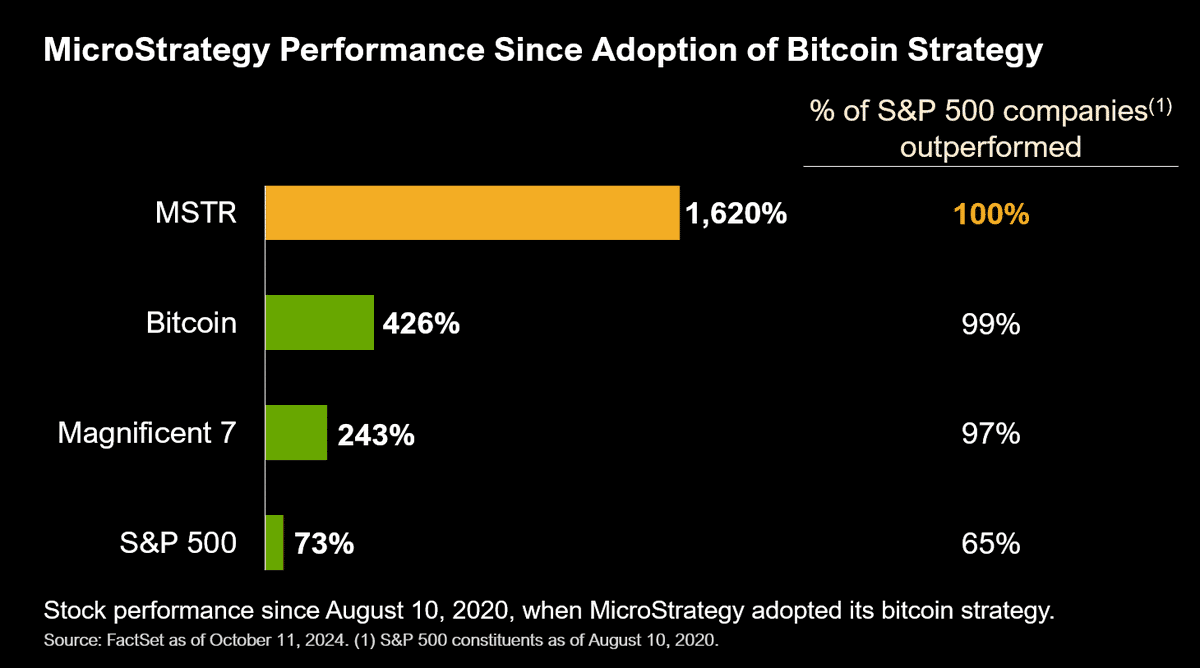

As a seasoned crypto investor with over a decade of experience in this wild and unpredictable market, I must admit that MicroStrategy’s ambitious plan to transform itself into a Bitcoin bank has caught my attention. The stock’s all-time high (ATH) is a testament to the faith investors have in Michael Saylor’s vision.

The MicroStrategy’s MSTR shares reached a new peak following the disclosure that their ambition is to transform into a billion-dollar Bitcoin (BTC) financial institution.

Michael Saylor, the founder of MicroStrategy, shared with Bernstein analysts that his company aims to reach a staggering $1 trillion market value, positioning itself as the world’s leading Bitcoin banking institution.

This could be facilitated, in part, by its swift amassing of the globe’s most substantial asset, as analysts forecasted a stock price goal of $290.

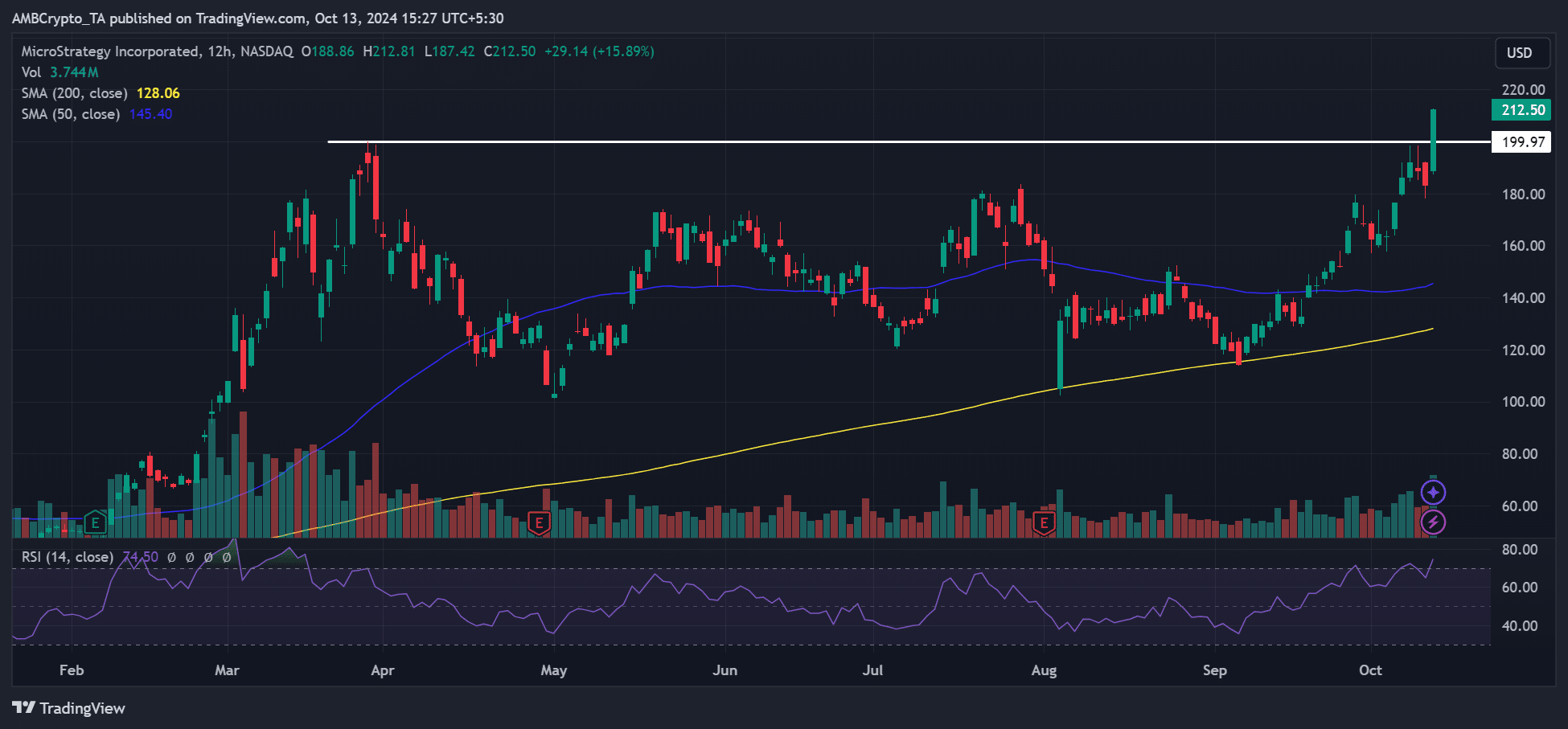

On October 11th, during intraday trading, MSTR reached an all-time peak of $212.50, marking a 15% rise and breaking through the previous resistance at $200.

Bitcoin bank end-game

In response to MSTR’s surge, Saylor pointed out that nothing outperformed Bitcoin quite like additional Bitcoin.

“The only thing better than #Bitcoin is more Bitcoin.”

As of the current news report, MicroStrategy owns approximately 252,220 Bitcoins, valued at around $15.8 billion according to Bitcoin Treasuries. In interviews, Michael Saylor, the company’s CEO, has not clarified whether MicroStrategy plans to sell its Bitcoin reserves or what their ultimate objective is.

But the end-game was made clear last week.

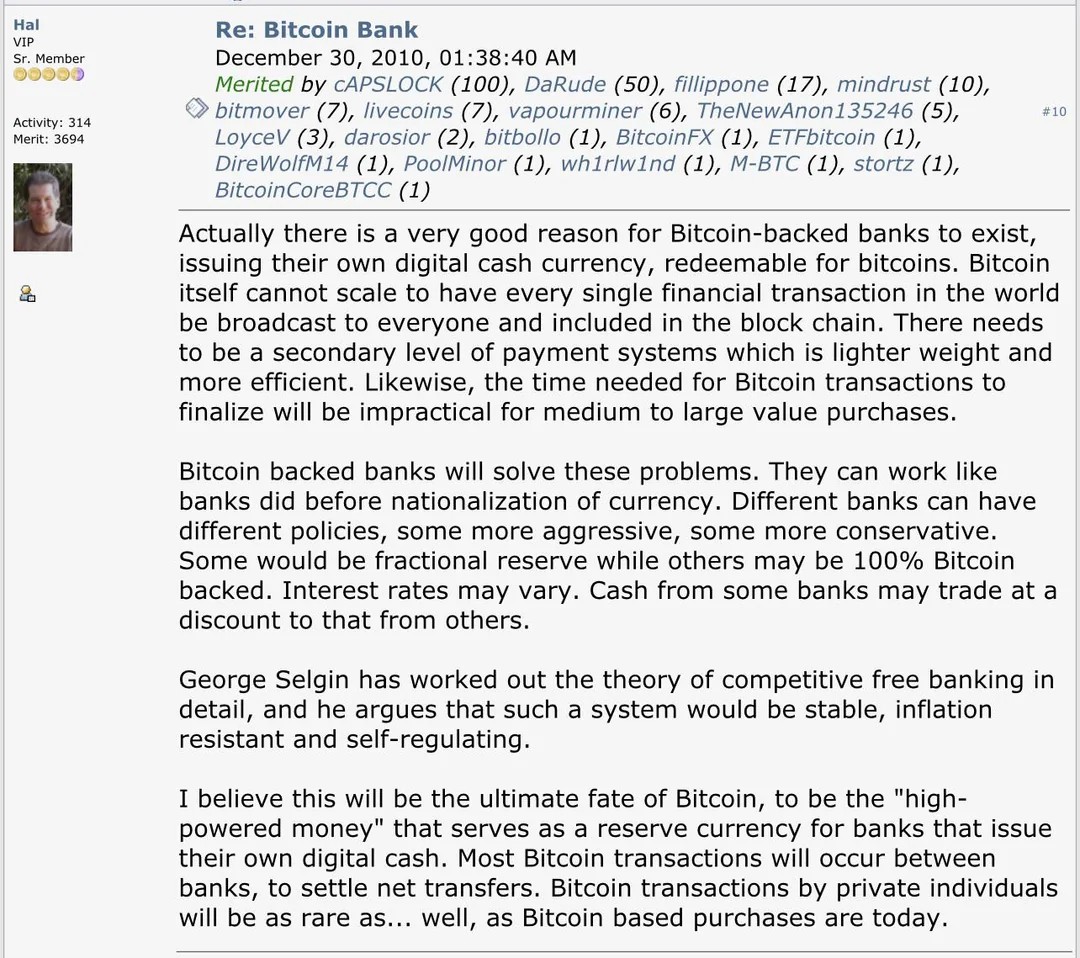

So, what’s a Bitcoin bank?

As a crypto investor, I’ve been intrigued by the idea that, much like traditional asset classes, Bitcoin could serve as the foundation for new financial structures, as proposed by Saylor. To put it simply, this means creating institutions specifically tailored to Bitcoin and its associated ecosystem. Interestingly, a part of the Bernstein report hints at this very concept.

Michael thinks that MSTR primarily focuses on developing various financial products tied to Bitcoin within categories like stocks, convertible bonds, fixed-income securities, and preferred shares.

Previously, Saylor predicted that Bitcoin might reach a value between $3 million and $49 million by the year 2045, growing as it becomes integrated within the global financial system.

Consequently, the executive anticipated it would be less complex to generate profits by developing Bitcoin (BTC) financial products such as bonds or shares compared to loaning out Bitcoin assets owned by MicroStrategy.

Back in 2010, I found myself pondering over an intriguing thought – a concept that had been previously proposed by Hal Finney, one of the pioneers within the Bitcoin network.

But some called for advanced self-custody technology to ensure such a system remains honest.

That said, some market pundits foresaw a strong BTC rally as a positive catalyst for MSTR’s value.

According to financial consultant Ben Franklin, based on MicroStrategy’s financial health and BTC appreciation, MSTR’s value could grow 6x-10x.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2024-10-14 03:03