- ASM crypto rallied nearly 50% in 48 hours.

- ASM saw massive accumulation since August; will the uptrend extend?

As a seasoned researcher who’s witnessed countless crypto market rollercoasters, I find myself intrigued by the meteoric rise of ASM crypto. The token’s 50% surge in just 48 hours is reminiscent of a rocket launch, and it’s hard not to get caught up in the excitement.

On October 14th, the Assemble AI native token, also known as its global reward point and AI-driven news analysis tool, was among the day’s highest climbers.

The token surged nearly 50% within 48 hours. The rally was part of the broader market recovery led by Bitcoin’s [BTC] upswing to $64K.

But the uptrend faced an overhead roadblock. Can bulls could push through?

ASM crypto roadblock

In recent market trends, meme coins and AI sectors have significantly outperformed, particularly during the market recovery in the last quarter. Consequently, it’s not unexpected that the rapid surge in ASM cryptocurrency could occur, given the intense speculation that reached an all-time high.

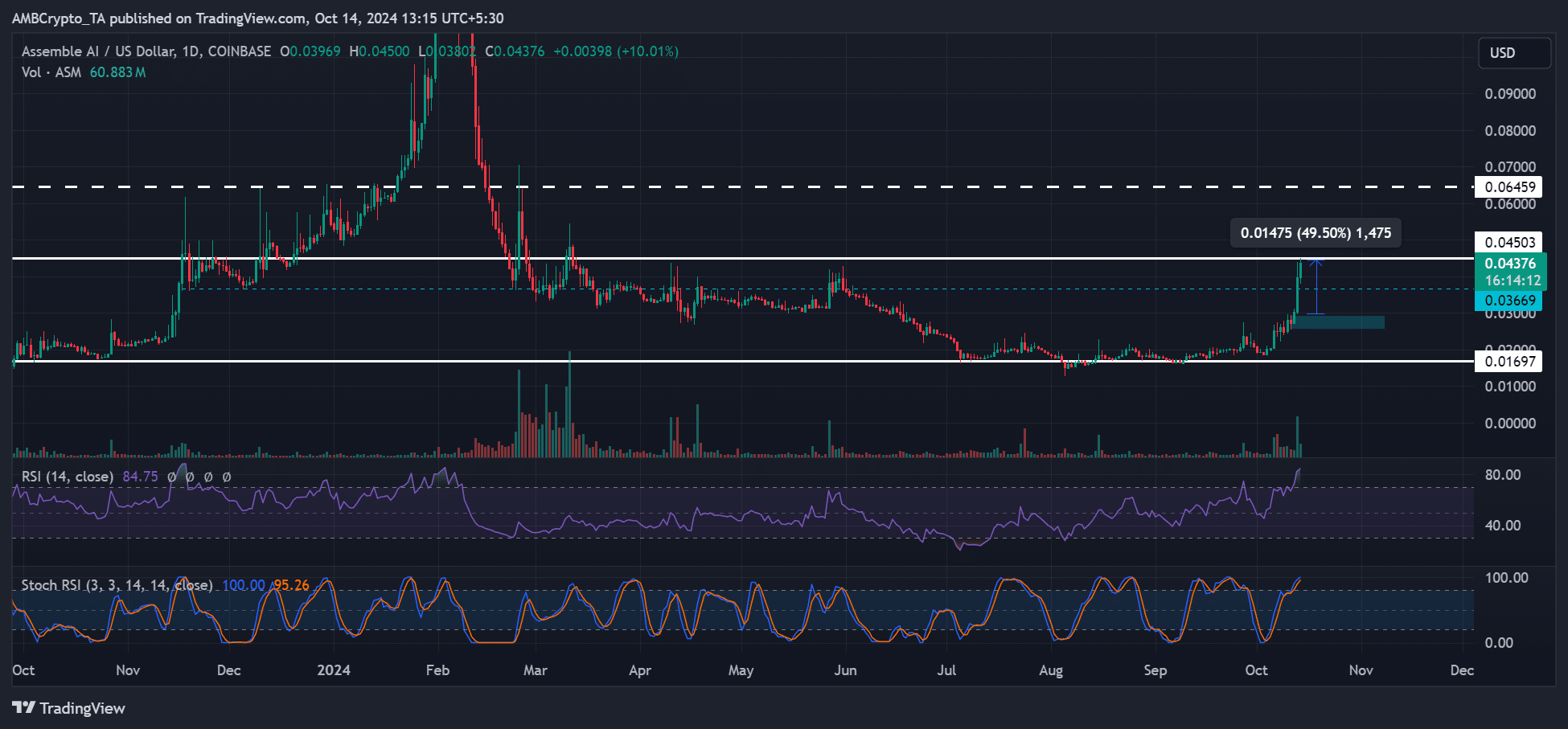

After the initial rise at the start of the week, various daily chart indicators signaled that the market was becoming overbought. The Relative Strength Index (RSI) and Stochastic RSI both moved into overbought zones. This suggests strong buying pressure, but also signals a potential upcoming price correction or reversal.

If it blasts the $0.045 roadblock, ASM could add another 40% potential gain if it reaches $0.064.

In early 2024 and late 2023, the $0.045 level proved to be a barrier for buyers. Should the buying momentum weaken, there’s a possibility of price rejection occurring at this level. If that happens, $0.03 might serve as the next line of defense or potential support.

Wild accumulation since August

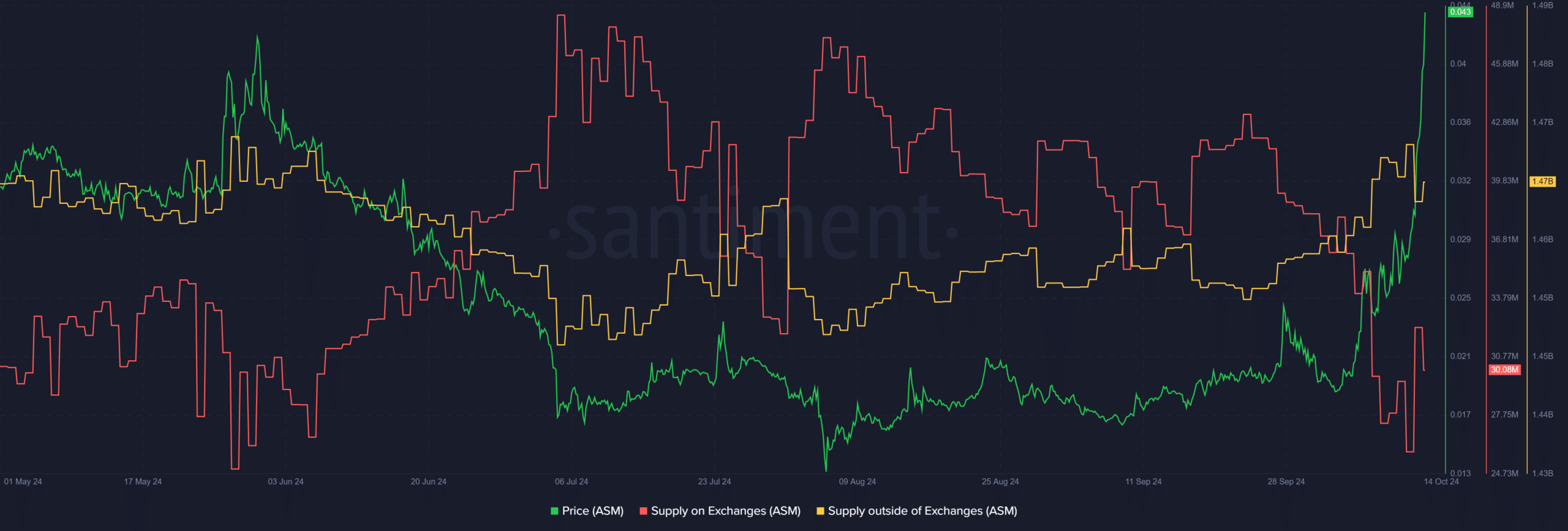

Over the past couple of months from August, ASM has been consistently building up its holdings. This is evident in the decreasing amount of supply available on exchanges (depicted in red) and the increasing supply outside of exchanges (yellow). This trend suggests a shortage of ASM’s supply within exchanges as users transfer their assets away from centralized exchanges (CEXs).

At the moment, there was a slight increase in available supply on the exchange, which might be putting some pressure on the market. If selling pressure increases significantly, it could potentially disrupt the current upward trend.

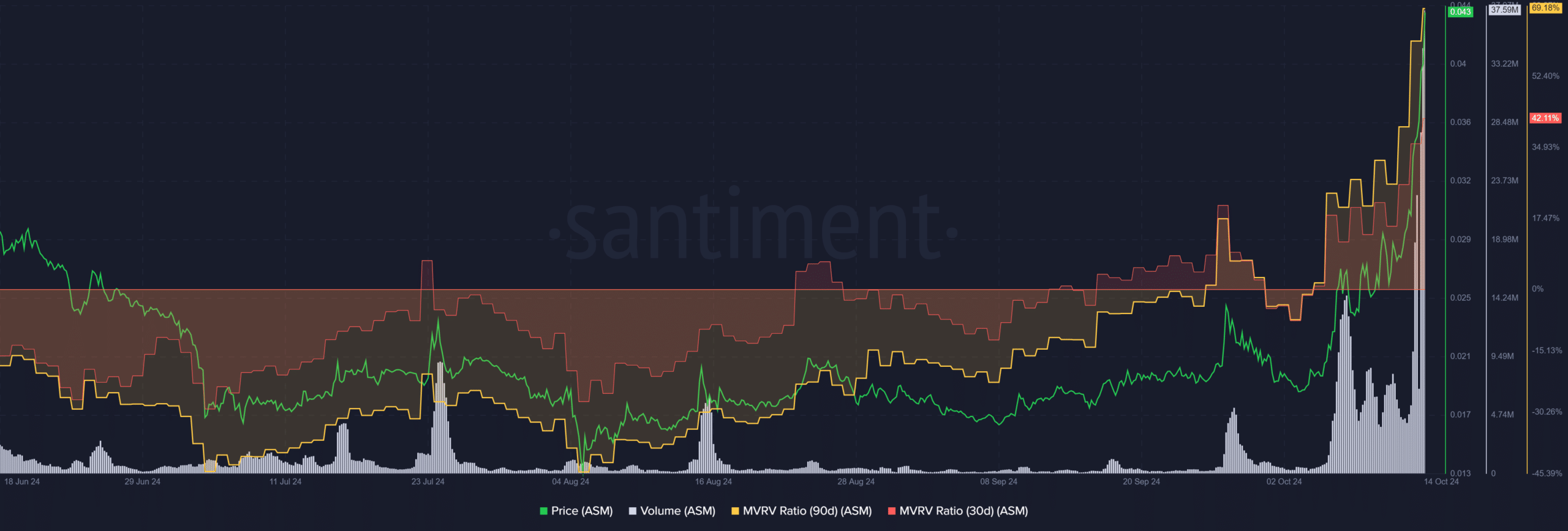

The high unrealized profit amongst short and medium-term investors further painted the above cautious outlook. Those who held the token for a month and three months had +40% and nearly 70% in unrealized profit. This could trigger profit-taking.

As a researcher observing current market trends, I’ve noticed a significant uptick that has transformed both short-term and medium-term investors into holders realizing double-digit profits. This trend could potentially place $0.045 as a noteworthy barrier to keep an eye on.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-10-14 19:03