- Bitcoin dominance has surged to new heights, indicating a bullish market sentiment.

- Yet, dwindling new investor interest may impede this upward trajectory.

As an analyst with over two decades of experience in the financial markets, I have seen countless bullish trends falter due to a lack of investor enthusiasm. While Bitcoin’s dominance has reached new heights and its price is breaking past $64K, this doesn’t automatically guarantee a rebound.

The dominance of Bitcoin (BTC) has soared to a record level, almost reaching 57% of the entire market share compared to other cryptocurrencies. This increase coincides with Bitcoin’s resurgence as it surpasses the $64K barrier and is currently trading at $64,400.

The pricing here is noteworthy as it resembles the late August surge, during which Bitcoin plummeted below $55K within a fortnight due to intensified bearish influence.

As a researcher, I find myself standing at an important juncture, where this particular level could significantly influence Bitcoin’s upcoming major shift.

Bitcoin dominance does not guarantee a rebound

Essentially, Bitcoin dominance shows BTC’s share in the overall crypto market.

In terms of market capitalization, Bitcoin stands as the pioneer and biggest cryptocurrency, holding a prominent role that attracts close scrutiny from traders. They keep a keen eye on its dominance as it serves as a significant gauge reflecting the overall market’s mood or sentiment.

At the moment, there’s a positive trend as many shareholders are shifting away from losing money. For a major leap forward to occur, these investors should resist selling their holdings instead.

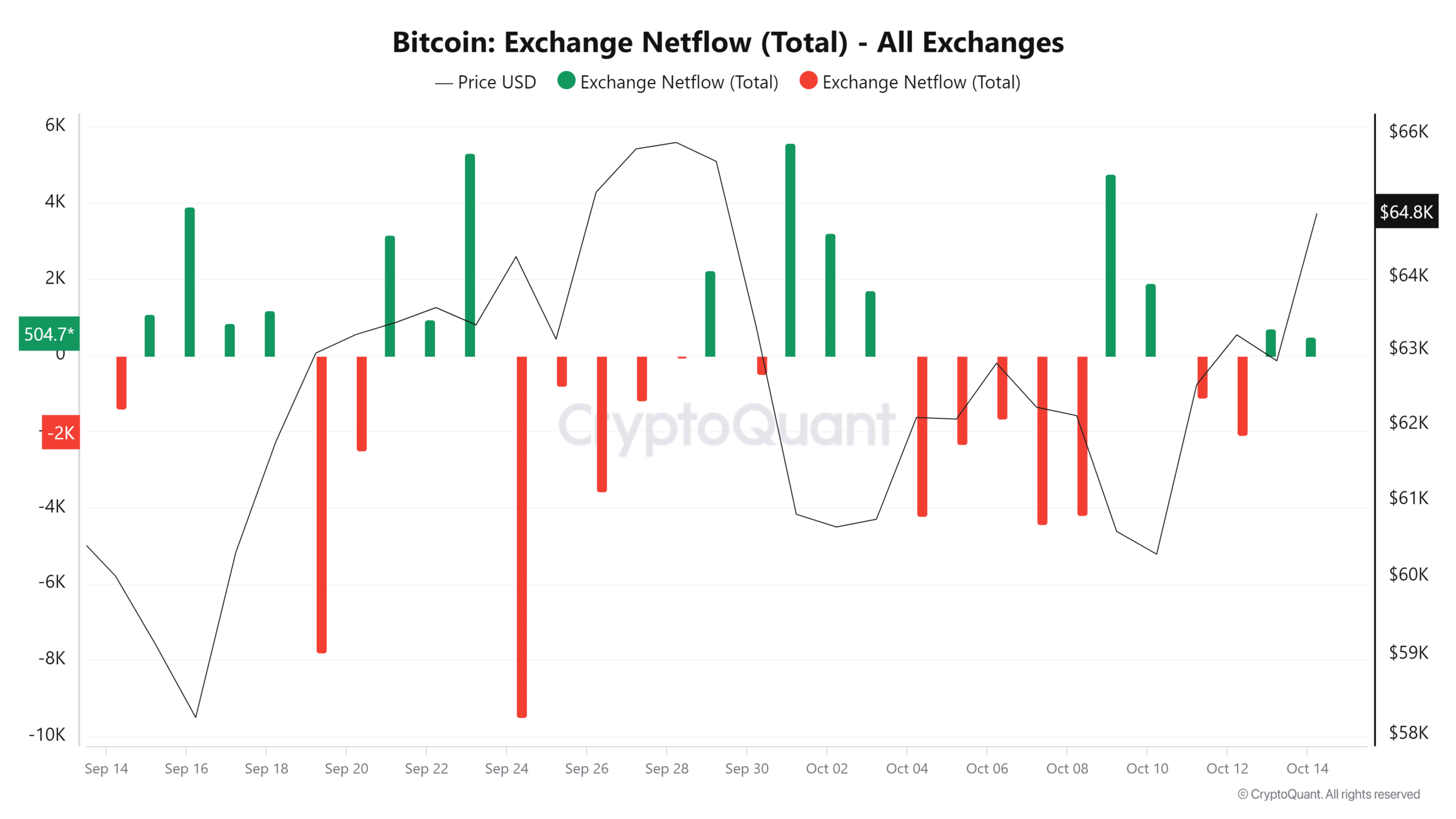

historically, an increase in Bitcoin deposits into trading platforms tends to occur around daily price bottoms. If traders perceive the current price drop as just a temporary setback rather than a significant decrease, the predicted surge towards $66K could be hindered.

Source : CryptoQuant

Furthermore, it’s troubling that there aren’t many new investors joining the market even though Bitcoin has a significant dominance in it. This absence of fresh investment might prevent Bitcoin from reaching its next projected price level.

Should this trend continue over the next couple of days, there’s a possibility that Bitcoin could experience a downturn, potentially bringing its value down to around $62,000.

As a researcher observing the cryptocurrency landscape, it appears that the present Bitcoin ($BTC) level of $64K hasn’t yet shown signs of becoming a solid support point. This suggests hesitation among investors regarding market entry at this price. Many might be adopting a ‘wait and see’ approach, preferring to buy when Bitcoin reaches a temporary low in the local market.

Another retracement may become necessary

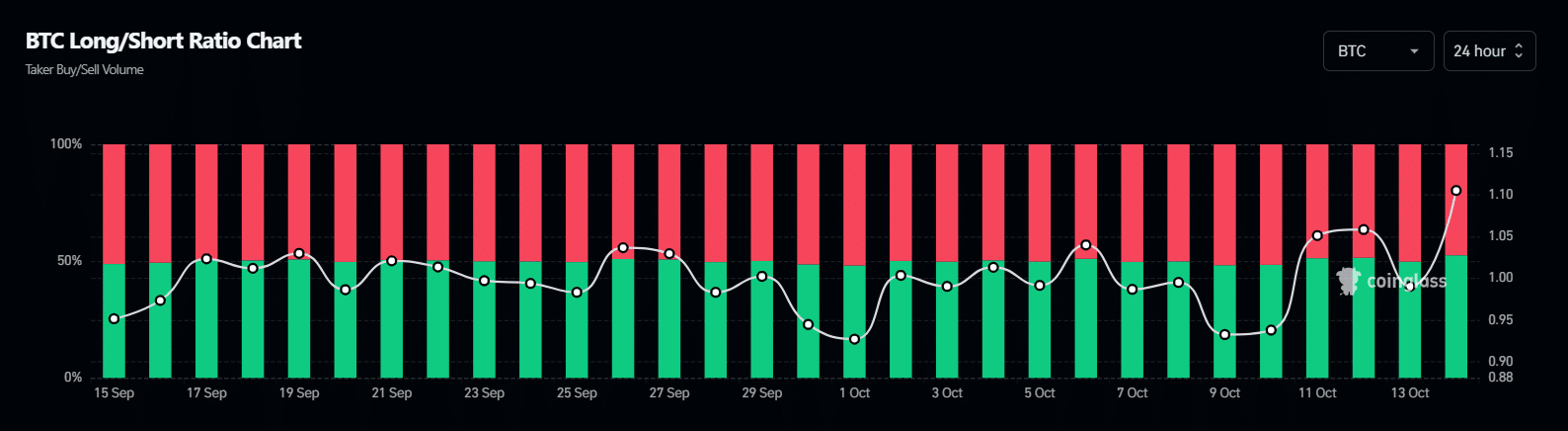

Bitcoin’s attempt to replicate its late July surge, where it closed at approximately $66K, has faced setbacks on three occasions so far, mainly due to the influence of speculative traders.

During the late September period, as Bitcoin came close to hitting its predicted price, an abundance of selling (shorting) caused a dip since those holding long positions were compelled to offload their investments.

At present, most upcoming traders appear to be wagering on a recovery, given the surge seen in the ‘caution’ or ‘downturn’ area.

Source : Coinglass

On the other hand, it’s important to exercise caution because while traders in the spot market may not be as optimistic about Bitcoin (BTC) as those in the derivatives market, their perspectives might differ significantly.

This difference could potentially be utilized by short sellers, who might boost their holdings, profiting from the scarcity of new funds flowing into the market.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Essentially, maintaining a strong Bitcoin dominance requires that the $64K level serves as a foundation for future prices. This could happen if potential investors perceive the current price drop as a chance to purchase at a discount.

Instead, if there’s hesitation, it might be required for Bitcoin to return to around $62K-$64K for a proper correction or consolidation, following which it could potentially rise above $66K again.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Solo Leveling Arise Tawata Kanae Guide

2024-10-14 20:08