-

The token’s price increased by over 16% in the last 24 hours alone.

Selling pressure on ENA was rising, which could cause a price correction.

As a seasoned researcher with a knack for deciphering market trends, I find myself intrigued by Ethena’s [ENA] recent performance. The token’s meteoric rise of over 16% in the last 24 hours is nothing short of spectacular. However, my analytical instincts can’t help but raise a brow at the rising selling pressure that could potentially lead to a price correction.

In the last day, Ethena (ENA) put on a remarkable display with its token price surging by more than ten percent.

Consequently, AMBCrypto decided to delve further and explore how the token’s on-chain statistics were impacted and anticipate future developments.

Tracking Ethena’s bull rally

According to CoinMarketCap’s findings, Ethena’s value significantly increased by 16% over the past day, which was driven mainly by aggressive buying from the bulls. To be precise, last week saw a strong dominance of the bullish sentiment in the market.

In just the past week, ENA‘s value surged by more than 40%, an impressive achievement. Currently, it is being exchanged for approximately $0.4015 per token, and its total market value stands above $1.1 billion.

Despite such a major price rise, most of the investors were at loss.

According to AMBCrypto’s examination of Intolock’s data, it was found that approximately 6,290 ENA addresses were generating a profit, representing about 15% of all ENA address accounts.

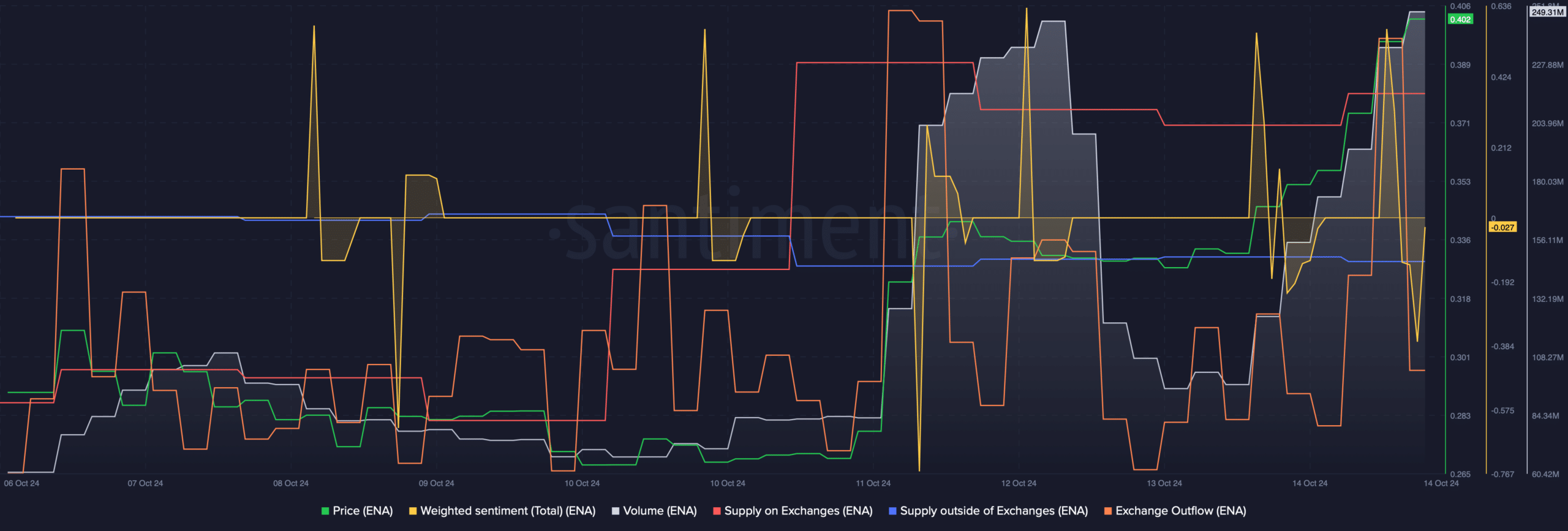

On the social side, things seemed unfavorable as well. Upon scrutinizing Santiment’s data, we discovered that Ethena’s Weighted Sentiment dipped into the negative territory. This hinted at an increase in pessimistic feelings among users.

However, the token’s trading volume increased in the last few days, while ENA’s price surged. Though at first sight this might look bullish, there was more meat to the story.

Significantly, as trading activity escalated, so did the amount of ENA tokens available for trade on exchanges. This suggested that investors were indeed offloading the token.

Additionally, it’s worth noting that Ethena’s tokens held outside of exchanges decreased, while the amount of tokens flowing out from exchanges increased significantly. This trend strongly indicates that there was a considerable amount of selling activity on the token.

A rise in selling pressure often results in price correction.

Our look at Coinglass’ data revealed yet another bearish metric. Ethena’s Long/Short Ratio dipped, meaning that there were more short positions in the market than long positions.

Tracking ENA’s upcoming targets

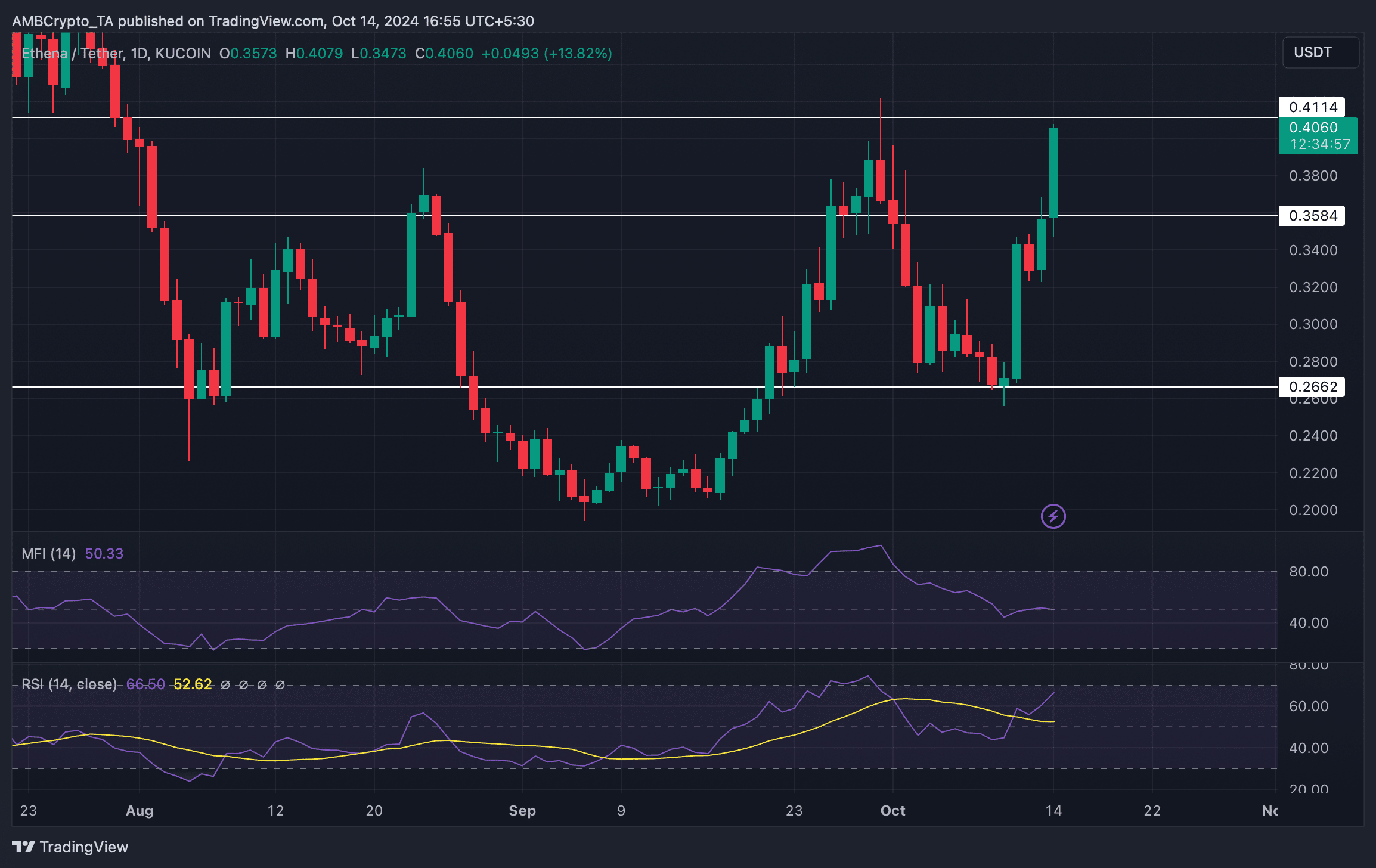

After analyzing the day-to-day graph of the token, AMBCrypto identified potential market signals pointing towards ENA‘s prospective goals. Upon examination, we noticed a decline in the Money Flow Index (MFI).

Read Ethena [ENA] Price Prediction 2024-25

Ethena’s Relative Strength Index (RSI) was also about to enter the overbought zone.

Based on these indicators, it seems there could be a potential price adjustment. If this correction occurs, Ethena’s price might dip to around $0.35. Conversely, if the bullish trend persists, Ethena may overcome its resistance at $0.411 and potentially rise higher.

Read More

- OM/USD

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- ETH/USD

- Solo Leveling Season 3: What You NEED to Know!

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Aimee Lou Wood: Embracing Her Unique Teeth & Self-Confidence

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

- Leslie Bibb Reveals Shocking Truth About Sam Rockwell’s White Lotus Role!

- Solo Leveling Season 3: What Fans Are Really Speculating!

2024-10-15 01:11