- Sentiment and momentum around MANEKI crypto were bullish.

- The lack of accumulation in recent weeks was a worry for bulls.

As a seasoned analyst with over two decades of market observations under my belt, I have learned to navigate the crypto space with a keen eye and a steady hand. The bullish sentiment around MANEKI was indeed palpable, but recent lack of accumulation left me worried for the bulls.

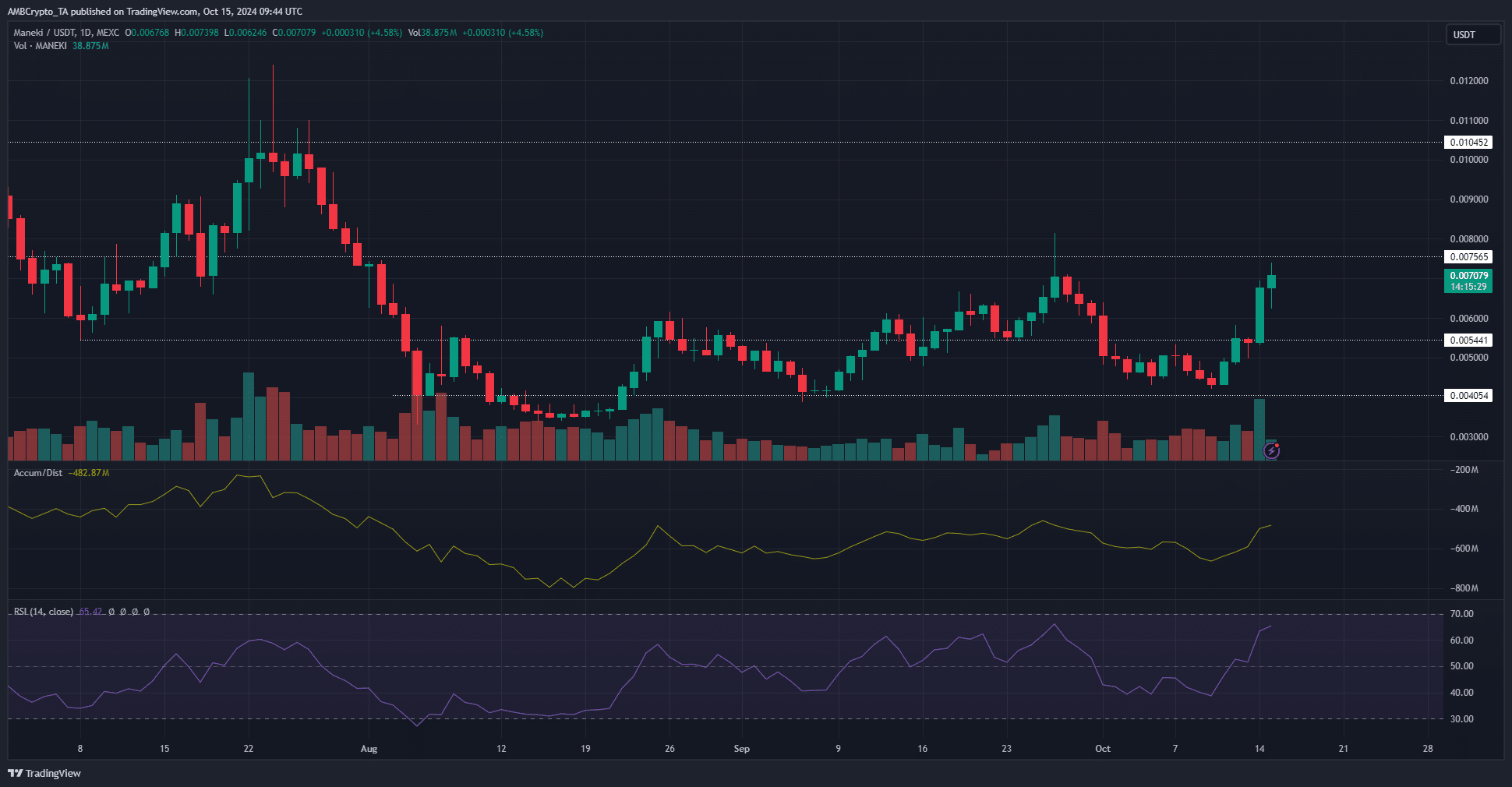

In the past four days, the price of MANEKI, the digital cat meme coin on the Solana network, has increased by a significant 62.15%. Starting from October 14th, this token has experienced a surge of 32% and continues to rise.

At press time, the indicators reflected bullishness.

Yet, Bitcoin [BTC] has reached a resistance zone around $66k. MANEKI bulls also contended with the supply zone at $0.00756.

Caution is better than FOMO for now

For Maneki, the market trend over the past day showed a bullish pattern. The breakthrough of the $0.054 resistance level during the weekend transformed the previous supply area into a demand area. This shift triggered a significant surge in price on Monday.

Over the last two days, a strong upward trend has driven the price close to the barrier of approximately $0.0075. On September 27th, this same level proved resistant to the attempts by MANEKI’s bulls to push through it.

There’s a chance that the same situation might occur again, since the A/D indicator didn’t reach new highs, despite MANEKI hitting a major resistance level.

It appears that, even with the recent bullish trend, the demand might not have been strong enough to support a prolonged upward movement.

Market expectations are more tempered

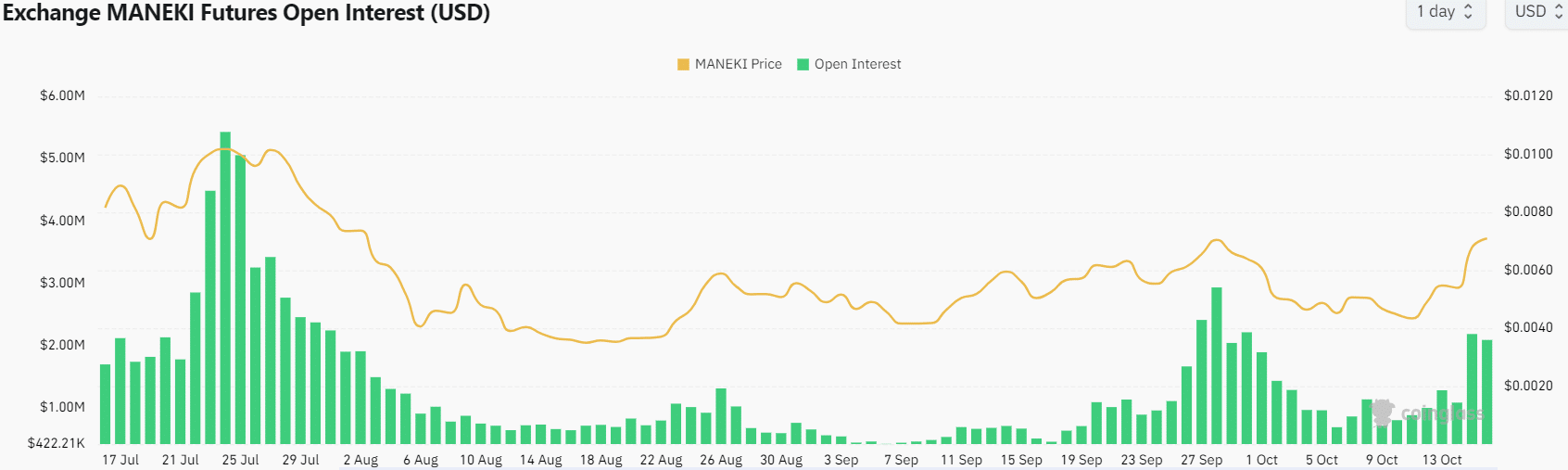

As a researcher, I’ve observed that the Open Interest is approaching the peaks it reached around the end of September. Yet, it currently stands approximately a million dollars lower than it did about three weeks back.

This suggested that the bullish speculators were fewer.

Based on the analysis of the A/D indicator and the OI chart, it appeared that some uncertainty existed among investors regarding a prolonged MANEKI bull run. This insight suggested to traders that they might consider cashing out their gains and getting ready for a possible price correction or reversal.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

2024-10-15 22:15