- Bitcoin Cash’s Long/Short ratio was 1.20, indicating strong bullish sentiment.

- BCH’s trading volume skyrocketed by 218%, indicating heightened participation from traders.

As a seasoned researcher with years of experience navigating the volatile waters of the cryptocurrency market, I can confidently say that Bitcoin Cash (BCH) is currently shaping up to be an intriguing investment opportunity. The technical analysis and on-chain metrics suggest a bullish outlook for BCH, with its recent breakout of a crucial resistance level and a strong Long/Short ratio indicating strong bullish sentiment among traders.

In recent times, there’s been a strong resurgence in prices within the cryptocurrency market. Notably, Bitcoin Cash (BCH) has sparked interest among both traders and investors because of its outstanding performance.

The feeling about Bitcoin Cash (BCH) has moved from a declining trend to an increasing trend, with the token recently breaking through a significant resistance point, setting it up for a potentially big surge in value.

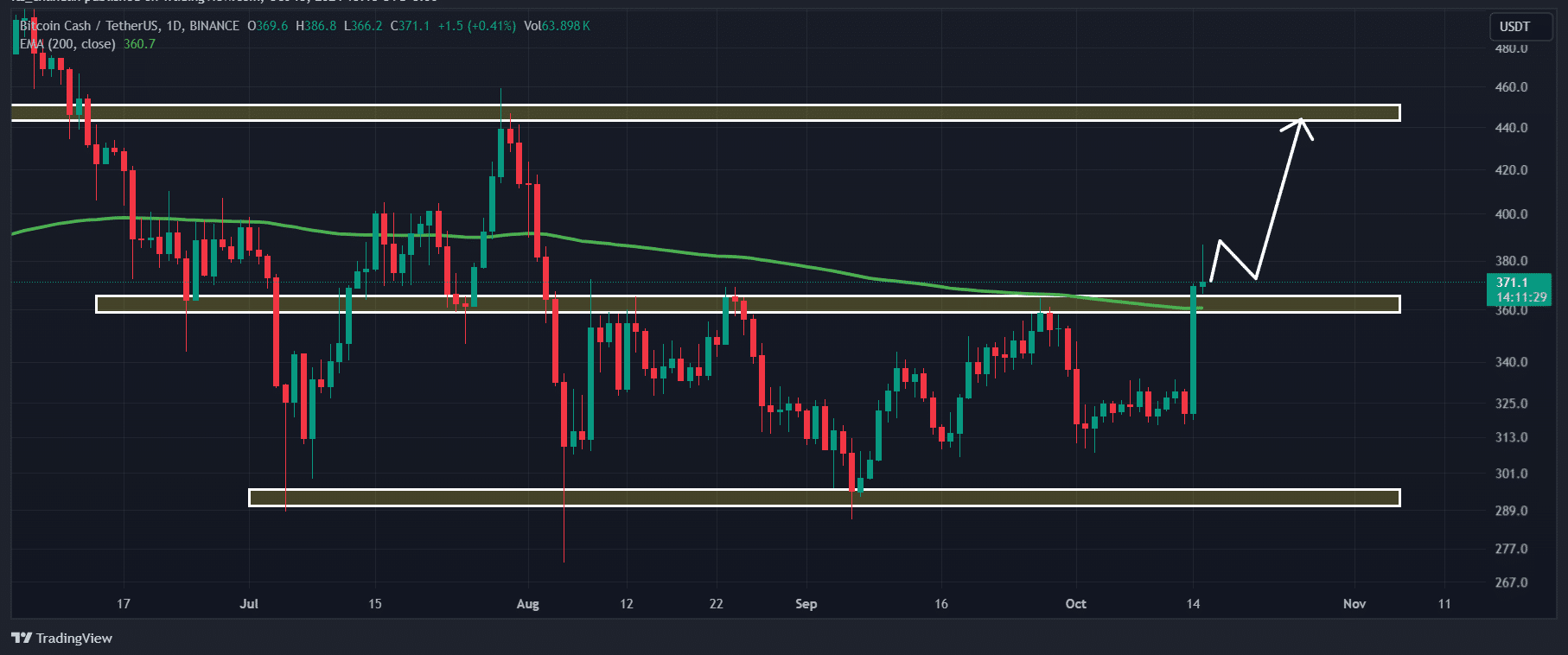

Bitcoin Cash technical analysis

Based on AMBCrypto’s technical assessment, Bitcoin Cash exhibited a bullish trend after surpassing its resistance threshold.

When studying the day-to-day graph, it appears that the token has attempted to breach this resistance level on three occasions. However, due to the optimistic atmosphere in the market prior to the presidential election, it successfully burst through with a large candlestick pattern known as a “large engulfing candle.

As an analyst, I find it significant that the current bullish candle has surpassed the 200-day Exponential Moving Average (EMA). This points towards a potential change in the market trend moving upwards.

After the recent surge, there are no obstacles or barriers visible on the daily chart at present. Given its past price trends, Bitcoin Cash (BCH) appears likely to experience an increase of approximately 18%, potentially reaching the $450 mark in the near future.

Even though there’s an optimistic forecast for Bitcoin Cash (BCH), its 16% increase in one candle could cause a pause or accumulation of prices around the breakout point before a substantial surge takes place.

BCH’s bullish on-chain metrics

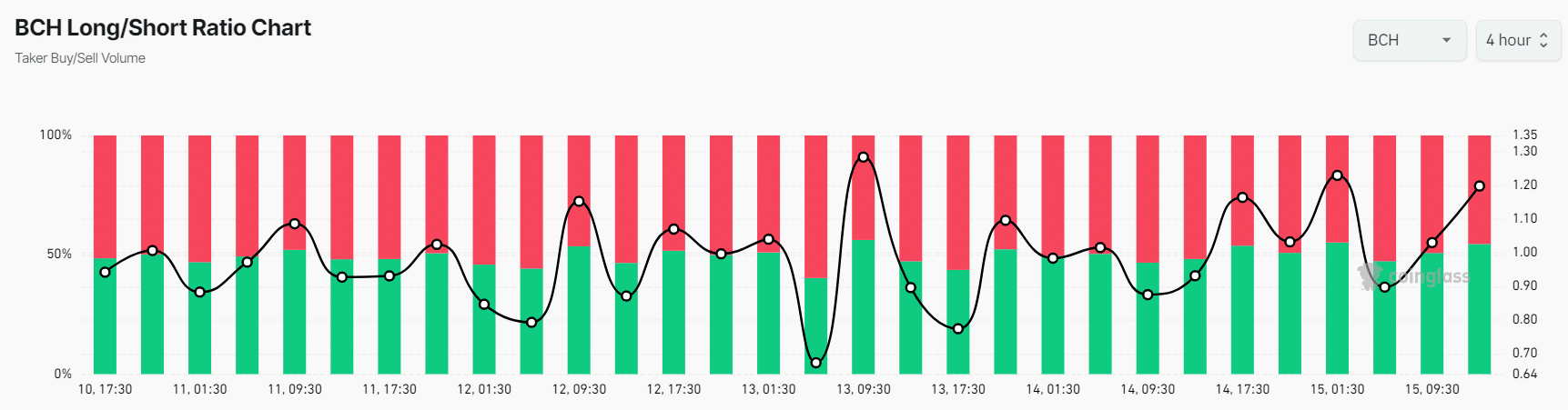

The optimistic view toward BCH is reinforced by data from the blockchain. As per the blockchain analytics company Coinglass, the long/short ratio of BCH over a four-hour period stood at 1.20, suggesting robust bullishness among investors.

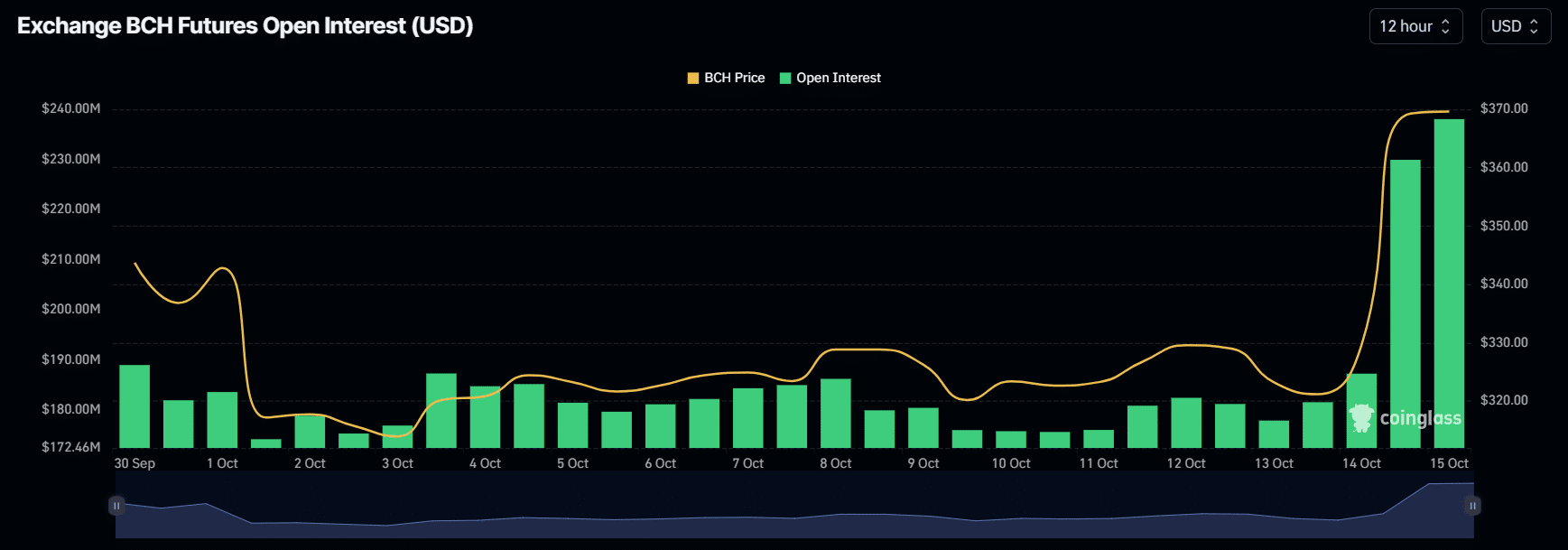

Furthermore, there’s been a significant increase of 30% in the Open Interest for Futures contracts over the past day. This rise indicates that traders have a high confidence in Bitcoin Cash and could be taking advantage of longer-term investment opportunities.

Many traders and investors frequently construct their long positions by utilizing a strategy that involves an increase in Open Interest and a Long/Short Ratio greater than 1.

As an analyst, I’m observing a trend where long positions appear to be leading the charge in the asset market, which could potentially spark a substantial upward momentum. At this moment, approximately 54.5% of top traders are holding long positions, while about 45.5% are holding short positions.

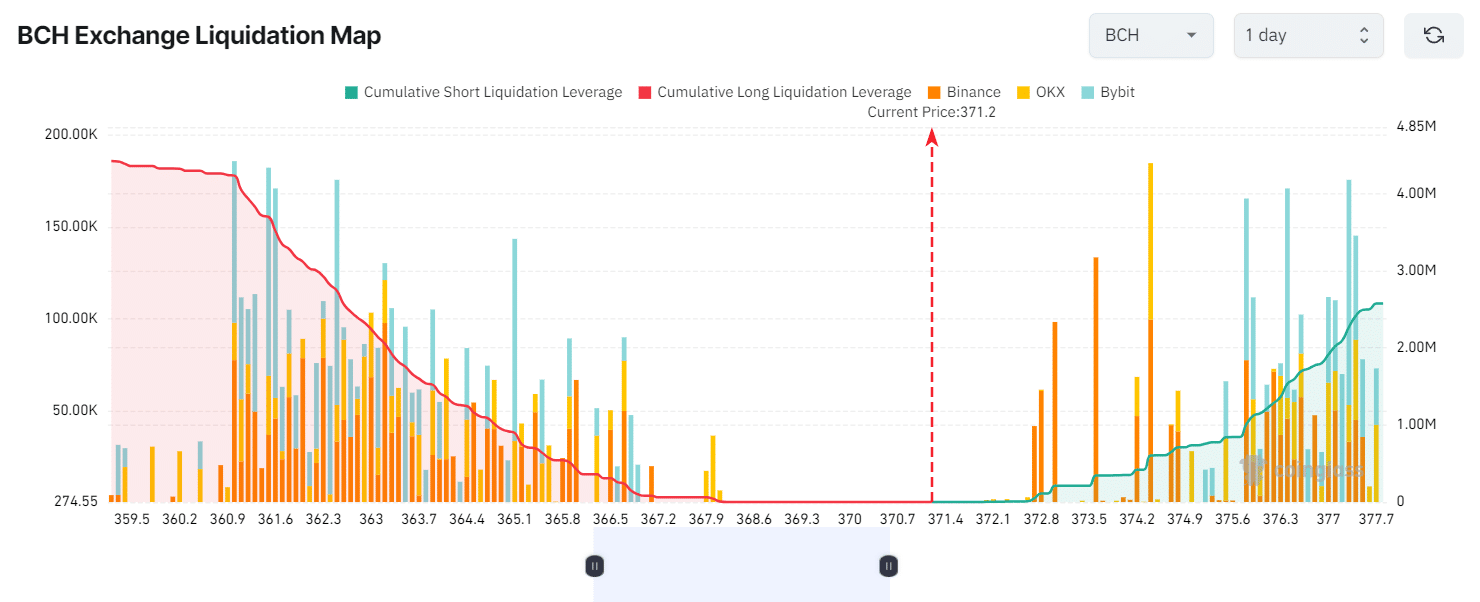

Major liquidation levels

Currently, the significant point for potential sell-offs lies around $361, a zone where many bullish investors have taken on excessive leverage. Should the market mood turn bearish and the price dips below this threshold, roughly $4.23 million in long positions could be automatically sold off or liquidated.

Conversely, $374.4 serves as a significant liquidation point on the upward trend, where bears have taken on too much leverage. If market sentiment stays consistent and the price surpasses this level, it could lead to about $603,680 being wiped out from short positions.

These figures indicate a substantial difference between the long positions held by optimistic investors (bulls) compared to the short positions taken by pessimistic ones (bears).

Read Bitcoin Cash’s [BCH] Price Prediction 2024–2025

Current price momentum

Currently, Bitcoin Cash (BCH) is being traded around $370.5. This follows a significant increase of more than 12.75% in its value over the last day.

Over that timeframe, the trading volume significantly increased by 218%, suggesting a surge in activity from both traders and investors. This jump could be attributed to the recent market breakout.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-10-16 01:44