- Bitcoin breezed past the October range highs,

- A minor price dip before the uptrend resumes is the ideal outcome for bulls.

As an analyst with over a decade of experience observing the cryptocurrency market, I find myself cautiously optimistic about Bitcoin’s current trajectory. The recent surge beyond the October resistance level is indeed promising, but it’s essential to remember that markets often have a knack for throwing us a curveball or two.

Bitcoin [BTC] has a comfortably bullish outlook, going by social media posts.

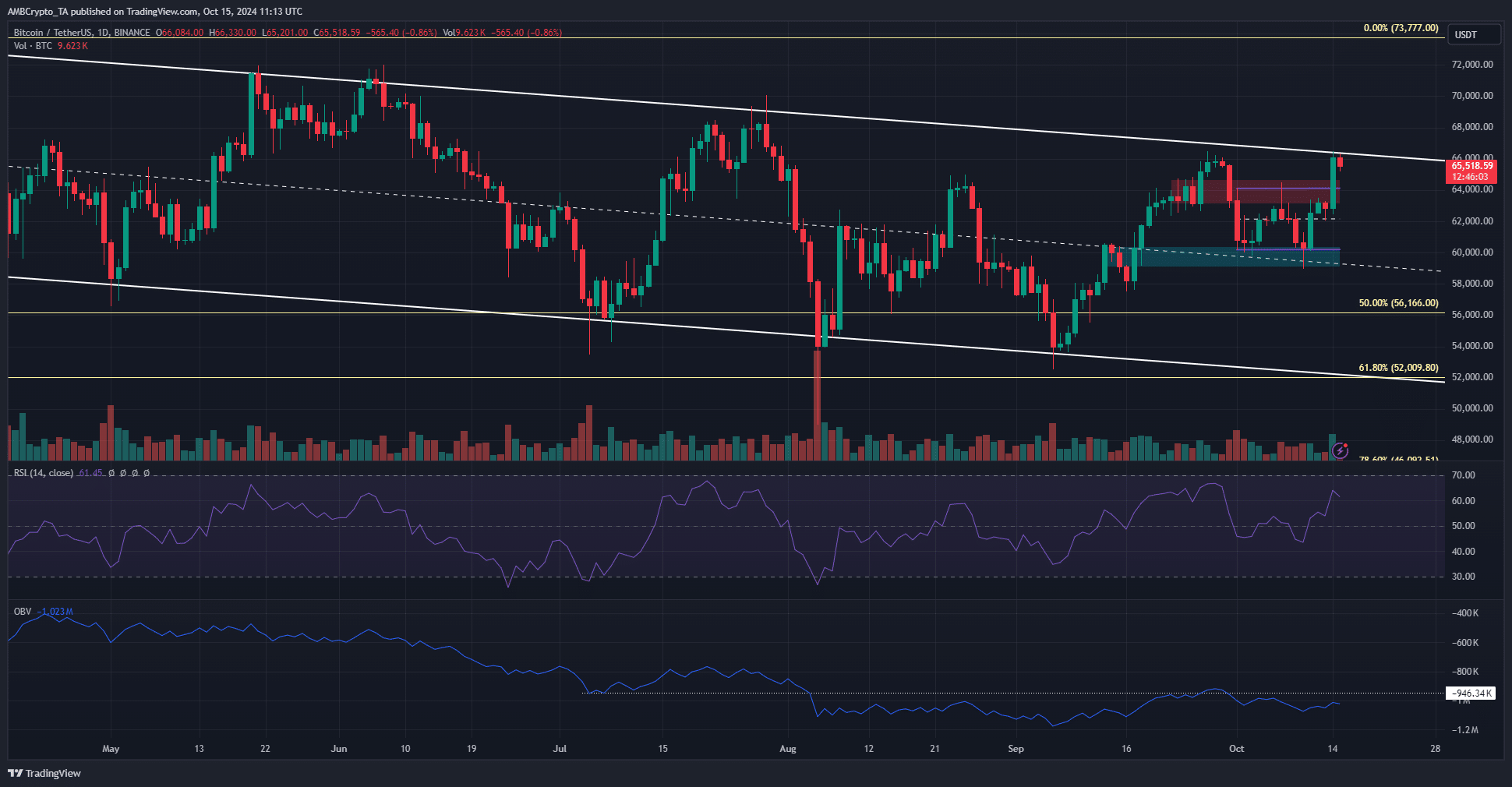

On October 14th, there was a significant breakthrough over the $64k barrier that had previously held back the bulls in October, with prices reaching levels near the upper bounds of the channel again.

It’s possible that the significant inflows into the record-setting Bitcoin spot ETF played a role in the 5.1% price increase we’ve seen. Yet, it’s important to note that the shares of this ETF represent just a small portion of the overall trading activity. So, the question becomes whether this price move signals a potential breakout or another price rejection – a decision for investors to ponder.

Channel highs vs. range breakout

In October, Bitcoin’s price fluctuated between approximately $60,200 and $64,100 within a short-term bracket. On Monday, it effortlessly surpassed the resistance level, but encountered obstacles at around $66,500.

During this period, the price reached the peaks of the downward sloping channel and also corresponded with the highest prices seen since September 27th. If the session ends with a closing price above $66,500, it will indicate strong bullish sentiment.

The OBV failed to surpass the nearby peaks, and it was significantly lower than those levels, with the price encountering the same resistance point at approximately $66,500.

This suggests that the recent weeks’ purchases were not as substantial compared to periods when Bitcoin experienced declines.

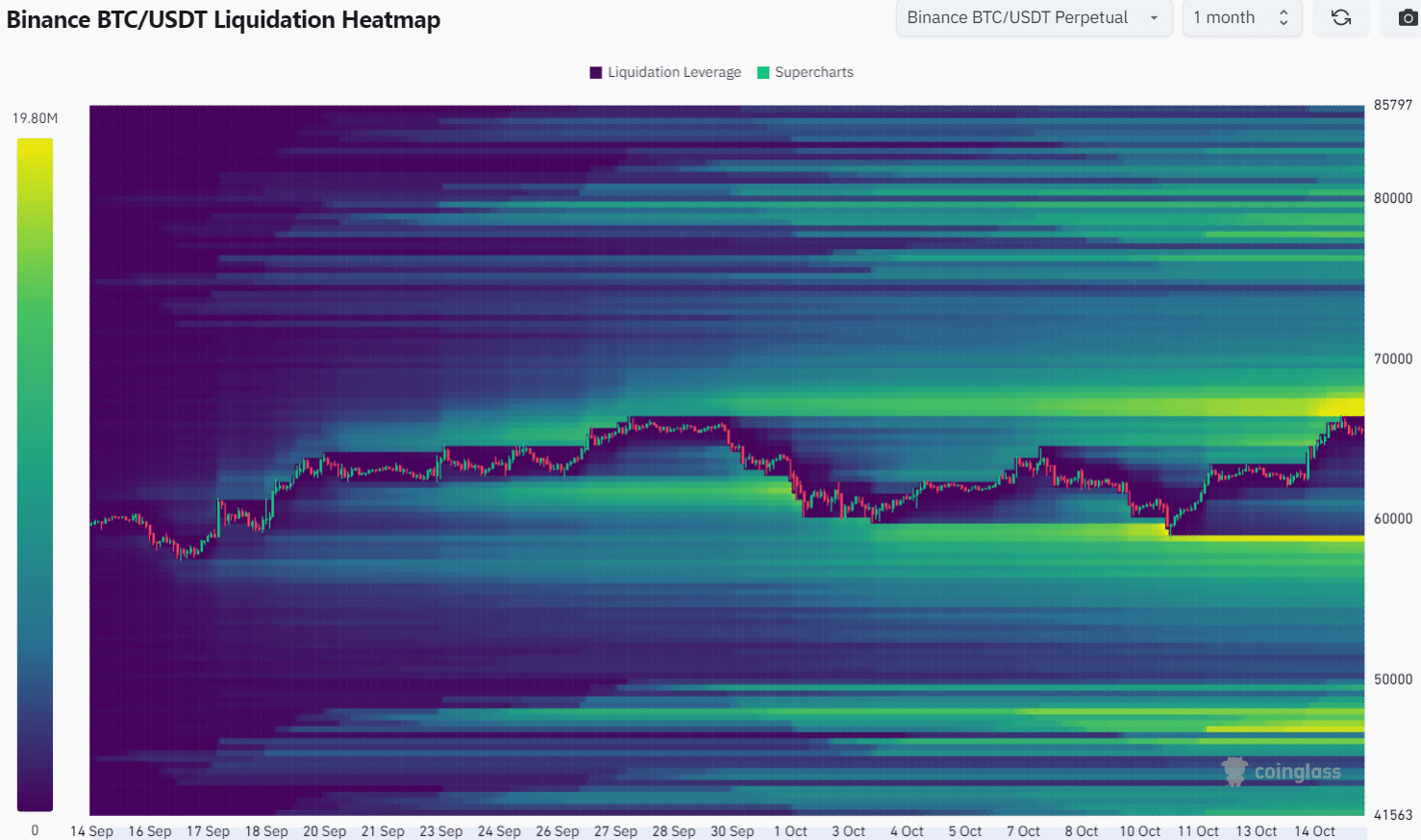

Potential short squeeze imminent

Over the past month, we’ve seen a cluster of selling points around $66,600 and $67,400. This area of high liquidity might draw prices upwards slightly before a possible downturn towards $60,000.

Read Bitcoin’s [BTC] Price Prediction 2024-25

There’s some uncertainty about whether Bitcoin will experience a significant price increase predicted for Q4 2024, or if it will continue to stabilize first. The liquidation map and On-Balance Volume (OBV) suggest that a potential reversal might occur.

In simpler terms, if the price reaches its old peak of $64k, it might lead to an upward trend, offering a chance for investors to buy. However, keep in mind that there could also be a more significant drop, so swing traders need to be ready and carefully handle their risk levels.

Read More

- OM/USD

- Solo Leveling Season 3: What You NEED to Know!

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- ETH/USD

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Aimee Lou Wood: Embracing Her Unique Teeth & Self-Confidence

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-10-16 04:07