- LINK was gaining momentum, with technical indicators pointing to a possible breakout above $13.

- Market sentiment has improved, supported by rising network activity and decreasing exchange reserves.

As a seasoned researcher with years of experience observing the crypto market, I can confidently say that Chainlink (LINK) is presenting an exciting opportunity for investors and traders alike. The momentum LINK has been gaining, along with its technical indicators hinting at a potential breakout above $13, has caught my attention.

As a researcher studying cryptocurrencies, I’ve noticed an impressive surge in the value of Chainlink (LINK) recently. This growth seems to be driven by significant advancements within its ecosystem.

Introducing staking, expanding the data oracle network, and launching Secure MChain have collectively fueled Chainlink’s price surge.

Currently, LINK stands at $11.53 per unit, marking a 4.80% rise over the previous 24-hour period. What’s intriguing is whether this upward trend will propel LINK beyond its significant hurdle at $13.

Is Chainlink signaling the next bullish breakout?

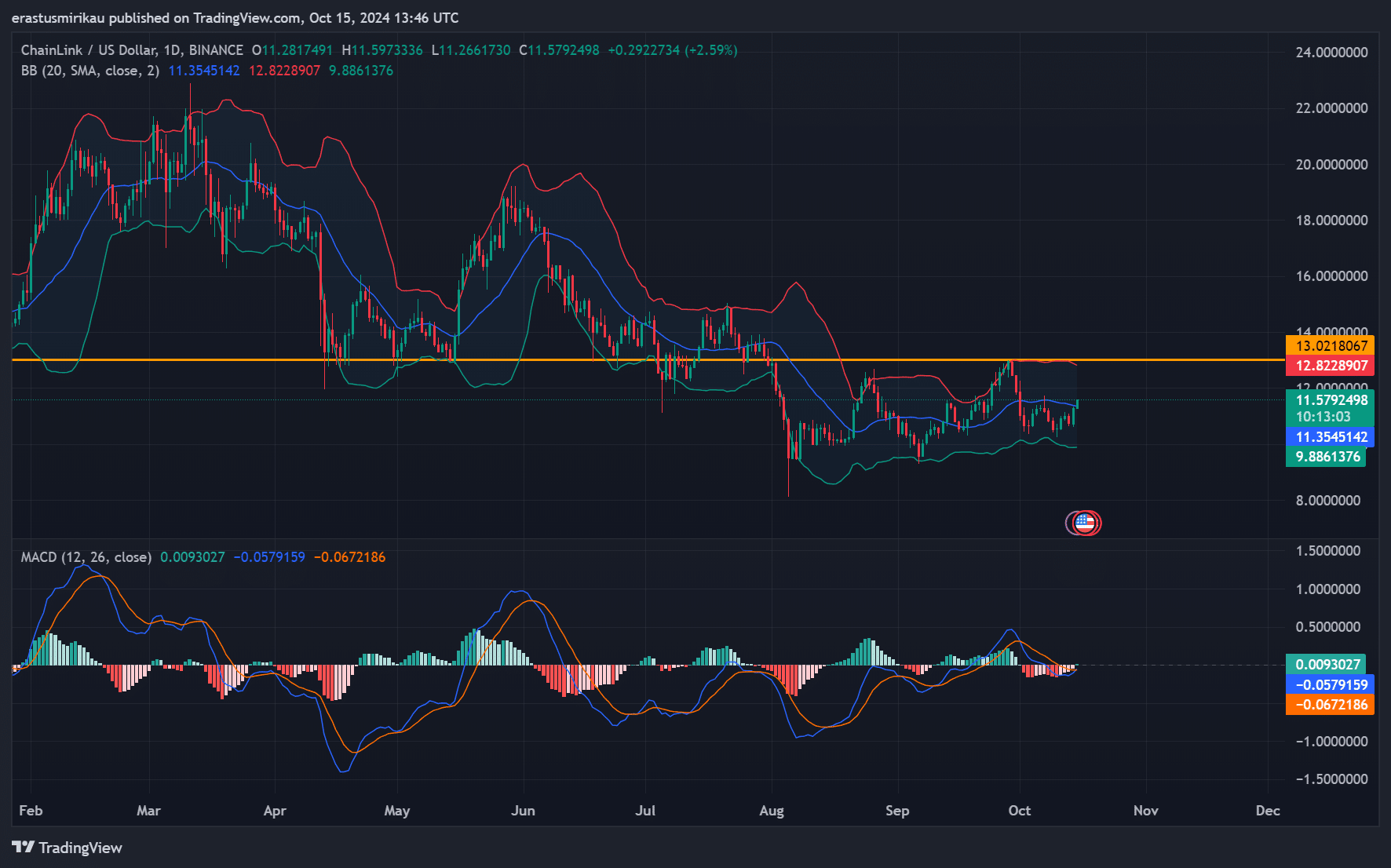

The price of LINK has struggled to maintain any long-term movement above $13. The current technical analysis showed the Bollinger Bands tightening, suggesting that a potential breakout could be imminent.

Furthermore, the Moving Average Convergence Divergence (MACD) was moving towards a bullish position, suggesting a possible price increase. But, to confirm this, the price needs to surpass the $12.82 resistance level convincingly.

If LINK can clear this level, it will likely trigger a rally beyond $13.

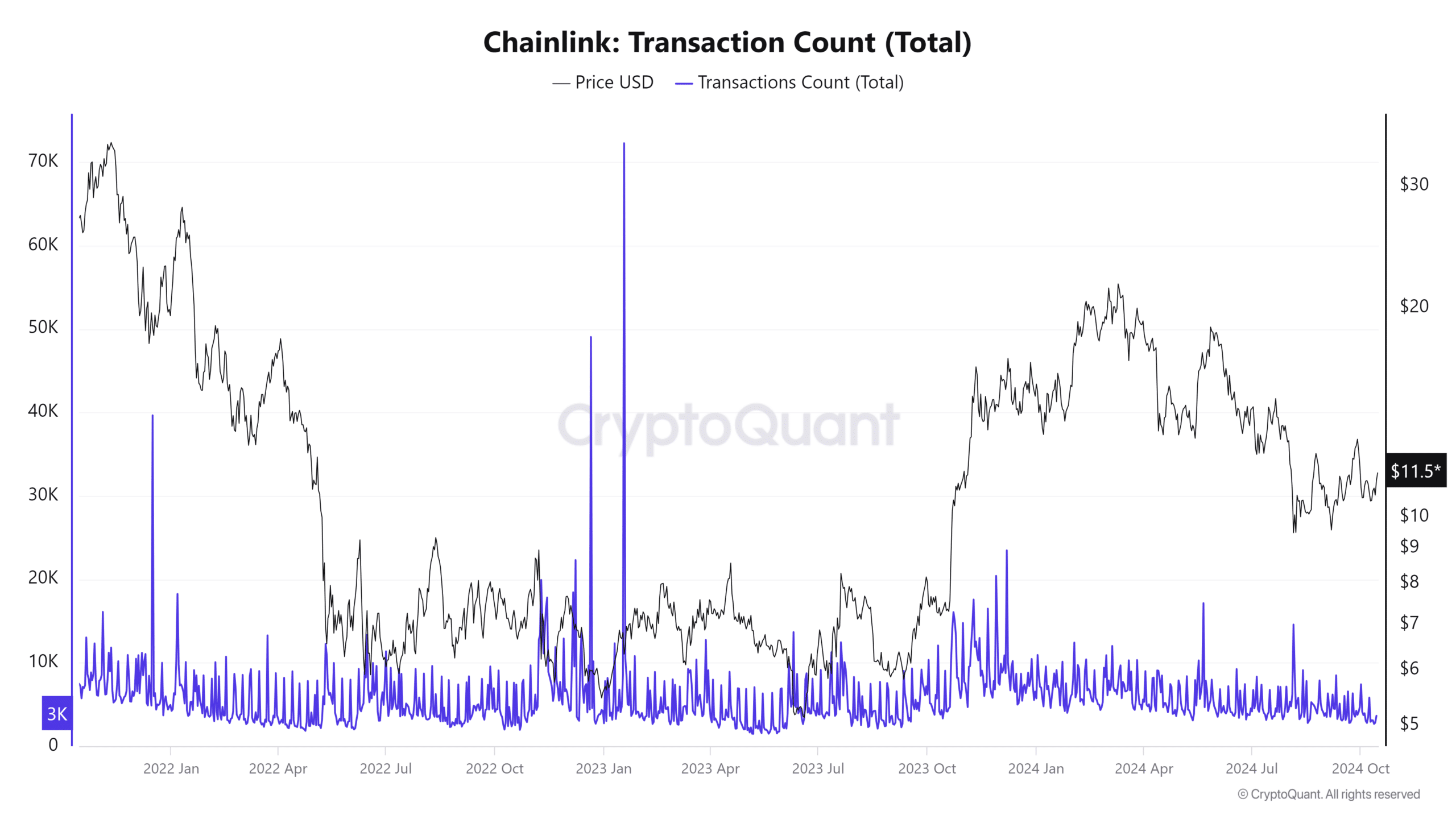

Growing network activity boosts bullish sentiment

As a crypto investor, I’ve noticed an upward trend in Chainlink’s on-chain activity. Over the past 24 hours, the number of active addresses swelled by approximately 1.25%, reaching a significant figure of 178,910. This increase suggests a growing interest and engagement within the network, which could potentially lead to more transactions and increased value for Chainlink holders.

Additionally, the number of transactions increased by 1.28%, totaling approximately 4,050 transactions, according to CryptoQuant’s data for that period.

As a crypto investor, I’m seeing a steady increase in the numbers associated with LINK, which indicates a growing appetite for this cryptocurrency. This trend suggests that the network is thriving and expanding healthily, adding weight to the argument that a significant surge could be on the horizon.

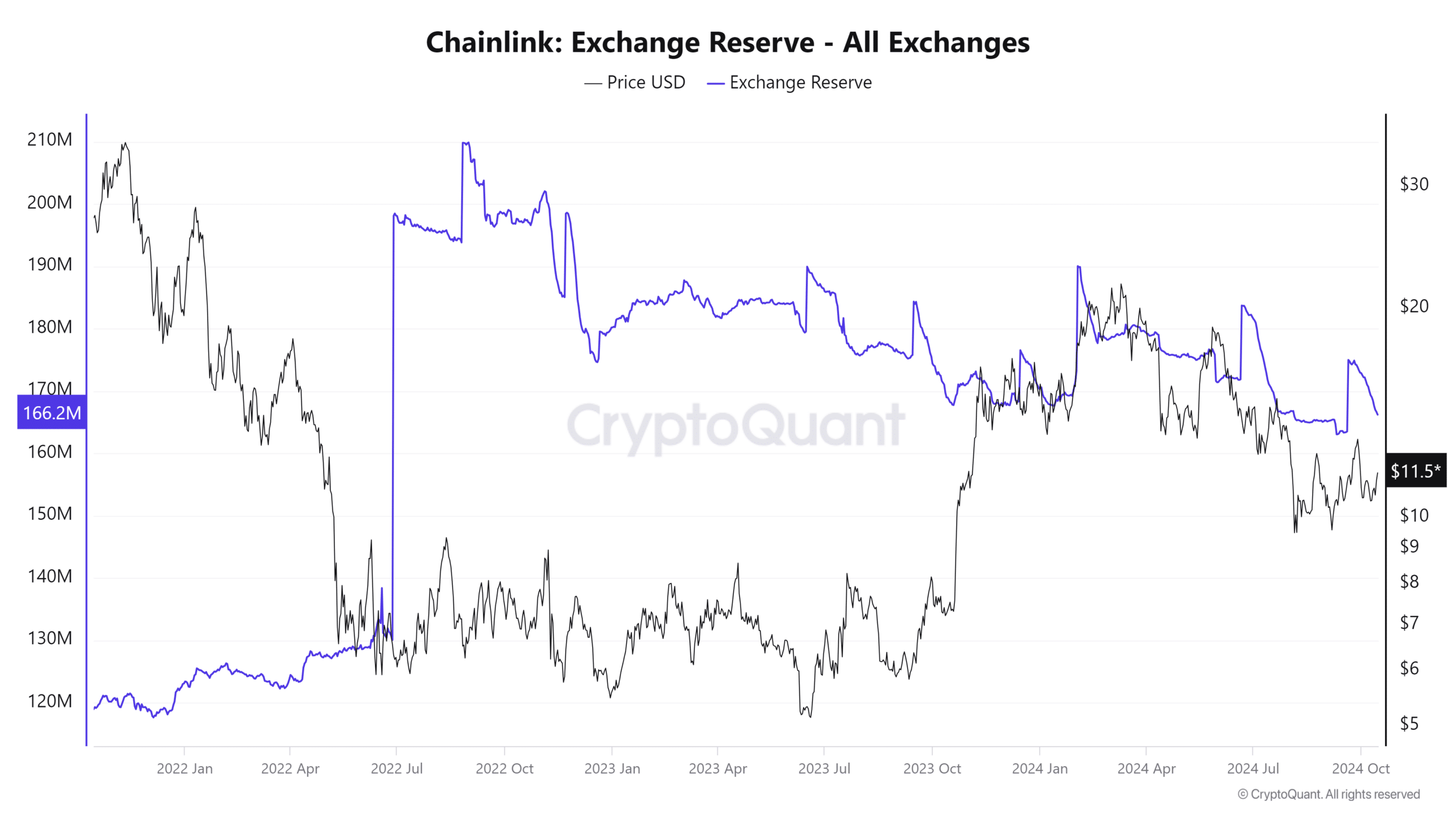

Exchange reserves decline as selling pressure weakens

A promising indicator for LINK’s price increase is the reduction in exchange holdings, which fell by 0.26% to 166.21 million LINK over the past 24 hours.

This decrease indicates that there are fewer tokens being stored in exchanges, leading to less selling pressure and potentially fostering conditions conducive to price growth.

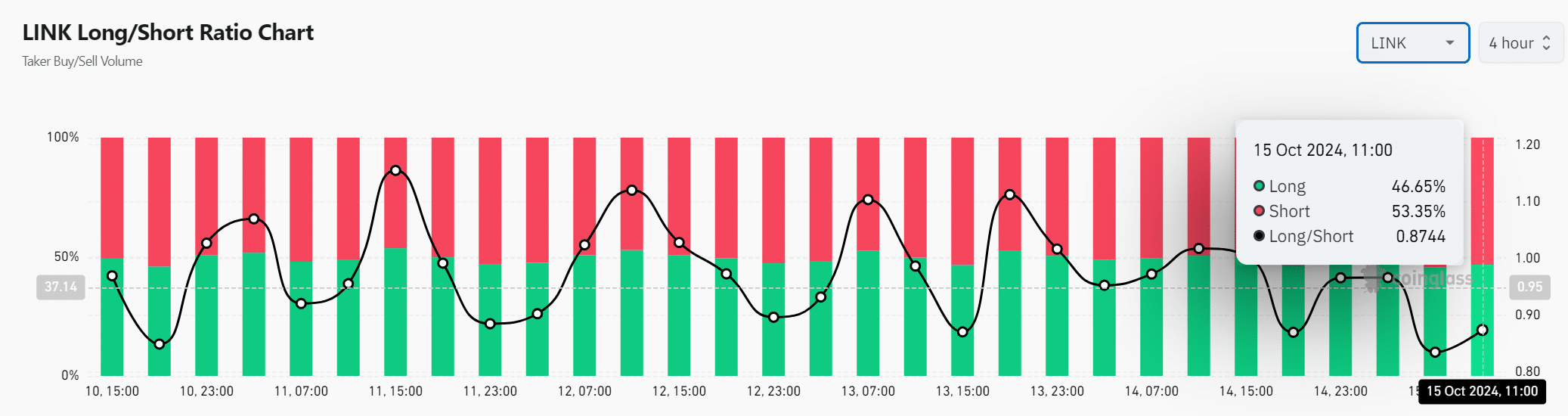

Chainlink’s shorts outweigh longs, but for how long?

Currently, 53.35% of traders are short on LINK, while 46.65% are holding long positions.

If LINK surpasses its $13 resistance level, this imbalance might lead to a rapid buying spree among short sellers as they rush to cover their positions, a scenario known as a “short squeeze.

This could lead to rapid price appreciation, pushing LINK to even higher levels.

The latest rise in Chainlink’s price, coupled with strengthening on-chain statistics and dwindling reserve levels on exchanges, suggests a possible breakthrough could be imminent.

Should LINK manage to surpass the $12.81 barrier, it could potentially spark a rapid price increase. Nevertheless, sustaining purchase pressure and maintaining market backing are vital factors in deciding if this upward trend will actually occur.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

2024-10-16 12:08