- APT bulls demonstrate strength as price pushes further away from local lows.

- Will Aptos’ budding utility and demand soften APT’s potential pullback?

As a seasoned researcher with years of experience in the crypto market, I’ve seen more than a few bull runs and bear markets. The recent performance of Aptos [APT] has been intriguing, to say the least. While the current rally is impressive, it reminds me of a rollercoaster ride we all love but fear at the same time.

In the past day, APT (Aptos) reached a fresh 5-month peak, boosted by its ongoing bullish trend that has been strengthening since its September surge.

On Sunday, APT surpassed $10 for the first time since April, marking a new attempt to break free from its prolonged stagnation in the lower price bracket.

Following the collision that took place between March and July, it wiped out the progress made during its earlier surge.

Could it be that APT may experience another dip soon? Although its recent progress suggests robust interest, a reversal seems plausible.

Despite hitting a fresh 5-month peak of $10.68 within the past day, it has shown signs of resistance to further increases.

APT exchanged hands at $10.08 at press time, highlighting the risk of sliding below $10 once more.

Previously, the cryptocurrency encountered difficulty advancing past $10. This could potentially lead to a pullback in the middle of the week at or near the same price point.

A temporary decrease might occur, but the cryptocurrency may still show further growth before the year concludes.

APT bears are ready to take over

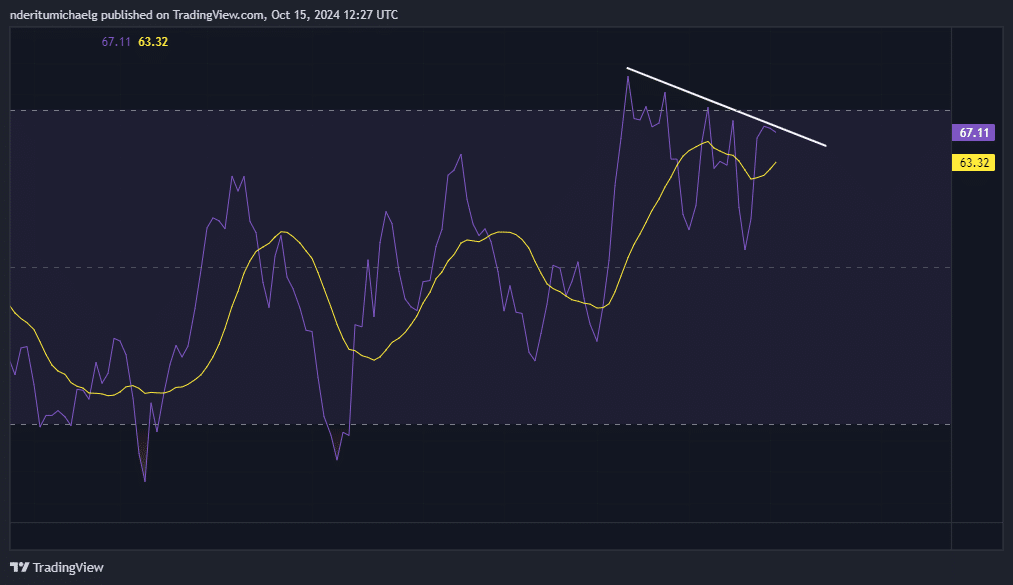

Despite APT’s recent rise, there have been hints suggesting a possible shift. For instance, the Relative Strength Index (RSI) has been registering lower peaks over the past three weeks, creating a potentially bearish price-RSI divergence.

This suggests that the bulls might be losing their momentum.

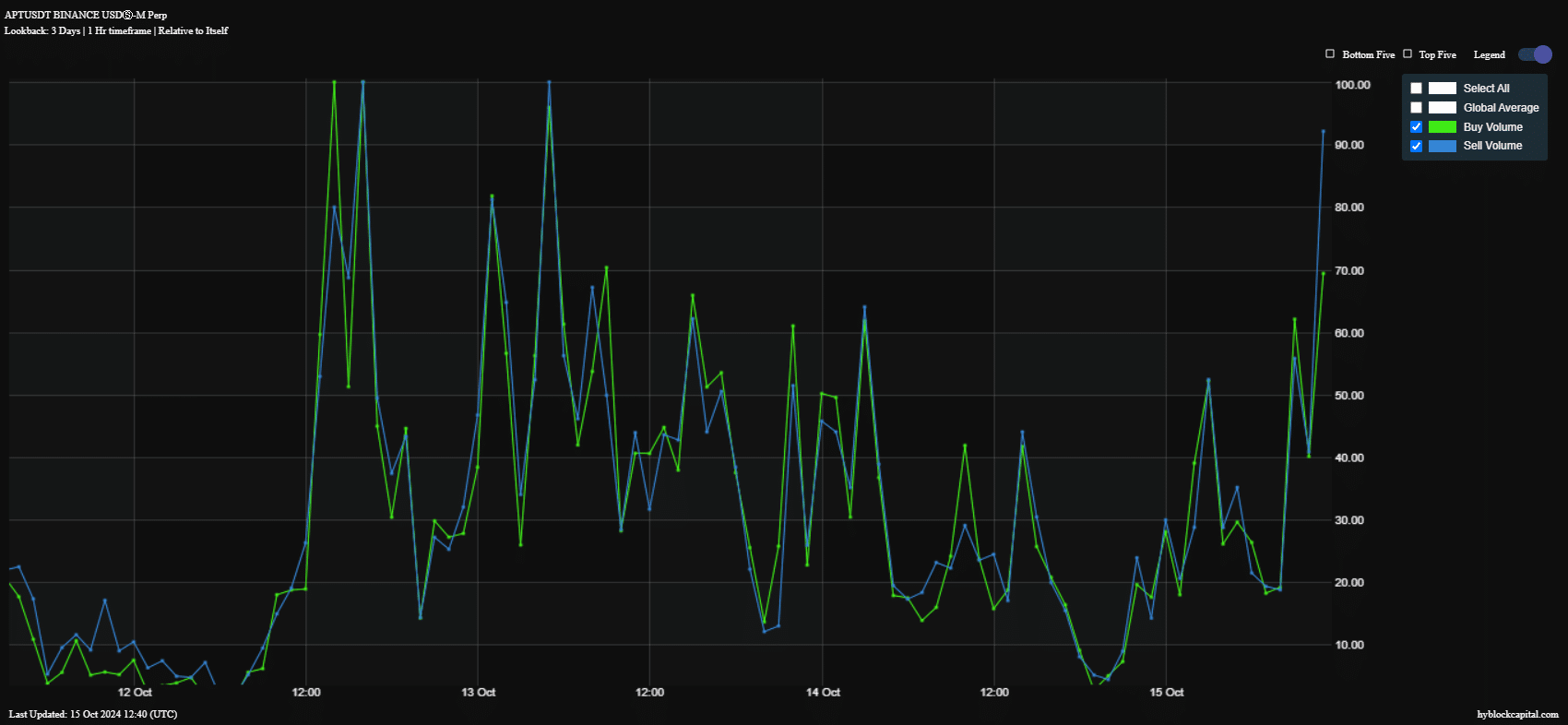

The bearish divergence suggests that sell pressure is likely to surge. An assessment of APT buy and sell volume revealed that such an outcome was already playing out.

In the past 24 hours, there’s been a significant increase in sell transactions compared to buys on the blockchain. This could be because traders are cashing out their profits, given the recent upward trend.

Based on these findings, it seems quite probable that Asset Performance Token (APT) might encounter some selling activity. However, this potential drop could be somewhat contained or brief.

This is due to a significant influx of Advanced Persistent Threat (APT) demand originating from the rapidly developing Aptos network infrastructure.

Read Aptos’ [APT] Price Prediction 2024–2025

In the past 24 hours, Assets Under Management (TVL) for Aptos reached a record high of $730.71 million. Additionally, during this timeframe, the market capitalization of its stablecoin surpassed $256 million, marking a new milestone as well.

These observations underscore the surging network utility, underpinned by more confidence in the network. These factors may shield APT from a strong pullback.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-10-16 13:43