- Bitcoin ETFs saw record inflows amid the broader market’s recovery, signaling investor optimism

- Political shifts are driving digital asset inflows, with Republicans seen as being pro-crypto

As a seasoned crypto investor with a keen eye for market trends and political shifts, I find myself increasingly optimistic about Bitcoin [BTC] and its ETF counterparts. The record inflows into Bitcoin ETFs, particularly following the US Vice Presidential debate, is a clear sign that institutional investors are betting on a pro-crypto future.

In recent times, as the overall market recovers, there’s been growing interest in Bitcoin Exchange-Traded Funds (ETFs), with substantial investments flowing in – Indicating a favorable market direction.

Bitcoin ETF update

On October 15th, as reported by Farside Investors, there were a total inflow of $371 million into Bitcoin Exchange-Traded Funds (ETFs).

Leading the field was BlackRock’s IBIT with an impressive $288.8 million, closely trailed by Fidelity’s FBTC at $35 million. The Ark 21Shares’ ARK ETF wasn’t far behind, reporting inflows of $14.7 million, and Grayscale’s GBTC rounded out the top with a take of $13.4 million.

Although certain ETFs didn’t receive new investments, none experienced withdrawals. This trend suggests a rising curiosity towards Bitcoin investment tools.

Indeed, Bitcoin ETFs saw their largest daily net influx since June, totaling approximately $555.9 million only yesterday.

Over the past period, it was FBTC that spearheaded this trend, reporting an inflow of $239.3 million – its largest since June 4. Moreover, GBTC experienced a resurgence of interest with a $37.8 million inflow – the highest since May and indicating its first positive inflows in October.

At this point, Bitcoin was trading at $67,823.08 on the charts, which came after a 3.56% increase within 24 hours and a 9.44% rise over the past week. Unsurprisingly, these developments have sparked discussions suggesting that the cryptocurrency could be preparing for another record peak.

CoinShares links this to election – But why?

It’s worth noting that CoinShares’ recent findings indicate an increase in digital asset investments, amounting to $407 million. This surge is believed to be driven by rising investor enthusiasm linked to the possibility of a Republican victory.

This surge of funds indicates an increased curiosity about cryptocurrencies, fueled by anticipation that a Republican-led government might introduce beneficial changes in regulations for the sector.

The report noted,

Investments in digital assets witnessed a flow of approximately $407 million, indicating that investors’ choices might be swayed more by the upcoming U.S. elections rather than predictions about monetary policies.

The company backed up its findings by explaining that the latest trends in investments are closely tied to political events, not economic signals.

Notably, stronger-than-anticipated economic data had minimal effect on halting prior outflows.

Indeed, as reported by CoinShares, an increase in investments (inflows) occurred, and this surge took place just after the recent U.S. Vice Presidential debate. Notably, the public opinion swing that followed favored the Republican party, which is perceived to be more favorable towards digital asset projects.

Execs weigh in…

As a researcher, I wholeheartedly concur with the viewpoint that the outcomes of the upcoming U.S. elections may significantly shape the trajectory of the digital assets sector in the near future, a perspective endorsed by ETF Store President Nate Geraci.

He said,

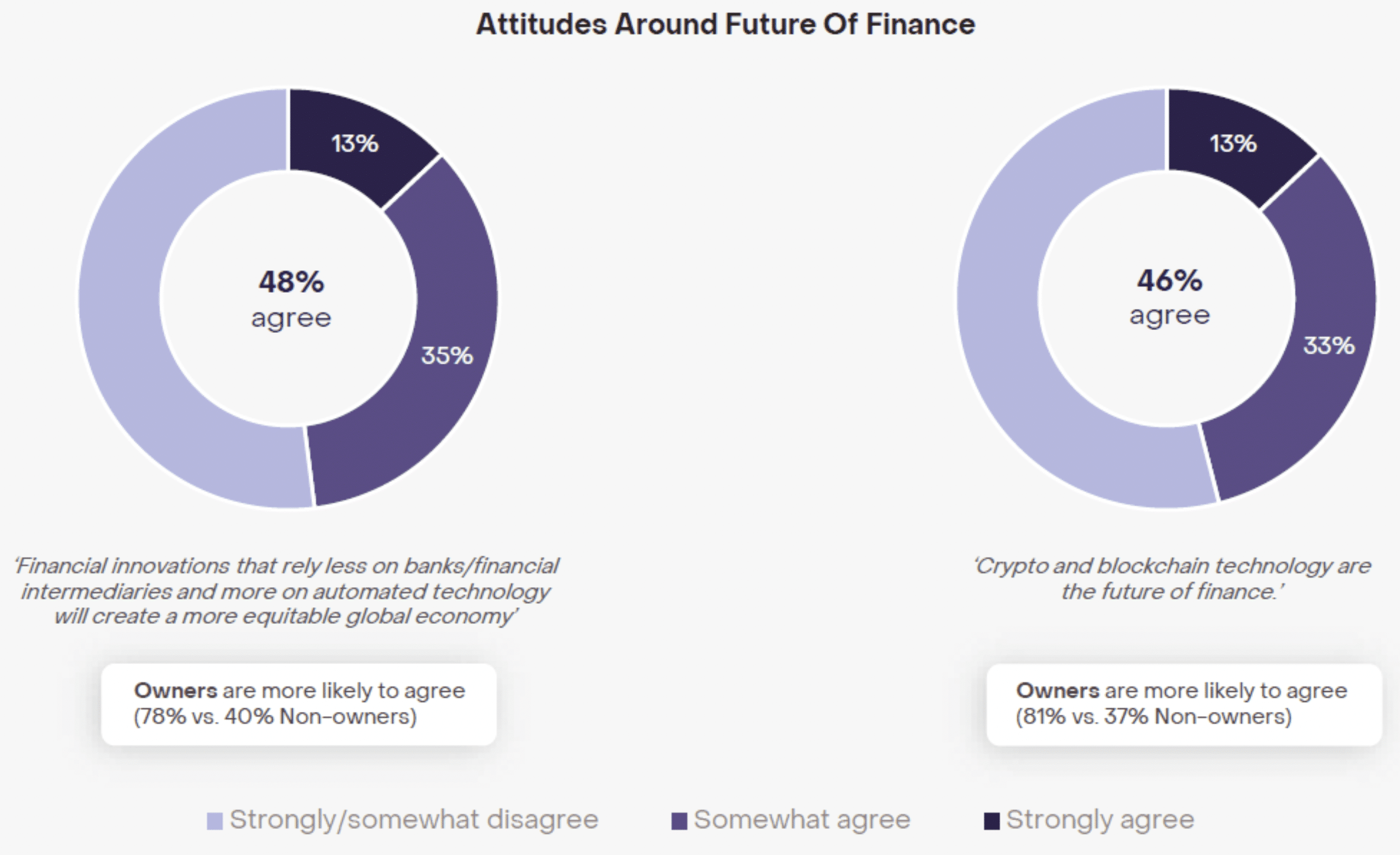

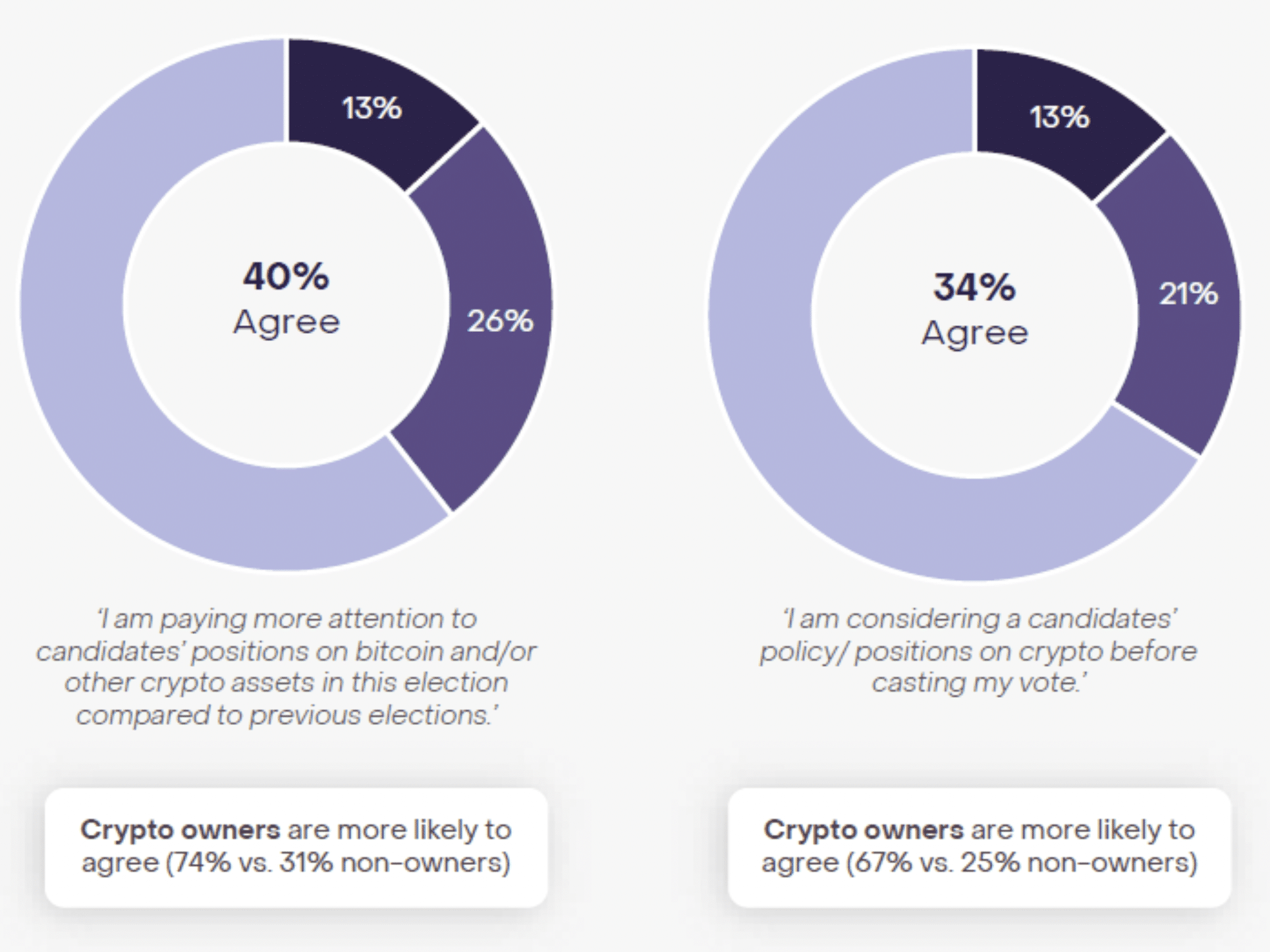

Nearly half (46%) believe that cryptocurrency and blockchain technology will shape the future of finance, while 34% admitted to considering candidates’ stance on cryptocurrencies when casting their votes.

Geraci added,

“Becoming mainstream issue.”

In this context, Geraci emphasized key findings from a recent survey commissioned by Grayscale, which explored the connection between cryptocurrencies and the approaching elections.

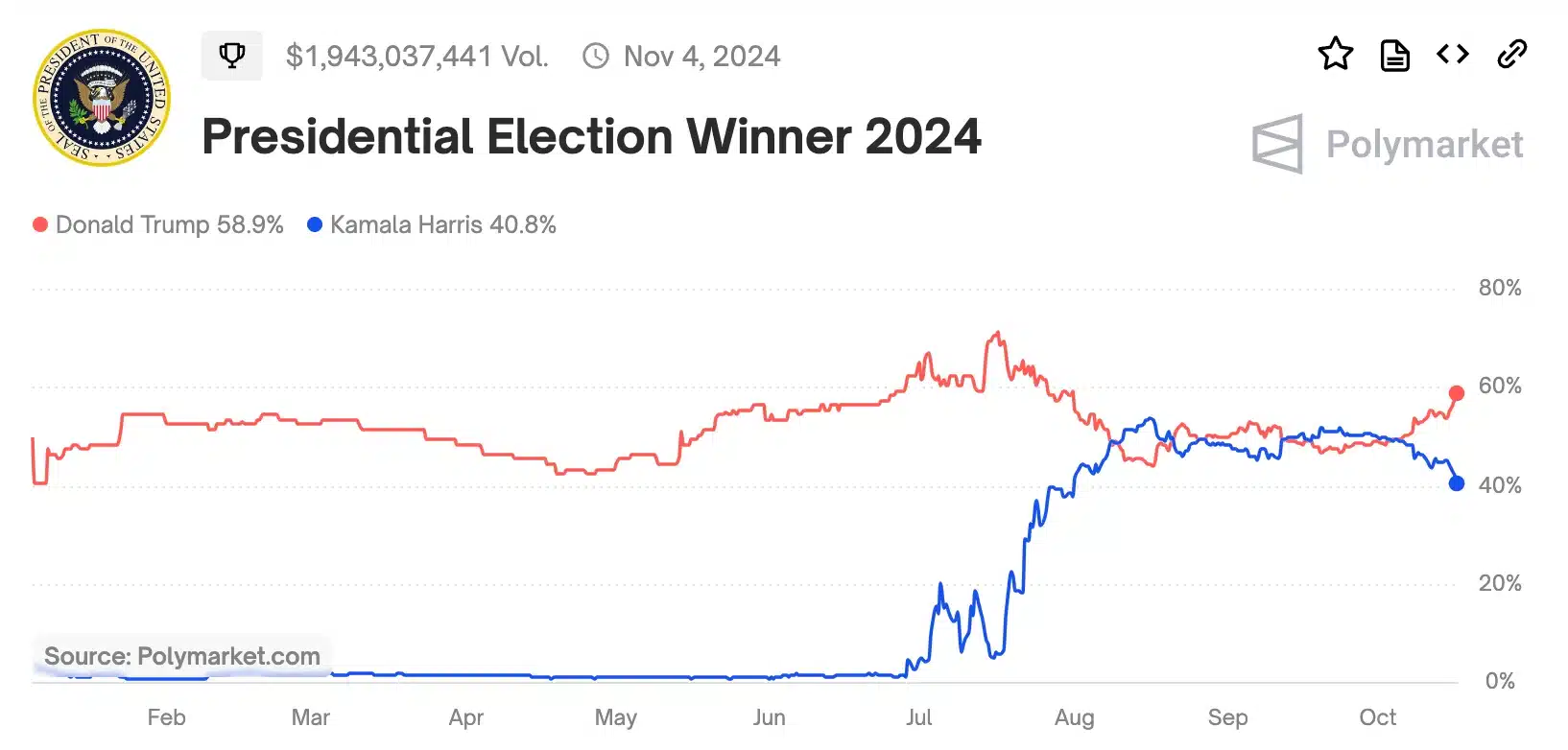

As Donald Trump continues to gather support as the potential Republican nominee on the Polymarket platform, the upcoming stages are likely to witness significant events that could shape the industry’s future.

Read More

- OM/USD

- Solo Leveling Season 3: What You NEED to Know!

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- ETH/USD

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Aimee Lou Wood: Embracing Her Unique Teeth & Self-Confidence

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-10-17 04:08