- DEX trading volume hiked by over 9% in 24 hours, with Uniswap leading the surge

- Uniswap’s total value locked (TVL) reached $4.9 billion, underlining a significant rise in activity

As a seasoned crypto investor who’s been through the bull runs of 2017 and the bear markets of 2018, I’ve learned to keep a keen eye on market trends and always be ready for surprises. The recent surge in DEX trading volume, with Uniswap leading the charge, is a testament to the resilience and adaptability of the crypto market.

In simple terms, the trading volume on DEX platforms has experienced a substantial increase during the last week, with the past 24 hours showing even more growth. Uniswap, a decentralized exchange, is driving this trend, as it has been quite active in trades. This heightened activity has significantly boosted the overall trading volume and increased its Total Value Locked (TVL).

DEX trading volume sees 24-hour spike

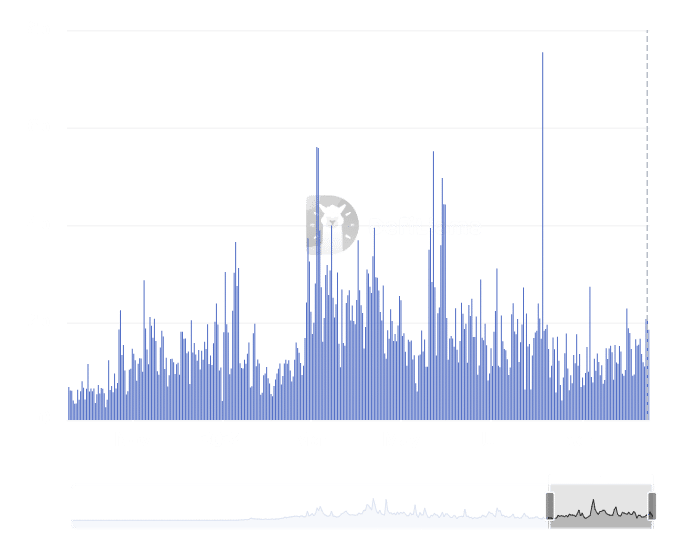

As per the latest figures, there has been a significant increase in trading volume on Decentralized Exchanges (DEX) over the past week, particularly within the last day, showing a marked rise.

Indeed, a look at the figures from CoinGecko shows an impressive 9% increase in trading volume just within the past day. At the moment of this report, the accumulated trading volume had exceeded an astonishing $544 trillion.

Uniswap dominates DEX trading volume

It turned out that Uniswap has stood out as the leading force in the world of decentralized exchanges.

For the last seven days, I’ve been closely monitoring the trading activity on decentralized exchanges (DEX), and it’s clear that Uniswap has been leading the pack. In fact, during this period, Uniswap recorded an impressive trading volume exceeding $10 billion, leaving the second-ranked DEX far behind. At the moment I’m reporting this, Uniswap’s 24-hour trading volume stands at more than $1.8 billion. This significant activity underscores Uniswap’s growing influence in the decentralized finance (DeFi) space.

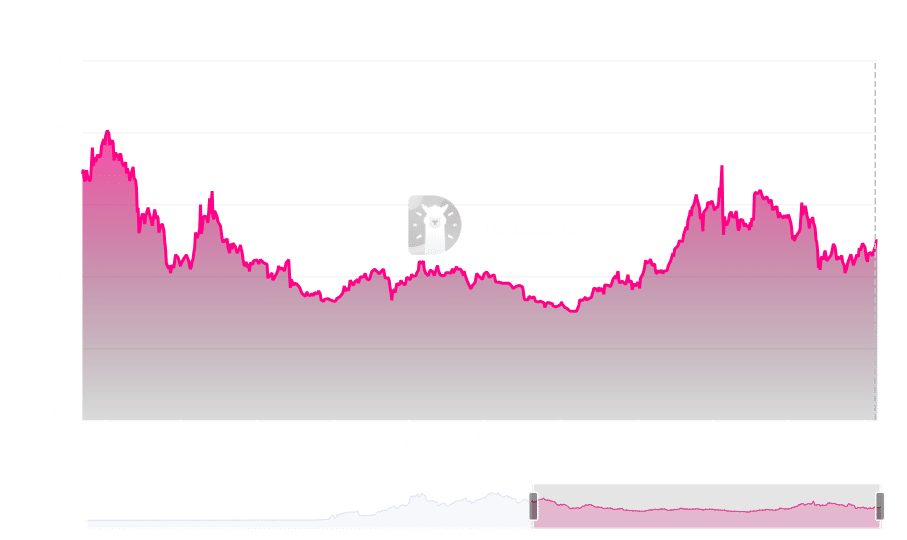

Uniswap’s TVL nears $5 billion

As a crypto investor, I’ve noticed an impressive increase in DEX trading volume, and Uniswap seems to be right in the thick of it. At the moment, Uniswap’s Total Value Locked (TVL) is edging towards $5 billion, currently standing at approximately $4.9 billion. This surge in TVL coincides with the recent spike in trading activity, indicating a strong and vibrant market for Uniswap.

Starting from roughly October 11th, the Total Value Locked (TVL) started climbing, initially standing at around $4.5 billion. Since that time, Uniswap has seen an approximately $500 million increase in its TVL – Indicating a growing level of engagement and enthusiasm on the platform.

At present, Uniswap has unveiled its Layer 2 (L2) solution, a move coinciding with an increase in trading activity and Total Value Locked (TVL). This new launch is anticipated to escalate the trading volume even more and entice additional liquidity to the platform, as users capitalize on the enhanced scalability and reduced transaction costs that Layer 2 solutions provide.

Trading volume highlights greater activity

The surge in transactions on Decentralized Exchanges (DEX), particularly fueled by Uniswap, points towards a growing interest in decentralized financial (DeFi) offerings. With Uniswap leading the pack and enhancing its platform using Layer 2 technologies, it’s expected that both its trading volume and Total Value Locked (TVL) will continue to expand.

Read More

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- The Lowdown on Labubu: What to Know About the Viral Toy

- Masters Toronto 2025: Everything You Need to Know

2024-10-17 05:11